by Calculated Risk on 12/27/2021 09:49:00 AM

Monday, December 27, 2021

Housing Inventory December 27th Update: Inventory Down 4.8% Week-over-week; Near Record Low

Tracking existing home inventory is very important in 2022.

Inventory usually declines sharply over the holidays - so we will likely see new record lows next week.

This inventory graph is courtesy of Altos Research.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 12/27/2021 08:23:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of December 25th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 17.1% from the same day in 2019 (82.9% of 2019). (Dashed line)

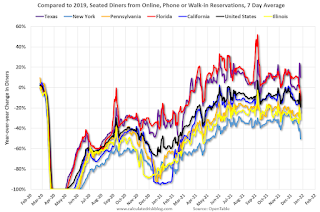

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through December 25, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining was mostly moving sideways, but there has been a significant decline recently, probably due to the winter wave of COVID. The 7-day average for the US is down 19% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $418 million last week, down about 5% from the median for the week.

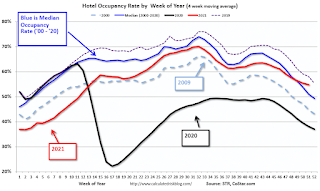

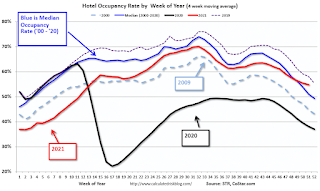

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through December 18th. The occupancy rate was up 8.0% compared to the same week in 2019. Although down compared to 2019, the 4-week average of the occupancy rate is now above the median rate for the previous 20 years (Blue).

Notes: Y-axis doesn't start at zero to better show the seasonal change.

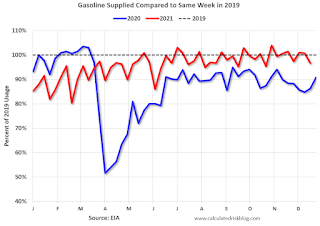

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of December 17th, gasoline supplied was down 3.4% compared to the same week in 2019.

There have been 12 weeks this year that gasoline supplied was up compared to the same week in 2019 - so consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through December 25th

This data is through December 25th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 83% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, December 24th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, December 26, 2021

Sunday Night Futures

by Calculated Risk on 12/26/2021 06:13:00 PM

Weekend:

• Schedule for Week of December 26, 2021

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for December.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $73.79 per barrel and Brent at $76.14 per barrel. A year ago, WTI was at $48, and Brent was at $51 - so WTI oil prices are up 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.25 per gallon. A year ago prices were at $2.24 per gallon, so gasoline prices are up $1.01 per gallon year-over-year.

Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

by Calculated Risk on 12/26/2021 11:59:00 AM

Today, in the Real Estate Newsletter: Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

Brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2022. Some of these questions concern real estate (inventory, house prices, housing credit, housing starts, new home sales), and I’ll post those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I'm adding some thoughts, and maybe some predictions for each question.

...

And the sharp decline in inventory during the pandemic (green arrow) was an indicator that price appreciation would increase. Inventory declined due to a combination of potential sellers keeping their properties off the market during a pandemic, and a pickup in buying due to record low mortgage rates, a move away from multi-family rentals and strong second home buying (to escape the high-density cities). And at the same time, demographics were favorable for home buying (a large cohort has moved into the peak home buying years).

...

First, it appears we will see record low inventories over the next few months. This suggests we will see further strong price gains over the next several months (with low inventories).

In 2021, the NAR showed inventory bottomed in January and (inventory bottoms in December), however the local MLS data, and the Altos Research data, showed inventory bottomed even later than usual - in March or early April 2021. If 2022 follows the normal seasonal pattern, we will see inventory increasing by February (and maybe even in January).

The timing of the seasonal bottom will be important this year. If inventory bottoms seasonally in December, we might see inventory increase YoY later in 2022. However, if inventory doesn't bottom until March or April, we will probably see another crazy year with little inventory.

Saturday, December 25, 2021

Real Estate Newsletter Articles this Week

by Calculated Risk on 12/25/2021 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Lawler: More on Investor Purchases of Residential Homes: Pretium

• New Home Sales: Record 110 thousand homes have not been started New Home Prices Are Up 20% Year-over-year

• Existing-Home Sales Increased to 6.46 million in November Inventory down 13.3% year-over-year

• 5th Look at Local Housing Markets in November

• Supply Chain Disruptions and Housing Inventory

This is usually published several times a week, and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Currently all content is available for free - and some will always be free - but please subscribe!.

