by Calculated Risk on 3/15/2022 09:51:00 AM

Tuesday, March 15, 2022

Predicting the Next Recession

Way back in 2013, I wrote a post "Predicting the Next Recession. This post was in response to several recession forecasts (that were incorrect).

In that 2013 post, I wrote:

The next recession will probably be caused by one of the following (from least likely to most likely):Unfortunately, in 2020, one of these low probability events happened (pandemic, emphasis added), and that led to a recession in 2020.

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

2) Significant policy error. Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession.We've seen several policy errors over the last several years, mostly related to immigration and trade during the previous administration, but none that would lead the economy into a recession.

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession.And this most common cause of a recession is the current concern. With inflation picking up due to the pandemic (stimulus spending, supply constraints) and now due to the invasion of Ukraine, the Fed will embark this week on a tightening cycle to slow inflation.

Click on graph for larger image.

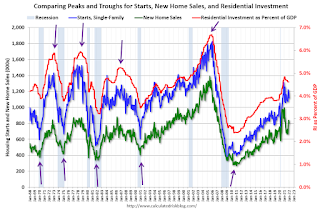

Click on graph for larger image.The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

New home sales and single-family starts turned down last year, but this was because of the huge surge in sales and starts in the 2nd half of 2020.

The second graph shows the YoY change in New Home Sales from the Census Bureau.

The second graph shows the YoY change in New Home Sales from the Census Bureau.Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

Some observations:

1) When the YoY change in New Home Sales falls about 20%, usually a recession will follow. An exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession. Another exception was the recent situation - we saw a YoY decline in new home sales related to the pandemic and the surge in new home sales in the second half of 2020.

2) It is also interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As I noted in earlier posts, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

If the Fed tightening cycle will lead to a recession, we should see housing turn down first (new home sales, single family starts, residential investment). There are other indicators too - such as the yield curve and heavy truck sales - but mostly I'll be watching housing. (I'm not currently on recession watch)

Monday, March 14, 2022

Tuesday: PPI, NY Fed Mfg

by Calculated Risk on 3/14/2022 09:05:00 PM

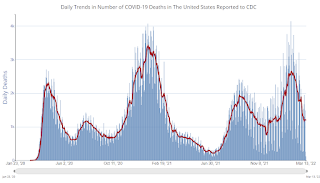

It appears there is another wave coming (Europe and China are seeing sharp increases). According to Andy Slavitt the new variant "BA2 spreads approx 30% faster than omicron". Hopefully it will not be severe.

Tuesday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of 7.2, up from 3.1.

• At 8:30 AM, The Producer Price Index for February from the BLS. The consensus is for a 0.9% increase in PPI, and a 0.6% increase in core PPI.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.7 | --- | ≥2321 | |

| New Cases per Day3 | 34,113 | 41,216 | ≤5,0002 | |

| Hospitalized3 | 21,471 | 31,949 | ≤3,0002 | |

| Deaths per Day3 | 1,187 | 1,295 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

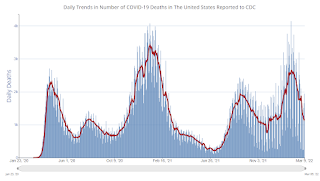

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

"Mortgage Rates Explode Higher"

by Calculated Risk on 3/14/2022 04:37:00 PM

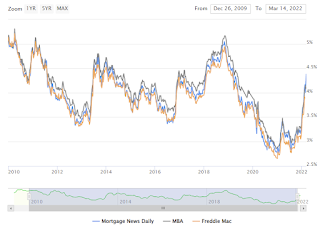

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Explode Higher. Anything Quoted Before Right Now is LONG Gone

If you received a mortgage rate quote any time in the past few days or weeks, unless it was at the end of the business day on Monday, March 14th, you're looking at a relic of a bygone era. Print it out and hang it up in the halls of Woulda, Shoulda, Coulda. ...

In the very best cases, some lenders are only .125% higher in rate (to put that in perspective, few individual days see bigger moves). Other lenders are closer to 0.25% higher. That puts today in a league with fewer than 10 players over the past decade. The average conventional 30yr fixed rate is easily up and over 4.25% now, with lenders anywhere from 4.375 to 4.625% depending on the scenario.

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30-year fixed rates from three sources (MND, MBA, Freddie Mac) since 2010.

