by Calculated Risk on 12/13/2021 12:19:00 PM

Monday, December 13, 2021

A Few Comments on Inflation

Click on graph for larger image.

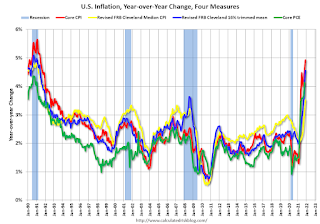

Click on graph for larger image.The recent increase in inflation has led to some analysts to call for the Fed to raise rates. For example, from CNBC this morning: El-Erian says ‘transitory’ was the ‘worst inflation call in the history’ of the Fed

“If I were them, I would do three things, which they will not do,” [El-Erian] said during a “Squawk Box” interview. “I would 1) be very open and honest as to why I got the inflation call wrong and try to regain the inflation narrative. 2) I would go even further than doubling the rate of taper, and 3) I would open it up to the possibility that rate hikes may come faster than what the market has. They’re not gonna do that."The FOMC will likely announce a faster pace of tapering assets purchases at the meeting this week, and asset purchases will probably end in March (if not sooner).

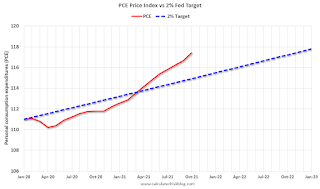

The second graph is from January 2005 (just an arbitrary date).

The second graph is from January 2005 (just an arbitrary date).This shows that inflation has been below target for years. If we were doing price targeting (we aren't), then prices would just be getting back to the target.

The graphs for core PCE inflation show the same pattern, but core PCE is even further below the trend line.

The question is not will some prices "stick", but rather will YoY inflation ease back towards the Fed's target? Or will inflation stay elevated?

My sense is inflation will ease back towards the Fed's target over the next year.

Housing Inventory December 13th Update: Inventory Down 3.3% Week-over-week

by Calculated Risk on 12/13/2021 10:14:00 AM

Tracking existing home inventory is very important this year and in 2022.

This inventory graph is courtesy of Altos Research.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 12/13/2021 08:20:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of December 12th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 16.2% from the same day in 2019 (83.8% of 2019). (Dashed line)

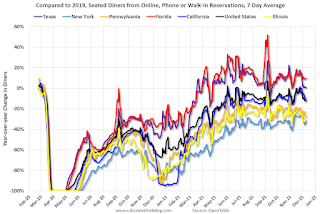

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through December 9, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend but declined after the holiday - and is mostly moving sideways. The 7-day average for the US is down 12% compared to 2019.

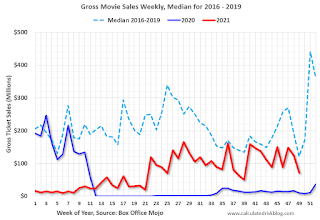

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $70 million last week, down about 42% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through December 4th. The occupancy rate was down 8.8% compared to the same week in 2019. Although down compared to 2019, the 4-week average of the occupancy rate is close to the median rate for the previous 20 years (Blue).

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of December 3rd, gasoline supplied was up 0.9% compared to the same week in 2019.

This was the 11th week this year that gasoline supplied was up compared to the same week in 2019 - so consumption is running close to 2019 levels now.

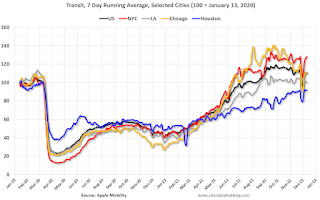

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through December 10th

This data is through December 10th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 111% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, December 10th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, December 12, 2021

Sunday Night Futures

by Calculated Risk on 12/12/2021 07:24:00 PM

Weekend:

• Schedule for Week of December 12, 2021

• FOMC Preview: Accelerated Taper Announcement Expected

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 10 and DOW futures are up 90 (fair value).

Oil prices were up over the last week with WTI futures at $72.55 per barrel and Brent at $75.92 per barrel. A year ago, WTI was at $47, and Brent was at $50 - so WTI oil prices are up 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.32 per gallon. A year ago prices were at $2.14 per gallon, so gasoline prices are up $1.18 per gallon year-over-year.

