by Calculated Risk on 10/25/2021 06:34:00 PM

Monday, October 25, 2021

October Vehicle Sales Forecast: "First Month-to-Month Improvement Since April"

From WardsAuto: October U.S. Light-Vehicle Sales Forecast to Show First Month-to-Month Improvement Since April (pay content)

Low inventories and supply issues continue to impacting vehicle sales.

This graph shows actual sales from the BEA (Blue), and Wards forecast for October (Red).

The Wards forecast of 12.6 million SAAR, would be up about 3.5% from last month, and down 23% from a year ago (sales were solid in October 2020, as sales recovered from the depths of the pandemic).

Freddie Mac: Mortgage Serious Delinquency Rate decreased in September

by Calculated Risk on 10/25/2021 05:30:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in September was 1.46%, down from 1.62% in August. Freddie's rate is down year-over-year from 3.04% in September 2020.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble, and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Also - for multifamily - delinquencies were at 0.12%, unchanged from 0.12% in August, and down from the peak of 0.20% in April 2021.

October 25th COVID-19: Data Released On Monday is Always Low and Revised Up

by Calculated Risk on 10/25/2021 05:23:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 57.4% | 57.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 190.6 | 189.1 | ≥2321 | |

| New Cases per Day3 | 59,129 | 79,213 | ≤5,0002 | |

| Hospitalized3 | 45,801 | 53,648 | ≤3,0002 | |

| Deaths per Day3 | 1,122 | 1,214 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 20 states have between 50% and 59.9% fully vaccinated: Minnesota at 59.5%, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina, Ohio and Montana at 50.0%.

Next up (total population, fully vaccinated according to CDC) are Indiana at 49.6%, Oklahoma at 49.6%, South Carolina at 49.5%, Missouri at 49.4%, Arkansas at 47.6%, and Georgia at 47.6%.

Click on graph for larger image.

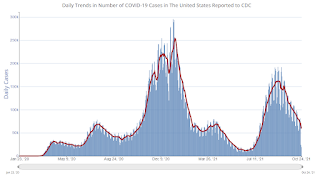

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 2.21%"

by Calculated Risk on 10/25/2021 04:00:00 PM

Note: This is as of October 17th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 2.21%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 2.28% of servicers’ portfolio volume in the prior week to 2.21% as of October 17, 2021. According to MBA’s estimate, 1.1 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 5 basis points to 1.00%. Ginnie Mae loans in forbearance decreased 5 basis points to 2.72%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 13 basis points to 5.21%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 8 basis points relative to the prior week to 2.49%, and the percentage of loans in forbearance for depository servicers decreased 5 basis points to 2.11%.

“Following two weeks of rapid declines, the share of loans in forbearance dropped again, but at a reduced rate. As reported in the past, many servicers process forbearance exits at the beginning of the month, therefore it is not surprising to see the pace of exits slow again mid-month,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The composition of loans in forbearance is evolving. More than 25% of loans in forbearance are now made up of new forbearance requests and re-entries, while many other homeowners who have reached the end of 18-month terms are successfully exiting into deferrals or modifications.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. The number of forbearance plans is decreasing rapidly recently since many homeowners have reached the end of the 18-month term.

The MBA notes: "By stage, 15.3% of total loans in forbearance are in the initial forbearance plan stage, while 74.8% are in a forbearance extension. The remaining 9.9% are forbearance re-entries."

Housing and Recessions

by Calculated Risk on 10/25/2021 01:34:00 PM

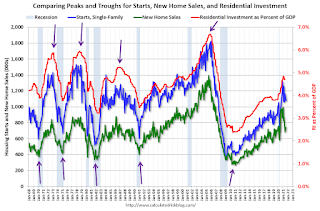

Click on graph for larger image.

Click on graph for larger image.The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

New home sales and single family starts have turned down recently, but this is because of the huge surge in sales and starts in the 2nd half of 2020.

The second graph shows the YoY change in New Home Sales from the Census Bureau.

The second graph shows the YoY change in New Home Sales from the Census Bureau.Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

Some observations:

1) When the YoY change in New Home Sales falls about 20%, usually a recession will follow. An exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession. Another exception is the current situation - due to the pandemic and the pickup in new home sales in the second half of 2020.

2) It is also interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As I noted in earlier posts, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

Although new home sales are currently down over 20% year-over-year, this is just due to the delayed sales in 2020, and is not an indicator of an impending recession. No worries.