Schedule for Week of December 26, 2021

by Calculated Risk on 12/25/2021 08:11:00 AM

Merry Christmas and Happy New Year! Wishing you all the best in 2022.

The key indicator this week is Case-Shiller House Prices for October.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for December.

9:00 AM: FHFA House Price Index for October. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.

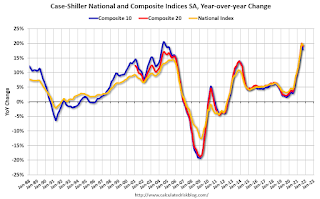

9:00 AM ET: S&P/Case-Shiller House Price Index for October.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 18.5% year-over-year increase in the Composite 20 index for October.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 0.6% increase in the index.

8:30 AM: The initial weekly unemployment claims report will be released. Initial claims were 205 thousand last week.

9:45 AM: Chicago Purchasing Managers Index for December.

No major economic releases scheduled. Markets will be open.

Friday, December 24, 2021

Lawler: More on Investor Purchases of Residential Homes: Pretium

by Calculated Risk on 12/24/2021 01:33:00 PM

Today, in the Real Estate Newsletter: Lawler: More on Investor Purchases of Residential Homes: Pretium

Brief excerpt:

“In a report last month, I wrote about how data from Redfin and CoreLogic indicated that there had been a surge in investor buying of SF homes in the second and third quarters of this year, with some of the biggest increases coming from “large” investors.You can subscribe at https://calculatedrisk.substack.com/

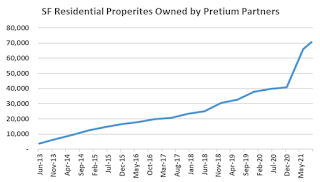

One private company that has massively increased its holdings of SF residential properties is Pretium Partners, a “specialized investment manager” with a huge portfolio of SF residential properties for rent. (Pretium owns Progress Residential, which has recently gotten some negative press.)

According to Pretium’s website, Pretium has increased the number of SF properties it owns from 41,000 at the end of 2020 to 70,700 at the end of September 2021.

Ten Economic Questions for 2022

by Calculated Risk on 12/24/2021 10:32:00 AM

Here is a review of the Ten Economic Questions for 2021

Below are my ten questions for 2022. These are just questions; I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2022, and if there are surprises - like in 2020 - to adjust my thinking.

1) Economic growth: Economic growth was probably around 5.5% in 2021 as the economy rebounded from 2020. There will be a drag from fiscal policy in 2022, and monetary policy will be less accommodative. The FOMC is expecting growth of 3.6% to 4.5% Q4-over-Q4 in 2022. How much will the economy grow in 2022?

2) Employment: Through November 2021, the economy added 6.1 million jobs in 2021. This makes 2021 the best year for job growth ever - by far. However, there are still 3.9 million fewer jobs than in February 2020 (pre-pandemic). Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

3) Unemployment Rate: The unemployment rate was at 4.2% in November, down 2.5 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.4% to 3.7% range in Q4 2022. What will the unemployment rate be in December 2022?

4) Participation Rate: In November 2021, the overall participation rate was at 61.8%, up year-over-year from 61.5% in November 2020. Long term, the BLS is projecting the overall participation rate will decline to 60.4% by 2030 due to demographics. Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)? What will be the participation rate in December 2022?

5) Inflation: Core PCE was up 4.7% YoY through November. This was the highest YoY increase in core PCE since 1989. The FOMC is forecasting the YoY change in core PCE will be in the 2.5% to 3.0% range in Q4 2022. Will the core inflation rate increase or decrease by December 2022?

6) Monetary Policy: In response to the pandemic, the FOMC cut rates to zero, and initiated an asset purchase program in March 2020. The FOMC is currently on pace to stop the asset purchase program in March 2022. A majority of FOMC participants expect three rate hikes in 2022. Will the Fed raise rates in 2022? If so, how many times?

7) Residential Investment: Residential investment (RI) was a slight drag on growth in 2021, because investment was so strong in the 2nd half of 2020. Through November, starts were up 16.3% year-to-date compared to the same period in 2020. New home sales were down 6.5% year-to-date through November. Note: RI is mostly investment in new single-family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI change in 2022? How about housing starts and new home sales in 2022?