FOMC Preview: Accelerated Taper Announcement Expected

by Calculated Risk on 12/12/2021 08:11:00 AM

Expectations are the FOMC will announce a faster pace of tapering assets purchases at the meeting this week.

From Goldman Sachs:

"The FOMC is very likely to double the pace of tapering to $30bn per month at its December meeting next week, putting it on track to announce the last two tapers at the January FOMC meeting and to implement the last taper in March. We now expect the FOMC to deliver rate hikes next year in May, July, and November (vs. June, September, and December previously)."Analysts will also be looking for comments on inflation and on rate hikes in 2022.

Wall Street forecasts are for GDP to increase at close to a 6.5% annual rate in Q4 that would put Q4-over-Q4 at around 5.4% - so the FOMC projections for 2021 are now a little on the high side compared to Wall Street.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 5.8 to 6.0 | 3.4 to 4.5 | 2.2 to 2.5 | 2.0 to 2.2 |

| June 2021 | 6.8 to 7.3 | 2.8 to 3.8 | 2.0 to 2.5 | |

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 4.6 to 4.8 | 3.6 to 4.0 | 3.3 to 3.7 | 3.3 to 3.6 |

| June 2021 | 4.4 to 4.8 | 3.5 to 4.0 | 3.2 to 3.8 | |

As of October 2021, PCE inflation was up 5.0% from October 2020. This is above the top end of the projected range for Q4, and projections will be revised up.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 4.0 to 4.3 | 2.0 to 2.5 | 2.0 to 2.3 | 2.0 to 2.2 |

| June 2021 | 3.1 to 3.5 | 1.9 to 2.3 | 2.0 to 2.2 | |

PCE core inflation was up 4.1% in October year-over-year. Core PCE projections will be revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 3.6 to 3.8 | 2.0 to 2.5 | 2.0 to 2.3 | 2.0 to 2.2 |

| June 2021 | 2.9 to 3.1 | 1.9 to 2.3 | 2.0 to 2.2 | |

Saturday, December 11, 2021

Real Estate Newsletter Articles this Week

by Calculated Risk on 12/11/2021 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 2nd Look at Local Housing Markets in November Adding Houston, Jacksonville, Nashville, New Hampshire, North Texas, Portland and Santa Clara

• The Home ATM in Q3 2021 aka Mortgage Equity Withdrawal (MEW)

• Lawler: Updates on Key Drivers of US Population Growth Lowest Growth in over a Century from 7/1/2020 to 7/1/2021

• 1st Look at Local Housing Markets in November "2022 will be a wild and competitive ride"

• As Forbearance Ends

This is usually published several times a week, and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Currently all content is available for free - and some will always be free - but please subscribe!.

Schedule for Week of December 12, 2021

by Calculated Risk on 12/11/2021 08:11:00 AM

The key economic reports this week are November Retail Sales and Housing Starts.

For manufacturing, November Industrial Production, and the December New York, Philly and Kansas City Fed surveys, will be released this week.

The FOMC meets this week, and the FOMC is expected to announce a faster taper pace for asset purchases.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for November.

8:30 AM: The Producer Price Index for November from the BLS. The consensus is for a 0.6% increase in PPI, and a 0.5% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 1.4% increase in retail sales.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 1.4% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 25.0, down from 30.9.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 84, up from 83. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to announce a faster taper pace for asset purchases.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 200 thousand initial claims, up from 184 thousand last week.

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.570 million SAAR, up from 1.520 million SAAR.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 27.0, down from 39.0.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.7% increase in Industrial Production, and for Capacity Utilization to increase to 76.8%.

11:00 AM: the Kansas City Fed manufacturing survey for December.

10:00 AM: State Employment and Unemployment (Monthly) for November

Friday, December 10, 2021

Black Knight: Number of Mortgages in Forbearance Declines "Significantly"

by Calculated Risk on 12/10/2021 07:05:00 PM

This data is as of December 7th.

