by Calculated Risk on 11/17/2021 09:02:00 AM

Wednesday, November 17, 2021

Most Housing Units Under Construction Since 1974

Today, in the Real Estate Newsletter: Most Housing Units Under Construction Since 1974

Excerpt:

The fourth graph shows starts under construction, Seasonally Adjusted (SA).You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Red is single family units. Currently there are 726 thousand single family units under construction (SA). This is the highest level since 2007.

For single family, most of these homes are already sold (Census counts sales when contract is signed). The reason there are so many homes is probably due to construction delays. Since most of these are already sold, it is unlikely this is “overbuilding”, or that this will impact prices.

Blue is for 2+ units. Currently there are 725 thousand multi-family units under construction. This is the highest level since 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Census will release data next year on the length of time from start to completion, and that will probably show long delays in 2021. In 2020, it took an average of 6.8 months from start to completion for single family homes, and 15.4 months for buildings with 2 or more units.

Combined, there are 1.451 million units under construction. This is the most since 1974.

Housing Starts Decreased to 1.520 Million Annual Rate in October

by Calculated Risk on 11/17/2021 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in October were at a seasonally adjusted annual rate of 1,520,000. This is 0.7 percent below the revised September estimate of 1,530,000, but is 0.4 percent above the October 2020 rate of 1,514,000. Single‐family housing starts in October were at a rate of 1,039,000; this is 3.9 percent below the revised September figure of 1,081,000. The October rate for units in buildings with five units or more was 470,000.

Building Permits:

Privately‐owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,650,000. This is 4.0 percent above the revised September rate of 1,586,000 and is 3.4 percent above the October 2020 rate of 1,595,000. Single‐family authorizations in October were at a rate of 1,069,000; this is 2.7 percent above the revised September figure of 1,041,000. Authorizations of units in buildings with five units or more were at a rate of 528,000 in October.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in October compared to September. Multi-family starts were up 37% year-over-year in October.

Single-family starts (red) decreased in October, and were down 10.6% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in October were below expectations, and starts in August and September were revised down, combined.

I'll have more later …

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 11/17/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 12, 2021.

... The Refinance Index decreased 5 percent from the previous week and was 31 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 6 percent lower than the same week one year ago.

“Refinance applications decreased for the seventh time in eight weeks, as mortgage rates moved higher after two weeks of declines. Activity has been particularly sensitive to rate movements, and last week’s decline was driven by a drop in conventional and FHA refinance applications, which offset an increase in VA refinance applications. All mortgage rates in MBA’s survey increased, with the 30-year fixed rate climbing to 3.2 percent.” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications increased for both conventional and government loan segments, as housing demand continues to show resiliency at a time – late fall – when home buying activity typically slows. The second straight increase in purchase applications suggests that stronger sales activity may continue in the weeks to come. Despite elevated demand, purchase applications were 5.7 percent lower than a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.20 percent from 3.16 percent, with points increasing to 0.43 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With relatively low rates, the index remains somewhat elevated.

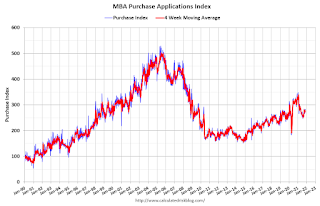

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 6% year-over-year unadjusted.

According to the MBA, purchase activity is down 6% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, November 16, 2021

Wednesday: Housing Starts, Architecture Billings Index

by Calculated Risk on 11/16/2021 08:16:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for October. The consensus is for 1.580 million SAAR, up from 1.555 million SAAR.

• During the day, The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

November 16th COVID-19: New Cases Increasing, Above 83K per Day

by Calculated Risk on 11/16/2021 04:15:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.9% | 58.4% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 195.4 | 193.8 | ≥2321 | |

| New Cases per Day3🚩 | 83,671 | 73,349 | ≤5,0002 | |

| Hospitalized3 | 39,884 | 40,419 | ≤3,0002 | |

| Deaths per Day3 | 1,029 | 1,072 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Wisconsin at 59.0%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 50.3%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 49.0%, Tennessee at 48.9%, Arkansas at 48.8%, Louisiana at 48.3% and North Dakota at 48.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

October California Home Sales

by Calculated Risk on 11/16/2021 02:04:00 PM

Today, in the Real Estate Newsletter: October California Home Sales

Excerpt:

Sales Down 10.4% YoY. Active Listings down 18.3%You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

...

California is a key market, and sometimes we see trends in California early. Unfortunately the C.A.R. doesn’t release monthly sales or inventory numbers. Not Seasonally Adjusted (NSA).

...

"October’s sales pace dipped 0.9 percent on a monthly basis from 438,190 in September and was down 10.4 percent from a year ago, when 484,510 homes were sold on an annualized basis."

