by Calculated Risk on 1/19/2022 10:42:00 AM

Wednesday, January 19, 2022

December Housing Starts: Most Housing Units Under Construction Since 1973

Today, in the CalculatedRisk Real Estate Newsletter: December Housing Starts: Most Housing Units Under Construction Since 1973

Excerpt:

The 1.595 million total starts in 2021 were up 15.6% from 1.380 million in 2020. Starts in 2021 were the most since 2006 when 1.801 million units were started.There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).

Red is single family units. Currently there are 769 thousand single family units under construction (SA). This is the highest level since February 2007.

For single family, most of these homes are already sold (Census counts sales when contract is signed). The reason there are so many homes is probably due to construction delays. Since most of these are already sold, it is unlikely this is “overbuilding”, or that this will impact prices (although the buyers will be moving out of their current home or apartment once these homes are completed).

Blue is for 2+ units. Currently there are 750 thousand multi-family units under construction. This is the highest level since July 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Census will release data in March (part of February survey) on the length of time from start to completion, and that will probably show long delays in 2021. In 2020, it took an average of 6.8 months from start to completion for single family homes, and 15.4 months for buildings with 2 or more units.

Combined, there are 1.519 million units under construction. This is the most since November 1973.

Housing Starts Increased to 1.702 million Annual Rate in December

by Calculated Risk on 1/19/2022 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in December were at a seasonally adjusted annual rate of 1,702,000. This is 1.4 percent above the revised November estimate of 1,678,000 and is 2.5 percent (±13.8 percent)* above the December 2020 rate of 1,661,000. Single‐family housing starts in December were at a rate of 1,172,000; this is 2.3 percent below the revised November figure of 1,199,000. The December rate for units in buildings with five units or more was 524,000.

An estimated 1,595,100 housing units were started in 2021. This is 15.6 percent (±4.0 percent) above the 2020 figure of 1,379,600.

Building Permits:

Privately‐owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,873,000. This is 9.1 percent above the revised November rate of 1,717,000 and is 6.5 percent above the December 2020 rate of 1,758,000. Single‐family authorizations in December were at a rate of 1,128,000; this is 2.0 percent above the revised November figure of 1,106,000. Authorizations of units in buildings with five units or more were at a rate of 675,000 in December. [Special Note: In December, there was a large increase in building permits issued in Philadelphia, PA. Philadelphia enacted several real estate tax changes for residential projects permitted after December 31, 2021.]

An estimated 1,724,700 housing units were authorized by building permits in 2021. This is 17.2 percent (±0.6 percent) above the 2020 figure of 1,471,100.

emphasis added

Click on graph for larger image.

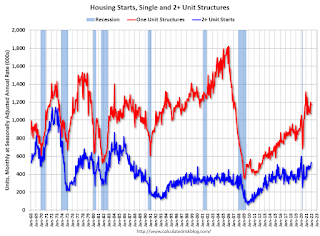

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in December compared to November. Multi-family starts were up 53% year-over-year in December.

Single-family starts (red) decreased in December and were down 10.9% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in December were above expectations and starts in October and November were revised up slightly, combined.

I'll have more later …

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/19/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 14, 2022.

... The Refinance Index decreased 3 percent from the previous week and was 49 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 8 percent from one week earlier. The unadjusted Purchase Index increased 14 percent compared with the previous week and was 13 percent lower than the same week one year ago.

“Mortgage rates hit their highest levels since March 2020, leading to the slowest pace of refinance activity in over two years. The 30-year fixed rate reached 3.64 percent and has increased more than 30 basis points over the past two weeks. FHA and VA refinance declines drove most of the refinance slowdown,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite the increase in rates, purchase applications jumped almost 8 percent, with conventional purchase applications accounting for much of the stronger activity. The average loan size for a purchase application set a record at $418,500. The continued rise in purchase loan application sizes is driven by high home price appreciation and the lack of housing inventory on the market – especially for entry-level homes. The slower growth in government purchase activity is also contributing to the larger loan balances and suggests that prospective first-time buyers are struggling to find homes to buy in their price range.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 3.64 percent from 3.52 percent, with points remaining unchanged at 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 13% year-over-year unadjusted.

According to the MBA, purchase activity is down 13% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, January 18, 2022

Wednesday: Housing Starts

by Calculated Risk on 1/18/2022 08:52:00 PM

From Matthew Graham at Mortgage News Daily: Remember Mortgage Rates in the 2's? They're Closer to 4% Now

One of the very few welcome byproducts of the pandemic was the pervasive availability of new all-time low mortgage rates. Depending on when you checked in, you were highly likely to see top tier 30yr fixed rates in the 2% range. ... The average lender is now up to 3.75% after starting the day at 3.625%. [30 year fixed 3.70%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for December. The consensus is for 1.655 million SAAR, down from 1.679 million SAAR.

