by Calculated Risk on 4/26/2022 10:35:00 AM

Tuesday, April 26, 2022

Comments on February Case-Shiller and FHFA House Price Increases; New Record Monthly Increase

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller National Index up 19.8% Year-over-year in February; New Record Monthly Increase

Excerpt:

This graph below shows existing home months-of-supply (inverted, from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through February 2022).

Note that the months-of-supply is not seasonally adjusted.

There is a clear relationship, and this is no surprise (but interesting to graph). If months-of-supply is high, prices decline. If months-of-supply is very low (like now), prices rise quickly.

In February, the months-of-supply was at 1.7 months, and the Case-Shiller National Index (SA) increased 1.90% month-over-month. The black arrow points to the February 2022 dot. In the March existing home sales report, the NAR reported months-of-supply increased to 2.0 months.

My sense is the Case-Shiller National annual growth rate of 19.99% in August 2021 was probably the peak YoY growth rate, although this was close! Since the normal level of inventory is probably in the 4 to 6 months range - we’d have to see a significant increase in inventory to sharply slow price increases, and that is why I’m focused on inventory!

Since Case-Shiller is a 3-month average, and this report was for February (includes December and January), this included price increases when mortgage rates were significantly lower than today. In December, the Freddie Mac PMMS averaged 3.1% for a 30-year mortgage, and 3.4% in January. Currently mortgage rates are around 5.32%.

Note: I’ll have more on real prices, price-to-rent and affordability tomorrow. emphasis added

New Home Sales decrease to 763,000 Annual Rate in March

by Calculated Risk on 4/26/2022 10:09:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 763 thousand.

The previous three months were revised up sharply.

Sales of new single‐family houses in March 2022 were at a seasonally adjusted annual rate of 763,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.6 percent below the revised February rate of 835,000 and is 12.6 percent below the March 2021 estimate of 873,000.

emphasis added

Click on graph for larger image.

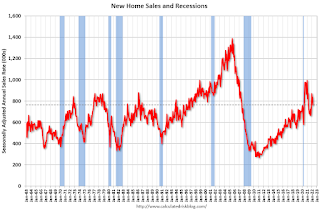

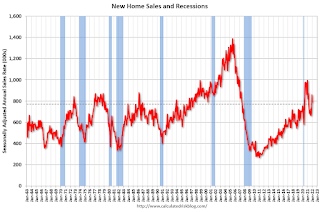

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are now declining year-over-year since sales soared following the first few months of the pandemic.

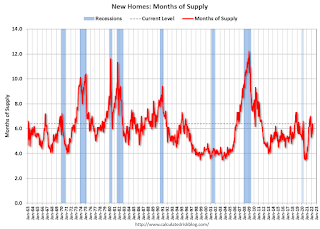

The second graph shows New Home Months of Supply.

The months of supply increased in March to 6.4 months from 5.6 months in February.

The months of supply increased in March to 6.4 months from 5.6 months in February. The all-time record high was 12.1 months of supply in January 2009. The all-time record low was 3.5 months, most recently in October 2020.

This is above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of March was 407,000. This represents a supply of 6.4 months at the current sales rate"

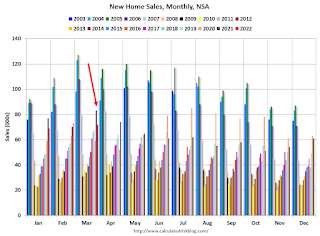

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In March 2022 (red column), 72 thousand new homes were sold (NSA). Last year, 83 thousand homes were sold in March.

The all-time high for March was 127 thousand in 2005, and the all-time low for March was 28 thousand in 2011.

This was below expectations, however sales in the three previous months were revised up sharply. I'll have more later today.

Case-Shiller: National House Price Index increased 19.8% year-over-year in February

by Calculated Risk on 4/26/2022 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3-month average of December, January and February prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Shows Annual Home Price Gains Increased To 19.8% In February

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 19.8% annual gain in February, up from 19.1% in the previous month. The 10-City Composite annual increase came in at 18.6%, up from 17.3% in the previous month. The 20-City Composite posted a 20.2% year-over-year gain, up from 18.9% in the previous month.

