by Calculated Risk on 1/13/2022 10:43:00 AM

Thursday, January 13, 2022

3rd Look at Local Housing Markets in December

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in December

A brief excerpt:

Adding Albuquerque, Colorado, Houston, Memphis, Nashville, Sacramento, Santa Clara and South CarolinaThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a summary of active listings for these housing markets in December. Inventory was down 17.7% in December month-over-month (MoM) from November, and down 30.0% year-over-year (YoY).

Inventory almost always declines seasonally in December, so the MoM decline is not a surprise. Last month, these markets were down 26.2% YoY, so the YoY decline in December is larger than in November. This isn’t indicating a slowing market.

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

Totals do not include Denver (included in state total).

Weekly Initial Unemployment Claims Increase to 230,000

by Calculated Risk on 1/13/2022 08:34:00 AM

The DOL reported:

In the week ending January 8, the advance figure for seasonally adjusted initial claims was 230,000, an increase of 23,000 from the previous week's unrevised level of 207,000. The 4-week moving average was 210,750, an increase of 6,250 from the previous week's unrevised average of 204,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 210,750.

The previous week was unrevised.

Weekly claims were above the consensus forecast, perhaps due to the current COVID wave.

Wednesday, January 12, 2022

Thursday: Unemployment Claims, PPI

by Calculated Risk on 1/12/2022 08:52:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims.

• Also, at 8:30 AM, The Producer Price Index for December from the BLS. The consensus is for a 0.4% increase in PPI, and a 0.5% increase in core PPI.

• At 10:00 AM, Testimony, Fed Governor Lael Brainard, Nomination Hearing, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

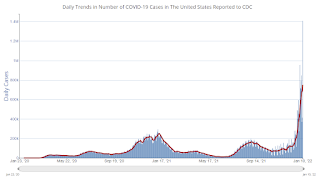

And on COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 62.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 208.0 | --- | ≥2321 | |

| New Cases per Day3🚩 | 761,535 | 556,134 | ≤5,0002 | |

| Hospitalized3🚩 | 124,163 | 91,030 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,656 | 1,238 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

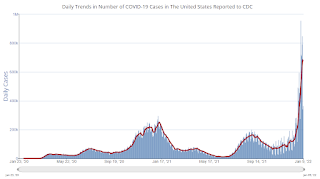

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Fed's Beige Book: "A sudden pull back in leisure travel, hotel occupancy and patronage at restaurants"

by Calculated Risk on 1/12/2022 03:08:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Kansas City based on information collected on or before January 3, 2022."

Economic activity across the United States expanded at a modest pace in the final weeks of 2021. Contacts from many Districts indicated growth continued to be constrained by ongoing supply chain disruptions and labor shortages. Despite the modest pace of growth, demand for materials and inputs, and demand for workers, remained elevated among businesses. Lending activity picked up slightly toward the end of the year, led by commercial real estate borrowers. Consumer spending continued to grow at a steady pace ahead of the rapid spread of the Omicron COVID-19 variant. Most Districts noted a sudden pull back in leisure travel, hotel occupancy and patronage at restaurants as the number of new cases rose in recent weeks. Although optimism remained high generally, several Districts cited reports from businesses that expectations for growth over the next several months cooled somewhat during the last few weeks. The manufacturing sector continued to expand nationally, with some regional differences in the pace of growth. Overall activity in the transportation sector expanded at a moderate pace. While farm incomes were elevated throughout 2021, agricultural conditions were marred by drought conditions across several Districts.

...

Employment grew modestly in recent weeks, but contacts from most Districts reported that demand for additional workers remains strong. Job openings were up but overall payroll growth was constrained by persistent labor shortages. Tightness in labor markets drove robust wage growth nationwide, with some Districts highlighting additional growth in labor costs associated with non-wage benefits. While many contacts noted that wage gains among low-skill workers were particularly strong, compensation growth remained well above historical averages across industries, across worker demographics, and across geographies. Besides wage gains, many contacts indicated adjustments to job demands – such as accommodating part-time work or adjusting qualification requirements – to attract more applicants and retain existing workforces.

emphasis added

Cleveland Fed: Median CPI increased 0.4% and Trimmed-mean CPI increased 0.4% in December

by Calculated Risk on 1/12/2022 12:38:00 PM

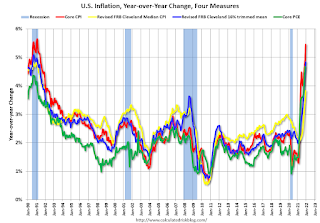

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.4% in December. The 16% trimmed-mean Consumer Price Index increased 0.4% in December. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Used Cars" were up 51% annualized.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Mortgage Rates: Moving on Up; Refinance Activity Will Slow Sharply

by Calculated Risk on 1/12/2022 11:39:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Mortgage Rates: Moving on Up

