by Calculated Risk on 2/10/2022 04:27:00 PM

Thursday, February 10, 2022

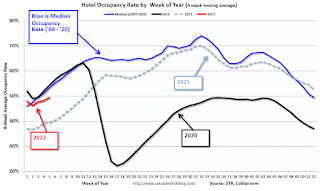

Hotels: Occupancy Rate Down 16% Compared to Same Week in 2019

U.S. weekly hotel occupancy eclipsed 50% for the first time in more than a month, but the index to 2019 dipped from the week prior, according to STR‘s latest data through 5 February.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Jan. 30 through Feb. 5, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 50.4% (-15.8%)

• Average daily rate (ADR): $125.06 (-1.2%)

• evenue per available room (RevPAR): $63.05 (-16.8%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

The Impact on Housing of Higher Mortgage Rates

by Calculated Risk on 2/10/2022 12:05:00 PM

Today, in the Calculated Risk Real Estate Newsletter: The Impact on Housing of Higher Mortgage Rates

A brief excerpt:

Looking back at previous periods with similar increases in mortgage rates - like in 2013 when mortgage rates increased from 3.4% to 4.5% from May to July - new home sales fell from about 440 thousand per month to about 390 thousand per month. This was a decline of about 10%.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

There was a similar decline in 1994 when rates increased from 7.2% to 8.4%, and new home sales fell from around 730 thousand to 650 thousand. And in 2018, rates increased from around 4.0% to 4.9%, and new home sales declined from around 650 thousand to 590 thousand.

There are other periods when rates increased - like in 1999 - and new home sales only declined slightly. Here is a graph of 30-year mortage rates. The arrows point to the three periods mentioned above.

...

With 4% 30-year mortgage rates, we will likely see a slowdown in both new and existing home sales (based on previous periods of rising rates). It also seems likely house price growth will slow. However, the impact on inventory is unclear.

An interesting question: Will higher mortgage rates slow investor buying? Higher rates will make buy-to-rent less attractive. Investor buying - and build-to-rent - will be areas to watch.

There is further downside risk if mortgage rates continue to increase, or if we see a significant increase in inventory (something we didn’t see in previous periods of rising mortgage rates).

Cleveland Fed: Median CPI increased 0.6% and Trimmed-mean CPI increased 0.6% in January

by Calculated Risk on 2/10/2022 11:21:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.6% in January. The 16% trimmed-mean Consumer Price Index also increased 0.6% in January. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Used Cars" were only up 19% annualized, and this will likely show declines in coming months.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

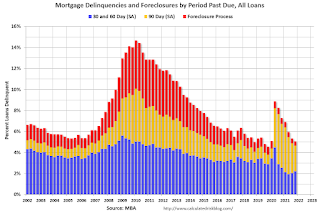

MBA: "Mortgage Delinquencies Decrease in the Fourth Quarter of 2021"

by Calculated Risk on 2/10/2022 10:44:00 AM

From the MBA: Mortgage Delinquencies Decrease in the Fourth Quarter of 2021

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.65 percent of all loans outstanding at the end of the fourth quarter of 2021, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate was down 23 basis points from the third quarter of 2021 and down 208 basis points from one year ago.

“Mortgage delinquencies descended in the final three months of 2021, reaching levels at or below MBA’s survey averages dating back to 1979,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The fourth-quarter delinquency rate of 4.65 percent was 67 basis points lower than MBA’s survey average of 5.32 percent. Furthermore, the seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.83 percent in the fourth quarter, close to the long-term average of 2.80 percent.”

Added Walsh, “The quarters right before the COVID-19 pandemic represented some of the lowest delinquencies ever recorded. Delinquencies are now approaching levels not seen since the first quarter of 2020, which is a testament to the strength of the U.S. labor market.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q4.

