by Calculated Risk on 4/12/2022 08:33:00 AM

Tuesday, April 12, 2022

BLS: CPI increased 1.2% in March; Core CPI increased 0.3%

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.2 percent in March on a seasonally adjusted basis after rising 0.8 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.5 percent before seasonal adjustment.CPI was at expectations and core CPI was lower than expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Increases in the indexes for gasoline, shelter, and food were the largest contributors to the seasonally adjusted all items increase. The gasoline index rose 18.3 percent in March and accounted for over half of the all items monthly increase; other energy component indexes also increased. The food index rose 1.0 percent and the food at home index rose 1.5 percent.

The index for all items less food and energy rose 0.3 percent in March following a 0.5-percent increase the prior month. The shelter index was by far the biggest factor in the increase, with a broad set of other indexes also contributing, including those for airline fares, household furnishings and operations, medical care, and motor vehicle insurance. In contrast, the index for used cars and trucks fell 3.8 percent over the month.

The all items index continued to accelerate, rising 8.5 percent for the 12 months ending March, the largest 12-month increase since the period ending December 1981. The all items less food and energy index rose 6.5 percent, the largest 12-month change since the period ending August 1982. The energy index rose 32.0 percent over the last year, and the food index increased 8.8 percent, the largest 12-month increase since the period ending May 1981.

emphasis added

Monday, April 11, 2022

Tuesday: CPI

by Calculated Risk on 4/11/2022 08:16:00 PM

From Matthew Graham at Mortgage News Daily: MBS Live Recap: Running Out of Ways to Say "Higher Rates"

Market watchers are at risk of major desensitization when it comes to "rates continuing higher." For essentially all of 2022 apart from the onset of the Ukraine war, rates have moved one direction. Not only that, but the pace has been relatively unprecedented unless we compare it to some of the most horrific historical precedents. It seems that every time the market gives us a shred of hope that the outlook is moderating, the hope is quickly shredded and we're back to wondering how high rates will go before we see legitimate relief. Today ended up being just another day in that saga. [30 year fixed 5.25%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for March.

• At 8:30 AM, The Consumer Price Index for March from the BLS. The consensus is for 1.2% increase in CPI (up 8.5% YoY) and a 0.5% increase in core CPI (up 6.6% YoY).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 218.4 | --- | ≥2321 | |

| New Cases per Day3🚩 | 28,927 | 25,877 | ≤5,0002 | |

| Hospitalized3 | 9,240 | 11,064 | ≤3,0002 | |

| Deaths per Day3 | 500 | 582 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

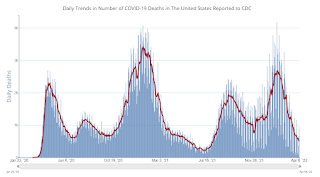

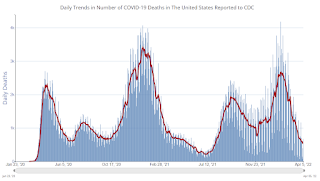

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths are the lowest since early August 2021.

Apartment Vacancy Rate Declined in Q1

by Calculated Risk on 4/11/2022 01:23:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Apartment Vacancy Rate Declined in Q1

A brief excerpt:

Reis reported that the apartment vacancy rate was at 4.7% in Q1 2022, down from 4.8% in Q4, and down from a pandemic peak of 5.4% in both Q1 and Q2 2021.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.Reis also reported the effective rents were up 2.5% in Q1 compared to Q4, and up 15.6% year-over-year. ...

Click on graph for larger image.

Effective rents declined significantly in the early stages of the pandemic, and even with the recent surge in rents, rents are only up 5.9% annualized over the last 2 years. So, a large portion of the rent increase over the last year was just making up for the previous declines.

For some cities, effective rents were up significantly more, especially in some cities like Albuquerque, Jacksonville and Phoenix. Other sunbelt areas like Las Vegas, Florida, and Southern California also saw huge rent increases.

Housing Inventory April 11th Update: Inventory up 2.3% Week-over-week; Up 8.3% from Seasonal Bottom

by Calculated Risk on 4/11/2022 09:32:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 8.3% since then.

This inventory graph is courtesy of Altos Research.

Last year inventory bottomed seasonally in April 2021 - very late in the year. This year, by this measure, inventory bottomed seasonally at the beginning of March.

Inventory is still very low. Compared to the same week in 2021, inventory is down 14.8% from 307 thousand, and compared to the same week in 2020, and inventory is down 65.1% from 749 thousand.

One of the keys will be to watch the year-over-year change each week to see if the declines are decreasing. Here is a table of the year-over-year change by week since the beginning of the year.

| Week Ending | YoY Change |

|---|---|

| 12/31/2021 | -30.0% |

| 1/7/2022 | -26.0% |

| 1/14/2022 | -28.6% |

| 1/21/2022 | -27.1% |

| 1/28/2022 | -25.9% |

| 2/4/2022 | -27.9% |

| 2/11/2022 | -27.5% |

| 2/18/2022 | -25.8% |

| 2/25/2022 | -24.9% |

| 3/4/2022 | -24.2% |

| 3/11/2022 | -21.7% |

| 3/18/2022 | -21.7% |

| 3/25/2022 | -19.0% |

| 4/1/2022 | -17.6% |

| 4/8/2022 | -14.8% |

Six High Frequency Indicators for the Economy

by Calculated Risk on 4/11/2022 09:03:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

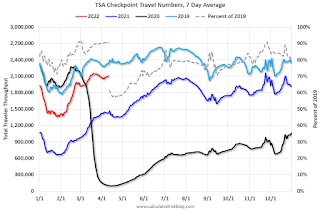

The TSA is providing daily travel numbers.

This data is as of April 10th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 9.5% from the same day in 2019 (90.5% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through April 9, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways but declined during the winter wave of COVID and is now increasing. The 7-day average for the US is down 1% compared to 2019.

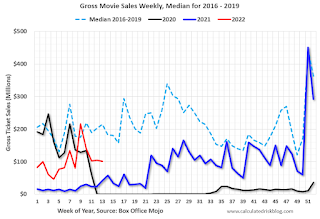

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $101 million last week, down about 52% from the median for the week.

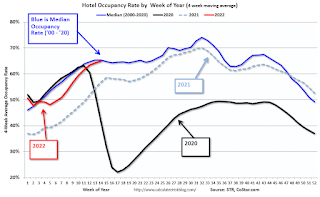

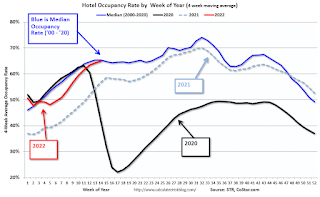

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through April 2nd. The occupancy rate was down 6.4% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

NOTE: This is the last Apple update. Apple will stop providing this data on April 14th.

This data is through April 9th

This data is through April 9th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 125% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, April 8th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, April 10, 2022

Sunday Night Futures

by Calculated Risk on 4/10/2022 08:12:00 PM

Weekend:

• Schedule for Week of April 10, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 7 and DOW futures are down 55 (fair value).

Oil prices were down over the last week with WTI futures at $96.82 per barrel and Brent at $101.30 per barrel. A year ago, WTI was at $60 and Brent was at $62 - so WTI oil prices are up 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.10 per gallon. A year ago prices were at $2.86 per gallon, so gasoline prices are up $1.24 per gallon year-over-year.

Second Home Markets and FHFA Changes as of April 1st

by Calculated Risk on 4/10/2022 12:03:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Second Home Markets and FHFA Changes as of April 1st

A brief excerpt:

Earlier this year the FHFA announced “Targeted Increases to Enterprise Pricing Framework”. Effective April 1st (just over a week ago), these higher fees applied to certain high balance loans, and to second home loans (for Fannie and Freddie). Excerpt:There is more in the article. You can subscribe at https://calculatedrisk.substack.com/... In April, upfront fees for high balance loans will increase between 0.25 percent and 0.75 percent, tiered by loan-to-value ratio. Fannie Mae and Freddie Mac refer to these mortgages as high balance loans and super conforming loans, respectively. For second home loans, upfront fees will increase between 1.125 percent and 3.875 percent, tiered by loan-to-value ratio.South Lake Tahoe: Second Home Market

emphasis added

...

Click on graph for larger image.

With the pandemic, there was a surge in second home buying. One of the second home markets I’ve been tracking is South Lake Tahoe.The following graph is for single family homes in South Lake Tahoe since 2004 through March 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).Note: The median price is distorted by the mix, but this is the available data.

...

This will be interesting to watch over the next several months, but so far there isn't any evidence of a second home slowdown in these numbers.

Saturday, April 09, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 4/09/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• "Unpacking builders’ market sentiment with Rick Palacios"

• 1st Look at Local Housing Markets in March

• Rents Still Increasing Sharply Year-over-year

• Denver Real Estate: Active Inventory up Sharply in March

• Black Knight Mortgage Monitor for February; "Tightest affordability in 15 years"

This is usually published several times a week and provides more in-depth analysis of the housing market.

The blog will continue as always!

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of April 10, 2022

by Calculated Risk on 4/09/2022 08:11:00 AM

The key reports this week are March CPI and retail sales.

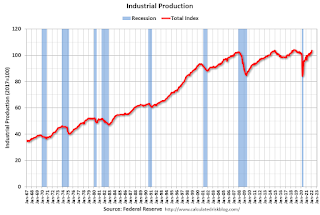

For manufacturing, the March Industrial Production report and the April NY Fed manufacturing survey will be released this week.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for March.

8:30 AM: The Consumer Price Index for March from the BLS. The consensus is for 1.2% increase in CPI (up 8.5% YoY) and a 0.5% increase in core CPI (up 6.6% YoY).

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for March from the BLS. The consensus is for a 1.1% increase in PPI, and a 0.5% increase in core PPI.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a increase to 175 thousand from 166 thousand last week.

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 0.6% increase in retail sales.

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 0.6% increase in retail sales. This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 16.1% on a YoY basis in February.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for April).

8:30 AM: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 2.0, up from -11.8.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 77.8%.

10:00 AM: State Employment and Unemployment (Monthly) for March 2022

Friday, April 08, 2022

COVID Update: Deaths Under 500 per day, Lowest since August 2021

by Calculated Risk on 4/08/2022 10:02:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 218.1 | --- | ≥2321 | |

| New Cases per Day3🚩 | 26,595 | 25,362 | ≤5,0002 | |

| Hospitalized3 | 10,164 | 11,990 | ≤3,0002 | |

| Deaths per Day3 | 496 | 637 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths are the lowest since August 1st, 2021. The pandemic low (after initial surge) was just over 200 in July 2021.

Reis: Regional Mall Vacancy Rate Decreased in Q1

by Calculated Risk on 4/08/2022 03:08:00 PM

Reis reported that the vacancy rate for regional malls was 11.0% in Q1 2022, down from 11.2% in Q4 2021, and down from 11.4% in Q1 2021. The regional mall vacancy rate peaked at 11.5% in Q2 2021.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.3% in Q1, unchanged from 10.3% in Q4, and down from 10.6% in Q1 2021. For strip malls, the vacancy rate peaked during the pandemic at 10.6% in both Q1 and Q2 2021.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

In the last several years, even prior to the pandemic, the regional mall vacancy rates increased significantly from an already elevated level.

Mall vacancy data courtesy of Reis

Reis: Office Vacancy Rates Unchanged in Q1

by Calculated Risk on 4/08/2022 01:40:00 PM

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis also reported that office effective rents were essentially unchanged in Q1; rents are about at the same rate as early 2019.

Q1 GDP Forecasts: Around 1%

by Calculated Risk on 4/08/2022 12:39:00 PM

From BofA:

Our 1Q GDP tracking estimate remains unchanged at 0.4% qoq SAAR. [April 8 estimate]From Goldman:

emphasis added

[W]e left our Q1 GDP tracking estimate unchanged at +1.0% (qoq ar). [April 6 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 1.1 percent on April 8, up from 0.9 percent on April 5. After this morning's wholesale trade release from the US Census Bureau, the nowcast of first-quarter real gross private domestic investment growth increased from -1.0 percent to -0.1 percent. [April 8 estimate]

"Unpacking builders’ market sentiment with Rick Palacios"

by Calculated Risk on 4/08/2022 10:46:00 AM

This is a very informative podcast on the impact of higher mortgage rates on new home builders: Unpacking builders’ market sentiment with Rick Palacios. In the podcast, Housing Wire CEO Clayton Collins interviews Rick Palacios Jr., the director of research, at John Burns Real Estate Consulting about the findings in their March new home builder survey. Here is a tweet from Rick about the survey results:

"Pretty clear shift in builder tone this month across our survey"Here are a couple of quotes from Rick in the podcast:

"On the entry level side, that is the part of the market that always feels it first when rates start to climb, and we definitely saw that [in the March survey]”And on an early indicator:

emphasis added

"There are always early indicators of price declines on the new home side, and one of the earliest indicators is lot premiums going way. ... When the market starts to pull back, those lot premiums start to shrink pretty quickly. And those are some of the comments we've been picking up [in the March survey]. Which again, big picture, now versus a year ago, that is a total shift."Note: This is also in the Real Estate Newsletter; You can subscribe at https://calculatedrisk.substack.com/

AAR: March Rail Carloads Up Year-over-year, Intermodal Down

by Calculated Risk on 4/08/2022 08:11:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

March 2022 was another mixed month for U.S. rail volumes. Total carloads were up 1.2% over March 2021. That’s their 12th gain in the past 13 months, but also their smallest percentage gain during that period. Total carloads averaged 233,909 per week, the second most in the past nine months. Intermodal originations, by contrast, were down 6.4% in March 2022 from March 2021. Intermodal has been down on a year-over-year basis for seven of the past eight months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

n March 2022, total originated U.S. rail carloads were up 1.2% (13,456 carloads) over March 2021. That’s the 12th gain for total carloads in the past 13 months, but it’s also the smallest percentage increase for the 12 months with gains. Total carloads averaged 233,909 per week in March 2022, the second most in the past nine months (October 2021 was higher).

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):For intermodal, originations in March 2022 totaled 1.34 million containers and trailers, down 6.4% (92,170 units) from March 2021. For the first three months of 2022, volume was 3.37 million units, down 6.9% (249,672) from last year. The first three months of 2021 were by far the highest-volume first three months of a year in history for intermodal. The comparable figure for this year is the fourth highest in history (behind 2021, 2018, and 2019).

Thursday, April 07, 2022

1st Look at Local Housing Markets in March: A Sea Change in Active Inventory

by Calculated Risk on 4/07/2022 02:20:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in March

A brief excerpt:

Here is a summary of active listings for these housing markets in March. Note: Inventory usually increases seasonally in March, so the month-over-month (MoM) increase is not surprising.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Inventory was up 31.5% in March MoM from February, and down 1.0% year-over-year (YoY). The YoY decline in inventory in these markets was due entirely to San Diego (a very tight market). The other markets were up YoY.

This is early, and just a few markets, but it appears inventory has bottomed. Last month, these markets were down 26.1% YoY, so this is a significant change from February. This is the first step towards a more balanced market, but inventory levels are still very low.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle)

Hotels: Occupancy Rate Down 6.4% Compared to Same Week in 2019

by Calculated Risk on 4/07/2022 01:01:00 PM

Reflecting continued seasonal slowing in spring break travel, U.S. hotel performance fell slightly from the previous week, according to STR‘s latest data through April 2.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

March 27 through April 2, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 64.1% (-6.4%)

• Average daily rate (ADR): $145.74 (+11.7%)

• Revenue per available room (RevPAR): $93.48 (+4.5%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

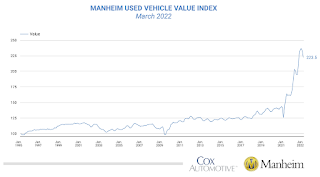

Used Vehicle Wholesale Prices Decline Seasonally Adjusted in March

by Calculated Risk on 4/07/2022 09:14:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decline in March from Seasonal Adjustment

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 3.3% in March from February. The Manheim Used Vehicle Value Index declined to 223.5, which was up 24.8% from a year ago. The non-adjusted price change in March was an increase of 0.6% compared to February, leaving the unadjusted average price up 23.2% year over year.

Manheim Market Report (MMR) values saw weekly price increases that accelerated in each full week of March after the first week saw the smallest decline of the year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Weekly Initial Unemployment Claims Decrease to 166,000

by Calculated Risk on 4/07/2022 08:38:00 AM

The DOL reported:

In the week ending April 2, the advance figure for seasonally adjusted initial claims was 166,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised down by 31,000 from 202,000 to 171,000. The 4-week moving average was 170,000, a decrease of 8,000 from the previous week's revised average. The previous week's average was revised down by 30,500 from 208,500 to 178,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 170,000.

The previous week was revised down (there was a significant change to seasonal adjustment factors).

Weekly claims were well below the consensus forecast.

Wednesday, April 06, 2022

Thursday: Unemployment Claims

by Calculated Risk on 4/06/2022 09:08:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 200 thousand from 202 thousand last week.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 218.0 | --- | ≥2321 | |

| New Cases per Day3🚩 | 26,845 | 24,809 | ≤5,0002 | |

| Hospitalized3 | 10,505 | 12,729 | ≤3,0002 | |

| Deaths per Day3 | 533 | 642 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths are the lowest since early August 2021.