Housing Inventory Oct 25th Update: Inventory Down Slightly Week-over-week

by Calculated Risk on 10/25/2021 10:50:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 10/25/2021 08:26:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of October 24th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 21.0% from the same day in 2019 (79.0% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through October 23, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - but might be picking up a little again. The 7-day average for the US is down 7% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $136 million last week, down about 14% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through October 16th. The occupancy rate was down 10.0% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of October 15th, gasoline supplied was up slightly compared to the same week in 2019.

This was the 7th week so far this year when gasoline supplied was up compared to the same week in 2019 - and consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through October 23rd for the United States and several selected cities.

This data is through October 23rd for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 115% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, October 15th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, October 24, 2021

Sunday Night Futures

by Calculated Risk on 10/24/2021 07:08:00 PM

Weekend:

• Schedule for Week of October 24, 2021

• Final Look: Local Housing Markets in September

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for September. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for October.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 8 and DOW futures are down 66 (fair value).

Oil prices were up over the last week with WTI futures at $83.98 per barrel and Brent at $85.62 per barrel. A year ago, WTI was at $40, and Brent was at $41 - so WTI oil prices are up more than double year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.36 per gallon. A year ago prices were at $2.15 per gallon, so gasoline prices are up $1.21 per gallon year-over-year.

Final Look: Local Housing Markets in September

by Calculated Risk on 10/24/2021 09:12:00 AM

Today, in the Real Estate Newsletter: Final Look: Local Housing Markets in September

Adding Alabama, Charlotte, Columbus, Miami, New York, Phoenix and the Twin Cities

Excerpt:

Key Points:

1. Inventory is still very low, and inventory in most areas is at a record low for the month of September.

2.There is significant divergence between markets.

3. It is possible inventory will be up year-over-year during the Winter, but still at very low levels.

Saturday, October 23, 2021

Real Estate Newsletter Articles this Week

by Calculated Risk on 10/23/2021 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Will 4% Mortgage Rates "Halt the Housing Market"? Some comments on an interview with Ivy Zelman

• 4th Look at Local Housing Markets in September Adding Austin, California, Des Moines, Houston and Maryland

• Most Housing Units Under Construction Since 1974 Housing Starts Decreased to 1.555 Million Annual Rate in September

• 'Some prospective buyers took a break' Existing Home Sales forecast, and adding Boston, Indiana, Rhode Island, and Washington D.C. September Data

• Existing-Home Sales Increased to 6.29 million in September

• The Coming Deceleration in House Price Growth Still, the August Case-Shiller National Index will be up about 20% YoY

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Currently all content is available for free - and some will always be free - but please subscribe!.

Schedule for Week of October 24, 2021

by Calculated Risk on 10/23/2021 08:11:00 AM

The key reports this week are the advance estimate of Q3 GDP and September New Home sales.

Other key indicators include Personal Income and Outlays for September and Case-Shiller house prices for August.

For manufacturing, the Dallas, Richmond and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for October.

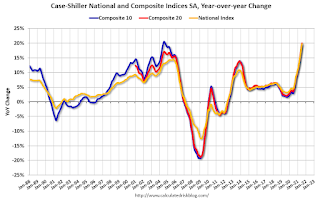

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 20.1% year-over-year.

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 20.1% year-over-year.This graph shows the year-over-year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 760 thousand SAAR, up from 740 thousand in August.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 295 thousand initial claims, up from 290 thousand last week.

8:30 AM: Gross Domestic Product, 3rd quarter 2021 (advance estimate). The consensus is that real GDP increased 2.8% annualized in Q3, down from 6.7% in Q2.

10:00 AM: Pending Home Sales Index for September. The consensus is 0.5% increase in the index.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for October. This is the last of the regional surveys for October.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.1% decrease in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 64.0, down from 64.7 in September.

10:00 AM: University of Michigan's Consumer sentiment index (Final for October). The consensus is for a reading of 71.6.

Friday, October 22, 2021

30 Year Mortgage Rates "Highest Since April" at 3.27%

by Calculated Risk on 10/22/2021 05:21:00 PM

From Matthew Graham at Mortgage News Daily: Highest Rates Since April, But There's a Catch

Over the past 30 days, interest rates have risen sharply. This is true for both mortgage rates and bond market benchmarks like 10yr Treasury yields. ...

Translation: at the beginning of the month, traders only saw a small chance of the first rate hike happening in September and no chance for June. Fast forward 3 weeks and September is seen as 100% likely and June is up to about a 60% chance. [30 year fixed 3.27%]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac) since 2010.