A brief excerpt:

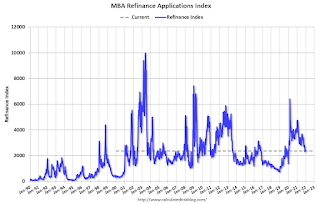

The general rule of thumb is refinance activity will be strong if current mortgage rates are 50bps lower than the maximum of the previous year (this is just a general rule - but it works pretty well).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The following graph shows the MBA Refinance Index (Blue) and the change in mortgage rates (Red). The change is calculated as Maximum in Previous Year minus the current rate). When the red line is above 0.5% (more than 50bps decline in mortgage rates), then refinance activity generally picks up.

Currently the maximum for the last year is 3.22% (excluding this week), and with current rates at 3.59%, refinance activity will probably decline significantly over the next few weeks.

BLS: CPI increased 0.5% in December; Core CPI increased 0.6%

by Calculated Risk on 1/12/2022 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in December on a seasonally adjusted basis after rising 0.8 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.0 percent before seasonal adjustment.Both CPI and core CPI were close to expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Increases in the indexes for shelter and for used cars and trucks were the largest contributors to the seasonally adjusted all items increase. The food index also contributed, although it increased less than in recent months, rising 0.5 percent in December. The energy index declined in December, ending a long series of increases; it fell 0.4 percent as the indexes for gasoline and natural gas both decreased.

The index for all items less food and energy rose 0.6 percent in December following a 0.5-percent increase in November. This was the sixth time in the last 9 months it has increased at least 0.5 percent. Along with the indexes for shelter and for used cars and trucks, the indexes for household furnishings and operations, apparel, new vehicles, and medical care all increased in December. As in November, the indexes for motor vehicle insurance and recreation were among the few to decline over the month.

The all items index rose 7.0 percent for the 12 months ending December, the largest 12-month increase since the period ending June 1982. The all items less food and energy index rose 5.5 percent, the largest 12-month change since the period ending February 1991. The energy index rose 29.3 percent over the last year, and the food index increased 6.3 percent.

emphasis added

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/12/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

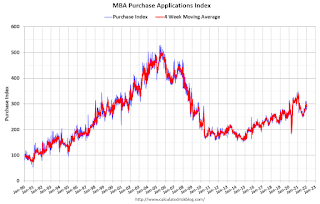

Mortgage applications increased 1.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 7, 2022. The previous week’s results included an adjustment for the holidays.

... The Refinance Index decreased 0.1 percent from the previous week and was 50 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 51 percent compared with the previous week and was 17 percent lower than the same week one year ago.

“Mortgage rates increased significantly across all loan types last week as the Federal Reserve’s signaling of tighter policy ahead pushed U.S. Treasury yields higher. The 30-year fixed rate hit 3.52 percent, its highest level since March 2020. Rates at these levels are quickly closing the door on refinance opportunities for many borrowers. Although refinance activity changed little over the week, applications remained at their lowest level in over a month, and conventional refinance applications were at their lowest level since January 2020,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The housing market started 2022 on a strong note. Both conventional and government purchase applications showed increases, with FHA purchase applications increasing almost 9 percent, and VA applications increasing more than 5 percent. MBA expects solid growth in purchase activity this year, as demographic drivers and the strong economy support housing demand. However, the strength in growth will be dependent on housing inventory growing more rapidly to meet demand.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 3.52 percent from 3.33 percent, with points decreasing to 0.45 from 0.48 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 17% year-over-year unadjusted.

According to the MBA, purchase activity is down 17% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, January 11, 2022

Wednesday: CPI

by Calculated Risk on 1/11/2022 07:11:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for December from the BLS. The consensus is for 0.5% increase in CPI, and a 0.5% increase in core CPI.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 62.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 207.8 | --- | ≥2321 | |

| New Cases per Day3🚩 | 750,996 | 509,446 | ≤5,0002 | |

| Hospitalized3🚩 | 119,115 | 86,401 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,633 | 1,163 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Update: The Inland Empire

by Calculated Risk on 1/11/2022 03:58:00 PM

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. However, prior to the pandemic, the Inland Empire was coming back strong.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

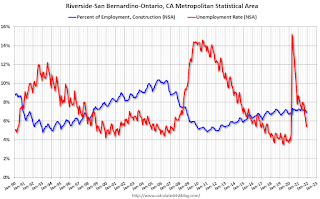

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate was falling before the pandemic and was down to 3.6% (down from 14.4% in 2010). During the pandemic, the unemployment rate increased to 15.2%, but is down to 5.4%.

So, the Inland Empire economy isn't as heavily depending on construction as during the bubble.

