by Calculated Risk on 10/08/2021 02:08:00 PM

Friday, October 08, 2021

2nd Look at Local Housing Markets in September: Memphis, Nashville, North Texas (Dallas), Northwest (Seattle), Sacramento and Santa Clara (San Jose)

Today, in the Newsletter: 2nd Look at Local Housing Markets in September Adding Memphis, Nashville, North Texas (Dallas), Northwest (Seattle), Sacramento and Santa Clara (San Jose)

Excerpt:

Here is a summary of active listings for these housing markets in September. Inventory was up 0.1% in September MoM from August, and down 26.8% YoY.

Inventory in San Diego is at an all time low, whereas inventory in Denver and Sacramento is up more than double from the all time low earlier this year. Sacramento is one of the few areas with inventory up YoY.

Note: New additions to table in BOLD.

Q3 GDP Forecasts: Significant Downgrades

by Calculated Risk on 10/08/2021 12:34:00 PM

| Merrill | Goldman | GDPNow | |

|---|---|---|---|

| 7/30/21 | 7.0% | 9.0% | 6.1% |

| 8/20/21 | 4.5% | 5.5% | 6.1% |

| 9/10/21 | 4.5% | 3.5% | 3.7% |

| 9/17/21 | 4.5% | 4.5% | 3.6% |

| 9/24/21 | 4.5% | 4.5% | 3.7% |

| 10/1/21 | 4.1% | 4.25% | 2.3% |

| 10/8/21 | 2.0% | 3.25% | 1.3% |

From BofA Merrill Lynch:

We are taking down 3Q GDP tracking to 2% from 3.8% previously, reflecting a reassessment of equipment and inventories, and the likely soft retail sales data. [Oct 8 estimate]From Goldman Sachs:

emphasis added

Following today’s payroll miss and outright decline in education payrolls, we lowered our Q3 GDP tracking estimate by ¼pp to 3¼% (qoq ar). [Oct 8 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 1.3 percent on October 8 [Oct 8 estimate]

Reis: Apartment Vacancy Rate Decreased Sharply in Q3

by Calculated Risk on 10/08/2021 11:08:00 AM

Reis reported that the apartment vacancy rate was at 4.7% in Q3 2021, down from 5.3% in Q2, and down from 5.1% in Q3 2020. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999).

Reis also reported the asking rents were up 7.5% year-over-year, compared to up 1.2% in Q2.

Comments on September Employment Report

by Calculated Risk on 10/08/2021 09:12:00 AM

The headline jobs number in the September employment report was well below expectations, however employment for the previous two months was revised up significantly. The participation rate declined, and the unemployment rate decreased to 4.8%.

Earlier: September Employment Report: 194 Thousand Jobs, 4.8% Unemployment Rate

In September, the year-over-year employment change was 5.7 million jobs. This turned positive in April due to the sharp jobs losses in April 2020.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today. (ht Joe Weisenthal at Bloomberg).

In September, the number of permanent job losers decreased to 2.251 million from 2.487 million in August.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key as the economy recovers.

The 25 to 54 participation rate decreased in September to 81.6% from 81.8% in August, and the 25 to 54 employment population ratio was unchanged at 78.0% from 78.0% in August.

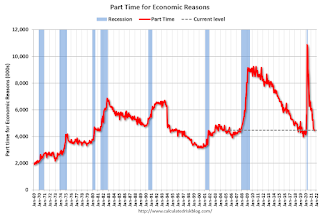

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"In September, the number of persons employed part time for economic reasons, at 4.5 million, was essentially unchanged for the second month in a row. There were 4.4 million persons in this category in February 2020. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons was essentially unchanged in September at 4.468 million from 4.469 million in August. This is back close to pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 8.5% from 8.8% in August. This is down from the record high in April 22.9% for this measure since 1994. This measure was at 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.683 million workers who have been unemployed for more than 26 weeks and still want a job, down from 3.179 million in August.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was well below expectations, however the previous two months were revised up by 169,000 combined. And the headline unemployment rate decreased to 4.8%.