October 22nd COVID-19: Still Over 70,000 New Cases per Day

by Calculated Risk on 10/22/2021 03:31:00 PM

"This paper supports vaccination as an important strategy for reducing infection and transmission, along with hand-washing, mask-wearing, and physical distancing.” ... “Other research has clearly and definitively established that the vaccines significantly reduce the risk of hospitalization and mortality.”

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 57.3% | 56.8% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 190.2 | 188.7 | ≥2321 | |

| New Cases per Day3 | 71,550 | 84,239 | ≤5,0002 | |

| Hospitalized3 | 49,864 | 56,177 | ≤3,0002 | |

| Deaths per Day3 | 1,257 | 1,306 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Pennsylvania at 59.9%, Minnesota, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.5%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.9%, Indiana at 49.5%, Oklahoma at 49.5%, South Carolina at 49.4%, Missouri at 49.3%, and Georgia at 47.6%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

The Coming Deceleration in House Price Growth

by Calculated Risk on 10/22/2021 12:56:00 PM

Today, in the Newsletter: The Coming Deceleration in House Price Growth

Excerpt:

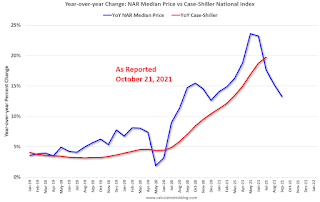

[This graph] - as of the NAR release yesterday - shows that Case-Shiller followed the median prices up, and that median prices are now falling.

...

This suggests that Case-Shiller will start to show some deceleration in the September or October reports (to be released in late November and December). emphasis added

Black Knight: "Forbearance Declines Hit Mid-Month Lull"

by Calculated Risk on 10/22/2021 10:41:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of October 19th.

From Andy Walden at Black Knight: Forbearance Declines Hit Mid-Month Lull

After two weeks of sizable drops in the number of active forbearance plans (as hundreds of thousands of homeowners reached the end of their allowable terms), we saw much more modest improvement this week – the same mid-month lull in removal activity that we’ve been reporting on for many months now.

According to our McDash Flash daily forbearance tracking dataset, the number of active forbearance plans fell by just 7,300 (-0.6%) this week, with declines of 10,500 among FHA/VA loans and 2,800 among GSE mortgages being partially offset by a 6,000 rise in plan volumes among portfolio and PLS mortgages. That’s substantially less than last week’s 143,000 (10%) drop.

As of October 19, 1.24 million mortgage holders remain in COVID-19 related forbearance plans, representing 2.3% of all active mortgages, including 1.3% of GSE, 3.9% of FHA/VA and 3% of portfolio held and privately securitized loans.

Click on graph for larger image.

Still, on a monthly basis, improvement remains strong, with forbearances declining by 356,000 (-22.3%) over the past 30 days, and the past few weeks have seen the fastest monthly rates of improvement since the start of the pandemic.

Some 432,000 homeowners left forbearance in the first 19 days of October, making it the largest single month in terms of exit volumes since October of last year. And with more than 280,000 plans still up for review through the end of October, significant opportunity remains for additional declines through the first few weeks of November.

emphasis added

Q3 GDP Forecasts: Around 2.5%

by Calculated Risk on 10/22/2021 10:33:00 AM

These are forecasts of the advance estimate of GDP to be released on Oct 28th.

| Merrill | Goldman | GDPNow | |

|---|---|---|---|

| 7/30/21 | 7.0% | 9.0% | 6.1% |

| 8/20/21 | 4.5% | 5.5% | 6.1% |

| 9/10/21 | 4.5% | 3.5% | 3.7% |

| 9/17/21 | 4.5% | 4.5% | 3.6% |

| 9/24/21 | 4.5% | 4.5% | 3.7% |

| 10/1/21 | 4.1% | 4.25% | 2.3% |

| 10/8/21 | 2.0% | 3.25% | 1.3% |

| 10/15/21 | 2.0% | 3.25% | 1.2% |

| 10/22/21 | 2.5% | 3.25% | 0.5% |

From BofA Merrill Lynch:

We forecast 3Q GDP growth of 2.5% qoq saar, down from 6.7% qoq saar in 2Q as the effects of the Delta variant stifled consumption. [Oct 22 estimate]From Goldman Sachs:

emphasis added

We have been assuming higher home sales and home prices in September, and we left our Q3 GDP tracking estimate unchanged on a rounded basis at +3¼% (qoq ar). [Oct 21 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 0.5 percent on October 19, down from 1.2 percent on October 15. [Oct 19 estimate]