From the MBA:

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate increased 14 basis points to 1.65 percent, the 60-day delinquency rate increased 4 basis points to 0.56 percent, and the 90-day delinquency bucket decreased 41 basis points to 2.44 percent.This sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.42 percent, down 4 basis points from the third quarter of 2021 and 14 basis points lower than one year ago. This is the lowest foreclosure inventory rate since the third quarter of 1981. The percentage of loans on which foreclosure actions were started in the fourth quarter rose by 1 basis point to 0.04 percent, up from the survey low seen in third-quarter 2021 at 0.03 percent.

The percent of loans in the foreclosure process declined further and was at the lowest level since 1981.

Weekly Initial Unemployment Claims Decrease to 223,000

by Calculated Risk on 2/10/2022 08:40:00 AM

The DOL reported:

In the week ending February 5, the advance figure for seasonally adjusted initial claims was 223,000, a decrease of 16,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 238,000 to 239,000. The 4-week moving average was 253,250, a decrease of 2,000 from the previous week's revised average. The previous week's average was revised up by 250 from 255,000 to 255,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 253,250.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

BLS: CPI increased 0.6% in January; Core CPI increased 0.6%

by Calculated Risk on 2/10/2022 08:31:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.6 percent in January on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.5 percent before seasonal adjustment.Both CPI and core CPI were above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Increases in the indexes for food, electricity, and shelter were the largest contributors to the seasonally adjusted all items increase. The food index rose 0.9 percent in January following a 0.5-percent increase in December. The energy index also increased 0.9 percent over the month, with an increase in the electricity index being partially offset by declines in the gasoline index and the natural gas index.

The index for all items less food and energy rose 0.6 percent in January, the same increase as in December. This was the seventh time in the last 10 months it has increased at least 0.5 percent. Along with the index for shelter, the indexes for household furnishings and operations, used cars and trucks, medical care, and apparel were among many indexes that increased over the month.

The all items index rose 7.5 percent for the 12 months ending January, the largest 12-month increase since the period ending February 1982. The all items less food and energy index rose 6.0 percent, the largest 12-month change since the period ending August 1982. The energy index rose 27.0 percent over the last year, and the food index increased 7.0 percent.

emphasis added

Wednesday, February 09, 2022

Thursday: CPI, Initial Unemployment Claims

by Calculated Risk on 2/09/2022 08:14:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for a decrease to 235 thousand from 238 thousand last week.

• Also, at 8:30 AM, The Consumer Price Index for January from the BLS. The consensus is for 0.5% increase in CPI, and a 0.5% increase in core CPI.

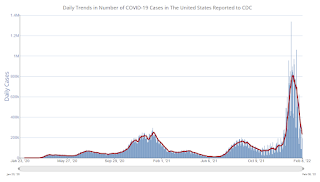

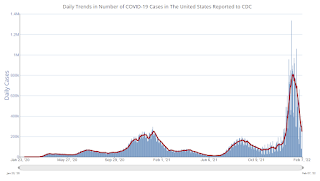

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 213.2 | --- | ≥2321 | |

| New Cases per Day3 | 230,602 | 413,730 | ≤5,0002 | |

| Hospitalized3 | 102,695 | 128,366 | ≤3,0002 | |

| Deaths per Day3 | 2,303 | 2,402 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

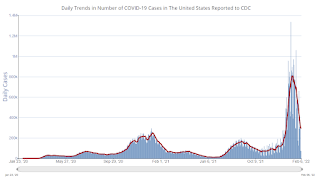

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

2nd Look at Local Housing Markets in January

by Calculated Risk on 2/09/2022 03:09:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in January

A brief excerpt:

Adding Houston, Memphis, Nashville, New Hampshire, North Texas and PortlandThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the second look at local markets in January. I’m tracking about 30 local housing markets in the US. Some of the 30 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

My view is that if the housing market starts slowing, it will show up in inventory first (not yet!).

The following data is important, especially active inventory. One of the key factors for house prices is supply and tracking local inventory reports will help us understand what is happening with supply.

On a national basis, we are seeing record low inventory over the Winter. I’ll be watching to see if inventory follows the normal seasonal pattern and bottoms in February. Last year, inventory didn’t bottom until April.

...

