by Calculated Risk on 3/18/2022 09:22:00 PM

Friday, March 18, 2022

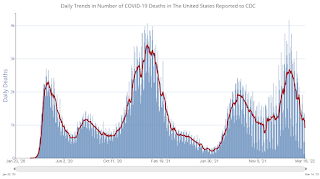

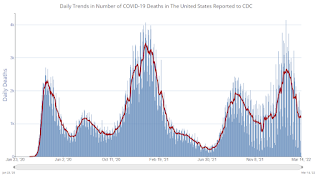

COVID Update: March 18, 2022; Deaths at 1,000 per Day, Lowest Since December 2021

Last June, new cases per day dropped to 8,000, hospitalizations fell to 12,000, and deaths were at 250 per day. We are still well above those levels.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.0 | --- | ≥2321 | |

| New Cases per Day3 | 29,312 | 34,471 | ≤5,0002 | |

| Hospitalized3 | 19,031 | 26,329 | ≤3,0002 | |

| Deaths per Day3 | 1,032 | 1,184 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Q1 GDP Forecasts: Around 1%

by Calculated Risk on 3/18/2022 02:05:00 PM

From BofA:

This week's data-retail sales, industrial production, and import & export prices- on balance lifted our 1Q GDP tracking estimate by 0.6ppt to 1.6% qoq saar. [March 18 estimate]From Goldman:

emphasis added

Following today’s data, we left our Q1 GDP tracking estimate unchanged at +0.5% (qoq ar). [March 18 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 1.3 percent on March 17, up from 1.2 percent on March 16. After this morning’s releases from the US Census Bureau and the Federal Reserve Board of Governors, the nowcast of first-quarter real gross private domestic investment growth increased from -4.9 percent to -4.2 percent. [March 17 estimate]

More Analysis on February Existing Home Sales

by Calculated Risk on 3/18/2022 11:06:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 6.02 million SAAR in February

Excerpt:

The Impact of the February 2021 Texas FreezeThere is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

When the local data was released, I highlighted the sharp increase in sales in Houston (up 25.6% year-over-year). From the Houston Association of REALTORS® (HAR): February Is a Strong Month for Houston Home SalesHome sales scored double-digit gains in February, but part of the strong showing was because the statistics compared to last February, when that deadly Texas freeze halted real estate activity for days, and in some cases, even longer. Undistorted by the weather factor were the continued squeeze on inventory, which returned to its all-time low, and pricing, which due to limited supply and ongoing consumer demand, soared to record highs.In February 2022, the only region that showed a year-over-year increase was the South (an increase from the weak sales in 2021 due to the freeze). The other regions were down an average of 6.7% year-over-year compared to the 2.4% reported by the NAR for the entire country.

emphasis added

...

This graph shows existing home sales by month for 2021 and 2022.

Sales declined 2.3% year-over-year compared to January 2021. This was the seventh consecutive month with sales down year-over-year.

...

[and on inventory] According to the NAR, inventory increased to 0.87 million in February from 0.85 million in January. Inventory is now just above the record low.

NAR: Existing-Home Sales Decreased to 6.02 million SAAR in February

by Calculated Risk on 3/18/2022 10:12:00 AM

From the NAR: Existing-Home Sales Fade 7.2% in February

Existing-home sales dipped in February, continuing a seesawing pattern of gains and declines over the last few months, according to the National Association of Realtors®. Each of the four major U.S. regions saw sales fall on a month-over-month basis in February. Sales activity year-over-year was also down overall, though the South experienced an increase while the remaining three regions reported drops in transactions.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, sank 7.2% from January to a seasonally adjusted annual rate of 6.02 million in February. Year-over-year, sales decreased 2.4% (6.17 million in February 2021).

...

Total housing inventory at the end of February totaled 870,000 units, up 2.4% from January and down 15.5% from one year ago (1.03 million). Unsold inventory sits at a 1.7-month supply at the current sales pace, up from the record-low supply in January of 1.6 months and down from 2.0 months in February 2021.

emphasis added

Click on graph for larger image.