8) Housing Credit: Will we see easier mortgage lending in 2022? Will we see a further sharp increase in mortgage equity withdrawal (MEW)?

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, FHFA, and CoreLogic) - will be up around 18% to 20% in 2021. What will happen with house prices in 2022?

10) Housing Inventory: Housing inventory decreased sharply during the pandemic to record lows in early 2021. Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

Some thoughts:

• Question #2 for 2022: Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

• Question #3 for 2022: What will the unemployment rate be in December 2022?

• Question #4 for 2022: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)?

• Question #5 for 2022: Will the core inflation rate increase or decrease by December 2022?

• Question #6 for 2022: Will the Fed raise rates in 2022? If so, how many times?

• Question #7 for 2022: How about housing starts and new home sales in 2022?

• Question #8 for 2022: Housing Credit: Will we see easier mortgage lending in 2022?

• Question #9 for 2022: What will happen with house prices in 2022?

• Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

Black Knight: National Mortgage Delinquency Rate Decreased in November; Foreclosures at Record Low

by Calculated Risk on 12/24/2021 08:11:00 AM

Note: At the beginning of the pandemic, the delinquency rate increased sharply (see table below). Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Mortgage Delinquencies Continue Steady Improvement; Active Foreclosures Fall to Yet Another Record Low Entering Final Month of 2021

• The national delinquency rate saw yet another month of steady improvement, with November’s 4.1% monthly decline matching the 18-month average rate of reductionAccording to Black Knight's First Look report, the percent of loans delinquent decreased 4.1% in November compared to October and decreased 43% year-over-year.

• Despite serious delinquencies (loans 90+ days past due but not in foreclosure) falling another 80,000 from October, over 1 million such delinquencies remain, 2.5 times more than at the start of the pandemic

• Both foreclosure starts (3,700) and active foreclosure inventory (132,000) hit new record lows in November as borrowers continue to work through available forbearance and loss mitigation options

• More than 800,000 forbearance exits have occurred over the past 60 days, with nearly 560,000 homeowners remaining in post-forbearance loss mitigation

• Given the size of this population, both serious delinquency and foreclosure metrics demand close attention as we enter 2022

• Prepayment activity (SMM) fell by 8.9% in November to hit its lowest level in 22 months, as rising 30-year rates continue to put downward pressure on refinance volumes

emphasis added

The percent of loans in the foreclosure process decreased 4.3% in November and were down 24% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.59% in November, down from 3.74% in October.

The percent of loans in the foreclosure process decreased in November to 0.25%, from 0.26% in October.

The number of delinquent properties, but not in foreclosure, is down 1,475,000 properties year-over-year, and the number of properties in the foreclosure process is down 44,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Nov 2021 | Oct 2021 | Nov 2020 | Nov 2019 | |

| Delinquent | 3.59% | 3.74% | 6.33% | 3.53% |

| In Foreclosure | 0.25% | 0.26% | 0.33% | 0.47% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,906,000 | 1,986,000 | 3,381,000 | 1,868,000 |

| Number of properties in foreclosure pre-sale inventory: | 132,000 | 138,000 | 176,000 | 248,000 |

| Total Properties | 2,039,000 | 2,125,000 | 3,557,000 | 2,116,000 |

Thursday, December 23, 2021

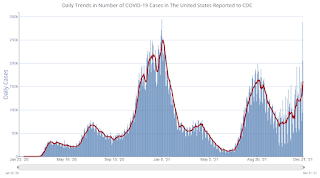

COVID December 23, 2021: Average Cases Exceeds Delta Peak

by Calculated Risk on 12/23/2021 08:58:00 PM

There will be no COVID updates over the 3-day Christmas weekend. Stay safe.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 61.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 204.7 | --- | ≥2321 | |

| New Cases per Day3🚩 | 176,097 | 121,154 | ≤5,0002 | |

| Hospitalized3🚩 | 60,871 | 60,043 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,213 | 1,170 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of cases reported.

Freddie Mac: Mortgage Serious Delinquency Rate decreased in November

by Calculated Risk on 12/23/2021 04:42:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in November was 1.24%, down from 1.32% in October. Freddie's rate is down year-over-year from 2.75% in November 2020.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble, and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but are not reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Also - for multifamily - delinquencies were at 0.09%, down from the peak of 0.20% in April 2021.