September Employment Report: 194 Thousand Jobs, 4.8% Unemployment Rate

by Calculated Risk on 10/08/2021 08:41:00 AM

From the BLS:

Total nonfarm payroll employment rose by 194,000 in September, and the unemployment rate fell by 0.4 percentage point to 4.8 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, in professional and business services, in retail trade, and in transportation and warehousing. Employment in public education declined over the month.

...

The change in total nonfarm payroll employment for July was revised up by 38,000, from +1,053,000 to +1,091,000, and the change for August was revised up by 131,000, from +235,000 to +366,000. With these revisions, employment in July and August combined is 169,000 higher than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In September, the year-over-year change was 5.7 million jobs. This was up significantly year-over-year.

Total payrolls increased by 194 thousand in August. Private payrolls increased by 317 thousand.

Payrolls for July and August were revised up 169 thousand, combined.

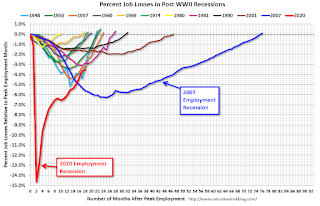

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was declined to 61.6% in September, from 61.7% in August. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was declined to 61.6% in September, from 61.7% in August. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 58.7% from 58.5% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in September to 4.8% from 5.2% in August.

This was well below consensus expectations, however July and August were revised up by 169,000 combined.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans "Largest Weekly Decline in 12 Months"

by Calculated Risk on 10/08/2021 08:18:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of October 5th.

From Andy Walden at Black Knight: Largest Weekly Forbearance Decline in 12 Months

We’ve been waiting for a sizable drop in the number of active forbearance plans, given the large number of plans both marked for either review (for extension/removal) or final expiration in September.

Well, this week has brought the first real signs of that. In fact, according to our McDash Flash daily forbearance tracking dataset, the population dropped by 11% since last Tuesday, marking the largest weekly decline in 12 months.

The number of active forbearance plans fell by 177,000 this week with declines seen across all investor classes, led by an 84,000 plan drop among FHA/VA loans. Plans among GSE loans and those held in bank portfolios and private label securities also fell, seeing 50,000 (-11%) and 43,000 (-8%) declines respectively.

As of October 5, 1.39 million mortgage holders remain in COVID-19 related forbearance plans, representing 2.6% of all active mortgages, including 1.4% of GSE, 4.3% of FHA/VA and 3.6% of portfolio held and privately securitized loans.

Click on graph for larger image.

Overall, forbearances have declined by 294,000 (-17%) over the past 30 days, the fastest monthly rate of improvement since October 2020. Plan exits surged then as the first wave of forbearance entrants reached their six-month mark. The folks who’d remained are now reaching the end of their allowable terms.

There are still more than 180,000 plans with September month-end review dates. Keep in mind that this data only covers the last business day in that month and the first three in October. Additional exits are likely in coming weeks as well as servicers continue to work through the large volumes of expirations.

emphasis added

Thursday, October 07, 2021

Friday: Employment Report

by Calculated Risk on 10/07/2021 08:26:00 PM

My August Employment Preview

Goldman September Payrolls Preview

Friday:

• At 8:30 AM, Employment Report for September. The consensus is for 460 thousand jobs added, and for the unemployment rate to decrease to 5.1%.

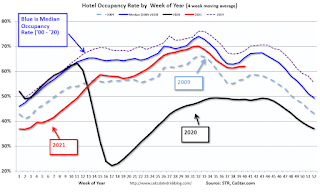

Hotels: Occupancy Rate Down 9.2% Compared to Same Week in 2019

by Calculated Risk on 10/07/2021 04:16:00 PM

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

U.S. hotel performance dipped from the previous week, according to STR‘s latest data through Oct. 2.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

26 September through 2 October 2021 (percentage change from comparable week in 2019*):

• Occupancy: 61.7% (-9.2%)

• Average daily rate (ADR): US$130.87 (+1.2%)

• Revenue per available room (RevPAR): US$80.78 (-8.2%)