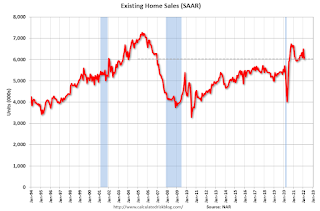

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February (6.02 million SAAR) were down 7.2% from the previous month and were 2.4% below the February 2021 sales rate.

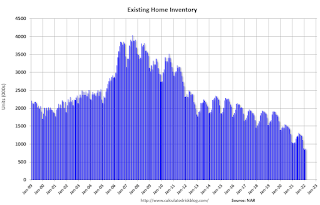

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 0.87 million in February from 0.85 million in January.

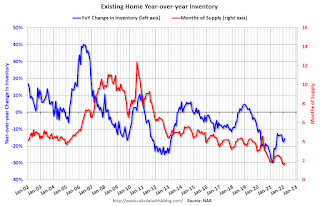

According to the NAR, inventory increased to 0.87 million in February from 0.85 million in January.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 15.5% year-over-year (blue) in February compared to February 2021.

Inventory was down 15.5% year-over-year (blue) in February compared to February 2021. Months of supply (red) increased to 1.7 months in February from 1.6 months in January.

This was below the consensus forecast. I'll have more later.

Hotels: Occupancy Rate Down 10% Compared to Same Week in 2019

by Calculated Risk on 3/18/2022 08:30:00 AM

Overall U.S. hotel performance increased from the previous week, according to STR‘s latest data through March 12.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

March 6-12, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 63.2% (-9.8%)

• Average daily rate (ADR): $144.68 (+7.7%)

• Revenue per available room (RevPAR): $91.45 (-2.8%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

Thursday, March 17, 2022

Friday: Existing Home Sales

by Calculated Risk on 3/17/2022 08:54:00 PM

Thursday:

• At 10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.16 million SAAR, down from 6.50 million. Housing economist Tom Lawler expects the NAR to report 5.97 million SAAR.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.9 | --- | ≥2321 | |

| New Cases per Day3 | 30,040 | 36,009 | ≤5,0002 | |

| Hospitalized3 | 20,780 | 29,017 | ≤3,0002 | |

| Deaths per Day3 | 909 | 1,187 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Lawler: Early Read on Existing Home Sales in February

by Calculated Risk on 3/17/2022 02:02:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.97 million in February, down 8.2% from January’s preliminary pace and down 3.2% from last February’s seasonally adjusted pace.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY % decline in the inventory of existing homes for sale last month was lower than that in January.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 16.5% from last February.

CR Note: The National Association of Realtors (NAR) is scheduled to release February existing home sales tomorrow, Friday, March 18, 2022, at 10:00 AM ET. The consensus is for 6.16 million SAAR.

February Housing Starts: Most Housing Units Under Construction Since 1973

by Calculated Risk on 3/17/2022 10:03:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: February Housing Starts: Most Housing Units Under Construction Since 1973

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Red is single family units. Currently there are 799 thousand single family units under construction (SA). This is the highest level since December 2006.

For single family, many of these homes are already sold (Census counts sales when contract is signed). The reason there are so many homes is probably due to construction delays. Since many of these are already sold, it is unlikely this is “overbuilding”, or that this will impact prices (although the buyers will be moving out of their current home or apartment once these homes are completed).

Blue is for 2+ units. Currently there are 784 thousand multi-family units under construction. This is the highest level since June 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are 1.583 million units under construction. This is the most since August 1973.

Length of Time from Authorization to Start and from Start to Completion

Census released the annual data on the length of time from start to completion, and this showed construction delays in 2021.

In 2021, it took an average of 7.2 months from start to completion for single family homes, up from 6.8 months in 2020. For multi-family, it took 15.4 months for buildings with 2 or more units in 2021, the same as in 2020 (the long delays will likely show up in the 2022 data since it takes over a year to complete).

From Authorization to Start, it took 1.3 months in 2021 for single family homes, up from 1.0 months in 2020, and it took 2.1 months in 2021 for multi-family, up from 2.0 months.