• During the day, The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

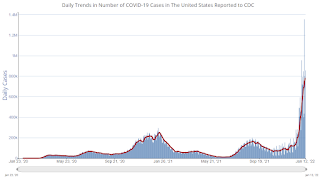

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 209.3 | --- | ≥2321 | |

| New Cases per Day3 | 701,277 | 752,342 | ≤5,0002 | |

| Hospitalized3🚩 | 137,384 | 120,397 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,746 | 1,664 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

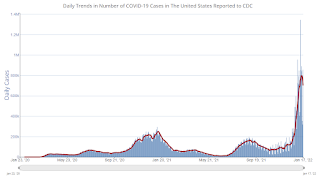

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/18/2022 04:26:00 PM

From housing economist Tom Lawler:

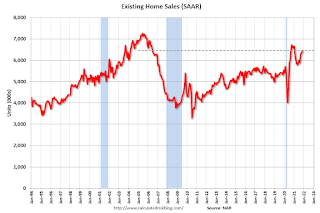

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 6.33 million in December, down 2.0% from November’s preliminary pace and down 4.8% from last December’s seasonally adjusted pace.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY % decline in the inventory of existing homes for sale last month similar to the drop in November.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 14.5% from last December.

CR Note: The National Association of Realtors (NAR) is scheduled to release November existing home sales on Thursday, January 20, 2022, at 10:00 AM ET. The consensus is for 6.45 million SAAR. Take the under.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 1.41% in December 2021"

by Calculated Risk on 1/18/2022 04:00:00 PM

Note: This is as of December 31st.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 1.41% in December 2021

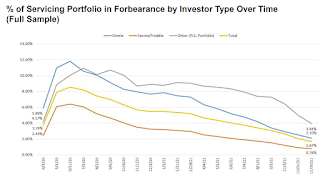

The Mortgage Bankers Association’s (MBA) new monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 26 basis points from 1.67% of servicers’ portfolio volume in the prior month to 1.41% as of December 31, 2021. According to MBA’s estimate, 705,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 8 basis points to 0.68%. Ginnie Mae loans in forbearance decreased 47 basis points to 1.63%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 51 basis points to 3.43%.

“The share of loans in forbearance continued to decline in December 2021. This was especially the case for government and private-label and portfolio loans, as those loans have higher levels of forbearance than loans backed by Fannie Mae and Freddie Mac,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “With the number of borrowers in forbearance continuing to decrease below 750,000, the pace of monthly forbearance exits reached its lowest level since MBA started tracking exits in June 2020.”

Added Walsh, “It is likely that the remaining borrowers in forbearance have experienced either a permanent hardship that may require more complex loan workout solutions, or they have encountered a recent hardship for which they are now seeking relief.” emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. The number of forbearance plans is decreasing rapidly recently since many homeowners have reached the end of the 18-month term.

4th Look at Local Housing Markets in December

by Calculated Risk on 1/18/2022 02:09:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in December

A brief excerpt:

Here is a summary of active listings for these housing markets in December. Inventory was down 19.2% in December month-over-month (MoM) from November, and down 29.2% year-over-year (YoY).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Inventory almost always declines seasonally in December, so the MoM decline is not a surprise. Last month, these markets were down 25.5% YoY, so the YoY decline in December is larger than in November. This isn’t indicating a slowing market.

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

Totals do not include Denver (included in state total).

NAHB: Builder Confidence Decreased to 83 in January

by Calculated Risk on 1/18/2022 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 83, down from 84 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Edges Lower on Inflation Concerns

Growing inflation concerns and ongoing supply chain disruptions snapped a four-month rise in builder sentiment even as consumer demand remains robust. Builder confidence in the market for newly built single-family homes moved one point lower to 83 in January, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). The HMI has hovered at the 83 or 84 level, the same rate as the spring of 2021, for the past three months.

Higher material costs and lack of availability are adding weeks to typical single-family construction times. NAHB analysis indicates the aggregate cost of residential construction materials has increased almost 19% since December 2021. Policymakers need to take action to fix supply chains. Obtaining a new softwood lumber agreement with Canada and reducing tariffs is an excellent place to start.

The most pressing issue for the housing sector remains a lack of inventory. Building has increased but the industry faces constraints, namely cost/availability of materials, labor and lots. And while 2021 single-family starts are expected to end the year about 25% higher than the pre-Covid 2019 level, we expect higher interest rates in 2022 will put a damper on housing affordability.

It is worth noting that the HMI responses for the January survey were collected January 3 through January 13, with many responses collected before interest rates jumped last week. The impact of these higher rates will be more fully reflected in the February HMI.

...

The HMI index gauging current sales conditions held steady at 90, the gauge measuring sales expectations in the next six months fell two points to 83, and the component charting traffic of prospective buyers also posted a two-point decline to 69.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 73, the Midwest increased one point to 75 and the South and West each posted a one-point rise to 88, respectively.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was close to the consensus forecast, and a strong reading.

Monday, January 17, 2022

Tuesday: NY Fed Mfg, Homebuilder Survey

by Calculated Risk on 1/17/2022 08:11:00 PM

Tuesday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 26.0, down from 31.9.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 84, unchanged from 84 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

Housing Inventory January 17th Update: Inventory Down 2.9% Week-over-week; New Record Low

by Calculated Risk on 1/17/2022 10:01:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines sharply over the holidays and into January, and this is a new record low for this series.

This inventory graph is courtesy of Altos Research.

Six High Frequency Indicators for the Economy

by Calculated Risk on 1/17/2022 08:42:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

Note: Gasoline consumption returned to pre-pandemic levels.

The TSA is providing daily travel numbers.

This data is as of January 16th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 23.9% from the same day in 2019 (76.1% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through January 15, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways, but there has been some decline recently, probably due to the winter wave of COVID. The 7-day average for the US is down 27% compared to 2019.

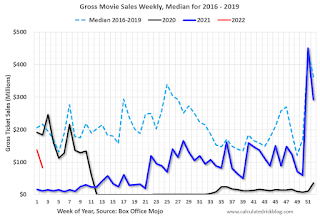

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $83 million last week, down about 62% from the median for the week.

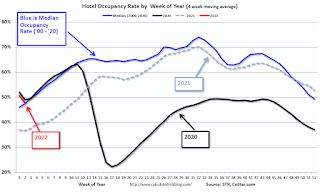

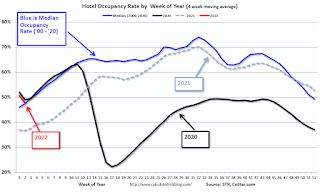

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through January 8th. The occupancy rate was down 14.9% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

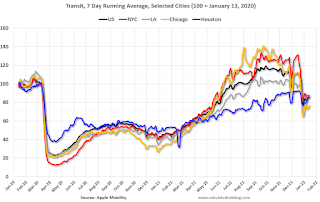

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through January 13th

This data is through January 13th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 86% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday,January 14th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, January 16, 2022

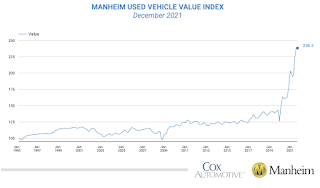

Used Vehicle Wholesale Prices

by Calculated Risk on 1/16/2022 10:56:00 AM

Since the pandemic has disrupted new car production and sales, used car prices have increased sharply. This has pushed up inflation ("Used Cars" were up 51% annualized in December).

Here is some data on used vehicle wholesale prices. From Manheim Consulting: Wholesale Prices Increased at Slowing Pace on Seasonally Adjusted Basis in December

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 1.6% month-over-month in December. This brought the Manheim Used Vehicle Value Index to 236.2, a 46.6% increase from a year ago. The non-adjusted price change in December was a decline of 1.1% compared to November, leaving the unadjusted average price up 43.4% year-over-year.

...

According to Cox Automotive estimates, total used vehicle sales were down 4% year-over-year in December. We estimate the December used SAAR to be 39.1 million, down from 40.6 million last December and flat compared to November’s revised 39.1 million SAAR. The December used retail SAAR estimate is 20.4 million, down from 21.6 million last year and flat month-over-month.

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

According to the BLS, "Used cars and trucks in U.S. city average, all urban consumers, seasonally adjusted" is up 55% since the low in June 2020.

Saturday, January 15, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 1/15/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Lawler: More on Investor Purchases of Single-Family Homes Single-Family Rental Trade Association Butchers Analysis of Investor Home Purchase Reports

• 2nd Look at Local Housing Markets in December Adding Jacksonville, New Hampshire, North Texas, Portland, and Northwest (Seattle)

• Homebuilder Comments in December: “Still a ton of demand for new homes" “Costs are through the roof!”

• Mortgage Rates: Moving on Up Refinance Activity Will Slow Sharply

• 3rd Look at Local Housing Markets in December Adding Albuquerque, Colorado, Houston, Memphis, Nashville, Sacramento, Santa Clara and South Carolina

This is usually published several times a week, and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Most content is available for free, but please subscribe!.

Schedule for Week of January 16, 2022

by Calculated Risk on 1/15/2022 08:11:00 AM

The key reports this week are December housing starts and existing home sales.

For manufacturing, the January NY and Philly Fed manufacturing surveys will be released.

All US markets will be closed in observance of Martin Luther King Jr. Day

8:30 AM: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 26.0, down from 31.9.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 84, unchanged from 84 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.655 million SAAR, down from 1.679 million SAAR.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims.

8:30 AM: the Philly Fed manufacturing survey for January. The consensus is for a reading of 23.0, up from 15.4.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 6.45 million SAAR, down from 6.46 million.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 6.45 million SAAR, down from 6.46 million.The graph shows existing home sales from 1994 through the report last month.

No major economic releases are scheduled.

Friday, January 14, 2022

COVID January 14, 2022: Record Cases and Hospitalizations

by Calculated Risk on 1/14/2022 08:18:00 PM

Next update on COVID will be Tuesday (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 62.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 208.8 | --- | ≥2321 | |

| New Cases per Day3🚩 | 794,587 | 616,246 | ≤5,0002 | |

| Hospitalized3🚩 | 131,332 | 100,684 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,730 | 1,367 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Q4 GDP Forecasts: Around 6%

by Calculated Risk on 1/14/2022 12:59:00 PM

From BofA:

Our 4Q GDP tracking estimate remains at 5.5% qoq saar. [January 14 estimate]From Goldman Sachs:

emphasis added

We lowered our Q4 GDP tracking estimate by ½pp to +6½% (qoq ar), to reflect the downside surprises this morning on both industrial production and retail sales. [January 14 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2021 is 5.0 percent on January 14, down from 6.8 percent on January 10. [January 14 estimate]

Industrial Production Decreased 0.1 Percent in December

by Calculated Risk on 1/14/2022 09:20:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production declined 0.1 percent in December. Losses of 0.3 percent for manufacturing and 1.5 percent for utilities were mostly offset by a gain of 2.0 percent for mining. For the fourth quarter as a whole, total industrial production rose at an annual rate of 4.0 percent. At 101.9 percent of its 2017 average, total industrial production in December was 3.7 percent higher than it was at the end of 2020 and 0.6 percent above its pre-pandemic (February 2020) reading. Capacity utilization for the industrial sector edged down 0.1 percentage point in December to 76.5 percent, a rate that is 3.1 percentage points below its long-run (1972–2020) average.

emphasis added

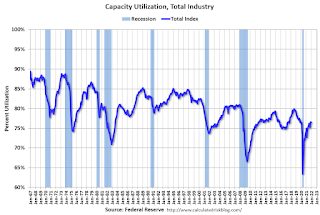

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 76.5% is 3.1% below the average from 1972 to 2020. This was well below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

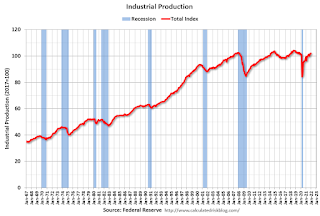

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in December to 101.9. This is above the February 2020 level.

The change in industrial production was below consensus expectations.

Retail Sales Decreased 1.9% in December

by Calculated Risk on 1/14/2022 08:38:00 AM

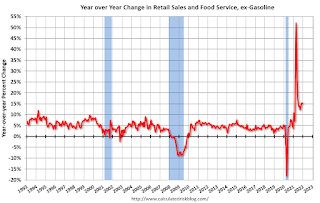

On a monthly basis, retail sales were decreased 1.9% from November to December (seasonally adjusted), but sales were up 16.9 percent from December 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for December 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $626.8 billion, a decrease of 1.9 percent from the previous month, but 16.9 percent above December 2020.

emphasis added

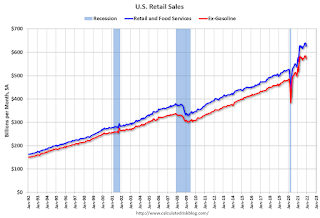

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 2.0% in December.

Thursday, January 13, 2022

Friday: Retail Sales, Industrial Production

by Calculated Risk on 1/13/2022 08:16:00 PM

Friday:

• At 8:30 AM ET, Retail sales for December is scheduled to be released. The consensus is for a 0.1% decrease in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 77.0%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for January).

And on COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 62.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 208.2 | --- | ≥2321 | |

| New Cases per Day3🚩 | 782,765 | 587,722 | ≤5,0002 | |

| Hospitalized3🚩 | 128,222 | 95,853 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,729 | 1,263 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Hotels: Occupancy Rate Down 15% Compared to Same Week in 2019

by Calculated Risk on 1/13/2022 01:22:00 PM

Reflecting post-holiday seasonality, U.S. hotel performance fell from the previous week, according to STR‘s latest data through Jan. 8.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Jan. 2-8, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 45.4% (-14.9%)

• Average daily rate (ADR): $119.92 (-4.8%)

• Revenue per available room (RevPAR): $54.47 (-19.0%)

Occupancy fell week over week because of a slowdown in leisure demand and a continued absence of business travel due to a Saturday holiday. While ADR also dropped from an all-time high the previous week, the metric came in at roughly 95% of the 2019 comparable. ...

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.