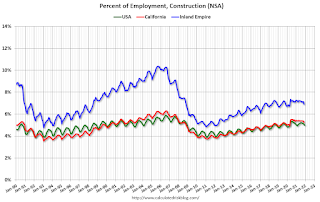

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S.

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S.Clearly the Inland Empire is more dependent on construction than most areas. Construction employment - as a percent of total employment - has picked up but is still below the levels during the housing bubble.

Homebuilder Comments in December: “Still a ton of demand for new homes"

by Calculated Risk on 1/11/2022 12:21:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Homebuilder Comments in December: “Still a ton of demand for new homes"

A brief excerpt:

Some homebuilder comments courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Here is Rick’s summary of builder comments for various markets (emphasis added in bold):

Home builder survey results are in for full month of December. Top themes: 1) Still a ton of demand for new homes. 2) Rampant construction material & labor shortages. 3) Bit of chatter on possible margin compression several quarters ahead. Market commentary to follow…

#Atlanta builder: “Have virtually no available inventory & huge backlog of 1,000+ units going in to 2022. Still metering sales in most communities, where the demand of waiting buyers still outnumbers our supply.”

#LasVegas builder: “Busiest orders for December I can remember in a long time.”

#Charlotte builder: “Haven’t seen this hot of a new homebuilding market in 27 years in Charlotte. Reminds me of the go-go days in the late 1980's right before the S & L's (Savings & Loan Crisis) rocked my new homebuilding world in Southern California.”

Missing Workers by Age Group

by Calculated Risk on 1/11/2022 10:11:00 AM

Note: This is an update to an earlier post.

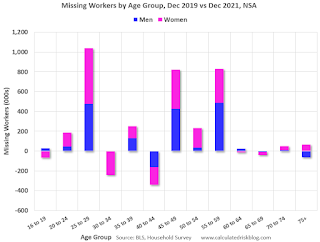

In November, Goldman Sachs economists put out a research note on the labor force participation rate: Why Isn’t Labor Force Participation Recovering?

While the unemployment rate continues to fall quickly, labor force participation has made no progress since August 2020. ... Most of the 5.0mn persons who have exited the labor force since the start of the pandemic are over age 55 (3.4mn), largely reflecting early (1.5mn) and natural (1mn) retirements that likely won’t reverse. The outlook for prime-age persons who have exited the labor force (1.7mn) is more positive, since very few are discouraged and most still view their exits as temporary.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 634,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

Click on graph for larger image.

Click on graph for larger image.This data is comparing December 2021 to December 2019, using Not Seasonally Adjusted (NSA) data (I compared to December 2019 to minimize the seasonal impact when using NSA data).

Almost all of the missing employed workers - by this method - are in the 25 to 29, 45 to 49, and in the 55 to 59 age groups.

Note: this is over a 2-year period, and there have been some demographic shifts between cohorts.

This data would suggest most of the missing workers are prime age or took early retirement (the missing workers in their '50s).

Leading Index for Commercial Real Estate "Declines in December"; Up Sharply Year-over-year

by Calculated Risk on 1/11/2022 08:34:00 AM

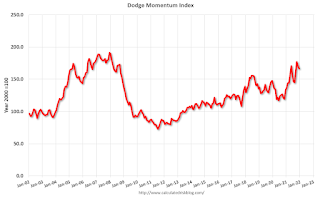

From Dodge Data Analytics: Dodge Momentum Index Declines In December

The Dodge Momentum Index fell 3% in December to 166.4 (2000=100), down from the revised November reading of 170.7. The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. In December, commercial planning fell 4%, and institutional planning slipped 1%.

Despite these declines, 2021 was a banner year for the Dodge Momentum Index — despite the lingering risks of COVID-19 and low demand for some types of nonresidential buildings. Throughout the year, the overall Momentum Index increased 23%, the strongest annual gain since 2005. Both the commercial and institutional components of the Momentum Index saw similar gains — with their levels of activity reaching 13- and 14-year highs, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 166.4 in December, down from 170.7 in November.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggested a decline in Commercial Real Estate construction through most of 2021, but a solid pickup in 2022.

Monday, January 10, 2022

Tuesday: Fed Chair Powell Nomination Hearing

by Calculated Risk on 1/10/2022 08:55:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Spiking at Fastest Pace in a Long Time

This morning's additional weakness in the bond market brings the average conventional 30yr fixed scenario closer to 3.625% (as always, rate quotes depend on multiple factors, and the overall range is very wide). [30 year fixed 3.64%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for December.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Nomination Hearing, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 62.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 207.7 | --- | ≥2321 | |

| New Cases per Day3🚩 | 674,406 | 443,099 | ≤5,0002 | |

| Hospitalized3🚩 | 109,874 | 81,843 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,552 | 1,181 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Update: Framing Lumber Prices Up 75% Year-over-year

by Calculated Risk on 1/10/2022 04:15:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through January 10th.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.A combination of strong demand and various supply constraints have pushed up the price of lumber again.