Industrial Production Increased 0.5 Percent in February

by Calculated Risk on 3/17/2022 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Total industrial production rose 0.5 percent in February to a level that is 103.6 percent of its 2017 average. Manufacturing output increased 1.2 percent after having been little changed in each of the previous two months. In February, the index for utilities declined 2.7 percent, and the output of mines edged up 0.l percent.

Total industrial production in February was 7.5 percent higher than its year-earlier level, but severe winter weather in February 2021 significantly suppressed industrial activity that month. A more useful comparison shows that the index has advanced a still-strong 4.2 percent since January 2021. Capacity utilization for the industrial sector increased 0.3 percentage point in February to 77.6 percent, a rate that is 1.9 percentage points below its long-run (1972–2021) average.

emphasis added

Click on graph for larger image.

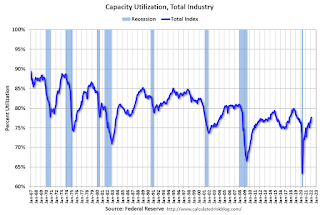

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 77.6% is 1.9% below the average from 1972 to 2020. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

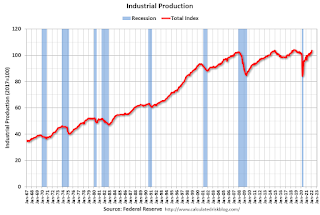

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in February to 103.6. This is above the February 2020 level.

The change in industrial production was at consensus expectations.

Housing Starts Increased to 1.769 million Annual Rate in February

by Calculated Risk on 3/17/2022 08:42:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in February were at a seasonally adjusted annual rate of 1,769,000. This is 6.8 percent above the revised January estimate of 1,657,000 and is 22.3 percent above the February 2021 rate of 1,447,000. Single‐family housing starts in February were at a rate of 1,215,000; this is 5.7 percent above the revised January figure of 1,150,000. The February rate for units in buildings with five units or more was 501,000.

Building Permits:

Privately‐owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,859,000. This is 1.9 percent below the revised January rate of 1,895,000, but is 7.7 percent above the February 2021 rate of 1,726,000. Single‐family authorizations in February were at a rate of 1,207,000; this is 0.5 percent below the revised January figure of 1,213,000. Authorizations of units in buildings with five units or more were at a rate of 597,000 in February.

emphasis added

Click on graph for larger image.

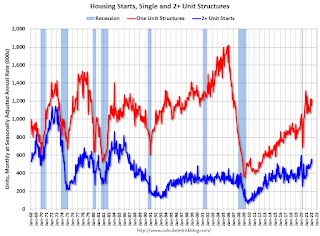

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in February compared to January. Multi-family starts were up 46.5% year-over-year in February. Note: Last year, starts were impacted by the freeze in Texas.

Single-family starts (red) increased in February and were up 13.7% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in February were above expectations, and starts in December and January were revised up, combined.

I'll have more later …

Weekly Initial Unemployment Claims Decrease to 214,000

by Calculated Risk on 3/17/2022 08:33:00 AM

The DOL reported:

In the week ending March 12, the advance figure for seasonally adjusted initial claims was 214,000, a decrease of 15,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 227,000 to 229,000. The 4-week moving average was 223,000, a decrease of 8,750 from the previous week's revised average. The previous week's average was revised up by 500 from 231,250 to 231,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 223,000.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Wednesday, March 16, 2022

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg, Industrial Production

by Calculated Risk on 3/16/2022 08:55:00 PM

Thursday:

• At 8:30 AM ET, Housing Starts for February. The consensus is for 1.695 million SAAR, up from 1.638 million SAAR.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 225 thousand from 227 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for March. The consensus is for a reading of 15.0, down from 16.0.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for February. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.8 | --- | ≥2321 | |

| New Cases per Day3 | 30,934 | 36,852 | ≤5,0002 | |

| Hospitalized3 | 20,780 | 29,017 | ≤3,0002 | |

| Deaths per Day3 | 1,107 | 1,153 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Housing, the Fed, Interest Rates and Inflation

by Calculated Risk on 3/16/2022 04:43:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Housing, the Fed, Interest Rates and Inflation

