by Calculated Risk on 10/18/2021 09:23:00 AM

Monday, October 18, 2021

Industrial Production Decreased 1.3 Percent in September

From the Fed: Industrial Production and Capacity Utilization

Industrial production fell 1.3 percent in September after moving down 0.1 percent in August; output was previously reported to have risen 0.4 percent in August. In September, manufacturing output decreased 0.7 percent: The production of motor vehicles and parts fell 7.2 percent, as shortages of semiconductors continued to hobble operations, while factory output elsewhere declined 0.3 percent. The output of utilities dropped 3.6 percent, as demand for cooling subsided after a warmer-than-usual August. Mining production fell 2.3 percent.

The lingering effects of Hurricane Ida more than accounted for the drop in mining in September; they also contributed 0.3 percentage point to the drop in manufacturing. Overall, about 0.6 percentage point of the drop in total industrial production resulted from the impact of the hurricane.

Despite the decrease in September, total industrial production rose 4.3 percent at an annual rate for the third quarter as a whole, its fifth consecutive quarter with a gain of at least 4 percent.

At 100.0 percent of its 2017 average, total industrial production in September was 4.6 percent above its year-earlier level. Capacity utilization for the industrial sector fell 1.0 percentage point in September to 75.2 percent, a rate that is 4.4 percentage points below its long-run (1972–2020) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, but below the level in February 2020 (pre-pandemic).

Capacity utilization at 75.2% is 4.4% below the average from 1972 to 2020. This was well below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in September to 100.0. This is 1.3% below the February 2020 level.

The change in industrial production was well below consensus expectations.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 10/18/2021 08:39:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of October 17th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 21.4% from the same day in 2019 (78.6% of 2019). (Dashed line)

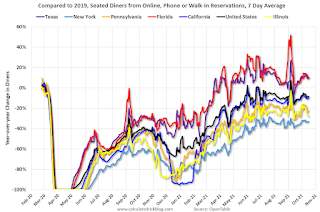

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through October 16, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - but might be picking up a little again. The 7-day average for the US is down 8% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $147 million last week, down about 12% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through October 2nd. The occupancy rate was down 9.6% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of October 8th, gasoline supplied was down 1.8% compared to the same week in 2019.

There have been six weeks so far this year when gasoline supplied was up compared to the same week in 2019 - and consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through October 15th for the United States and several selected cities.

This data is through October 15th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 117% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, October 15th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, October 17, 2021

Sunday Night Futures

by Calculated Risk on 10/17/2021 06:56:00 PM

Weekend:

• Schedule for Week of October 17, 2021

• Will 4% Mortgage Rates "Halt the Housing Market"?

Monday:

• At 9:15 AM ET, The Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 76.5%.

• At 10:00 AM, The October NAHB homebuilder survey. The consensus is for a reading of 76, unchanged from 76 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $83.05 per barrel and Brent at $85.31 per barrel. A year ago, WTI was at $41, and Brent was at $41 - so WTI oil prices are up more than double year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.31 per gallon. A year ago prices were at $2.14 per gallon, so gasoline prices are up $1.17 per gallon year-over-year.

Will 4% Mortgage Rates "Halt the Housing Market"? Some comments on an interview with Ivy Zelman

by Calculated Risk on 10/17/2021 04:14:00 PM

Today, in the Newsletter: Will 4% Mortgage Rates "Halt the Housing Market"?

Excerpt:

On Friday, Sara Eisen asked: “Do you think this hot housing market gets even hotter?”

And Zelman answered:

"No. I don’t. I think the housing market is already starting to show some moderation. And I think that it is going to become even more evident as rates are starting to back up. And the continued upward pressure on home prices which is not sustainable is really impacting affordability. We are starting to see incentives by builders creep back into the market. And we are seeing resistance by consumers that are really questioning whether or not, not only can they can afford it, and do they really want to buy at the top of the market."