Here is a summary of active listings for these housing markets in January. Inventory was down 9.5% in January month-over-month (MoM) from December, and down 25.7% year-over-year (YoY).

Inventory almost always declines seasonally during the Winter, so the MoM decline is not a surprise. Last month, these markets were down 24.8% YoY, so the YoY decline in January is slightly larger than in December. This isn’t indicating a slowing market.

Notes for all tables:

New additions to table in BOLD.

Northwest (Seattle), North Texas (Dallas)

Energy expenditures as a percentage of PCE

by Calculated Risk on 2/09/2022 09:25:00 AM

During the early stages of the pandemic, energy expenditures as a percentage of PCE hit an all-time low of 3.3% of PCE. Since then, energy expenditures have increased. Here is an update through the December PCE report.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through December 2021.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In general, energy expenditures as a percent of PCE have been trending down for years.

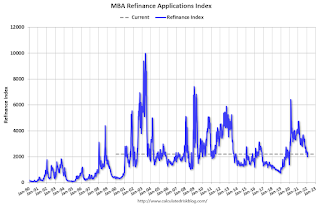

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/09/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 8.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 4, 2022.

... The Refinance Index decreased 7 percent from the previous week and was 52 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 10 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 12 percent lower than the same week one year ago.

“Mortgage rates continued to edge higher last week, with the 30-year fixed rate climbing to 3.83 percent. Mortgage rates followed the U.S. 10-year yield and other sovereign bonds as the Federal Reserve and other key global central banks responded to growing inflationary pressures and signaled that they will start to remove accommodative policies. With rates 87 basis points higher than the same week a year ago, refinance applications continued to decrease,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase activity slowed after the previous week's gain. Both conventional and FHA purchase applications saw proportional declines, resulting in purchase activity overall dropping 10 percent. The average loan size again hit another record high at $446,000. Activity continues to be dominated by larger loan balances, as inventory remains tight for entry-level buyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 3.83 percent from 3.78 percent, with points decreasing to 0.40 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 12% year-over-year unadjusted.

According to the MBA, purchase activity is down 12% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, February 08, 2022

COVID February 8, 2022: New Cases and Hospitalizations Declining

by Calculated Risk on 2/08/2022 09:08:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 213.1 | --- | ≥2321 | |

| New Cases per Day3 | 247,319 | 444,473 | ≤5,0002 | |

| Hospitalized3 | 105,449 | 131,099 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,404 | 2,334 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

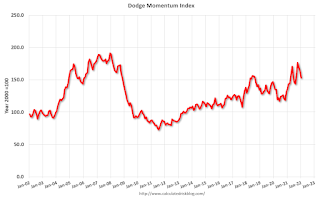

Leading Index for Commercial Real Estate "Falls in January"

by Calculated Risk on 2/08/2022 04:00:00 PM

From Dodge Data Analytics: Dodge Momentum Index Falls in January

The Dodge Momentum Index declined 7% in January to a four-month low of 152.9 (2000=100), from the revised December reading of 163.7. The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. In January, commercial planning fell 9%, and institutional planning slipped 1%.

The Dodge Momentum Index had a stellar 2021, rising 23% from 2020 and reaching levels not seen in nearly 14 years. The recent string of declines, however, may be blamed on rising costs, logistical problems and shortages of skilled labor. Still, even as it has decreased, the dollar value of projects in planning remains exceptionally strong, especially for education, warehouse and healthcare projects.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 152.9 in January, down from 163.7 in December.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggested a decline in Commercial Real Estate construction through most of 2021, but a solid pickup in 2022.

1st Look at Local Housing Markets in January

by Calculated Risk on 2/08/2022 12:26:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in January

A brief excerpt:

From the Northwest MLS: Northwest MLS brokers see signs of busy spring market despite slow JanuaryThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/"When there's uncertainty, the default position for most sellers is to stay put, do nothing, and hunker down," suggested Mike Larson, managing broker at Compass Tacoma. He said many things are contributing to sellers' reluctance to put their homes on the market, "most notably, COVID, inflation, the economy, the holidays, and finding a replacement property. Security and certainty are more important than cashing in on record amounts of equity."And a table of January sales. Sales were down 11.2% YoY, Not Seasonally Adjusted (NSA).