Q4 2021 Update: Unofficial Problem Bank list Decreased to 57 Institutions

by Calculated Risk on 1/10/2022 02:50:00 PM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources only, and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here are the quarterly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List through December 31, 2021. Since the last update at the end of September 2021, the list decreased by two to 57 institutions after two additions and four removals. Assets increased by $1.7 billion to $56.6 billion, with the change primarily resulting from a $1.7 billion increase from updated asset figures through September 30, 2021. A year ago, the list held 65 institutions with assets of $58.2 billion.

Additions during the fourth quarter included BancCentral, National Association, Alva, OK ($542 million) and Herring Bank, Amarillo, TX ($521 million). Removals during the quarter because of action termination included Texas Citizens Bank, National Association, Pasadena, TX ($515 million); Civis Bank, Rogersville, TN ($189 million); and Canyon Community Bank, National Association, Tucson, AZ ($146 million). CornerstoneBank, Atlanta, GA ($224 million) exited through an unassisted merger. On November 30, 2021, the FDIC released third quarter results and provided an update on the Official Problem Bank List. In that release, the FDIC said there were 46 institutions with assets of $51 billion on the official list, down from the 51 institutions but up in assets from $46 billion in the second quarter of 2021.

With the conclusion of the fourth quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since we first published the Unofficial Problem Bank List on August 7, 2009 with 389 institutions, 1,781 institutions have appeared on a weekly or monthly list since then. Only 3.2 percent of the banks that have appeared on a list remain today as 1,724 institutions have transitioned through the list. Departure methods include 1,017 action terminations, 411 failures, 278 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 3 or less than 1.0 percent, still have a troubled designation more than ten years later. The 411 failures represent 23.1 percent of the 1,781 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

2nd Look at Local Housing Markets in December

by Calculated Risk on 1/10/2022 12:37:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in December

A brief excerpt:

Commenting on the slowdown in sales, Dick Beeson, managing broker at RE/MAX Northwest Realtors, said, "That's to be expected considering inventory in the fourth quarter was down sharply from last year. You can't sell what isn't there."There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a summary of active listings for these housing markets in December. Inventory was down 22.7% in December month-over-month (MoM) from November, and down 34.2% year-over-year (YoY).

Inventory almost always declines seasonally in December, so the MoM decline is not a surprise. Last month, these markets were down 30.5% YoY, so the YoY decline in December is larger than in November. This isn’t indicating a slowing market.

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), North Texas (Dallas), Jacksonville, Source: Northeast Florida Association of REALTORS®

Housing Inventory January 10th Update: Inventory Down 0.5% Week-over-week; New Record Low

by Calculated Risk on 1/10/2022 10:09:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines sharply over the holidays, and this is a new record low for this series.

This inventory graph is courtesy of Altos Research.

Six High Frequency Indicators for the Economy

by Calculated Risk on 1/10/2022 08:22:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

Note: Gasoline consumption returned to pre-pandemic levels.

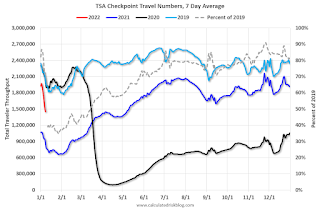

The TSA is providing daily travel numbers.

This data is as of January 8th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 27.9% from the same day in 2019 (72.1% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through January 8, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways, but there has been some decline recently, probably due to the winter wave of COVID. The 7-day average for the US is down 24% compared to 2019.

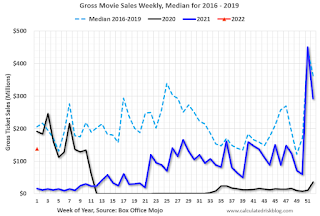

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $138 million last week, down about 33% from the median for the week.

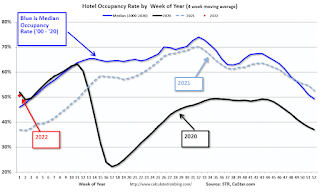

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red dot is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through January 1st. The occupancy rate was down slightly compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through January 8th

This data is through January 8th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 85% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday,January 7th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, January 09, 2022

Sunday Night Futures

by Calculated Risk on 1/09/2022 07:02:00 PM

Weekend:

• Schedule for Week of January 9, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 11 and DOW futures are down 91 (fair value).

Oil prices were up over the last week with WTI futures at $78.90 per barrel and Brent at $81.75 per barrel. A year ago, WTI was at $52, and Brent was at $56 - so WTI oil prices are up 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.29 per gallon. A year ago prices were at $2.31 per gallon, so gasoline prices are up $0.98 per gallon year-over-year.