by Calculated Risk on 6/17/2022 10:43:00 AM

Friday, June 17, 2022

Slowdown in Showings, Sharp Decline in California Pending Sales, Inventory Surges

Today, in the Calculated Risk Real Estate Newsletter: Slowdown in Showings, Sharp Decline in California Pending Sales, Inventory Surges

A brief excerpt:

The following data is courtesy of David Arbit, Director of Research at the Minneapolis Area REALTORS® and NorthstarMLS (posted with permission). Here is a link to their data.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows the 7-day average showings for the Twin Cities area for 2019, 2020, 2021, and 2022. The 7-day average showings (red) is currently off 22% from 2019.

There was a huge dip in showings in 2020 (black) at the start of the pandemic, and then showing were well above 2019 (blue) levels for the rest of the year. And showings in 2021 (gold) were very strong in the first half of the year, and then were closer to 2019 in the 2nd half.

Click on graph for larger image.

Note that there were dips in showings during holidays (July 4th, Memorial Day, Thanksgiving and Christmas), and also dips related to protests and curfews related to the deaths of George Floyd and Daunte Wright.

2022 (red) started off solid but is now below the previous three years.

Industrial Production Increased 0.2 Percent in May

by Calculated Risk on 6/17/2022 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

Total industrial production moved up 0.2 percent in May. Output has increased in every month of the year so far, with an average monthly gain of nearly 0.8 percent. In May, manufacturing output declined 0.1 percent after three months when growth averaged nearly 1 percent; the indexes for utilities and mining rose 1.0 percent and 1.3 percent, respectively, in May. At 105.7 percent of its 2017 average, total industrial production in May was 5.8 percent above its year-earlier level. Capacity utilization edged up to 79.0 percent, 0.5 percentage point below its long-run (1972–2021) average.

emphasis added

Click on graph for larger image.

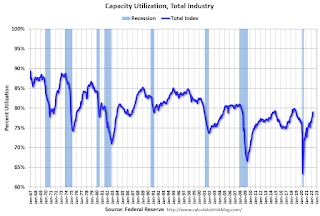

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 79.0% is 0.5% below the average from 1972 to 2020. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

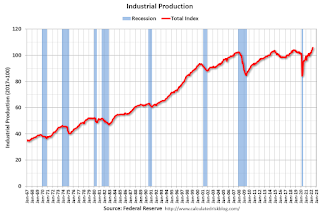

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in May to 105.7. This is above the pre-pandemic level.

The change in industrial production was below consensus expectations.

Thursday, June 16, 2022

Friday: Industrial Production

by Calculated Risk on 6/16/2022 09:02:00 PM

Friday:

• At 9:15 AM ET, The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

• At 10:00 AM, State Employment and Unemployment (Monthly) for May 2022

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.9 | --- | ≥2321 | |

| New Cases per Day3 | 102,750 | 109,841 | ≤5,0002 | |

| Hospitalized3🚩 | 24,160 | 23,598 | ≤3,0002 | |

| Deaths per Day3 | 265 | 326 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

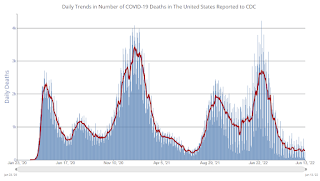

Click on graph for larger image.

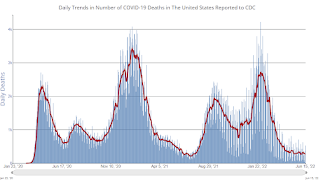

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/16/2022 03:33:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.35 million in May, down 4.6% from April’s preliminary pace and down 9.6% from last May’s seasonally adjusted pace. Unadjusted sales should show a smaller YOY % decline, reflecting this May’s higher business-day count compared to last May’s.

Local realtor reports, as well as reports from national inventory trackers, suggest that the inventory of existing homes for sale last month was up slightly from a year earlier. However, the NAR’s estimate may not show the same increase as other reports, many of which exclude listings with pending contracts. E.g., the Realtor.com report for May showed that listings excluding those with pending contracts were up 8.0% from last May, while listings including pending contracts were down 3.9% YOY. (Pending listings in the Realtor.com report were down 12.2% from last May.). The NAR’s inventory estimate has tracked the Realtor.com total inventory measure more closely that the “ex-pendings” inventory measure. (Note also that the Realtor.com inventory number reflects average listings during the month, while the NAR inventory number is an end-of-month estimate.)