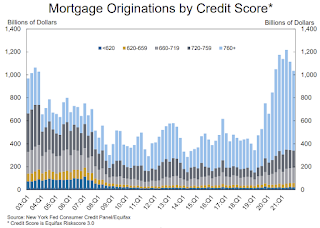

NY Fed Q4 Report: Total Household Debt Increases to $15.6 trillion

by Calculated Risk on 2/08/2022 11:13:00 AM

From the NY Fed: Robust Mortgage and Auto Loan Originations Help Drive Total Household Debt to $15.58 Trillion in Q4 2021

The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows that total household debt increased by $333 billion (2.2%) to $15.58 trillion in the fourth quarter of 2021. The total debt balance reflects an increase of $1 trillion during 2021 and is $1.4 trillion higher than at the end of 2019. In nominal terms, the 2021 total increase in overall debt is the largest seen since 2007. The Report is based on data from the New York Fed's nationally representative Consumer Credit Panel.

Mortgage balances rose by $258 billion in the fourth quarter of 2021 and stood at $10.93 trillion at the end of December. Credit card balances increased by $52 billion, representing the largest quarterly increase observed in the 22-year history of the data. However, credit card balances remain $71 billion lower than at the end of 2019. Auto loan balances increased by $15 billion, consistent with the previous two quarters. Student loan balances contracted by $8 billion, remaining roughly flat in nominal terms at the end of 2021 after almost two decades of steady increases. In total, non-housing balances grew by $74 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows aggregate consumer debt increased in Q4. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a huge decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $333 billion in the fourth quarter of 2021, a 2.2% rise from 2021Q3, and the largest increase since 2007 in both percentage and nominal terms. Balances now stand at $15.58 trillion, reflecting an increase of $1 trillion during 2021, and stand $1.4 trillion higher than at the end of 2019.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate was unchange in Q4. From the NY Fed:

Aggregate delinquency rates were flat in the fourth quarter of 2021 but remain very low, after declining sharply through the beginning of the pandemic. The fourth quarter saw a continued decline in late delinquency offset by a small increase in the share of earlier delinquency. The low delinquency rates have reflected forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit records from the reporting of skipped or deferred payments but are now winding down. As of late December, 2.7% of outstanding debt was in some stage of delinquency, a 2.0 percentage point decrease from the fourth quarter of 2019, just before the COVID-19 pandemic hit the United States. Of the $424 billion of debt that is delinquent, $298 billion is seriously delinquent (at least 90 days late or “severely derogatory”, which includes some debts that have been removed from lenders’ books but upon which they continue to attempt collection).

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

The credit scores of newly originated mortgages had increased in the early part of the pandemic, but have declined in recent quarters, yet remain very high and reflect a continuing high quality of newly opened mortgages as well as a higher share of refinances. The median credit score on newly originated auto loans was roughly flat. ... In all, 2021 saw historically high volumes of new extensions of installment credit for both mortgages and auto loans. Mortgage originations, measured as appearances of new mortgage balances on consumer credit reports and which include refinances, were at $1 trillion in 2021Q4. In annual terms, mortgage origination volumes were at a historic high in 2021, with over $4.5 trillion in mortgages originated.There is much more in the report.

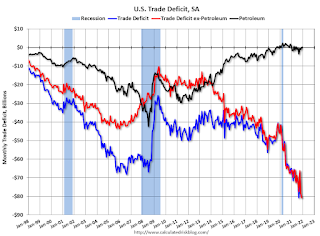

Trade Deficit Increased to $80.7 Billion in December

by Calculated Risk on 2/08/2022 08:38:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $80.7 billion in December, up $1.4 billion from $79.3 billion in November, revised.

December exports were $228.1 billion, $3.4 billion more than November exports. December imports were $308.9 billion, $4.8 billion more than November imports

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in December.