Phoenix, Tampa, and Miami reported the highest year-over-year gains among the 20 cities in February. Phoenix led the way with a 32.9% year-over-year price increase, followed by Tampa with a 32.6% increase and Miami with a 29.7% increase. All 20 cities reported higher price increases in the year ending February 2022 versus the year ending January 2022.

...

Before seasonal adjustment, the U.S. National Index posted a 1.7% month-over-month increase in February, while the 10-City and 20-City Composites both posted increases of 2.4%.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.9%, and the 10-City and 20-City Composites both posted increases of 2.3% and 2.4%, respectively.

In February, all 20 cities reported increases before and after seasonal adjustments.

“U.S. home prices continued to advance at a very rapid pace in February,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite Index recorded a gain of 19.8% for the 12 months ended February 2022; the 10- and 20-City Composites rose 18.6% and 20.2%, respectively.All three composites reflect an acceleration of price growth relative to January’s level.

...

“The macroeconomic environment is evolving rapidly and may not support extraordinary home price growth for much longer. The post-COVID resumption of general economic activity has stoked inflation, and the Federal Reserve has begun to increase interest rates in response. We may soon begin to see the impact of increasing mortgage rates on home prices.”

emphasis added

Click on graph for larger image.

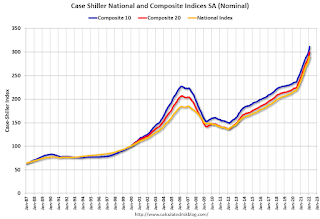

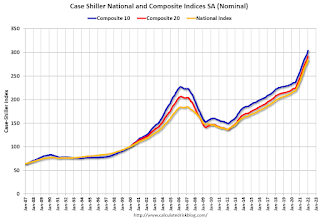

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 2.3% in February (SA).

The Composite 20 index is up 2.4% (SA) in February.

The National index is 57% above the bubble peak (SA), and up 1.9% (SA) in February. The National index is up 112% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 18.6% year-over-year. The Composite 20 SA is up 20.2% year-over-year.

The National index SA is up 19.8% year-over-year.

Price increases were above expectations. I'll have more later.

Monday, April 25, 2022

Tuesday: New Home Sales, Case-Shiller House Prices, Durable Goods, Richmond Fed Mfg

by Calculated Risk on 4/25/2022 09:15:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Regain Most of What They Lost Late Last Week

Thursday and Friday weren't great days for the mortgage market last week. ... One business day later, and lenders are closer to territory from the first 3 days of last week. This is roughly an eighth of a percentage point lower than Friday's rates fore most lenders (i.e. 5.375% instead of 5.5%). As always, these rates may not apply to every scenario and the best way to use this data is for the purpose of tracking day-over-day changes. [30 year fixed 5.32%]Tuesday:

emphasis added

• At 8:30 AM ET, Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for February. The consensus is for a 18.4% year-over-year increase in the Comp 20 index for February.

• Also at 9:00 AM, FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for March from the Census Bureau. The consensus is for 762 thousand SAAR, down from 772 thousand in February.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for April.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.4 | --- | ≥2321 | |

| New Cases per Day3🚩 | 44,416 | 36,209 | ≤5,0002 | |

| Hospitalized3 | 9,518 | 9,754 | ≤3,0002 | |

| Deaths per Day3 | 314 | 362 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

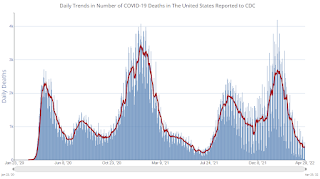

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

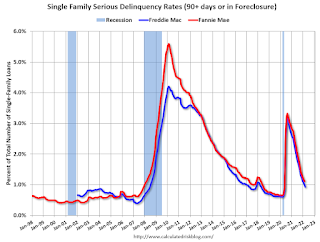

Freddie Mac: Mortgage Serious Delinquency Rate decreased in March

by Calculated Risk on 4/25/2022 04:35:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in March was 0.92%, down from 0.99% February. Freddie's rate is down year-over-year from 2.34% in March 2021.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Housing and Demographics

by Calculated Risk on 4/25/2022 11:07:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing and Demographics

A brief excerpt:

The current demographics are now very favorable for home buying - and will remain somewhat positive for most of the decade, although most of the increase is now behind us.There is much more in the article.

Here is an even longer-term graph from 1960 through 2060. The surge in baby boomers reaching their 20s (red), led to a huge increase in apartment construction in the early 1970s.

Then home-buying became favorable in the late ‘70s, but housing still slumped in the ‘79 to ‘82 period as the Volcker Fed raised interest rates to fight inflation. This is one reason I’ve been arguing Don't Compare the Current Housing Boom to the Bubble and Bust, look instead to the 1978 to 1982 period for lessons.

...

Population data is very useful in predicting long term trends, however, other factors (like in the 1980 period) can overwhelm demographics in the short term.

Housing Inventory April 25th Update: Inventory up 1.7% Week-over-week; Up 14.2% from Seasonal Bottom

by Calculated Risk on 4/25/2022 09:02:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 14.2% since then.

This inventory graph is courtesy of Altos Research.

Last year inventory bottomed seasonally in April 2021 - very late in the year. This year, by this measure, inventory bottomed seasonally at the beginning of March.

Inventory is still very low. Compared to the same week in 2021, inventory is down 11.2% from 310 thousand, and compared to the same week in 2020, and inventory is down 63.1% from 746 thousand.

One of the keys will be to watch the year-over-year change each week to see if the declines are decreasing. Here is a table of the year-over-year change by week since the beginning of the year.

| Week Ending | YoY Change |

|---|---|

| 12/31/2021 | -30.0% |

| 1/7/2022 | -26.0% |

| 1/14/2022 | -28.6% |

| 1/21/2022 | -27.1% |

| 1/28/2022 | -25.9% |

| 2/4/2022 | -27.9% |

| 2/11/2022 | -27.5% |

| 2/18/2022 | -25.8% |

| 2/25/2022 | -24.9% |

| 3/4/2022 | -24.2% |

| 3/11/2022 | -21.7% |

| 3/18/2022 | -21.7% |

| 3/25/2022 | -19.0% |

| 4/1/2022 | -17.6% |

| 4/8/2022 | -14.8% |

| 4/15/2022 | -13.1% |

| 4/22/2022 | -11.2% |

Four High Frequency Indicators for the Economy

by Calculated Risk on 4/25/2022 08:31:00 AM

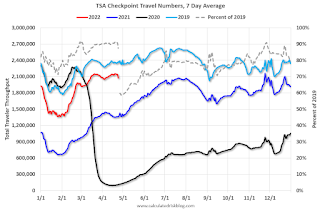

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Note: Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of April 24th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.6% from the same day in 2019 (87.4% of 2019). (Dashed line)

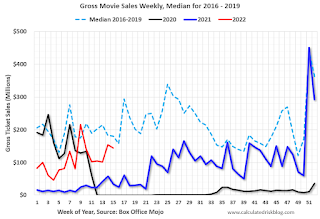

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $145 million last week, down about 20% from the median for the week.

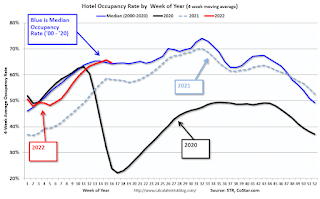

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through April 16th. The occupancy rate was down 5.6% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

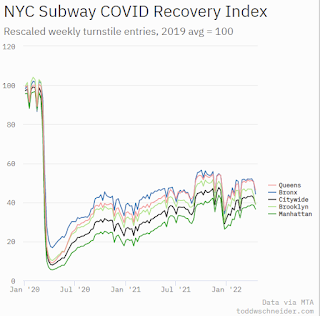

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, April 22nd.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Black Knight: "Mortgage Delinquencies Hit Record Low in March"

by Calculated Risk on 4/25/2022 08:05:00 AM

Note: At the beginning of the pandemic, the delinquency rate increased sharply. Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus. Foreclosures are starting to increase following the end of the moratorium, but are at very low levels (see: Delinquencies, Foreclosures and REO) for a discussion of rising foreclosures, and why this isn't a concern)

From Black Knight: Black Knight: Mortgage Delinquencies Hit Record Low in March, Driven by Both Seasonal and Broader Economic Improvements; Prepays Up Despite Rate Increases

• The national delinquency rate dropped by more than half a percentage point in March, falling to 2.84% and shattering the previous record low of 3.22% in January 2020According to Black Knight's First Look report, the percent of loans delinquent decreased 15.5% in March compared to February and decreased 43% year-over-year.

• While March typically sees the strongest mortgage performance of any month – with delinquencies falling more than 10% on average over the past 20 years – this year’s 15.5% reduction was exceptionally strong

• Robust employment, continued student loan deferrals, strong post-forbearance performance and millions of refinances into record-low interest rates have all helped put downward pressure on delinquency rates

• The strongest improvement was seen among borrowers who are a single payment past due, with 30-day delinquencies recording a 20% month-over-month decline

• Though serious delinquencies – those 90 or more days past due but not in foreclosure – fell 12% for the strongest single-month improvement in 20 years, they remain 70% above pre-pandemic levels

• Despite elevated serious delinquencies, foreclosure starts fell by 3% from the month prior and are holding well below pre-pandemic levels

• The number of active foreclosures edged slightly higher in March, marking the first year-over-year increase in almost 10 years, though inventories also remain well below pre-pandemic levels

• Prepayment activity bucked the recent trend of sharply rising interest rates driving falling prepay speeds, rising by 9% in March, likely driven at least in part by seasonal increases in home sales-related prepays

emphasis added

The percent of loans in the foreclosure process increased 3.7% in March and were up 3.9% over the last year. (First year-over-year increase in almost 10 years - but from very low levels)

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.84% in March, down from 3.36% in February.

The percent of loans in the foreclosure process increased in March to 0.32%, from 0.31% in February.

The number of delinquent properties, but not in foreclosure, is down 1,159,000 properties year-over-year, and the number of properties in the foreclosure process is up 7,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2022 | Feb 2022 | Mar 2021 | Mar 2020 | |

| Delinquent | 2.84% | 3.36% | 5.02% | 3.39% |

| In Foreclosure | 0.32% | 0.31% | 0.30% | 0.42% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,513,000 | 1,783,000 | 2,672,000 | 1,792,000 |

| Number of properties in foreclosure pre-sale inventory: | 169,000 | 162,000 | 162,000 | 220,000 |

| Total Properties | 1682,000 | 1,946,000 | 2,834,000 | 2,013,000 |

Sunday, April 24, 2022

Sunday Night Futures

by Calculated Risk on 4/24/2022 07:47:00 PM

Weekend:

• Schedule for Week of April 24, 2022

• U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2021

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for April.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $100.58 per barrel and Brent at $105.03 per barrel. A year ago, WTI was at $62 and Brent was at $66 - so WTI oil prices are up 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.10 per gallon. A year ago prices were at $2.87 per gallon, so gasoline prices are up $1.23 per gallon year-over-year.

U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2021

by Calculated Risk on 4/24/2022 08:11:00 AM

Eight years ago, I wrote: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group.

This month the Census Bureau released the population estimates for July 2021 by age, and I've updated the table from the previous post.

The table below shows the top 10 cohorts by size for 2010, 2021 (released this month), and the most recent Census Bureau projections for 2030.

In 2021, 6 of the top 7 cohorts were under 40 (the Boomers are fading away), and by 2030 the top 10 cohorts will be the youngest 10 cohorts.

There will be plenty of "gray hairs" walking around in 2030, but the key for the economy is the population in the prime working age group is now increasing.

As I noted in 2014, this was positive for apartments, and more recently positive for housing.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2021 | 2030 | |

| 1 | 45 to 49 years | 30 to 34 years | 35 to 39 years | |

| 2 | 50 to 54 years | 25 to 29 years | 40 to 44 years | |

| 3 | 15 to 19 years | 35 to 39 years | 30 to 34 years | |

| 4 | 20 to 24 years | 55 to 59 years | 25 to 29 years | |

| 5 | 25 to 29 years | 15 to 19 years | 20 to 24 years | |

| 6 | 40 to 44 years | 20 to 24 years | 45 to 49 years | |

| 7 | 10 to 14 years | 10 to 14 years | 5 to 9 years | |

| 8 | 5 to 9 years | 60 to 64 years | 10 to 14 years | |

| 9 | Under 5 years | 40 to 44 years | Under 5 years | |

| 10 | 35 to 39 years | 50 to 54 years | 15 to 19 years | |

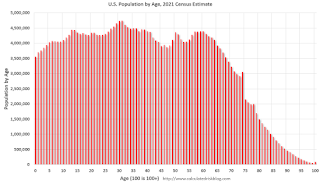

Click on graph for larger image.

This graph, based on the 2021 population estimate, shows the U.S. population by age in July 2021 according to the Census Bureau.

Note that the largest age groups are all in their late-20s or 30s. There is also a large cohort in their mid-teens.

And below is a table showing the ten most common ages in 2010, 2021, and 2030 (projections are from the Census Bureau, 2017).

Note the younger baby boom generation dominated in 2010. In 2021 the millennials have taken over and the boomers are off the list.

This is why - a number of years ago - I was so positive on housing. And this is still positive for the economy.

| Population: Most Common Ages by Year | ||||

|---|---|---|---|---|

| 2010 | 2021 | 2030 | ||

| 1 | 50 | 31 | 39 | |

| 2 | 49 | 30 | 40 | |

| 3 | 19 | 29 | 38 | |

| 4 | 48 | 32 | 37 | |

| 5 | 47 | 28 | 36 | |

| 6 | 46 | 33 | 41 | |

| 7 | 20 | 35 | 35 | |

| 8 | 45 | 36 | 30 | |

| 9 | 18 | 34 | 34 | |

| 10 | 52 | 27 | 33 | |

Saturday, April 23, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 4/23/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Goldman Sachs "Will Higher Rates Put Out the Housing Fire?"

• March Housing Starts: Most Housing Units Under Construction Since 1973

• NAR: Existing-Home Sales Decreased to 5.77 million SAAR in February

• Final Look at Local Housing Markets in March and Housing Inventory Milestones to Watch

• March Existing Home Sales Forecast and 4th Look at Local Housing Markets

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

The blog will continue as always!

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of April 24, 2022

by Calculated Risk on 4/23/2022 08:11:00 AM

The key reports scheduled for this week are the advance estimate of Q1 GDP and March New Home sales.

Other key reports include February Case-Shiller house prices and Personal Income and Outlays for March.

For manufacturing, the April Dallas, Richmond and Kansas City manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for April.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for February.

9:00 AM: S&P/Case-Shiller House Price Index for February.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 18.4% year-over-year increase in the Comp 20 index for February.

9:00 AM: FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 762 thousand SAAR, down from 772 thousand in February.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 1.8% decrease in the index.

10:00 AM: the Q1 2022 Housing Vacancies and Homeownership from the Census Bureau.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 180 thousand down from 184 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2021 (Advance estimate). The consensus is that real GDP increased 1.0% annualized in Q1, down from 6.9% in Q4.

11:00 AM: the Kansas City Fed manufacturing survey for April. This is the last of regional manufacturing surveys for April.

8:30 AM ET: Personal Income and Outlays, March 2021. The consensus is for a 0.4% increase in personal income, and for a 0.6% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 6.4% YoY, and core PCE prices up 5.3% YoY.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for a reading of 62.0, down from 62.9 in March.

10:00 AM: University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 65.7.

Friday, April 22, 2022

COVID Update: Hospitalizations Starting to Increase

by Calculated Risk on 4/22/2022 09:21:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.2 | --- | ≥2321 | |

| New Cases per Day3🚩 | 42,604 | 31,495 | ≤5,0002 | |

| Hospitalized3🚩 | 9,794 | 9,760 | ≤3,0002 | |

| Deaths per Day3 | 375 | 414 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

April Vehicle Sales Forecast: Increase to 14.5 million SAAR

by Calculated Risk on 4/22/2022 07:46:00 PM

From WardsAuto: April, Second-Quarter U.S. Light-Vehicle Sales to Continue Sequential Growth (pay content). Brief excerpt:

"Bottom line is U.S. sales remain weak, and below potential, but are trending up from the depths they fell to in the second half of last year due to a dearth in supply. Although geopolitics, economic headwinds and ongoing supply-chain issues undeniably are creating huge risks to the outlook, sales still are expected to gradually rise through the end of the year."

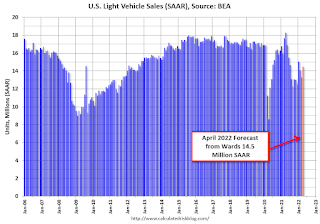

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for April (Red).

The Wards forecast of 14.5 million SAAR, would be up about 9% from last month, and down 21% from a year ago (sales were solid in April 2021, as sales recovered from the depths of the pandemic, and weren't yet impacted by supply chain issues).

Yellen: Inflation May have Peaked

by Calculated Risk on 4/22/2022 01:54:00 PM

According to Reuters, quoting Treasury Secretary Janet Yellen:

She said inflation may have peaked in the United States, but cautioned that prices may remain elevated "for a while longer."There are many drivers of inflation right now - supply chain issues, high energy and food prices, housing (Owners' Equivalent Rent will keep inflation high for some time) - to name a few. But it is possible, due to base effects, that inflation "may have peaked".

Click on graph for larger image.

Click on graph for larger image.This graph shows the month-to-month increase in PCE and core PCE prices since January 2020.

"Examining Resolution of Mortgage Forbearances and Delinquencies"

by Calculated Risk on 4/22/2022 10:45:00 AM

Here is a new report from the Philly Fed: Examining Resolution of Mortgage Forbearances and Delinquencies – April 2022

By our projections, 2.15 million mortgages are either in forbearance or past due; around 630,000 of those were still in forbearance as of April 7.And an excerpt from the report:

Forbearances and seriously delinquent loans continue to decline to prepandemic levels, attributable to the strong housing market and loss mitigation activities implemented by policymakers, investors, and mortgage servicers. Nonetheless, there are still pockets of borrowers who remain at high risk of losing their homes and require special attention. This report documents how these loss mitigation programs have performed to date and the remaining pockets of risk.

As shown in Table 1, as of April 7, we estimate that 629,714 mortgage loans remain in forbearance.In general, borrowers exiting forbearance have performed very well. The report shows that of 8.65 million forbearances, only 8% remain in active forbearance, and only 3% are delinquent, in-loss mitigation and not paying. Since the foreclosure moratoriums have ended, we've seen a pickup in foreclosures, but there will not be a huge wave of foreclosures.

These include mortgages from the Federal Housing Administration (FHA), Veterans Affairs (VA), and the two government-sponsored enterprises (GSEs) — Fannie Mae and Freddie Mac — comprising almost all of the federally insured mortgages, along with the major private-sector mortgages from private-label mortgage-backed securities (PLMBS) and portfolio loans.

Click on graph for larger image.

Figure 1 presents the projected forbearance expirations, assuming borrowers take the maximum forbearance allowed by various programs. Note that 39 percent of forbearances are FHA/VA mortgages. Unless mortgage servicers can successfully execute home-retention options in the coming months, many borrowers face the prospect of selling their homes or losing them to foreclosure.

Q1 GDP Forecasts: Around 1%

by Calculated Risk on 4/22/2022 08:15:00 AM

The BEA is scheduled to release the advance estimate of Q1 GDP this coming Thursday, April 28th. The consensus estimate is for a 1.0% increase in real GDP QoQ.

From BofA:

In the advance release of 1Q GDP, we expect growth slowed to a tepid 0.5% qoq saar clip from 6.9% qoq saar in 4Q 2021. Don’t be head-faked by the headline, however, as underlying demand remained robust. Indeed, we expect a slowing in inventory growth and a widening in the trade deficit to slice 3.5-4pp off real GDP growth this quarter, which means domestic final sales of 4-4.5%. [April 22 estimate]From Goldman:

emphasis added

We left our Q1 GDP tracking estimate unchanged at +1.5% (qoq ar). [April 20 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 1.3 percent on April 19, up from 1.1 percent on April 14. After recent releases from the Federal Reserve Board of Governors and the US Census Bureau, the nowcast of first-quarter real gross private domestic investment growth increased from -0.8 percent to 0.1 percent. [April 19 estimate]

Thursday, April 21, 2022

Fed's Powell: "50 basis points will be on the table for the May meeting"

by Calculated Risk on 4/21/2022 04:04:00 PM

Fed Chair Powell delivered prepared remarks on The Global Economy At the International Monetary Fund Debate on the Global Economy today.

Nick Timarios at the WSJ as some details: Fed’s Jerome Powell Seals Expectations of Half-Point Rate Rise in May

“It is appropriate in my view to be moving a little more quickly” to raise interest rates than the Fed has in the recent past, Mr. Powell said Thursday. “I also think there’s something in the idea of front-end-loading” the removal of stimulus, he said.And from Jeff Cox at CNBC: Powell says taming inflation ‘absolutely essential,’ and a 50 basis point hike possible for May

...

"It's too hot. It's unsustainably hot. It's our job to get it to a better place where supply and demand are closer together."

"I would say 50 basis points will be on the table for the May meeting.”

...

“Our goal is to use our tools to get demand and supply back in synch, so that inflation moves down and does so without a slowdown that amounts to a recession,” Powell said. “I don’t think you’ll hear anyone at the Fed say that that’s going to be straightforward or easy. It’s going to be very challenging. We’re going to do our best to accomplish that.”

“It’s absolutely essential to restore price stability,” he added. “Economies don’t work without price stability.”

Final Look at Local Housing Markets in March and Housing Inventory Milestones to Watch

by Calculated Risk on 4/21/2022 12:04:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in March

A brief excerpt:

This final update for March adds Alabama, Columbus, Des Moines, Illinois, Indiana, Miami and New York.There is much more in the article.

...

Housing Inventory Milestones to Watch

1. The seasonal bottom.

2. Inventory up year-over-year (currently down 9.5% according to NAR)

3. Inventory up compared to two years ago (currently down 36%)

4. Inventory back to median for last decade (currently down 43%)

So far #1 has happened, and #2 will probably happen mid-year 2022. The following graph (using NAR inventory data) shows the above changes since January 2020. Even when inventory is up YoY (that will happen soon), we will still be a long way from normal levels of inventory.

I will discuss house prices vs. inventory next week after the Case-Shiller house price index is released.

...

Closed Sales in March

And a table of March sales. Sales in these areas were down 5.4% YoY, Not Seasonally Adjusted (NSA). Sales were up YoY in about 30% of these markets. The NAR reported sales NSA in March (456,000) were 5.8% below sales in March 2021 (484,000). So, this sample of local markets is similar to the NAR report.

The table doesn’t include California where sales were down 4.4% year-over-year.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle), North Texas (Dallas) and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) Totals do not include Atlanta or Denver (included in state totals).