Second Home Market: South Lake Tahoe in February

by Calculated Risk on 3/14/2022 11:53:00 AM

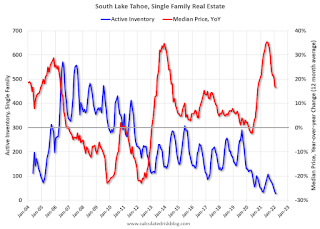

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through February 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is at a record low - just below the previous record low set in March 2021 - and prices are up sharply YoY (but the YoY change has been trending down).

Housing Inventory May Have Bottomed Seasonally

by Calculated Risk on 3/14/2022 09:19:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing Inventory May Have Bottomed Seasonally

A brief excerpt:

Last year inventory bottomed seasonally in April 2021 - very late in the year. This year, by this measure, it appears inventory bottomed seasonally at the beginning of March (we need a few more weeks of increasing inventory to confirm this).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Inventory is still very low. Compared to the same week in 2021, inventory is down 21.7%, and compared to the same week in 2020, and inventory is down 65.9% from 730 thousand.

One of the keys will be to watch the year-over-year change each week to see if the declines are decreasing. Here is a table of the year-over-year change by week since the beginning of the year.

Week Ending YoY Change 12/31/2021 -30.0% 1/7/2022 -26.0% 1/14/2022 -28.6% 1/21/2022 -27.1% 1/28/2022 -25.9% 2/4/2022 -27.9% 2/11/2022 -27.5% 2/18/2022 -25.8% 2/25/2022 -24.9% 3/4/2022 -24.2% 3/11/2022 -21.7%

Last week I wrote: "Based on the trend, it appears possible inventory bottomed seasonally last week, and will be up week-over-week in the next report." That happened.

Now we need to watch if the YoY change continues to decrease. Based on the current trend, it is possible inventory will be up YoY later this year.

Six High Frequency Indicators for the Economy

by Calculated Risk on 3/14/2022 08:38:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of March 14th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 14.3% from the same day in 2019 (85.7% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through March 9, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways but declined during the winter wave of COVID and is now increasing. The 7-day average for the US is down 7% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $216 million last week, up about 23% from the median for the week. Almost all of the ticket sales were for The Batman.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through March 5th. The occupancy rate was down 8.2% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through March 11th

This data is through March 11th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 118% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, March 11th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, March 13, 2022

Sunday Night Futures

by Calculated Risk on 3/13/2022 06:52:00 PM

Weekend:

• Schedule for Week of March 13, 2022

Monday:

• At 10:00 AM, State Employment and Unemployment (Monthly), January 2022

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 20, and and DOW futures are up 147 fair value).

Oil prices were down over the last week with WTI futures at $106.98 per barrel and Brent at $110.71 per barrel. A year ago, WTI was at $65, and Brent was at $69 - so WTI oil prices are up 65% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.30 per gallon. A year ago prices were at $2.85 per gallon, so gasoline prices are up $1.45 per gallon year-over-year.

FOMC Preview: Liftoff

by Calculated Risk on 3/13/2022 10:11:00 AM

Expectations are the FOMC will announce a 25bps rate hike at the meeting this week. In addition, the FOMC will hint at balance sheet reduction (runoff of assets / not reinvesting) and indicate further rate hikes at upcoming meetings.

"We expect the Fed to kick off the rate hiking cycle at the March FOMC meeting with a 25bp increase in the fed funds target range to 0.25-0.50%. In addition, the Fed is likely to release an addendum to their “Principles for Reducing the Size of the Federal Reserve's Balance Sheet”, with specifics on caps for the unwinding of their holdings of Treasuries and agency securities. This will provide a strong signal that the Fed is ready to commence Quantitative Tightening (QT) as early as the following meeting in May ...These actions would be in line with Chair Powell’s messaging at the semi-annual monetary policy testimony in early March, in which he explicitly stated that he would propose and support a 25bp hike and that he expects the Committee to set the pace of balance sheet runoff at the next meeting."

emphasis added

"We are raising our Fed forecast to include seven consecutive 25bp rate hikes at each of the remaining FOMC meetings in 2022 (vs. five hikes in 2022 previously).”And from Merrill:

"Inflation is here and it continues to make its presence known everywhere. We remain comfortable with our hawkish call for the Fed to hike seven times this year."Wall Street forecasts are for GDP to barely increase in Q1 2022, and to be in the 2% to 3% range for 2022. This is a sharp reduction in Wall Street growth forecasts, and the FOMC will probably lower their 2022 forecast down to 3% or so.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Dec 2021 | 3.6 to 4.5 | 2.0 to 2.5 | 1.8 to 2.0 | |

The unemployment rate was at 3.8% in February. There will likely be a slight reduction in the unemployment rate forecast for Q4 2022.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Dec 2021 | 3.4 to 3.7 | 3.2 to 3.6 | 3.2 to 3.7 | |

As of January 2022, PCE inflation was up 6.1% from January 2021. It seems like the FOMC will revise up their inflation projections for 2022.

"From the Russian Revolution to Vietnam, war has been a reliable precursor to inflation. History may be about to repeat as Russia’s invasion of Ukraine tilts the balance of global political and economic forces toward higher inflation."

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Dec 2021 | 2.2 to 3.0 | 2.1 to 2.5 | 2.0 to 2.2 | |

PCE core inflation was up 5.2% in January year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Dec 2021 | 2.5 to 3.0 | 2.1 to 2.4 | 2.0 to 2.2 | |

Saturday, March 12, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 3/12/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 2nd Look at Local Housing Markets in February

• The Home ATM Open in Q4 2021; Closing in 2022

• 1st Look at Local Housing Markets in February

• Homebuilder Comments in February: “Demand is still high"

• Black Knight Mortgage Monitor for January; "$275 billion in equity withdrawn" in 2021

This is usually published several times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of March 13, 2022

by Calculated Risk on 3/12/2022 08:11:00 AM

The key reports this week are February Retail Sales, Housing Starts and Existing Home Sales.

For manufacturing, the February Industrial Production report and the March NY and Philly Fed manufacturing surveys will be released.

The FOMC meets this week, and the FOMC is expected to raise rates.

10:00 AM: State Employment and Unemployment (Monthly), January 2022

8:30 AM: The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of 7.2, up from 3.1.

8:30 AM ET: The Producer Price Index for February from the BLS. The consensus is for a 0.9% increase in PPI, and a 0.6% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.4% increase in retail sales.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.4% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales ex-gasoline were up 4.2% in January.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 81, down from 82. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 25bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.695 million SAAR, up from 1.638 million SAAR.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 225 thousand from 227 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of 15.0, down from 16.0.

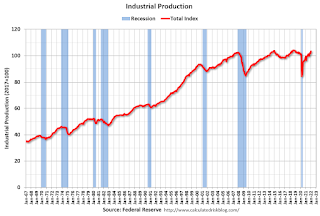

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.16 million SAAR, down from 6.50 million.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.16 million SAAR, down from 6.50 million.The graph shows existing home sales from 1994 through the report last month.

Friday, March 11, 2022

COVID Update: March 11, 2022; New Cases at 35,000, Lowest Since July 2021

by Calculated Risk on 3/11/2022 09:19:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.4 | --- | ≥2321 | |

| New Cases per Day3 | 35,652 | 49,000 | ≤5,0002 | |

| Hospitalized3 | 25,878 | 36,756 | ≤3,0002 | |

| Deaths per Day3 | 1,197 | 1,434 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Q1 GDP Forecasts: Close to Zero

by Calculated Risk on 3/11/2022 12:53:00 PM

From BofA:

This week’s trade and inventory data along with some adjustments to assumptions left our 1Q GDP tracking estimate unchanged at 1.0% qoq saar. [March 11 estimate]From Goldman:

emphasis added

We are downgrading our US GDP forecast to reflect higher oil prices and other drags on growth related to the war in Ukraine. ... As a result, we now forecast GDP growth of +0.5%/+1.5%/+2.5%/+2.5% in 2022Q1-Q4 (vs. 1.0%/2.5%/2.5%/2.0% previously), lowering our 2022 real GDP growth forecast to +1.75% on a Q4/Q4 basis (vs. +2.0% previous; 2.7% consensus). [0.5% Q1 March 10 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 0.5 percent on March 8, up from 0.0 percent on March 1. [March 8 estimate]

2nd Look at Local Housing Markets in February

by Calculated Risk on 3/11/2022 10:02:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in February

A brief excerpt:

Important on Houston MarketThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