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Goldman September Payrolls Preview

by Calculated Risk on 10/07/2021 04:07:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 600k in September ... we believe the nationwide expiration of enhanced unemployment benefits on September 5 boosted effective labor supply and job growth ... We are assuming a 200k boost in tomorrow’s numbers and a larger boost in October. We also believe the reopening of schools contributed to September job growth, by around 150k. ... We estimate a one-tenth drop in the unemployment rate to 5.1%CR Note: The consensus is for 460 thousand jobs added, and for the unemployment rate to decrease to 5.1%.

emphasis added

October 7th COVID-19: Progress

by Calculated Risk on 10/07/2021 03:23:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.2% | 55.6% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 186.6 | 184.6 | ≥2321 | |

| New Cases per Day3 | 95,448 | 107,953 | ≤5,0002 | |

| Hospitalized3 | 63,921 | 74,091 | ≤3,0002 | |

| Deaths per Day3 | 1,431 | 1,562 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 22 states have between 50% and 59.9% fully vaccinated: Colorado at 59.9%, California, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Texas, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 50.7%.

Next up (total population, fully vaccinated according to CDC) are Montana at 48.9%, Indiana at 48.8%, Missouri at 48.4% and Oklahoma at 48.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Homebuilder Comments in September: “Supply chain, supply chain, supply chain."

by Calculated Risk on 10/07/2021 01:29:00 PM

Today, in the Newsletter: Homebuilder Comments in September: “Supply chain, supply chain, supply chain."

Excerpt:

Some homebuilder comments courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):

"Just published September home builder survey results (sales, prices, costs, communities, etc.). Big themes: 1) Supply chain, supply chain, supply chain. 2) Monthly price hikes no longer the norm. 3) Some of the hottest markets sounding toppy. Market commentary to follow…"

September Employment Preview

by Calculated Risk on 10/07/2021 11:38:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for September. The consensus is for 460 thousand jobs added, and for the unemployment rate to decrease to 5.1%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 5.3 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but is now better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 568,000 private sector jobs, above the consensus estimate of 430,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be above expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in September to 50.2%, up from 49.0% last month. This would suggest a decline in manufacturing employment of around 20,000 jobs in September. ADP showed 49,000 manufacturing jobs added.

The ISM® Services employment index decreased in September to 53.0%, down from 53.7% last month. This would suggest an increase in service employment of around 150,000 jobs in September.

Combined, the ISM indexes suggest a weaker than expected employment report.

• Unemployment Claims: The weekly claims report showed little change in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 349,000 in August to 351,000 in September. This would usually suggest about the same number of layoffs in September as in August, although this might not be very useful right now. In general, weekly claims have been above expectations in September.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers hasn't increased as sharply.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers hasn't increased as sharply.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the June report.

This data is only available back to 1994, so there is only data for three recessions. In August, the number of permanent job losers decreased to 2.487 million from 2.930 million in July. These jobs will likely be the hardest to recover.

• IMPORTANT: Usually in September, about 1.2 million educators are hired as the school year starts in some areas. This is seasonally adjusted to around 0 (since it is expected). It is unclear if that many will be hired this year - or more (making up for low hiring), or less (due to the ongoing pandemic). This could distort the headline number.

• Conclusion: The data is mixed for September. However, the consensus is fairly low.

Weekly Initial Unemployment Claims Decrease to 326,000

by Calculated Risk on 10/07/2021 08:35:00 AM

The DOL reported:

In the week ending October 2, the advance figure for seasonally adjusted initial claims was 326,000, a decrease of 38,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 362,000 to 364,000. The 4-week moving average was 344,000, an increase of 3,500 from the previous week's revised average. The previous week's average was revised up by 500 from 340,000 to 340,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 344,000.

The previous week was revised up.

Regular state continued claims decreased to 2,714,000 (SA) from 2,811,000 (SA) the previous week.

Note (released with a 2 week delay): There were an additional 647,690 receiving Pandemic Unemployment Assistance (PUA) that decreased from 1,059,248 the previous week (there are questions about these numbers). This was a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And threre were an additional 630,814 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 991,813.