Exports are up 20% compared to December 2020; imports are up 20% compared to December 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $36.1 billion in December, from $27.3 billion in December 2020.

Monday, February 07, 2022

Tuesday: Trade Deficit, NY Fed Household Debt and Credit

by Calculated Risk on 2/07/2022 07:55:00 PM

From Matthew Graham at Mortgage News Daily: MBS Live Recap: Uneventfully Holding Near Long-Term Rate Highs

Heading into the new week, European bonds remain under pressure and US bonds weren't eager to lead the charge back down to lower yield levels. Bonds improved somewhat in the afternoon, but Treasuries were unchanged at the close. [30 year fixed 3.87%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for January.

• At 8:30 AM, Trade Balance report for December from the Census Bureau. The consensus is the trade deficit to be $83.0 billion. The U.S. trade deficit was at $80.2 billion in November.

• At 11:00 AM, NY Fed: Q4 Quarterly Report on Household Debt and Credit

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 212.9 | --- | ≥2321 | |

| New Cases per Day3 | 291,471 | 501,301 | ≤5,0002 | |

| Hospitalized3 | 104,902 | 133,784 | ≤3,0002 | |

| Deaths per Day3 | 2,294 | 2,340 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

U.S. Courts: Bankruptcy Filings Decline 24 Percent in 2021

by Calculated Risk on 2/07/2022 02:41:00 PM

From the U.S. Courts: Bankruptcy Filings Drop 24 Percent

Bankruptcy filings fell again for the 12-month period ending Dec. 31, 2021. A steady decline in filings has continued since the COVID-19 pandemic began.

Annual bankruptcy filings in calendar year 2021 totaled 413,616, compared with 544,463 cases in 2020, according to statistics released by the Administrative Office of the U.S. Courts. That is a decrease of 24.0 percent.

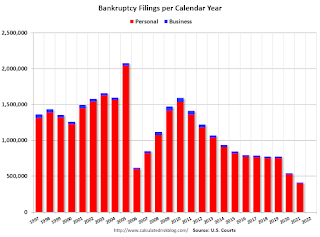

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by calendar year since 1997.

The sharp decline in 2006 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". (a good example of Orwellian named legislation since this was more a "Lender Protection Act").

Black Knight Mortgage Monitor for December: "Worst affordability levels since 2008"

by Calculated Risk on 2/07/2022 10:18:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor for December: "Worst affordability levels since 2008"

A brief excerpt:

And on the payment to income ratio:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• It now takes 25.8% of the median household income to purchase the average home with 20% down and a 30-year mortgage, up from the 22.4% required at the end of Q3 2021

• Interest rate jumps in recent weeks have pushed us rapidly above the long-term, pre-Great Recession average payment-to-income ratio of 25%, resulting in the worst affordability levels since 2008

• While a 20.5% ratio has been the tipping point between market acceleration and deceleration over the past decade, severe inventory shortfalls are keeping home prices running hotter than they might otherwise

Housing Inventory February 7th Update: Inventory Down 5.9% Week-over-week; New Record Low

by Calculated Risk on 2/07/2022 09:43:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and this is a new record low for this series.

This inventory graph is courtesy of Altos Research.

Six High Frequency Indicators for the Economy

by Calculated Risk on 2/07/2022 08:40:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

Note: Gasoline consumption returned to pre-pandemic levels.

The TSA is providing daily travel numbers.

This data is as of February 6th.

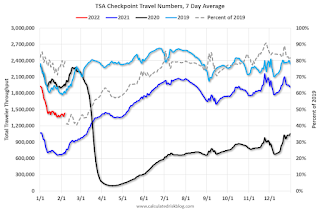

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 20.6% from the same day in 2019 (79.4% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through February 5, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways but declined during the winter wave of COVID and is now increasing. The 7-day average for the US is down 14% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $46 million last week, down about 73% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through January 29th. The occupancy rate was down 12.2% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through February 4th

This data is through February 4th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 99% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, February 4th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".