by Calculated Risk on 1/24/2022 07:41:00 PM

Monday, January 24, 2022

Tuesday: Case-Shiller House Prices

Tuesday:

• At 9:00 AM ET, FHFA House Price Index for November. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also, at 9:00 AM, S&P/Case-Shiller House Price Index for November. The consensus is for a 18.0% year-over-year increase in the Comp 20 index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for January.

• Also, at 10:00 AM, State Employment and Unemployment (Monthly) for December 2021

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.4% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 210.5 | --- | ≥2321 | |

| New Cases per Day3 | 663,908 | 788,527 | ≤5,0002 | |

| Hospitalized3 | 136,135 | 141,565 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,936 | 1,886 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

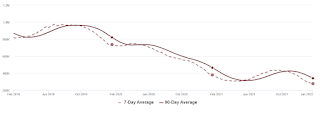

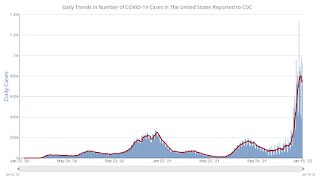

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Final Look at Local Housing Markets in December

by Calculated Risk on 1/24/2022 12:40:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in December

A brief excerpt:

This update adds Alabama, Columbus, Indiana, Miami, Minneapolis, New York, Phoenix and Rhode Island. ...There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Here is a summary of active listings for these housing markets in December. Inventory was down 17.7% in December month-over-month (MoM) from November, and down 31.3% year-over-year (YoY).

Inventory almost always declines seasonally in December, so the MoM decline is not a surprise. Last month, these markets were down 27.4% YoY, so the YoY decline in December is larger than in November. This isn’t indicating a slowing market.

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3. Totals do not include Denver and Minneapolis (included in state totals).

Housing Inventory January 24th Update: Inventory Down 2.4% Week-over-week; New Record Low

by Calculated Risk on 1/24/2022 10:25:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and this is a new record low for this series.

This inventory graph is courtesy of Altos Research.

Six High Frequency Indicators for the Economy

by Calculated Risk on 1/24/2022 08:45:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

Note: Gasoline consumption returned to pre-pandemic levels.

The TSA is providing daily travel numbers.

This data is as of January 23rd.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 24.7% from the same day in 2019 (75.3% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through January 22, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways, but there has been some decline recently, probably due to the winter wave of COVID. The 7-day average for the US is down 25% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $100 million last week, down about 49% from the median for the week.

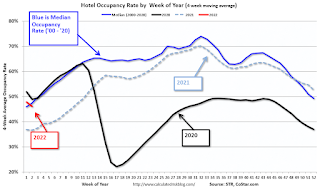

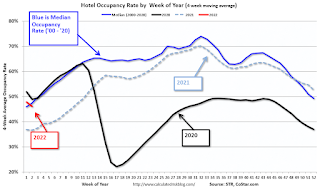

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through January 15th. The occupancy rate was down 16.3% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through January 21st

This data is through January 21st The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 90% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday,January 21st.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, January 23, 2022

Sunday Night Futures

by Calculated Risk on 1/23/2022 06:56:00 PM

Weekend:

• Schedule for Week of January 23, 2022

• FOMC Preview: Final Asset Purchase Announcement Expected; Hints at "Liftoff" in March

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for December. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 19 and DOW futures are up 106 (fair value).

Oil prices were up over the last week with WTI futures at $85.14 per barrel and Brent at $87.89 per barrel. A year ago, WTI was at $53, and Brent was at $55 - so WTI oil prices are up about 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.29 per gallon. A year ago prices were at $2.39 per gallon, so gasoline prices are up $0.90 per gallon year-over-year.

FOMC Preview: Final Asset Purchase Announcement Expected; Hints at "Liftoff" in March

by Calculated Risk on 1/23/2022 10:46:00 AM

Expectations are the FOMC will announce their final asset purchases at the meeting this week.

From Merrill Lynch:

"The Fed will announce the last round of asset purchases at the January FOMC meeting, which is well anticipated. We believe Chair Powell could continue to pivot hawkishly during the press conference."From Goldman Sachs:

"The FOMC is likely to use its January meeting next week to hint at a March liftoff and to begin formulating a plan for balance sheet reduction. We expect the FOMC to raise interest rates four times this year starting in March and to announce the start of balance sheet reduction in July."For review, for most of last year the FOMC was purchasing "at least $80 billion" Treasury securities per month and "at least $40 billion" agency mortgage‑backed securities (MBS) per month.

In November, the FOMC started to taper their purchases. The FOMC announced a reduction in their purchases to "at least $70 billion" Treasury securities per month and of "at least $35 billion" agency MBS per month. They also announced a further reduction in December to "at least $60 billion" Treasury securities per month and of "at least $30 billion" agency MBS per month.