From Andy Walden at Black Knight: Forbearance Plan Exits Drop Significantly

Active forbearance plan totals plunged in the first full week of December, led by portfolio held and privately securitized loans.

According to our McDash Flash daily forbearance tracking dataset, the number of active forbearance plans fell by 112,000 (-11%) this week, led by a 49,000 (-15%) drop in PLS/portfolio loans. FHA/VA plan volumes dropped 42,000 (-12%) followed by GSE (21,000/-7%). There is a modest opportunity for additional improvement in coming weeks with 33,000 loans still listed with November reviews for extension/removal (roughly half of which are expected to be reaching their final expirations).

As of December 7, 882,000 mortgage holders (1.7%) remain in COVID-19 related forbearance plans, including 1.1% of GSE, 2.6% of FHA/VA and 2.1% of portfolio/PLS.

Click on graph for larger image.

Overall, the number of forbearance plans is down by 177,000 (-17%) from the same time last month, with the potential for modest additional improvements through the end of the year. Plan starts over the past four weeks are up 24% from the preceding four-week period, driven by a more than 40% increase among FHA/VA loans (with GSEs seeing a 29% increase). This is a trend we’ll be watching closely as we round out the year.

emphasis added

2nd Look at Local Housing Markets in November

by Calculated Risk on 12/10/2021 01:33:00 PM

Today, in the Real Estate Newsletter: 2nd Look at Local Housing Markets in November

Excerpt:

Adding Houston, Jacksonville, Nashville, New Hampshire, North Texas, Portland and Santa Clara

...

Here is a summary of active listings for these housing markets in November. Inventory was down 15.8% in November month-over-month (MoM) from October, and down 25.0% year-over-year (YoY).

Inventory almost always declines seasonally in November, so the MoM decline is not a surprise. Last month, these markets were down 23.3% YoY, so the YoY decline in November is larger than in October. This isn’t indicating a slowing market.

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

Q4 GDP Forecasts: Moving Up

by Calculated Risk on 12/10/2021 12:36:00 PM

From BofA:

4Q GDP tracking moved up to 6.5% qoq saar from 6.0%, reflecting the strong signal from the BAC card spending data. [December 10 estimate]And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2021 is 8.7 percent on December 9, up from 8.6 percent on December 7. [December 9 estimate]

Cleveland Fed: Median CPI increased 0.5% and Trimmed-mean CPI increased 0.5% in November

by Calculated Risk on 12/10/2021 11:34:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.5% in November. The 16% trimmed-mean Consumer Price Index increased 0.5% in November. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Fuel oil and other fuels" were up 104% annualized.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

BLS: CPI increased 0.8% in November; Core CPI increased 0.5%

by Calculated Risk on 12/10/2021 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.8 percent in November on a seasonally adjusted basis after rising 0.9 percent in October, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.8 percent before seasonal adjustment.Both CPI and core CPI were close to expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The monthly all items seasonally adjusted increase was the result of broad increases in most component indexes, similar to last month. The indexes for gasoline, shelter, food, used cars and trucks, and new vehicles were among the larger contributors. The energy index rose 3.5 percent in November as the gasoline index increased 6.1 percent and the other major energy component indexes also rose. The food index increased 0.7 percent as the index for food at home rose 0.8 percent.

The index for all items less food and energy rose 0.5 percent in November following a 0.6-percent increase in October. Along with shelter, used cars and trucks, and new vehicles, the indexes for household furnishings and operations, apparel, and airline fares were among those that increased. The indexes for motor vehicle insurance, recreation, and communication all declined in November.

The all items index rose 6.8 percent for the 12 months ending October, the largest 12-month increase since the period ending June 1982. The index for all items less food and energy rose 4.9 percent over the last 12 months, while the energy index rose 33.3 percent over the last year, and the food index increased 6.1 percent. These changes are the largest 12-month increases in at least 13 years in the respective series.

emphasis added

Thursday, December 09, 2021

Friday: CPI

by Calculated Risk on 12/09/2021 08:47:00 PM

Friday:

• At 8:30 AM ET, The Consumer Price Index for November from the BLS. The consensus is for a 0.7% increase in CPI, and a 0.5% increase in core CPI.