Black Knight: National Mortgage Delinquency Rate Decreased in September

by Calculated Risk on 10/22/2021 07:00:00 AM

Note: At the beginning of the pandemic, the delinquency rate increased sharply (see table below). Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight: Foreclosure Starts Reverse Course in September, Pulling Back Despite Moratoria Expiration; Delinquency Rate Falls Below 4% for First Time Since Start of Pandemic

• The national delinquency rate fell to 3.91% in September – the first time it’s been below 4% in 18 months – marking a 2.3% decline from August and 41.3% from the same time last yearAccording to Black Knight's First Look report, the percent of loans delinquent decreased 2.3% in September compared to August, and decreased 41% year-over-year.

• What would have been stronger improvement was partially offset by delinquencies rising by 7,800 in FEMA-declared disaster areas in hurricane-impacted Louisiana and by 11,000 in the state as a whole

• Foreclosure starts also dipped in September after seeing a noticeable rise in August in the wake of the federal foreclosure moratoria expiration

• September’s 3,900 foreclosure starts was the third lowest monthly total on record and within 6% of the record low set back in April of this year

• likewise, the number of active foreclosures fell in September as well, hitting yet another all-time low

• With nearly 400,000 mortgage holders having exited forbearance plans in just the first two weeks of October alone, it will be essential to track foreclosure metrics closely in the coming months

• Some 1.2 million homeowners remain 90 or more days past due on their mortgages but are not yet in foreclosure, including those who are still in active forbearance plans

emphasis added

The percent of loans in the foreclosure process decreased 4.6% in September and were down 25% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.91% in September, down from 4.00% in August.

The percent of loans in the foreclosure process decreased in September to 0.26%, from 0.27% in August.

The number of delinquent properties, but not in foreclosure, is down 1,474,000 properties year-over-year, and the number of properties in the foreclosure process is down 46,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Sept 2021 | Aug 2021 | Sept 2020 | Sept 2019 | |

| Delinquent | 3.91% | 4.00% | 6.66% | 3.53% |

| In Foreclosure | 0.26% | 0.27% | 0.34% | 0.48% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,068,000 | 2,122,000 | 3,542,000 | 1,854,000 |

| Number of properties in foreclosure pre-sale inventory: | 135,000 | 142,000 | 181,000 | 252,000 |

| Total Properties | 2,203,000 | 2,264,000 | 3,722,000 | 2,106,000 |

Thursday, October 21, 2021

October 21st COVID-19: Progress

by Calculated Risk on 10/21/2021 03:49:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 57.2% | 56.7% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 189.9 | 188.3 | ≥2321 | |

| New Cases per Day3 | 73,079 | 86,045 | ≤5,0002 | |

| Hospitalized3 | 50,791 | 57,087 | ≤3,0002 | |

| Deaths per Day3 | 1,252 | 1,308 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Pennsylvania at 59.8%, Minnesota, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.4%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.9%, Indiana at 49.4%, South Carolina at 49.3%, Missouri at 49.2%, Oklahoma at 49.2% and Georgia at 47.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Hotels: Occupancy Rate Down 10% Compared to Same Week in 2019

by Calculated Risk on 10/21/2021 02:05:00 PM

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

U.S. hotel occupancy reached its highest level since mid-August, while room rates dipped from the previous week, according to STR‘s latest data through October 16.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

October 10-16, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 65.0% (-10%)

• verage daily rate (ADR): $134.03 (-1.4%)

• Revenue per available room (RevPAR): $87.15 (-11.3%)

Week-over-week demand growth came almost exclusively from the Sunday ahead of Columbus Day. Overall for the three-day holiday weekend (8-10 October), occupancy reached 72% as compared with 75% in 2019.

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

LA Area Port Traffic: Solid Imports, Weak Exports in September

by Calculated Risk on 10/21/2021 01:56:00 PM

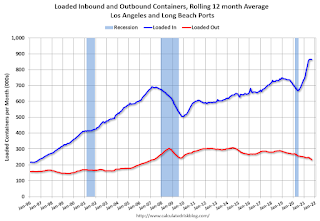

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Also, incoming port traffic is backed up significantly in the LA area with numerous ships at anchor waiting to unload.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.4% in September compared to the rolling 12 months ending in August. Outbound traffic was down 2.0% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down 4% YoY in September (recovered last year following the early months of the pandemic), and exports were down 23% YoY.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |