by Calculated Risk on 2/06/2022 06:14:00 PM

Sunday, February 06, 2022

Sunday Night Futures

Weekend:

• Schedule for Week of February 6, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $92.31 per barrel and Brent at $93.27 per barrel. A year ago, WTI was at $58, and Brent was at $60 - so WTI oil prices are up about 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.44 per gallon. A year ago prices were at $2.45 per gallon, so gasoline prices are up $0.99 per gallon year-over-year.

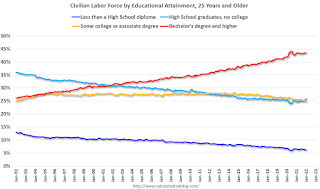

Trends in Educational Attainment in the U.S. Labor Force

by Calculated Risk on 2/06/2022 12:17:00 PM

The first graph shows the unemployment rate by four levels of education (all groups are 25 years and older) through March 2021. Note: This is an update to a post from a few years ago.

Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic). Clearly education matters with regards to the unemployment rate, with the lowest rate for college graduates at 2.3% in January, and highest for those without a high school degree at 6.3% in January.

All four groups were generally trending down prior to the pandemic. And all are nearly back to pre-pandemic levels now.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This brings up an interesting question: What is the composition of the labor force by educational attainment, and how has that been changing over time?

Here is some data on the U.S. labor force by educational attainment since 1992.

This is the only category trending up. "Some college" has been steady (and trending down lately), and both "high school" and "less than high school" have been trending down.

Based on current trends, probably half the labor force will have at least a bachelor's degree by the end of this decade (2020s).

Some thoughts: Since workers with bachelor's degrees typically have a lower unemployment rate, rising educational attainment is probably a factor in pushing down the overall unemployment rate over time.

Also, I'd guess more education would mean less labor turnover, and that education is a factor in lower weekly claims (prior to the pandemic).

A more educated labor force is a positive for the future.

Saturday, February 05, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 2/05/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• "Mortgage Rates Leap Toward 4.0%, Highest Since October 2019"

• Mike Simonsen of Altos Research and I Discuss Housing

• Rents Still Increasing Sharply Year-over-year NMHC: "Apartment occupancy remains at record-highs"

• Median vs Repeat Sales Index House Prices

This is usually published several times a week, and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Most content is available for free, but please subscribe!.

Schedule for Week of February 6, 2022

by Calculated Risk on 2/05/2022 08:11:00 AM

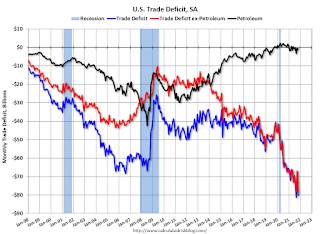

The key reports this week are January CPI and the December trade deficit.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for January.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $83.0 billion. The U.S. trade deficit was at $80.2 billion in November.

11:00 AM: NY Fed: Q4 Quarterly Report on Household Debt and Credit

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 235 thousand from 238 thousand last week.

8:30 AM: The Consumer Price Index for January from the BLS. The consensus is for 0.5% increase in CPI, and a 0.5% increase in core CPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 67.0.

Friday, February 04, 2022

COVID Update: February 4, 2022: Falling Cases and Hospitalizations; 2,400 Deaths per Day

by Calculated Risk on 2/04/2022 10:00:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 212.3 | --- | ≥2321 | |

| New Cases per Day3 | 343,563 | 577,975 | ≤5,0002 | |

| Hospitalized3 | 120,724 | 140,770 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,371 | 2,353 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

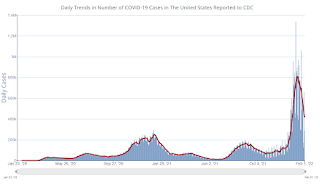

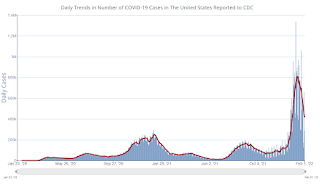

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

"Mortgage Rates Leap Toward 4.0%, Highest Since October 2019"

by Calculated Risk on 2/04/2022 04:17:00 PM

Today, in the Calculated Risk Real Estate Newsletter: "Mortgage Rates Leap Toward 4.0%, Highest Since October 2019"

A brief excerpt:

With the strong employment report for January, interest rates have increased.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Mortgage News Daily reports that the most prevalent 30-year fixed rate is now at 3.85% for top tier scenarios. Matthew Graham at Mortgage News Daily wrote today: Mortgage Rates Leap Toward 4.0%, Highest Since October 2019If we disregard the once-in-a-lifetime volatility seen in March 2020 (and we absolutely should), today's mortgage rates are now in line with the highs seen in October 2019. The average lender is now quoting conventional 30yr fixed rates in the 3.75-3.875% neighborhood. That's a full eighth of a point higher than yesterday, and more than a full percentage point higher than the lowest rates in August 2021. Many less than perfect loan scenarios will see rates over 4%.With the ten-year yield at 1.93%, and based on an historical relationship, 30-year rates should currently be around 3.8%. So, mortgage rates are as expected based on the ten-year yield.

The graph shows the relationship between the monthly 10-year Treasury Yield and 30-year mortgage rates from the Freddie Mac survey.

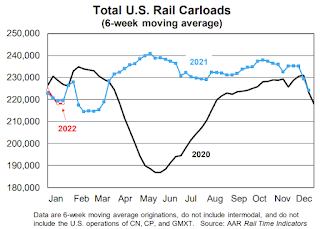

AAR: January Rail Carloads and Intermodal Down Year-over-year

by Calculated Risk on 2/04/2022 02:46:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. railroads originated 902,265 total carloads in January 2022, down 3.0% (27,861 carloads) from January 2021. It’s the fewest carloads for the first four weeks of a year since sometime before 1988, when our data begin. ...

U.S. intermodal volume was 1.00 million units in January 2022, down 14.6% from last year, but January 2021 was the second best month ever for intermodal.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2019, 2020 and 2021:

U.S. railroads originated 902,265 total carloads in January 2022, down 3.0% (27,861 carloads) from January 2021 and the fewest for the first four weeks of a year since sometime before 1988, when our data begin. ... Carloads excluding coal fell 6.0% in January 2022 from last year, their biggest year-over-year decline since February 2021 and, before that, August 2020.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):U.S. intermodal originations totaled 1.00 million units in January 2022, down 14.6% (171,796 units) from January 2021. As with some carload commodities, the comparisons for intermodal were tough: January 2021 was the second highest volume month ever for U.S. intermodal, fractionally behind April 2021. January 2022 was the fifth best January ever for intermodal.

Hotels: Occupancy Rate Down 12% Compared to Same Week in 2019

by Calculated Risk on 2/04/2022 01:07:00 PM

U.S. hotel performance increased slightly from the previous week and showed improved comparisons against 2019, according to STR‘s latest data through Jan. 29.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Jan. 23-29, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 49.7% (-12.2%)

• Average daily rate (ADR): $122.40 (-1.9%)

• Revenue per available room (RevPAR): $60.82 (-13.9%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

Comments on January Employment Report

by Calculated Risk on 2/04/2022 09:32:00 AM

This was a strong report, and the revisions show job growth was stronger - and steadier - over the last year than originally reported.

The headline jobs number in the January employment report was well above expectations, and employment for the previous two months was revised up by 709,000. The participation rate and the employment-population ratio both increased, however the unemployment rate increased to 4.0%.

In January, the year-over-year employment change was 6.61 million jobs.

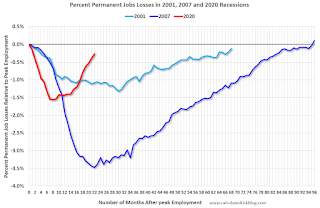

Permanent Job Losers

Click on graph for larger image.

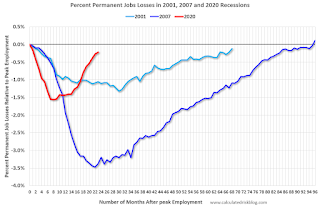

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today. (ht Joe Weisenthal at Bloomberg).

In January, the number of permanent job losers decreased to 1.630 million from 1.703 million in November.

Prime (25 to 54 Years Old) Participation

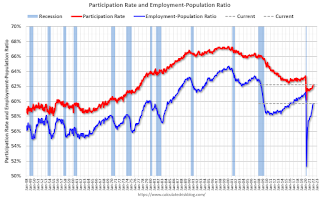

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key as the economy recovers.

The 25 to 54 participation rate increased in January to 82.0% from 81.9% in December, and the 25 to 54 employment population ratio increased to 79.1% from 79.0% the previous month.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 3.7 million, continued to trend down over the month. The over-the-year decline of 2.2 million brings this measure to 673,000 below its February 2020 level. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in January to 3.717 million from 3.929 million in December. This is lower than pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 7.1% from 7.3% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure was at 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

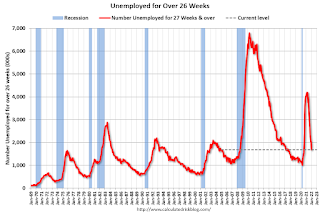

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.691 million workers who have been unemployed for more than 26 weeks and still want a job, down from 2.008 million the previous month.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was well above expectations; and the previous two months were revised up by 709,000 combined. With the revisions - including the benchmark revision - job growth was stronger and steadier over the last year than originally reported.

January Employment Report: 467 thousand Jobs, 4.0% Unemployment Rate

by Calculated Risk on 2/04/2022 08:47:00 AM

From the BLS:

Total nonfarm payroll employment rose by 467,000 in January, and the unemployment rate was little changed at 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment growth continued in leisure and hospitality, in professional and business services, in retail trade, and in transportation and warehousing.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In January, the year-over-year change was 6.61 million jobs. This was up significantly year-over-year.

Total payrolls increased by 467 thousand in January. Private payrolls increased by 444 thousand, and public payrolls increased 23 thousand.

Payrolls for November and December were revised up 709 thousand, combined.

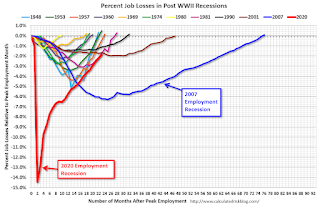

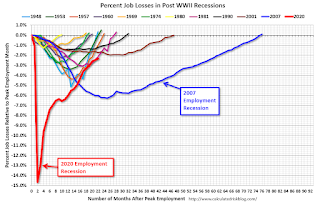

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 23 months after the onset, is now significantly better than the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 62.2% in January, from 61.9% in December. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 62.2% in January, from 61.9% in December. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 59.7% from 59.5% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in January to 4.0% from 3.9% in December.

This was well above consensus expectations; and November and December payrolls were revised up by 709,000 combined.

The total nonfarm employment level for March 2021 was revised upward by 374,000. On a not seasonally adjusted basis, total nonfarm employment for March 2021 was revised downward by 7,000, or less than -0.05 percent.

Thursday, February 03, 2022

Friday: Employment Report

by Calculated Risk on 2/03/2022 10:37:00 PM

My January Employment Preview

Goldman January Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for January. The consensus is for 155 thousand jobs added, and for the unemployment rate to be unchanged at 3.9%. There were 199 thousand jobs added in December, and the unemployment rate was at 3.9%.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 212.1 | --- | ≥2321 | |

| New Cases per Day3 | 415,552 | 636,024 | ≤5,0002 | |

| Hospitalized3 | 124,134 | 142,482 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,369 | 2,286 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Goldman January Payrolls Preview

by Calculated Risk on 2/03/2022 03:57:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls declined by 250k, 400k below consensus of +150k. Our forecast reflects a large and temporary drag from Omicron on the order of 500-1000k, as survey data indicate a surge in absenteeism during the month ... We estimate an unchanged unemployment rate of 3.9%—in line with consensus—reflecting likely declines in both household employment and labor force participation due to the virus wave.CR Note: The consensus is for 155 thousand jobs added, and for the unemployment rate to be unchanged at 3.9%.

emphasis added

Used Vehicle Wholesale Prices

by Calculated Risk on 2/03/2022 01:44:00 PM

Since the pandemic has disrupted new car production and sales, used car prices increased sharply. This pushed up inflation ("Used Cars" were up 51% annualized in December).

Here is some data on used vehicle wholesale prices. From Manheim Consulting today: Wholesale Prices Rise Further in First Half of January

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.8% in the first 15 days of January compared to the month of December. This brought the Manheim Used Vehicle Value Index to 238.0, a 46.0% increase from January 2021. As was the case in each of the last three months, much of the reported increase was a result of the seasonal adjustment. The non-adjusted price was statistically unchanged from December.

Manheim Market Report (MMR) prices saw declines through the first two full weeks of January. The Three-Year-Old MMR Index, which represents the largest model year cohort at auction, experienced a 1.3% cumulative decline over the last two weeks.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

According to the BLS, "Used cars and trucks in U.S. city average, all urban consumers, seasonally adjusted" is up 55% since the low in June 2020.

January Employment Preview

by Calculated Risk on 2/03/2022 11:58:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus is for 155 thousand jobs added, and for the unemployment rate to be unchanged at 3.9%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 3.6 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 22 months after the onset, is now significantly better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a loss of 301,000 private sector jobs, well below the consensus estimates of 208,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be below expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in January to 54.5%, up from 53.9% last month. This would suggest 5,000 jobs added in manufacturing employment in January. ADP showed 21,000 manufacturing jobs lost.

The ISM® Services employment index decreased in January to 52.3%, down from 54.7% last month. This would suggest a 135 thousand increase in service employment in January. Combined, the ISM indexes suggest employment slightly below the consensus estimate.

• Unemployment Claims: The weekly claims report showed a sharp increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 206,000 in December to 290,000 in January. This would usually suggest more layoffs in January than in December, although this might not be very useful right now. In general, weekly claims were below expectations in January.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.This data is only available back to 1994, so there is only data for three recessions. In December, the number of permanent job losers decreased to 1.703 million from 1.905 million in November.

• COVID: As far as the pandemic, the number of daily cases during the reference week in January was a record 800,000, up sharply from around 120,000 in December. The current wave peaked during the January reference week, and probably had a significant impact on January hiring.