In December, the FOMC announced an acceleration in the taper, and reduced their purchases to "at least $40 billion" Treasury securities per month and of "at least $20 billion" agency MBS per month starting in January. A similar reduction in asset purchases in February (to $20 billion in Treasury securities and $10 billion in agency MBS) seems likely - and that would be the final asset purchases.

Wall Street forecasts are for GDP to increase at close to a 6.0% annual rate in Q4 that would put Q4-over-Q4 close to the December projections.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Dec 2021 | 5.5 | 3.6 to 4.5 | 2.0 to 2.5 | 1.8 to 2.0 |

| Sept 2021 | 5.8 to 6.0 | 3.4 to 4.5 | 2.2 to 2.5 | 2.0 to 2.2 |

The unemployment rate was at 3.9% in December. That put Q4 unemployment close to the December projections.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Dec 2021 | 4.2 to 4.3 | 3.4 to 3.7 | 3.2 to 3.6 | 3.2 to 3.7 |

| Sept 2021 | 4.6 to 4.8 | 3.6 to 4.0 | 3.3 to 3.7 | 3.3 to 3.6 |

As of November 2021, PCE inflation was up 5.7% from November 2020.

So, inflation was above expectations in Q4.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Dec 2021 | 5.3 to 5.4 | 2.2 to 3.0 | 2.1 to 2.5 | 2.0 to 2.2 |

| Sept 2021 | 4.0 to 4.3 | 2.0 to 2.5 | 2.0 to 2.3 | 2.0 to 2.2 |

PCE core inflation was up 4.7% in November year-over-year.

Core inflation was also above expectations in Q4.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Dec 2021 | 4.4 | 2.5 to 3.0 | 2.1 to 2.4 | 2.0 to 2.2 |

| Sept 2021 | 3.6 to 3.8 | 2.0 to 2.5 | 2.0 to 2.3 | 2.0 to 2.2 |

Saturday, January 22, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 1/22/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 1.44 million Total Housing Completions in 2021 including Manufactured Homes Most since 2007

• Existing-Home Sales Decreased to 6.18 million in December Inventory down 14.2% year-over-year

• December Housing Starts: Most Housing Units Under Construction Since 1973 Housing Starts Increased to 1.702 million Annual Rate in December

• 4th Look at Local Housing Markets in December

• Altos Research: Existing Home Inventory at Record Low "Investor/speculator activity merits attention"

This is usually published several times a week, and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Most content is available for free, but please subscribe!.

Schedule for Week of January 23, 2022

by Calculated Risk on 1/22/2022 08:11:00 AM

The key reports scheduled for this week are the advance estimate of Q4 GDP and December New Home sales. Other key indicators include December Personal Income and Outlays and November Case-Shiller house prices.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released.

The FOMC meets this week, and they are expected to announce the final asset purchases.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

9:00 AM: FHFA House Price Index for November. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.This graph shows the Year over year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 18.0% year-over-year increase in the Comp 20 index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January.

10:00 AM: State Employment and Unemployment (Monthly) for December 2021

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

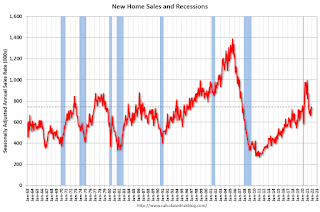

10:00 AM: New Home Sales for December from the Census Bureau.

10:00 AM: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

The consensus is for 760 thousand SAAR, up from 744 thousand in November.

2:00 PM: FOMC Meeting Statement. The FOMC is expected to announce the final asset purchases.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: Gross Domestic Product, 4th quarter 2021 (Advance estimate). The consensus is that real GDP increased 5.4% annualized in Q4.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 260 thousand from 286 thousand last week.

8:30 AM: Durable Goods Orders for December. The consensus is for a 0.5% decrease in durable goods.

10:00 AM: Pending Home Sales Index for December. The consensus is for a 0.3% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for January. This is the last of regional manufacturing surveys for January.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.5% increase in personal income, and for a 0.5% decrease in personal spending. And for the Core PCE price index to increase 0.5%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for January). The consensus is for a reading of 68.6.

Friday, January 21, 2022

COVID Update January 21, 2022: New Cases Declining

by Calculated Risk on 1/21/2022 09:23:00 PM

Another COVID update. Hopefully this wave declines soon. Best to all.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 210.0 | --- | ≥2321 | |

| New Cases per Day3 | 726,870 | 797,694 | ≤5,0002 | |

| Hospitalized3🚩 | 144,636 | 133,297 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,843 | 1,754 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

1.44 million Total Housing Completions in 2021 including Manufactured Homes; Most since 2007

by Calculated Risk on 1/21/2022 03:04:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: 1.44 million Total Housing Completions in 2021 including Manufactured Homes

Excerpt:

This graph shows total housing completions and placements since 1968. The net additional to the housing stock is less because of demolitions and destruction of older housing units.There is more in the post. You can subscribe at https://calculatedrisk.substack.com/

Even though there were significant construction delays in 2021 - and there are currently the most housing units under construction since 1973 - there were 1.444 million total completions in 2021, the most since 2007.

Hotels: Occupancy Rate Down 16% Compared to Same Week in 2019

by Calculated Risk on 1/21/2022 11:59:00 AM

U.S. weekly hotel occupancy worsened in comparison with pre-pandemic levels, according to STR‘s latest data through Jan. 15.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

January 9-15, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 48.8% (-16.3%)

• Average daily rate (ADR): $122.12 (-1.6%)

• Revenue per available room (RevPAR): $54.47 (-19.0%)

On an absolute basis, occupancy was higher than the previous week, but the gap to 2019 levels widened, pointing to a larger impact from the omicron variant. ADR and RevPAR were up week over week and when indexed to 2019. ...

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

Q4 GDP Forecasts: 5% to 6%

by Calculated Risk on 1/21/2022 10:16:00 AM

The advance estimate of Q4 GDP will be released on Thursday, January 27th. The consensus estimate is for 6.0% real GDP growth (seasonally adjusted annual rate).

From BofA:

We expect the advance estimate of 4Q GDP to show a pickup in growth to 5.0% qoq saar. [January 21 estimate]From Goldman Sachs:

emphasis added

We left our Q4 GDP tracking estimate unchanged at +6.5% (qoq ar). [January 20 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2021 is 5.1 percent on January 19, up from 5.0 percent on January 14. [January 19 estimate]

Black Knight: National Mortgage Delinquency Rate Decreased in December; Foreclosures at Record Low

by Calculated Risk on 1/21/2022 08:29:00 AM

Note: At the beginning of the pandemic, the delinquency rate increased sharply (see table below). Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight: 2021 Ends With Foreclosures at All-Time Low and Near Record-Low Delinquency Rate; Serious Delinquencies Still More than 2X Pre-Pandemic Levels

• At 3.38% entering January, the national delinquency rate sits just 0.1% above February 2020’s near record-low of 3.28%, just prior to the onset of the pandemicAccording to Black Knight's First Look report, the percent of loans delinquent decreased 5.9% in December compared to November and decreased 44% year-over-year.

• However, over half a million excess serious delinquencies remain – borrowers 90 or more days past due on their mortgages, including those in active forbearance – more than twice pre-pandemic levels

• Just 0.24% of loans are in active foreclosure in December – an all-time low – with the month’s 4,100 foreclosure starts some 90% below December 2019 levels

• While roughly twice as many foreclosure sales (completions) occurred in the month as compared to December 2020, there were only one-third as many as in pre-pandemic December 2019

• Given the volume of borrowers who’ve exited forbearance protections in recent months, the industry must keep a very close eye on foreclosure metrics moving forward in 2022

• Prepayment activity fell by more than 7% in December and is poised to fall even further as rising rates continue to erode refinance incentive

emphasis added

The percent of loans in the foreclosure process decreased 3.8% in December and were down 28% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.38% in December, down from 3.59% in November.

The percent of loans in the foreclosure process decreased in December to 0.24%, from 0.25% in November.

The number of delinquent properties, but not in foreclosure, is down 1,452,000 properties year-over-year, and the number of properties in the foreclosure process is down 50,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Dec 2021 | Nov 2021 | Dec 2020 | Dec 2019 | |

| Delinquent | 3.38% | 3.59% | 6.08% | 3.40% |

| In Foreclosure | 0.24% | 0.25% | 0.33% | 0.46% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,799,000 | 1,906,000 | 3,251,000 | 1,803,000 |

| Number of properties in foreclosure pre-sale inventory: | 128,000 | 132,000 | 178,000 | 245,000 |

| Total Properties | 1,927,000 | 2,039,000 | 3,429,000 | 2,047,000 |

Thursday, January 20, 2022

COVID Update, January 20, 2022

by Calculated Risk on 1/20/2022 08:54:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 209.8 | --- | ≥2321 | |

| New Cases per Day3 | 744,615 | 783,922 | ≤5,0002 | |

| Hospitalized3🚩 | 143,874 | 129,442 | ≤3,0002 | |

| Deaths per Day3 | 1,749 | 1,754 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Second Home Market: South Lake Tahoe in December

by Calculated Risk on 1/20/2022 03:33:00 PM

With the pandemic, there was a surge in 2nd home buying. In response, Fannie made some lending changes, from Jann Swanson at MortgageNewsDaily: Fannie Warns Lenders on Investment Properties and 2nd Homes.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from the lending changes.

This graph is for South Lake Tahoe since 2004 through December 2021, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low - above the record low set in March 2021, but down YoY - and prices are up sharply YoY.

More Analysis on December Existing Home Sales

by Calculated Risk on 1/20/2022 10:40:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: Existing-Home Sales Decreased to 6.18 million in December

Excerpt:

This graph shows existing home sales by month for 2020 and 2021.There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

This was the fifth consecutive month with sales down year-over-year. Sales will likely be down YoY in January 2022 too since were exceptionally strong last Winter.

...

[and on inventory] According to the NAR, inventory decreased to 0.92 million in December from 1.11 million in November. Inventory usually declines significantly in November and December as potential sellers remove their homes from the market for the holidays. Inventory is now at a record low.

NAR: Existing-Home Sales Decreased to 6.18 million in December

by Calculated Risk on 1/20/2022 10:18:00 AM

From the NAR: Annual Existing-Home Sales Hit Highest Mark Since 2006

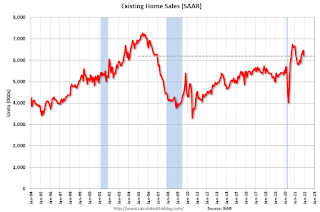

Existing-home sales declined in December, snapping a streak of three straight months of gains, according to the National Association of Realtors®. Each of the four major U.S. regions witnessed sales fall in December from both a month-over-month and a year-over-year basis. Despite the drop, overall sales for 2021 increased 8.5%.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 4.6% from November to a seasonally adjusted annual rate of 6.18 million in December. From a year-over-year perspective, sales waned 7.1% (6.65 million in December 2020).

...

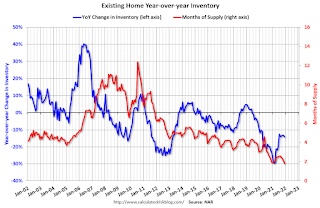

Total housing inventory at the end of December amounted to 910,000 units, down 18.0% from November and down 14.2% from one year ago (1.06 million). Unsold inventory sits at a 1.8-month supply at the present sales pace, down from 2.1 months in November and from 1.9 months in December 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December (6.18 million SAAR) were down 4.6% from last month and were 7.1% below the December 2020 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 0.91 million in December from 1.11 million in November.

According to the NAR, inventory decreased to 0.91 million in December from 1.11 million in November.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 14.2% year-over-year in December compared to December 2020.

Inventory was down 14.2% year-over-year in December compared to December 2020. Months of supply declined to 1.8 months in December from 2.1 months in November.

This was below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Increase to 286,000

by Calculated Risk on 1/20/2022 08:34:00 AM

Note: This report is for the BLS January reference week.

The DOL reported:

In the week ending January 15, the advance figure for seasonally adjusted initial claims was 286,000, an increase of 55,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 230,000 to 231,000. The 4-week moving average was 231,000, an increase of 20,000 from the previous week's revised average. The previous week's average was revised up by 250 from 210,750 to 211,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 231,000.

The previous week was revised up.

Weekly claims were well above the consensus forecast, likely due to the current COVID wave.

Wednesday, January 19, 2022

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 1/19/2022 07:10:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims.

• Also at 8:30 AM, the Philly Fed manufacturing survey for January. The consensus is for a reading of 23.0, up from 15.4.

• At 10:00 AM, Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 6.45 million SAAR, down from 6.46 million. Housing economist Tom Lawler expects the NAR to report 6.33 million SAAR.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 209.5 | --- | ≥2321 | |

| New Cases per Day3 | 755,095 | 763,722 | ≤5,0002 | |

| Hospitalized3🚩 | 142,595 | 125,106 | ≤3,0002 | |

| Deaths per Day3 | 1,669 | 1,687 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

AIA: "Architecture firms end 2021 on a strong note" in December

by Calculated Risk on 1/19/2022 12:27:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture firms end 2021 on a strong note

As architecture firms ended 2021 on a high note with strong business conditions, staff recruitment is becoming a growing concern among firms.

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November (any score over 50 indicates billings growth). Despite a variety of concerns related to the omicron variant, labor shortages, and rising prices as well as limited availability of construction materials, firms continued to report a robust supply of work in the pipeline. Inquiries into new work and the value of new design contracts both remained strong, and backlogs, at an average of 6.5 months, remained near their highest levels since the AIA began tracking this metric in 2010.

“Since demand for design projects has been healthy over the last year, recruiting architectural staff to keep up with project workloads has been a growing concern for firms,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Architecture is one of the few industries where payrolls have already surpassed their pre-pandemic high, so meeting future staffing needs is a challenge that most firms will need to confront."

...

• Regional averages: South (56.4); Midwest (51.0); West (47.5); Northeast (45.3)

• Sector index breakdown: mixed practice (60.6); multi-family residential (49.2); commercial/industrial (49.2); institutional (47.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.0 in December, up from 51.0 in November. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index was below 50 for eleven consecutive months but has been positive for the last eleven months.