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 14.7% from last May.

CR Note: The National Association of Realtors (NAR) is scheduled to release May existing home sales on Tuesday, June 21, 2022, at 10:00 AM ET. The consensus is for 5.41 million SAAR.

Hotels: Occupancy Rate Down 4.1% Compared to Same Week in 2019

by Calculated Risk on 6/16/2022 01:42:00 PM

U.S. hotel performance jumped from the previous week, and revenue per available room (RevPAR) reached an all-time weekly high on a nominal basis, according to STR‘s latest data through June 11.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

June 5-11, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 70.6% (-4.1%)

• Average daily rate (ADR): $155.37 (+15.4%)

• Revenue per available room (RevPAR): $109.76 (+10.7%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

May Housing Starts: All-Time Record Housing Units Under Construction

by Calculated Risk on 6/16/2022 09:20:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: May Housing Starts: All-Time Record Housing Units Under Construction

Excerpt:

Yesterday, Fed Chair Powell started to mention the record number of housing units under construction, see: Fed Chair Powell: "Homebuyers need a bit of a reset"There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).“How much will it affect housing prices? Not really sure. Obviously, we are watching that quite carefully. You’d think over time … There is a tremendous amount of supply in the housing market of unfinished homes … and as those come online …”And then he quickly changed direction. Perhaps he was concerned about spooking homebuyers about the coming increase in new supply.

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).

Red is single family units. Currently there are 822 thousand single family units under construction (SA). This matches last month as the highest level since November 2006. The reason there are so many homes is probably due to construction delays.

Blue is for 2+ units. Currently there are 843 thousand multi-family units under construction. This is the highest level since April 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are a record 1.665 million units under construction. This above the previous record of 1.628 million units that were under construction in 1973 (mostly apartments in 1973 for the baby boom generation).

Housing Starts Decreased to 1.549 million Annual Rate in May

by Calculated Risk on 6/16/2022 08:42:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in May were at a seasonally adjusted annual rate of 1,549,000. This is 14.4 percent below the revised April estimate of 1,810,000 and is 3.5 percent below the May 2021 rate of 1,605,000. Single‐family housing starts in May were at a rate of 1,051,000; this is 9.2 percent below the revised April figure of 1,157,000. The May rate for units in buildings with five units or more was 469,000

Building Permits:

Privately‐owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,695,000. This is 7.0 percent below the revised April rate of 1,823,000, but is 0.2 percent above the May 2021 rate of 1,691,000. Single‐family authorizations in May were at a rate of 1,048,000; this is 5.5 percent below the revised April figure of 1,109,000. Authorizations of units in buildings with five units or more were at a rate of 592,000 in May.

emphasis added

Click on graph for larger image.

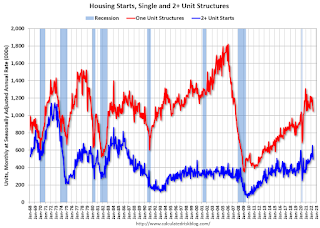

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) decreased in May compared to April. Multi-family starts were unchanged year-over-year in May.

Single-family starts (red) decreased in May and were down 5.3% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in May were well below expectations, however, starts in March and April, were revised up, combined.

I'll have more later …

Weekly Initial Unemployment Claims at 229,000

by Calculated Risk on 6/16/2022 08:33:00 AM

The DOL reported:

In the week ending June 11, the advance figure for seasonally adjusted initial claims was 229,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 229,000 to 232,000. The 4-week moving average was 218,500, an increase of 2,750 from the previous week's revised average. The previous week's average was revised up by 750 from 215,000 to 215,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 218,500.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, June 15, 2022

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 6/15/2022 09:03:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand down from 229 thousand last week.

• Also at 8:30 AM, Housing Starts for May. The consensus is for 1.700 million SAAR, down from 1.724 million SAAR in April.