• Conclusion: There is significant pessimism concerning the January employment report due to the current COVID wave, and many analysts are expecting job losses in January. For example, from Merrill Lynch economists:

"We expect nonfarm payrolls contracted by 150k in Jan owing to the shock from the Omicron variant. The U-rate should hold at 3.9%"

ISM® Services Index Decreased to 59.9% in January

by Calculated Risk on 2/03/2022 10:03:00 AM

(Posted with permission). The December ISM® Services index was at 59.9%, down from 62.3% last month. The employment index decreased to 52.3%, from 54.7%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 59.9% January 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in January for the 20th month in a row — with the Services PMI® registering 59.9 percent — say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.The employment index decreased to 52.3%, from 54.7% the previous month.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In January, the Services PMI® registered 59.9 percent, 2.4 percentage points below December’s seasonally adjusted reading of 62.3 percent. The Business Activity Index registered 59.9 percent, a decrease of 8.4 percentage points compared to the seasonally adjusted reading of 68.3 percent in December, and the New Orders Index registered 61.7 percent, 0.4 percentage point lower than the seasonally adjusted reading of 62.1 percent reported in December.

emphasis added

Weekly Initial Unemployment Claims Decrease to 238,000

by Calculated Risk on 2/03/2022 08:34:00 AM

The DOL reported:

In the week ending January 29, the advance figure for seasonally adjusted initial claims was 238,000, a decrease of 23,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 260,000 to 261,000. The 4-week moving average was 255,000, an increase of 7,750 from the previous week's revised average. The previous week's average was revised up by 250 from 247,000 to 247,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 255,000.

The previous week was revised up.

Weekly claims were close to the consensus forecast and increased recently likely due to the current COVID wave.

Wednesday, February 02, 2022

Thursday: Unemployment Claims, ISM Services

by Calculated Risk on 2/02/2022 08:50:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for a decrease to 250 thousand from 260 thousand last week.

• At 10:00 AM, the ISM Services Index for January.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 212.0 | --- | ≥2321 | |

| New Cases per Day3 | 415,552 | 636,024 | ≤5,0002 | |

| Hospitalized3 | 127,329 | 143,924 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,369 | 2,286 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Mike Simonsen of Altos Research and I Discuss Housing

by Calculated Risk on 2/02/2022 04:00:00 PM

Mike Simonsen of Altos Research and I discussed housing on “Top of the Mind”.

Here is webpage: Looking for Risks in the Future of the Real Estate Market

We discussed:

• Bill McBride shares why he started the Calculated Risk blog

• How Bill predicted the 2005 housing bubble

• What risks does Bill foresee in the future real estate market?

• Why are there fewer houses for sale, and is it a problem?

• Millennial home-buying trends

• Bill’s predictions for the second half of 2022

• Real estate trends outside of the US

• Why sellers should wait for multiple offers instead of taking the first one

• What’s the next big shift in the real estate market?

• How the remote working trend is impacting the real estate market

Update: Framing Lumber Prices Up More Than Double from Two Years Ago

by Calculated Risk on 2/02/2022 01:54:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through February 2nd.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.A combination of strong demand and various supply constraints have pushed up the price of lumber.

HVS: Q4 2021 Homeownership and Vacancy Rates

by Calculated Risk on 2/02/2022 10:14:00 AM

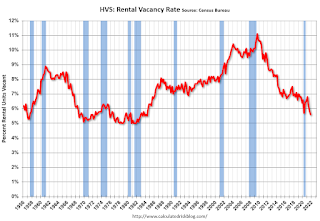

The Census Bureau released the Residential Vacancies and Homeownership report for Q4 2021.

The results of this survey were significantly distorted by the pandemic in 2020.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

National vacancy rates in the fourth quarter 2021 were 5.6 percent for rental housing and 0.9 percent for homeowner housing. The rental vacancy rate was 0.9 percentage points lower than the rate in the fourth quarter 2020 (6.5 percent) and not statistically different from the rate in the third quarter 2021 (5.8 percent).

The homeowner vacancy rate of 0.9 percent was 0.1 percentage points lower than the rate in the fourth quarter 2020 (1.0 percent) and virtually the same as the rate in the third quarter 2021 (0.9 percent).

The homeownership rate of 65.5 percent was not statistically different from the rate in the fourth quarter 2020 (65.8 percent) and not statistically different from the rate in the third quarter 2021 (65.4 percent). "

emphasis added

Click on graph for larger image.

Click on graph for larger image.The Red dots are the decennial Census homeownership rates for April 1st, 1990, 2000 and 2010. The Census Bureau will release data for 2020 soon.

The results starting in Q2 2020 were distorted by the pandemic.

The HVS homeowner vacancy was unchanged at 0.9% in Q4.

The HVS homeowner vacancy was unchanged at 0.9% in Q4. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.