• At 10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 60.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 200.7 | --- | ≥2321 | |

| New Cases per Day3🚩 | 118,515 | 86,315 | ≤5,0002 | |

| Hospitalized3🚩 | 53,714 | 48,089 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,092 | 854 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

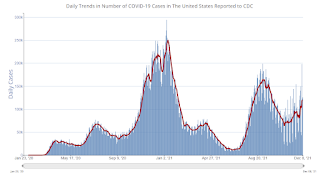

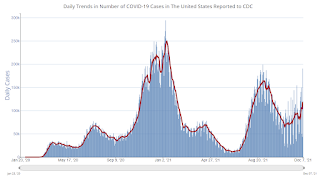

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

The Home ATM, aka Mortgage Equity Withdrawal (MEW)

by Calculated Risk on 12/09/2021 02:46:00 PM

Today, in the Real Estate Newsletter: The Home ATM in Q3 2021

Excerpt:

In Q3 2021, mortgage debt increased $230 billion, the largest quarterly increase since 2006.

...

For Q3 2021, the Net Equity Extraction was $147 billion, or 3.24% of Disposable Personal Income (DPI). The last two quarters have shown a sharp increase in equity extraction compared to recent years, but the level is nothing like the amount of equity extraction during the housing bubble as a percent of DPI. During the housing bubble we saw several quarters with MEW above 8% of DPI.

...

The bottom line is the recent increase in MEW is not concerning - it is far less as a percent of disposable personal income than during the bubble, and most homeowners have substantial equity.

Hotels: Occupancy Rate Down 9% Compared to Same Week in 2019

by Calculated Risk on 12/09/2021 01:13:00 PM

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

U.S. hotel occupancy increased from the previous week, but performance comparisons with 2019 were lower, according to STR‘s latest data through December 4.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

November 28 through December 4, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 54.8% (-8.8%)

• Average daily rate (ADR): $127.92 (-0.5%)

• Revenue per available room (RevPAR): $70.08 (-9.2%)

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

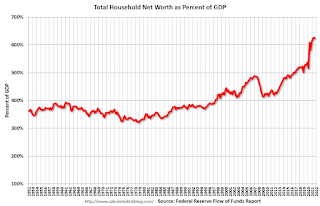

Fed's Flow of Funds: Household Net Worth Increased $2.4 Trillion in Q3

by Calculated Risk on 12/09/2021 12:55:00 PM

The Federal Reserve released the Q3 2021 Flow of Funds report today: Financial Accounts of the United States.

The net worth of households and nonprofits rose to $144.7 trillion during the third quarter of 2021. The value of directly and indirectly held corporate equities decreased $0.3 trillion and the value of real estate increased $1.4 trillion.

...

Household debt increased 6.2 percent at an annual rate in the third quarter of 2021. Consumer credit grew at an annual rate of 5.3 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 7.8 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP.

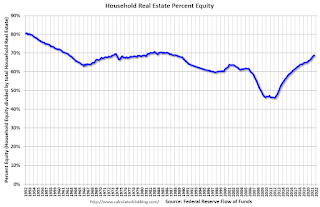

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2021, household percent equity (of household real estate) was at 68.8% - up from 68.3% in Q2. This is the highest percent equity since the 1980s.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So, the approximately 50+ million households with mortgages have less than 67.7% equity - and about 470 thousand homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.Mortgage debt increased by $230 billion in Q3. This is the largest quarterly increase in mortgage debt since 2006.

Mortgage debt is up $800 billion from the peak during the housing bubble, but, as a percent of GDP is at 49.6% - up slightly from Q2 - and down from a peak of 73.3% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, increased in Q3, and is well above the average of the last 30 years.