Weekly claims were lower than the consensus forecast.

Wednesday, October 06, 2021

Thursday: Unemployment Claims

by Calculated Risk on 10/06/2021 08:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 345 thousand initial claims, down from 362 thousand last week.

October 6th COVID-19: Slow Progress

by Calculated Risk on 10/06/2021 05:12:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.1% | 55.9% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 186.4 | 185.5 | ≥2321 | |

| New Cases per Day3 | 96,757 | 109,273 | ≤5,0002 | |

| Hospitalized3 | 65,162 | 75,426 | ≤3,0002 | |

| Deaths per Day3 | 1,428 | 1,488 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 22 states have between 50% and 59.9% fully vaccinated: Colorado at 59.8%, California, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Texas, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 50.6%.

Next up (total population, fully vaccinated according to CDC) are Montana at 48.8%, Indiana at 48.7%, Missouri at 48.4% and Oklahoma at 48.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

1st Look at Local Housing Markets in September; Denver, Las Vegas and San Diego

by Calculated Risk on 10/06/2021 11:33:00 AM

Today, in the Newsletter: 1st Look at Local Housing Markets in September

Excerpt:

Here is a summary of active listings for these housing markets in September. Inventory was down 1.0% in September MoM from August, and down 36.6% YoY.

Inventory in San Diego is at an all time low, whereas inventory in Denver is up 107% (about double) from the all time low in March of this year. Las Vegas inventory is up 74% from the record low in April. Most markets have seen active inventory increase from earlier this year, but San Diego and Miami are plumbing new lows.

ADP: Private Employment increased 568,000 in September

by Calculated Risk on 10/06/2021 08:19:00 AM

Private sector employment increased by 568,000 jobs from August to September according to the September ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual data of those who are on a company’s payroll, measures the change in total nonfarm private employment each month on a seasonally-adjusted basisThis was well above the consensus forecast of 430,000 for this report.

“The labor market recovery continues to make progress despite a marked slowdown from the 748,000 job pace in the second quarter,” said Nela Richardson, chief economist, ADP. “Leisure and hospitality remains one of the biggest beneficiaries to the recovery, yet hiring is still heavily impacted by the trajectory of the pandemic, especially for small firms. Current bottlenecks in hiring should fade as the health conditions tied to the COVID-19 variant continue to improve, setting the stage for solid job gains in the coming months.”

emphasis added

The BLS report will be released Friday, and the consensus is for 460 thousand non-farm payroll jobs added in September. The ADP report has not been very useful in predicting the BLS report.

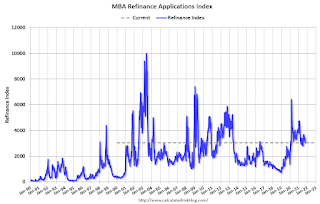

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 10/06/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 1, 2021.

... The Refinance Index decreased 10 percent from the previous week and was 16 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 13 percent lower than the same week one year ago.

“Mortgage applications to refinance dropped almost 10 percent last week to the lowest level in three months, as the 30-year fixed rate increased to 3.14 percent – the highest since July. Higher rates are reducing borrowers’ incentive to refinance, as declines were seen across all loan types,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase activity also fell, driven by a drop in conventional loan applications. Government purchase applications were up over 1 percent, but that was still not enough to bring down the average loan balance of $410,000. With home-price appreciation and sales prices remaining very elevated, applications for higher balance, conventional loans still dominate the mix of activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.14 percent from 3.10 percent, with points increasing to 0.35 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated - but the recent bump in rates has slowed activity.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 13% year-over-year unadjusted.

According to the MBA, purchase activity is down 13% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity was strong in the second half of 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, October 05, 2021

Wednesday: ADP Employment

by Calculated Risk on 10/05/2021 08:11:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 430,000 jobs added, up from 374,000 in August.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 10/05/2021 04:03:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through October 5th.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.There were supply constraints over the last year, for example, sawmills cut production and inventory at the beginning of the pandemic, and the West Coast fires in 2020 damaged privately-owned timberland (and maybe again in 2021).