"California’s Unsold Inventory Index (UII) dipped on a month-to-month basis for the first time in four months, as active listings fell 18.3 percent from last year."

NAHB: Builder Confidence Increased to 83 in November

by Calculated Risk on 11/16/2021 10:07:00 AM

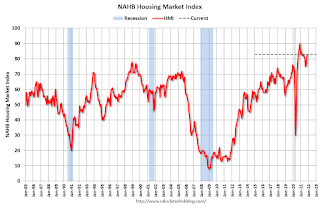

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 83, up from 80 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Up on Strong Demand Even as Supply Side Challenges Persist

Low existing inventories and strong buyer demand helped push builder confidence higher for the third consecutive month even as supply-side challenges — including building material bottlenecks and lot and labor shortages — remain stubbornly persistent. Builder sentiment in the market for newly built single-family homes moved three points higher to 83 in November, according to the NAHB/Wells Fargo Housing Market Index (HMI) released today.

“The solid market for home building continued in November despite ongoing supply-side challenges,” said NAHB Chairman Chuck Fowke. “Lack of resale inventory combined with strong consumer demand continues to boost single-family home building.”

“In addition to well publicized concerns over building materials and the national supply chain, labor and building lot access are key constraints for housing supply,” said NAHB Chief Economist Robert Dietz. “Lot availability is at multi-decade lows and the construction industry currently has more than 330,000 open positions. Policymakers need to focus on resolving these issues to help builders produce more housing to meet strong market demand.”

...

The HMI index gauging current sales conditions rose three points to 89 and the gauge charting traffic of prospective buyers also posted a three-point gain to 68. The component measuring sales expectations in the next six months held steady at 84.

Looking at the three-month moving averages for regional HMI scores, the Midwest rose four points to 72, the South registered a four-point gain to 84 and the West rose one point to 84. The Northeast fell two points to 70.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast, and a strong reading.

Industrial Production Increased 1.6 Percent in October; Back to Pre-pandemic Levels

by Calculated Risk on 11/16/2021 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 1.6 percent in October after falling 1.3 percent in September; about half of the gain in October reflected a recovery from the effects of Hurricane Ida. Manufacturing output increased 1.2 percent in October; excluding a large gain in the production of motor vehicles and parts, factory output moved up 0.6 percent. The output of utilities rose 1.2 percent, and mining output stepped up 4.1 percent.

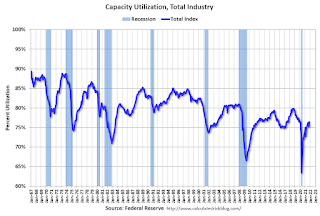

At 101.6 percent of its 2017 average, total industrial production in October was 5.1 percent above its year-earlier level and at its highest reading since December 2019. In October, capacity utilization for the industrial sector increased 1.2 percentage points to 76.4 percent; even so, it was still 3.2 percentage points below its long-run (1972–2020) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and back to the level in February 2020 (pre-pandemic).

Capacity utilization at 76.4% is 3.2% below the average from 1972 to 2020. This was above consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in October to 100.0. This is slightly above the February 2020 level.

The change in industrial production was above consensus expectations.

Retail Sales Increased 1.7% in October

by Calculated Risk on 11/16/2021 08:37:00 AM

On a monthly basis, retail sales were increased 1.7% from September to October (seasonally adjusted), and sales were up 16.3 percent from October 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for October 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $638.2 billion, an increase of 1.7 percent from the previous month, and 16.3 percent above October 2020.

emphasis added

Click on graph for larger image.

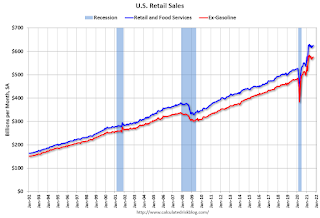

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 1.5% in October.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 13.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 13.9% on a YoY basis.Sales in October were above expectations, and sales in August and September were revised up.

Monday, November 15, 2021

Tuesday: Retail Sales, Industrial Production, Homebuilder Survey

by Calculated Risk on 11/15/2021 07:36:00 PM

From Matthew Graham at Mortgage News Daily: Upward Momentum Continues For Mortgage Rates

After hitting the lowest levels in over a month last Tuesday, mortgage rates have been moving higher fairly quickly each day since then. Most of the damage occurred on Wednesday and Friday of last week (markets were closed on Thursday), but today got progressively worse as the hours ticked by. [30 year fixed 3.23%]Tuesday:

emphasis added

• At 8:30 AM ET, Retail sales for October will be released. The consensus is for a 1.1% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.7% increase in Industrial Production, and for Capacity Utilization to increase to 75.7%.

• At 10:00 AM, The November NAHB homebuilder survey. The consensus is for a reading of 80, unchanged from 80. Any number above 50 indicates that more builders view sales conditions as good than poor.