A brief excerpt:

It is important to understand that housing is a key transmission mechanism for Federal Open Market Committee (FOMC) policy. There are several channels according to economist Frederick Mishkin: Housing and the Monetary Transmission MechanismThere is much more in the article.By raising or lowering short-term interest rates, monetary policy affects the housing market, and in turn the overall economy, directly or indirectly through at least six channels: through the direct effects of interest rates on (1) the user cost of capital, (2) expectations of future house-price movements, and (3) housing supply; and indirectly through (4) standard wealth effects from house prices, (5) balance sheet, credit-channel effects on consumer spending, and (6) balance sheet, credit-channel effects on housing demand.So, when the FOMC raises rates, housing is a key target. For example, higher rates change the trade-off between buying and renting, and also changes the calculation for investors. Higher rates have already slowed down the “home ATM” (Mortgage Equity Withdrawal) and will likely impact demand (not yet!).

FOMC Projections and Press Conference

by Calculated Risk on 3/16/2022 02:11:00 PM

Statement here.

Fed Chair Powell press conference video here starting at 2:30 PM ET.

Here are the projections. In December, most participants expected three rate hikes in 2022. Now, participants expect 7 rate hikes in 2022.

Wall Street forecasts are for GDP to barely increase in Q1 2022, and to be in the 2% to 3% range for 2022. This was a sharp reduction in Wall Street growth forecasts, and the FOMC lowered their 2022 forecast down significantly to similar growth rates.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 2.5 to 3.0 | 2.1 to 2.5 | 1.8 to 2.0 | |

| Dec 2021 | 3.6 to 4.5 | 2.0 to 2.5 | 1.8 to 2.0 | |

The unemployment rate was at 3.8% in February. So, there was a slight reduction in the unemployment rate forecast for Q4 2022.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 3.4 to 3.6 | 3.3 to 3.6 | 3.2 to 3.7 | |

| Dec 2021 | 3.4 to 3.7 | 3.2 to 3.6 | 3.2 to 3.7 | |

As of January 2022, PCE inflation was up 6.1% from January 2021. The FOMC revised up sharply their inflation projections for 2022.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 4.1 to 4.7 | 2.3 to 3.0 | 2.1 to 2.4 | |

| Dec 2021 | 2.2 to 3.0 | 2.1 to 2.5 | 2.0 to 2.2 | |

PCE core inflation was up 5.2% in January year-over-year and the FOMC revised up their projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 3.9 to 4.4 | 2.4 to 3.0 | 2.1 to 2.4 | |

| Dec 2021 | 2.5 to 3.0 | 2.1 to 2.4 | 2.0 to 2.2 | |

FOMC Statement: Raise Rates 25bps

by Calculated Risk on 3/16/2022 02:03:00 PM

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

Indicators of economic activity and employment have continued to strengthen. Job gains have been strong in recent months, and the unemployment rate has declined substantially. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Esther L. George; Patrick Harker; Loretta J. Mester; and Christopher J. Waller. Voting against this action was James Bullard, who preferred at this meeting to raise the target range for the federal funds rate by 0.5 percentage point to 1/2 to 3/4 percent. Patrick Harker voted as an alternate member at this meeting.

emphasis added

NAHB: Builder Confidence Decreased to 79 in March

by Calculated Risk on 3/16/2022 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 79, down from 81 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Diminished Future Sales Expectations, Rising Costs Lower Builder Confidence

Ongoing lumber and building material supply-side constraints and rising construction costs and expectations of higher interest rates continue to negatively affect builder sentiment even as buyer demand remains relatively solid.

Builder confidence in the market for newly built single-family homes moved two points lower to 79 in March from a downwardly revised reading in February, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This is the fourth straight month that builder sentiment has declined and the first time that the HMI has dipped below the 80-point mark since last September.

While builders continue to report solid buyer traffic numbers, helped by historically low existing home inventory and a persistent housing deficit, increasing development and construction costs have taken a toll on builder confidence.

The March HMI recorded the lowest future sales expectations in the survey since June 2020. Builders are reporting growing concerns that increasing construction costs (up 20% over the last 12 months) and expected higher interest rates connected to tightening monetary policy will price prospective home buyers out of the market. While low existing inventory and favorable demographics are supporting demand, the impact of elevated inflation and expected higher interest rates suggests caution for the second half of 2022.

...

The HMI index gauging current sales conditions fell three points to 86 and the gauge measuring sales expectations in the next six months dropped a whopping 10 points to 70. The component charting traffic of prospective buyers posted a two-point gain to 67.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell seven points to 69, the Midwest dropped one point to 72 and the South fell three points to 83. The West moved up one point to 90.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was below the consensus forecast, and still a strong reading.

Retail Sales Increased 0.3% in February

by Calculated Risk on 3/16/2022 08:42:00 AM

On a monthly basis, retail sales were increased 0.3% from January to February (seasonally adjusted), and sales were up 17.6 percent from February 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for February 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $658.1 billion, an increase of 0.3 percent from the previous month, and 17.6 percent above February 2021. ... The December 2021 to January 2022 percent change was revised from up 3.8 percent to up 4.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.2% in February.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/16/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 11, 2022.

... The Refinance Index decreased 3 percent from the previous week and was 49 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 8 percent lower than the same week one year ago.

“Mortgage rates continue to be volatile due to the significant uncertainty regarding Federal Reserve policy and the situation in Ukraine. Investors are weighing the impacts of rapidly increasing inflation in the U.S. and many other parts of the world against the potential for a slowdown in economic growth due to a renewed bout of supply-chain constraints,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “After declining two weeks ago, the 30-year fixed-rate mortgage increased last week to 4.27 percent – the highest since May 2019. Rates are now roughly a full percentage point higher than a year ago and continue to hamper refinance activity. Refinances declined for both conventional and government loans.”

Added Kan, “Purchase applications slightly increased, with both conventional and VA loan applications seeing gains. The average purchase application loan size remained elevated at $453,200 – the second highest amount in MBA’s survey.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 4.27 percent from 4.09 percent, with points increasing to 0.54 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 8% year-over-year unadjusted.

According to the MBA, purchase activity is down 8% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, March 15, 2022

Wednesday: FOMC Statement, Retail Sales, Homebuilder Survey

by Calculated Risk on 3/15/2022 08:52:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for February is scheduled to be released. The consensus is for a 0.4% increase in retail sales.

• At 10:00 AM, The March NAHB homebuilder survey. The consensus is for a reading of 81, down from 82. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 25bps at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.8 | --- | ≥2321 | |

| New Cases per Day3 | 32,458 | 39,184 | ≤5,0002 | |

| Hospitalized3 | 21,260 | 30,474 | ≤3,0002 | |

| Deaths per Day3 | 1,186 | 1,211 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

3rd Look at Local Housing Markets in February

by Calculated Risk on 3/15/2022 01:38:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in February

A brief excerpt:

California doesn’t report monthly sales (not seasonally adjusted) or inventory, but here is the press release from the California Association of Realtors® (C.A.R.): California home sales edge higher in February amid geopolitical tensions and inflation uncertainty, C.A.R. reportsThere is much more in the article.February’s sales pace was down 4.5 percent on a monthly basis from 444,540 in January and was down 8.2 percent from a year ago ... California’s Unsold Inventory Index (UII) rose in February as active listings climbed from January to the highest level in three months. February’s UII was 2.0 months and 2.1 months in February 2021.Active Inventory in February

Here is a summary of active listings for these housing markets in February. Inventory was down 5.3% in February month-over-month (MoM) from January, and down 23.9% year-over-year (YoY).

It appears inventory has bottomed seasonally in some areas. Last month, these markets were down 26.5% YoY, so the YoY decline in February is smaller than in January. This isn’t indicating a slowing market, but maybe a few baby steps towards a more balanced market in some areas.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) otals do not include Atlanta, Denver, Minneapolis (included in state totals).