From the Houston Association of REALTORS® (HAR): February Is a Strong Month for Houston Home Sales (Sales up sharply due partially to the freeze in February 2021)Home sales scored double-digit gains in February, but part of the strong showing was because the statistics compared to last February, when that deadly Texas freeze halted real estate activity for days, and in some cases, even longer. Undistorted by the weather factor were the continued squeeze on inventory, which returned to its all-time low, and pricing, which due to limited supply and ongoing consumer demand, soared to record highs.

emphasis addedAnd a table of February sales. Sales in these areas were down 2.0% YoY, Not Seasonally Adjusted (NSA). Note: The Houston market was up 25.6% year-over-year due to the freeze in February 2021.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) Totals do not include Atlanta, and Denver (included in state totals).

Hotels: Occupancy Rate Down 8% Compared to Same Week in 2019

by Calculated Risk on 3/11/2022 08:30:00 AM

U.S. hotel performance decreased from the previous week, according to STR‘s latest data through March 5.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Feb. 27 through March 5, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 61.2% (-8.2%)

• Average daily rate (ADR): $137.96 (+4.7%)

• Revenue per available room (RevPAR): $84.39 (-3.8%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

Thursday, March 10, 2022

30-Year Mortgage Rates Highest in almost 3 Years

by Calculated Risk on 3/10/2022 09:15:00 PM

From Matthew Graham at Mortgage News Daily: Sorry... Mortgage Rates Definitely Aren't Still Under 4%

The average lender is now definitively up and over 4.25% for the first time since early 2019. In other words, today's rates are the highest in almost 3 years. [30 year fixed 4.28%]Friday:

emphasis added

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for March).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.4 | --- | ≥2321 | |

| New Cases per Day3 | 37,146 | 52,155 | ≤5,0002 | |

| Hospitalized3 | 26,655 | 38,581 | ≤3,0002 | |

| Deaths per Day3 | 1,179 | 1,572 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

The Home ATM Open in Q4 2021; Closing in 2022, aka Mortgage Equity Withdrawal (MEW)

by Calculated Risk on 3/10/2022 02:32:00 PM

Today, in the Real Estate Newsletter: The Home ATM Open in Q4 2021; Closing in 2022

Excerpt:

First, here is the quarterly increase in mortgage debt from the Federal Reserve’s report since 2000. In the mid ‘00s, there was a large increase in mortgage debt associated with the housing bubble.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ (All ad free, most content free).

In Q4 2021, mortgage debt increased $245 billion, the largest quarterly increase since 2006. Note the almost 7 year of declining mortgage debt as distressed sales (foreclosures and short sales) wiped out a significant amount of debt.

However, some of this debt is being used to increase the housing stock (purchase new homes), so this isn’t all MEW.

...

The bottom line is the recent increase in MEW is not concerning - it is far less as a percent of disposable personal income than during the bubble, and most homeowners have substantial equity.

Also, it is very likely that MEW will decrease sharply in 2022 as refinance activity declines due to higher mortgage rates. I expect significantly lower levels of MEW in 2022.

Fed's Flow of Funds: Household Net Worth Increased $5.3 Trillion in Q4

by Calculated Risk on 3/10/2022 02:08:00 PM

The Federal Reserve released the Q4 2021 Flow of Funds report today: Financial Accounts of the United States.

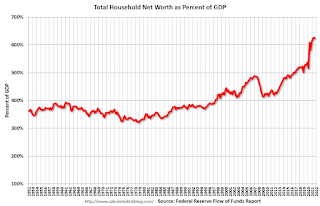

The net worth of households and nonprofits rose to $150.3 trillion during the fourth quarter of 2021. The value of directly and indirectly held corporate equities increased $2.5 trillion and the value of real estate increased $1.5 trillion.

...

Household debt increased 8 percent at an annual rate in the fourth quarter of 2021. Consumer credit grew at an annual rate of 6.9 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 8 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP.

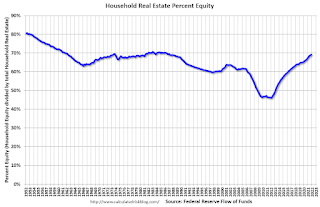

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2021, household percent equity (of household real estate) was at 69.2% - up from 68.8% in Q3 This is the highest percent equity since the 1980s.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So, the approximately 50+ million households with mortgages have less than 67.7% equity - and about 1.1 million homeowners still have negative equity.