HUD: FHA'S 2021 Annual Report Shows Increase in Capital Reserves; DTI Remains Elevated

by Calculated Risk on 11/15/2021 04:49:00 PM

The U.S. Department of Housing and Urban Development (HUD) today released its fiscal year (FY) 2021 report to Congress on the financial health of the Federal Housing Administration (FHA) Mutual Mortgage Insurance Fund. In addition to its emphasis on delivering relief options to homeowners financially impacted by the COVID-19 pandemic, FHA continued to deliver on its mission of enabling homeownership for first-time and low- and moderate-income, and households of color.From the report: Credit scores are decent, but DTI ratio remains elevated.

The MMI Fund supports FHA’s Single Family mortgage insurance programs, including all forward mortgage purchase and refinance transactions, as well as mortgages insured under the Home Equity Conversion Mortgage (HECM) reverse mortgage program. The report illustrates that the MMI Fund increased its overall Capital Ratio, ending the fiscal year at 8.03 percent, an increase of 1.93 percentage points over the previous fiscal year. For the first time since 2015, the HECM reverse mortgage program has a strong positive ratio, primarily due to strong national home price appreciation. As the recovery from the pandemic continues, the Fund remains well positioned to withstand future economic events and endure the outcomes from the pandemic induced delinquencies that remain in forbearance or are seriously delinquent.

“The strength of the fund is a promising sign and solidifies the important role FHA fulfills in making homeownership a reality for first-time homebuyers and those with lower incomes.” said U.S. Department of Housing and Urban Development Secretary Marcia L. Fudge. “This year, our Administration took unprecedented steps to deliver relief to those devastated by the pandemic. Managing the strong fiscal health and performance of the FHA program is a top priority, and I am encouraged to see the MMI Fund remain resilient through the events of the past year. Looking ahead, we will ensure FHA is well positioned to provide broad and equitable access to homeownership, especially for those who have been historically underserved in the mortgage market.”

Click on graph for larger image.

Click on graph for larger image.Exhibit III-8 above illustrates the distribution of credit scores for borrowers obtaining FHA endorsements. The share of endorsements with credit scores between 620 and 679 increased slightly in from 53.13 percent in FY 2020 to 57.16 percent in FY 2021. The share of endorsements on mortgages with credit scores of 720 or higher decreased from 14.69 percent in FY 2020 to 13.33 percent in FY 2021.

The average Debt-to-Income (DTI) ratio for borrowers with FHA-insured purchase mortgages increased slightly, from 43.08 percent in FY 2020 to 43.18 percent in FY 2021, as illustrated in Exhibit III-9 above. The percentage of borrowers with DTI ratios of 50 percent or greater in FY 2021 was at 23.71 percent, a decline from 24.20 percent in FY 2020 and a sign of slightly improving economic circumstances for FHA’s traditional borrowers.

November 15th COVID-19: New Cases Increasing, Above 80K per Day

by Calculated Risk on 11/15/2021 02:42:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.8% | 58.4% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 195.3 | 193.8 | ≥2321 | |

| New Cases per Day3🚩 | 80,823 | 72,204 | ≤5,0002 | |

| Hospitalized3 | 38,332 | 40,676 | ≤3,0002 | |

| Deaths per Day3 | 1,043 | 1,071 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Wisconsin at 59.0%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 50.3%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 48.8%, Tennessee at 48.8%, Arkansas at 48.8%, Louisiana at 48.3% and North Dakota at 48.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

4th Look at Local Housing Markets in October

by Calculated Risk on 11/15/2021 01:26:00 PM

Today, in the Real Estate Newsletter: 4th Look at Local Housing Markets in October

Excerpt:

This is the fourth look at local markets in October. This update adds Des Moines, Maryland, South Carolina, and Washington, D.C..You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

...

Here is a summary of active listings for the housing markets that have reported so far in October. For these markets, inventory was down 6.9% in October MoM from September, and down 25.2% YoY.

Of the markets that have reported so far, inventories in Jacksonville and San Diego are at record lows. Sacramento and Washington, D.C. are the only markets so far with inventory up YoY in October.

nventory almost always declines seasonally in October, so the MoM decline is not a surprise. Last month, these markets were down 23.1% YoY, so the YoY decline in October is slightly larger than in September. This is not indicating a slowing market.

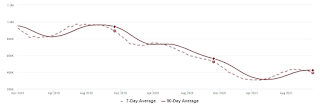

Housing Inventory Nov 15th Update: Inventory Down 1.7% Week-over-week

by Calculated Risk on 11/15/2021 10:38:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 11/15/2021 08:26:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of November 14th.

Click on graph for larger image.