Saturday, October 16, 2021

Newsletter Articles this Week

by Calculated Risk on 10/16/2021 02:11:00 PM

At the Calculated Risk Newsletter this week:

• House Prices to National Average Wage Index

• 3rd Look at Local Housing Markets in September Adding Albuquerque, Atlanta, Colorado, Georgia, Jacksonville, Minnesota, New Hampshire, Portland, and South Carolina

• Will House Prices Increase "a further 16% by the end of 2022"? This note is based on a new Goldman Sachs Forecast

• Mortgage Rates Highest in 6 Months Refinance Activity Will Slow

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Currently all content is available for free - and some will always be free - but please subscribe!.

Schedule for Week of October 17, 2021

by Calculated Risk on 10/16/2021 08:11:00 AM

The key economic reports this week are September Housing Starts and Existing Home sales.

For manufacturing, September Industrial Production, and the October Philly Fed survey will be released this week.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 76.5%.

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 76, unchanged from 76 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.620 million SAAR, up from 1.615 million SAAR.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 290 thousand initial claims, down from 293 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of 24.5, down from 30.7.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 6.06 million SAAR, up from 5.88 million in August.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 6.06 million SAAR, up from 5.88 million in August.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for September 2021

Friday, October 15, 2021

October 15th COVID-19: Slow Progress

by Calculated Risk on 10/15/2021 03:22:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.8% | 56.3% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 188.7 | 186.9 | ≥2321 | |

| New Cases per Day3 | 82,324 | 95,171 | ≤5,0002 | |

| Hospitalized3 | 56,817 | 64,388 | ≤3,0002 | |

| Deaths per Day3 | 1,248 | 1,399 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Pennsylvania at 59.2%, Minnesota, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.1%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.4%, Indiana at 49.2%, Missouri at 49.0%, Oklahoma at 48.9% and South Carolina at 48.8%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Q3 GDP Forecasts: Around 2%

by Calculated Risk on 10/15/2021 12:15:00 PM

These are forecasts of the advance estimate of GDP to be released on Oct 28th.

| Merrill | Goldman | GDPNow | |

|---|---|---|---|

| 7/30/21 | 7.0% | 9.0% | 6.1% |

| 8/20/21 | 4.5% | 5.5% | 6.1% |

| 9/10/21 | 4.5% | 3.5% | 3.7% |

| 9/17/21 | 4.5% | 4.5% | 3.6% |

| 9/24/21 | 4.5% | 4.5% | 3.7% |

| 10/1/21 | 4.1% | 4.25% | 2.3% |

| 10/8/21 | 2.0% | 3.25% | 1.3% |

| 10/15/21 | 2.0% | 3.25% | 1.2% |

From BofA Merrill Lynch:

We continue to track 2% for 3Q GDP [Oct 15 estimate]From Goldman Sachs:

emphasis added

We left our Q3 GDP tracking estimate unchanged after rounding at +3¼% (qoq ar). [Oct 15 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 1.2 percent on October 15, down from 1.3 percent on October 8. [Oct 15 estimate]

Black Knight: "Significant" Decline in Number of Homeowners in COVID-19-Related Forbearance Plans

by Calculated Risk on 10/15/2021 10:41:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of October 12th.

From Andy Walden at Black Knight: Another Week of Significant Forbearance Declines

As expected, we saw another significant drop in the number of active forbearances this week, as the first wave of final plan expirations continues.

According to our McDash Flash daily forbearance tracking dataset, active plans fell by another 10%, for an overall reduction of 143,000 since last Tuesday – on top of last week’s 177,000 (-11%) drop.

Once again, declines were seen across all investor classes, led by an 88,000 (-19%) plan drop among loans held in bank portfolios and private label securities. The number of homeowners in GSE and FHA/VA loans in forbearance saw matching 6% declines, for 22,000 and 33,000 reductions respectively.

As of October 12, 1.25 million mortgage holders remain in COVID-19 related forbearance plans, representing 2.4% of all active mortgages, including 1.3% of GSE, 4% of FHA/VA and 3% of portfolio held and privately securitized loans.

Click on graph for larger image.

More than 450,000 homeowners have exited their forbearance plans over the past two weeks alone. With some 47,000 September month-end expirations still left to process and another 329K scheduled for review for extension or removal in October, the potential for further, substantial declines will continue into early November.

emphasis added

Retail Sales Increased 0.7% in September

by Calculated Risk on 10/15/2021 08:38:00 AM

On a monthly basis, retail sales were increased 0.7% from August to September (seasonally adjusted), and sales were up 13.9 percent from September 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $625.4 billion, an increase of 0.7 percent from the previous month, and 13.9 percent above September 2020. ... The July 2021 to August 2021 percent change was revised from up 0.7 percent to up 0.9 percent.

emphasis added

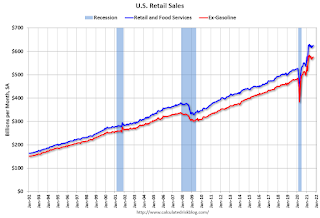

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 12.1% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 12.1% on a YoY basis.Sales in September were above expectations, and sales in July and August were revised up.

Thursday, October 14, 2021

Friday: Retail Sales, NY Fed Mfg

by Calculated Risk on 10/14/2021 08:01:00 PM

Friday:

• At 8:30 AM ET, Retail sales for September will be released. The consensus is for a 0.2% decrease in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 27.0, down from 34.3.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for October).

October 14th COVID-19: 42 Days till Thanksgiving; Need to Get Daily Cases Down Before Holidays

by Calculated Risk on 10/14/2021 07:08:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.7% | 56.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 188.3 | 186.4 | ≥2321 | |

| New Cases per Day3 | 84,555 | 96,666 | ≤5,0002 | |

| Hospitalized3 | 56,817 | 64,388 | ≤3,0002 | |

| Deaths per Day3 | 1,241 | 1,434 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Minnesota at 59.0%, Pennsylvania, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.0%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.3%, Indiana at 49.1%, Missouri at 48.9%, Oklahoma at 48.8% and South Carolina at 48.7%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

House Prices to National Average Wage Index

by Calculated Risk on 10/14/2021 01:07:00 PM

Today, in the Newsletter: House Prices to National Average Wage Index

Excerpt:

This graph shows the ratio of house price indexes divided by the National Average Wage Index (the Wage index for 2020 was released yesterday). This uses the annual average National Case-Shiller index since 1976 (and an estimate for 2021). ...Please subscribe!

As of 2021, house prices were well above the median historical ratio - and not far below the bubble peak.

Hotels: Occupancy Rate Down 9.6% Compared to Same Week in 2019

by Calculated Risk on 10/14/2021 10:40:00 AM

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

Lifted by the long Columbus Day weekend, U.S. hotel performance rose to a level similar to late summer, according to STR‘s latest data through October 9.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

October 3-9, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 63.9% (-9.6%)

• Average daily rate (ADR): US$134.63 (+2.4%)

• Revenue per available room (RevPAR): US$86.02 (-7.4%)

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Weekly Initial Unemployment Claims Decrease to 293,000

by Calculated Risk on 10/14/2021 08:36:00 AM

The DOL reported:

In the week ending October 9, the advance figure for seasonally adjusted initial claims was 293,000, a decrease of 36,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 3,000 from 326,000 to 329,000. The 4-week moving average was 334,250, a decrease of 10,500 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 750 from 344,000 to 344,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 334,250.

The previous week was revised up.

Regular state continued claims decreased to 2,593,000 (SA) from 2,727,000 (SA) the previous week.

Weekly claims were lower than the consensus forecast.

Wednesday, October 13, 2021

Thursday: Unemployment Claims, PPI

by Calculated Risk on 10/13/2021 08:14:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 315 thousand initial claims, down from 326 thousand last week.

• Also at 8:30 AM, The Producer Price Index for September from the BLS. The consensus is for a 0.6% increase in PPI, and a 0.5% increase in core PPI.

October 13th COVID-19: Progress

by Calculated Risk on 10/13/2021 05:09:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.6% | 56.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 187.9 | 186.4 | ≥2321 | |

| New Cases per Day3 | 86,181 | 97,773 | ≤5,0002 | |

| Hospitalized3 | 57,734 | 65,668 | ≤3,0002 | |

| Deaths per Day3 | 1,252 | 1,452 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Minnesota at 58.9%, Pennsylvania, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.0%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.3%, Indiana at 49.1%, Missouri at 48.7%, Oklahoma at 48.6% and South Carolina at 48.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

FOMC Minutes: "the process of tapering could commence ... in either mid-November or mid-December"

by Calculated Risk on 10/13/2021 02:05:00 PM

From the Fed: FOMC Minutes, Minutes of the Federal Open Market Committee, September 21–22, 2021. Excerpt on asset purchases:

A number of participants assessed that the standard of substantial further progress toward the goal of maximum employment had not yet been attained but that, if the economy proceeded roughly as they anticipated, it may soon be reached. On the basis of the cumulative performance of the labor market since December 2020, a number of other participants indicated that they believed that the test of "substantial further progress" toward maximum employment had been met. Some of these participants also suggested that labor supply constraints were the main impediments to further improvement in labor market conditions rather than lack of demand. They noted that adding monetary policy accommodation at this time would not address such constraints or that the costs of continuing asset purchases might be beginning to exceed their benefits. All participants agreed that it would be appropriate for the current meeting's postmeeting statement to relay the Committee's judgment that, if progress continued broadly as expected, a moderation in the pace of asset purchases may soon be warranted.

Participants also expressed their views on how slowing in the pace of purchases might proceed. In particular, participants commented on an illustrative path, developed by the staff and reflecting participants' discussions at the Committee's July meeting, that gave the speed and composition associated with a tapering of asset purchases. The illustrative tapering path was designed to be simple to communicate and entailed a gradual reduction in the pace of net asset purchases that, if begun later this year, would lead the Federal Reserve to end purchases around the middle of next year. The path featured monthly reductions in the pace of asset purchases, by $10 billion in the case of Treasury securities and $5 billion in the case of agency mortgage-backed securities (MBS). Participants generally commented that the illustrative path provided a straightforward and appropriate template that policymakers might follow, and a couple of participants observed that giving advance notice to the general public of a plan along these lines may reduce the risk of an adverse market reaction to a moderation in asset purchases. Participants noted that, in keeping with the outcome-based standard for initiating a tapering of asset purchases, the Committee could adjust the pace of the moderation of its purchases if economic developments were to differ substantially from what they expected. Several participants indicated that they preferred to proceed with a more rapid moderation of purchases than described in the illustrative examples.

No decision to proceed with a moderation of asset purchases was made at the meeting, but participants generally assessed that, provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate. Participants noted that if a decision to begin tapering purchases occurred at the next meeting, the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December.

emphasis added

3rd Look at Local Housing Markets in September

by Calculated Risk on 10/13/2021 01:18:00 PM

Today, in the Newsletter: 3rd Look at Local Housing Markets in September

This update adds data for Albuquerque, Atlanta, Colorado, Georgia, Jacksonville, Minnesota, New Hampshire, Portland, and South Carolina (Bold in tables).

Excerpt:

One of the key factors for house prices is supply, and tracking local inventory reports will help us understand what is happening with supply.Please subscribe!

...

Here is a summary of active listings for these housing markets in September. For the these markets, inventory was down 1.7% in September MoM from August, and down 27.8% YoY.

Cleveland Fed: Median CPI and Trimmed-mean CPI both increased 0.5% in September

by Calculated Risk on 10/13/2021 11:18:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.5% in September. The 16% trimmed-mean Consumer Price Index also increased 0.5% in September. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for September here. "Fuel oil and other fuels" were up 44% annualized.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.