CoreLogic: 470 thousand Homes with Negative Equity in Q3 2021

by Calculated Risk on 12/09/2021 09:55:00 AM

From CoreLogic: Homeowners Gained Over $3.2 Trillion in Equity in Q3 2021, CoreLogic Reports

CoreLogic® ... today released the Homeowner Equity Report for the third quarter of 2021. The report shows U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by 31.1% year over year, representing a collective equity gain of over $3.2 trillion, and an average gain of $56,700 per borrower, since the third quarter of 2020.

This summer, home price growth reached the highest level in more than 45 years, pushing equity gains to another record high and allowing 70,000 properties to regain equity in the third quarter of 2021. These equity gains provided a crucial barrier against foreclosure for the 1.2 million borrowers who reached the end of forbearance in September.

...

“Home price growth is the principal driver of home equity creation,” said Dr. Frank Nothaft, chief economist for CoreLogic. “The CoreLogic Home Price Index reported home prices were up 17.7% for the past 12 months ending September, spurring the record gains in home equity wealth.” ...

Negative equity, also referred to as underwater or upside-down mortgages, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the third quarter of 2021, negative equity share, and the quarter-over-quarter and year-over-year changes, were as follows:

• Quarterly change: From the second quarter of 2021 to the third quarter of 2021, the total number of mortgaged homes in negative equity decreased by 5.7% to 1.2 million homes, or 2.1% of all mortgaged properties.

• Annual change: In the third quarter of 2020, 1.6 million homes, or 3% of all mortgaged properties, were in negative equity. This number decreased by 28.9%, or approximately 470,000 properties, in the third quarter of 2021.

• National aggregate value: The national aggregate value of negative equity was approximately $276.2 billion at the end of the third quarter of 2021. This is up quarter over quarter by approximately $8.2 billion, or 3%, from $268 billion in the second quarter of 2021, and down year over year by approximately $8.3 billion, or 2.9%, from $284.5 billion in the third quarter of 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q3 to Q2 2021 equity distribution by LTV. There are still a few properties with LTV over 125%. But most homeowners have a significant amount of equity. This is a very different picture than at the start of the housing bust when many homeowners had little equity.

On a year-over-year basis, the number of homeowners with negative equity has declined from 1.6 million to 470 thousand.

Weekly Initial Unemployment Claims Decrease to 184,000

by Calculated Risk on 12/09/2021 08:34:00 AM

The DOL reported:

In the week ending December 4, the advance figure for seasonally adjusted initial claims was 184,000, a decrease of 43,000 from the previous week's revised level. This is the lowest level for initial claims since September 6, 1969 when it was 182,000. The previous week's level was revised up by 5,000 from 222,000 to 227,000. The 4-week moving average was 218,750, a decrease of 21,250 from the previous week's revised average. This is the lowest level for this average since March 7, 2020 when it was 215,250. The previous week's average was revised up by 1,250 from 238,750 to 240,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 218,750.

The previous week was revised up.

Regular state continued claims increased to 1,992,000 (SA) from 1,954,000 (SA) the previous week.

Weekly claims were well below the consensus forecast.

Wednesday, December 08, 2021

Thursday: Unemployment Claims, Q3 Flow of Funds

by Calculated Risk on 12/08/2021 08:58:00 PM

Thursday:

• At 8:30 AM ET,: The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, up from 222 thousand last week.

• At 12:00 PM, Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 60.4% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 200.4 | --- | ≥2321 | |

| New Cases per Day3🚩 | 117,488 | 82,848 | ≤5,0002 | |

| Hospitalized3🚩 | 52,605 | 47,372 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,097 | 798 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Lawler: Updates on Key Drivers of US Population Growth

by Calculated Risk on 12/08/2021 03:02:00 PM

Today, in the Real Estate Newsletter: Lawler: Updates on Key Drivers of US Population Growth

Excerpt:

This is an article from housing economist Tom Lawler (this is important for understanding demographics):

Based on provisional CDC data on US births and deaths, and using a reasonable “guesstimate” on Net International Migration based on available immigration data, it appears as if the US resident population from 7/1/2020 to 7/1/2021 grew by just 486,290, or 0.15%. That growth would be the lowest in over a century.

emphasis added