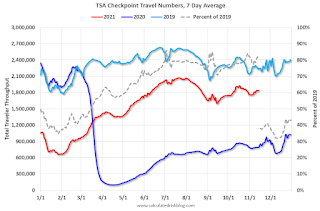

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 17.9% from the same day in 2019 (82.1% of 2019). (Dashed line)

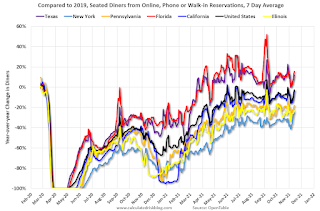

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through November 13, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - and appears to be declining again. The 7-day average for the US is down 3% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $151 million last week, down about 29% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through November 6th. The occupancy rate was down 13.0% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of November 5th, gasoline supplied was down 0.7% compared to the same week in 2019.

There have been eight weeks so far this year when gasoline supplied was up compared to the same week in 2019 - and consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through November 13th

This data is through November 13th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 112% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, November 12th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, November 14, 2021

Sunday Night Futures

by Calculated Risk on 11/14/2021 07:01:00 PM

Weekend:

• Schedule for Week of November 14, 2021

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 20.1, up from 10.5.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 10 and DOW futures are up 67 (fair value).

Oil prices were down over the last week with WTI futures at $81.17 per barrel and Brent at $82.45 per barrel. A year ago, WTI was at $40, and Brent was at $42 - so WTI oil prices are up double year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.40 per gallon. A year ago prices were at $2.12 per gallon, so gasoline prices are up $1.28 per gallon year-over-year.

The Labor Force Participation Rate

by Calculated Risk on 11/14/2021 02:13:00 PM

On Friday, Goldman Sachs economists put out a research note on the labor force participation rate: Why Isn’t Labor Force Participation Recovering?

While the unemployment rate continues to fall quickly, labor force participation has made no progress since August 2020. ... Most of the 5.0mn persons who have exited the labor force since the start of the pandemic are over age 55 (3.4mn), largely reflecting early (1.5mn) and natural (1mn) retirements that likely won’t reverse. The outlook for prime-age persons who have exited the labor force (1.7mn) is more positive, since very few are discouraged and most still view their exits as temporary.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 634,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

Click on graph for larger image.

Click on graph for larger image.The Labor Force Participation Rate was unchanged at 61.6% in October, from 61.6% in September. This is the percentage of the working age population in the labor force.

The Employment-Population ratio increased to 58.8% from 58.7% (black line).

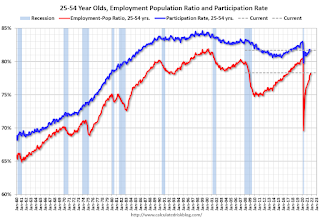

Since the overall participation rate has declined due to the pandemic and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to the pandemic and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate increased in October to 81.7% from 81.6% in September, and the 25 to 54 employment population ratio increased to 78.3% from 78.0% in September.

Here is a graph of the change in the participation rate by age cohort (October 2019, October 2020, and October 2021 NSA).

Here is a graph of the change in the participation rate by age cohort (October 2019, October 2020, and October 2021 NSA).Saturday, November 13, 2021

Real Estate Newsletter Articles this Week

by Calculated Risk on 11/13/2021 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• A Zillow Flip that Flopped

• Homebuilder Comments in October: “Builders are lifting sales caps" "Lack of lots & land development will hold back growth in 2022"

• 2nd Look at Local Housing Markets in October Inventory in San Diego is at an all time low

• Inventory will Tell the Tale

• "The deal of the Century ..." Best to all Veterans

• 3rd Look at Local Housing Markets in October Albuquerque, Atlanta, Colorado, Georgia, Houston, Jacksonville, Minnesota, Portland, Sacramento and Santa Clara

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Currently all content is available for free - and some will always be free - but please subscribe!.

Schedule for Week of November 14, 2021

by Calculated Risk on 11/13/2021 08:11:00 AM

The key economic reports this week are October Retail Sales and Housing Starts.

For manufacturing, October industrial production, and the November New York, Philly and Kansas City Fed surveys, will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 20.1, up from 10.5.

8:30 AM ET: Retail sales for October will be released.

8:30 AM ET: Retail sales for October will be released.The consensus is for a 1.1% increase in retail sales.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.7% increase in Industrial Production, and for Capacity Utilization to increase to 75.7%.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 80, unchanged from 80. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. This graph shows single and total housing starts since 1968.

The consensus is for 1.580 million SAAR, up from 1.555 million SAAR.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 260 thousand initial claims, down from 267 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 24.0, up from 23.8.

11:00 AM: the Kansas City Fed manufacturing survey for November.

10:00 AM: State Employment and Unemployment (Monthly) for October 2021 (And State Job Openings)

Friday, November 12, 2021

Mortgage Rates Increased This Week

by Calculated Risk on 11/12/2021 05:29:00 PM

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Are Actually Much Higher This Week

This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac) since 2010.