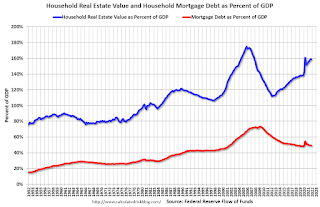

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.Mortgage debt increased by $245 billion in Q4. This is the largest quarterly increase in mortgage debt since 2006.

Mortgage debt is up $1.05 trillion from the peak during the housing bubble, but, as a percent of GDP is at 48.9% - down from Q2 - and down from a peak of 73.3% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, increased in Q4, and is well above the average of the last 30 years.

Cleveland Fed: Median CPI increased 0.5% and Trimmed-mean CPI increased 0.5% in February

by Calculated Risk on 3/10/2022 11:18:00 AM

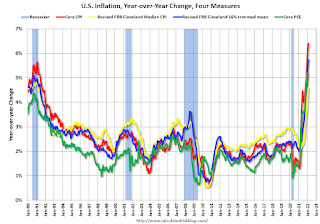

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.5% in February. The 16% trimmed-mean Consumer Price Index also increased 0.5% in February. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Used Cars" were down 3% annualized, and this will likely show declines in coming months. Motor fuel was up 118% annualized in February and will likely increase further in March.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

CoreLogic: Homeowners with Negative Equity Lowest in Over 12 Years

by Calculated Risk on 3/10/2022 09:14:00 AM

From CoreLogic: Number of U.S. Homeowners in Negative Equity Dropped to Lowest Level in Over 12 Years, CoreLogic Reports

CoreLogic® ... today released the Homeowner Equity Report for the fourth quarter of 2021. The report shows U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by 29.3% year over year, representing a collective equity gain of over $3.2 trillion, and an average gain of $55,300 per borrower, since the fourth quarter of 2020.

U.S. home prices rose 18% year over year in the fourth quarter of 2021, up from the 8% annual gain recorded in the fourth quarter of 2020. The appreciation helped push the national negative equity figure to the lowest in over a dozen years, with just 1.1 million homeowners underwater on their mortgages. Western state homeowners saw the biggest equity gains by dollar value, led by Hawaii, California and Washington. Year-over-year price appreciation increased by 19.1% in January 2022 according to CoreLogic’s latest Home Price Index, though growth is projected to eventually slow over the next 12 months.

“Home prices rose 18% during 2021 in the CoreLogic Home Price Index, the largest annual gain recorded in its 45-year history, generating a big increase in home equity wealth,” said Dr. Frank Nothaft, chief economist for CoreLogic. “For low- and moderate-income homeowners, home equity has historically been a major source of wealth.”

Negative equity, also referred to as underwater or upside-down mortgages, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the fourth quarter of 2021, negative equity share, and the quarter-over-quarter and year-over-year changes, were as follows:

• Quarterly change: From the third quarter of 2021 to the fourth quarter of 2021, the total number of mortgaged homes in negative equity decreased by 3% to 1.1 million homes, or 2.1% of all mortgaged properties.

• Annual change: In the fourth quarter of 2020, 1.5 million homes, or 2.8% of all mortgaged properties, were in negative equity. This number decreased by 24.9%, or approximately 380,000 properties, by the fourth quarter of 2021.

• Distribution of negative equity: Of loans in negative equity in the fourth quarter of 2021, 42% had a loan-to-value ratio below 125%, and 58% had a loan-to-value ratio of 125% or higher.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q4 to Q3 2021 equity distribution by LTV. There are still a few properties with LTV over 125%. But most homeowners have a significant amount of equity. This is a very different picture than at the start of the housing bust when many homeowners had little equity.

On a year-over-year basis, the number of homeowners with negative equity has declined from 1.5 million to 1.1 million.

Weekly Initial Unemployment Claims Increase to 227,000

by Calculated Risk on 3/10/2022 08:39:00 AM

The DOL reported:

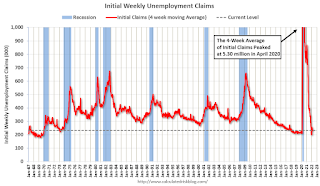

In the week ending March 5, the advance figure for seasonally adjusted initial claims was 227,000, an increase of 11,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 215,000 to 216,000. The 4-week moving average was 231,250, an increase of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 230,500 to 230,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 231,250.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.