Hotels: Occupancy Rate Up 8% Compared to Same Week in 2019

by Calculated Risk on 12/23/2021 02:15:00 PM

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

U.S. hotel performance surpassed the levels seen during the comparable week of 2019, according to STR‘s latest data through December 18.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

December 12-18, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 53.8% (+7.7%)

• Average daily rate (ADR): US$121.87 (+11.6%)

• Revenue per available room (RevPAR): US$65.61 (+20.2%)

Percentage changes were in part lifted by the comparable week of 2019 (ending 21 December) being closer to Christmas.

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

New Home Sales: Record 110 thousand homes have not been started

by Calculated Risk on 12/23/2021 12:35:00 PM

Today, in the Real Estate Newsletter: New Home Sales: Record 110 thousand homes have not been started

Brief excerpt:

Sales, year to date in 2021, are 6.5% below sales in 2020, and new home sales in 2021 will finish solidly below sales in 2020 - since sales in 2020 finished strong.You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

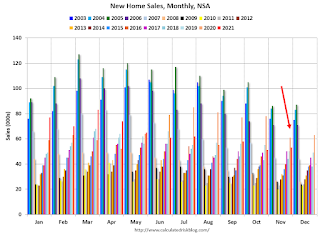

This graph shows new home sales for 2020 and 2021 by month (Seasonally Adjusted Annual Rate).

The year-over-year comparisons were easy in the first half of 2021 - especially in March and April. However, sales will be down year-over-year again in December - since the selling season was delayed in 2020.

...

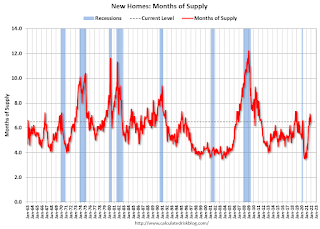

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.

The inventory of completed homes for sale was at 39 thousand in November, up from the record low of 33 thousand in March, April, May and July 2021. That is about 0.6 months of completed supply (red line). This is about half the normal level.

The inventory of new homes under construction is at 4.1 months (blue line) - well above the normal level. This elevated level of homes under construction is due to supply chain constraints.

And a record 110 thousand homes have not been started - about 1.8 months of supply (grey line) - almost double the normal level. Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices.

New Home Sales at 744,000 Annual Rate in November

by Calculated Risk on 12/23/2021 10:08:00 AM

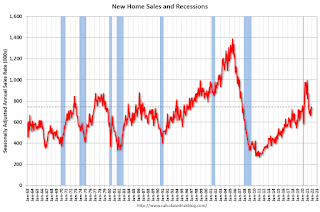

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 744 thousand.

The previous three months were revised down significantly.

Sales of new single‐family houses in November 2021 were at a seasonally adjusted annual rate of 744,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 12.4 percent above the revised October rate of 662,000, but is 14.0 percent below the November 2020 estimate of 865,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are now declining year-over-year since sales soared following the first few months of the pandemic.

The second graph shows New Home Months of Supply.

The months of supply decreased in November to 6.5 months from 7.1 months in October.

The months of supply decreased in November to 6.5 months from 7.1 months in October. The all-time record high was 12.1 months of supply in January 2009. The all-time record low was 3.5 months, most recently in October 2020.

This is above the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of November was 402,000. This represents a supply of 6.5 months at the current sales rate."

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2021 (red column), 53 thousand new homes were sold (NSA). Last year, 61 thousand homes were sold in November.

The all-time high for November was 86 thousand in 2005, and the all-time low for November was 20 thousand in 2010.

This was below expectations of 766 thousand SAAR, and sales in the three previous months were revised down significantly. I'll have more later today.

Personal Income increased 0.4% in November; Spending increased 0.6%

by Calculated Risk on 12/23/2021 08:41:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income increased $90.4 billion (0.4 percent) in November according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $70.4 billion (0.4 percent) and personal consumption expenditures (PCE) increased $104.7 billion (0.6 percent).The November PCE price index increased 5.7 percent year-over-year and the November PCE price index, excluding food and energy, increased 4.7 percent year-over-year.

Real DPI decreased 0.2 percent in November and Real PCE increased less than 0.1 percent; spending on services increased 0.5 percent and spending on goods decreased 0.8 percent. The PCE price index increased 0.6 percent. Excluding food and energy, the PCE price index increased 0.5 percent

emphasis added

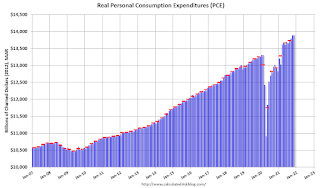

The following graph shows real Personal Consumption Expenditures (PCE) through November 2021 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations, and the increase in PCE was below expectations.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 5.7% annual rate in Q4 2021. (Using the mid-month method, PCE was increasing at 4.2%).

Weekly Initial Unemployment Claims Unchanged at 205,000

by Calculated Risk on 12/23/2021 08:34:00 AM

The DOL reported:

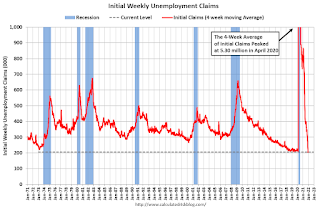

In the week ending December 18, the advance figure for seasonally adjusted initial claims was 205,000, unchanged from the previous week's revised level. The previous week's level was revised down by 1,000 from 206,000 to 205,000. The 4- week moving average was 206,250, an increase of 2,750 from the previous week's revised average. The previous week's average was revised down by 250 from 203,750 to 203,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 206,000.

The previous week was revised down.

Regular state continued claims decreased to 1,859,000 (SA) from 1,867,000 (SA) the previous week.

Weekly claims were at the consensus forecast.

Wednesday, December 22, 2021

Thursday: Unemployment Claims, Durable Goods, Personal Income and Outlays, New Home Sales

by Calculated Risk on 12/22/2021 07:34:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. Initial claims were 206 thousand last week.

• Also, at 8:30 AM, Durable Goods Orders for November.

• Also, at 8:30 AM, Personal Income and Outlays for November. The consensus is for a 0.2% increase in personal income, and for a 1.0% increase in personal spending.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is 766 thousand sales SAAR.

• Also, at 10:00 AM, University of Michigan's Consumer sentiment index (Final for December).

From CR on COVID (mostly focus on hospitalizations and deaths, although new cases are rising rapidly):

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 61.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 204.8 | --- | ≥2321 | |

| New Cases per Day3🚩 | 161,261 | 118,855 | ≤5,0002 | |

| Hospitalized3🚩 | 61,290 | 59,405 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,223 | 1,112 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of cases reported.

December Vehicle Sales Forecast: Decrease to 12.7 million SAAR

by Calculated Risk on 12/22/2021 03:23:00 PM

From WardsAuto: December U.S. Light-Vehicle Sales to Record 5-Month High Volume, but Seasonally Adjusted Rate Set to Fall from November (pay content)

Low inventories and supply issues continue to impact vehicle sales, but it appears the supply chain disruption bottom is in.

This graph shows actual sales from the BEA (Blue), and Wards forecast for December (Red).

The Wards forecast of 12.7 million SAAR, would be down about 1% from last month, and down 22% from a year ago (sales were solid in December 2020, as sales recovered from the depths of the pandemic, and weren't yet impacted by supply chain issues).

MBA Updated Economic and Mortgage Forecasts

by Calculated Risk on 12/22/2021 12:38:00 PM

The MBA released their updated Economic and Mortgage forecasts. Their prior forecast (included with several others) is here: 2022 Housing Forecasts: Second Look

A few highlights:

• Total mortgage originations are expected to decrease to $2.61T in 2022, as more of the activity shifts to the purchase market.

- Refinance originations are expected to drop to $870B.

- Purchase originations are forecast to eclipse 2021’s record high and reach $1.74T, backed by strong housing demand and rising home prices and sales.

• Home-price growth is forecast to moderate to 5.1%.

• Mortgage rates are expected to rise throughout the year and reach 4.0% by December 2022.

• Economic growth is forecast to be at 4.0% in 2022, with the unemployment rate declining to 3.5% by the end of the year.

More Analysis on November Existing Home Sales

by Calculated Risk on 12/22/2021 10:53:00 AM

Today, in the Real Estate Newsletter: Existing-Home Sales Increased to 6.46 million in November

Excerpt:

This graph shows existing home sales by month for 2020 and 2021.You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

This was the fourth consecutive month with sales down year-over-year. Sales will likely be down YoY in December and probably in January 2022 too since were exceptionally strong last Winter.

...

[and on inventory] Months-of-supply at 2.1 months is very low, but still above the record low of 1.9 months set in December 2020 and January 2021. That record will be tested next month.

We will probably see inventory at a new record low over the Winter. Inventory is currently at 1.11 million (according to the NAR), and the record low was 1.03 million in January and February of 2021.