• Also at 8:30 AM, the Philly Fed manufacturing survey for June. The consensus is for a reading of 5.3, up from 2.6.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.9 | --- | ≥2321 | |

| New Cases per Day3 | 103,935 | 108,458 | ≤5,0002 | |

| Hospitalized3🚩 | 23,898 | 23,477 | ≤3,0002 | |

| Deaths per Day3 | 276 | 314 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Fed Chair Powell: "Homebuyers need a bit of a reset"

by Calculated Risk on 6/15/2022 04:25:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fed Chair Powell: "Homebuyers need a bit of a reset"

A brief excerpt:

Here are some interesting comments on housing from Fed Chair Jerome Powell today. This is a quick transcript - sorry for any errors - the video is here and the discussion on housing starts around 1:51:00.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Powell: ..."I'd say if you are homebuyer, somebody or a young person looking to buy a home, you need a bit of a reset. We need to get to back to a place where supply and demand are back together and where inflation is down low again, and mortgage rates are low again.

This will be a process were by ideally, we do our work in a way were the housing market settles in a new place.

FOMC Projections and Press Conference

by Calculated Risk on 6/15/2022 02:12:00 PM

Statement here.

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

Here are the projections. In March, most participants expected seven rate hikes in 2022. Now, participants expect thirteen 25bp rate hikes in 2022.

Wall Street forecasts are being revised down for 2022 due to the ongoing negative impacts from the pandemic. the war in Ukraine and financial tightening. The FOMC lowered their 2022 forecast down to similar growth rates.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 1.5 to 1.9 | 1.3 to 2.0 | 1.5 to 2.0 | |

| Mar 2022 | 2.5 to 3.0 | 2.1 to 2.5 | 1.8 to 2.0 | |

The unemployment rate was at 3.6% in May. The FOMC increased their projections for the unemployment rate for Q4 2022.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 3.6 to 3.8 | 3.8 to 4.1 | 3.9 to 4.1 | |

| Mar 2022 | 3.4 to 3.6 | 3.3 to 3.6 | 3.2 to 3.7 | |

As of April 2022, PCE inflation was up 6.3% from April 2021. The FOMC revised up sharply their inflation projections for 2022.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 5.0 to 5.3 | 2.4 to 3.0 | 2.0 to 2.5 | |

| Mar 2022 | 4.1 to 4.7 | 2.3 to 3.0 | 2.1 to 2.4 | |

PCE core inflation was up 4.9% in April year-over-year. And the FOMC revised up their projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 4.2 to 4.5 | 2.5 to 3.2 | 2.1 to 2.5 | |

| Mar 2022 | 3.9 to 4.4 | 2.4 to 3.0 | 2.1 to 2.4 | |

FOMC Statement: Raise Rates 75 bp

by Calculated Risk on 6/15/2022 02:02:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Overall economic activity appears to have picked up after edging down in the first quarter. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The invasion and related events are creating additional upward pressure on inflation and are weighing on global economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1‑1/2 to 1-3/4 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Lisa D. Cook; Patrick Harker; Philip N. Jefferson; Loretta J. Mester; and Christopher J. Waller. Voting against this action was Esther L. George, who preferred at this meeting to raise the target range for the federal funds rate by 0.5 percentage point to 1-1/4 percent to 1-1/2 percent. Patrick Harker voted as an alternate member at this meeting.

emphasis added

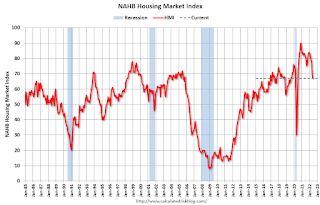

NAHB: Builder Confidence Decreased to 67 in June; "Traffic of prospective buyers" Falls below Breakeven

by Calculated Risk on 6/15/2022 10:07:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 67, down from 69 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Weakening Builder Confidence Points to Economic Troubles Ahead

Rising inflation and higher mortgage rates are slowing traffic of prospective home buyers and putting a damper on builder sentiment. In a troubling sign for the housing market, builder confidence in the market for newly built single-family homes posted its sixth straight monthly decline in June, falling two points to 67, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This marks the lowest HMI reading since June 2020.

“Six consecutive monthly declines for the HMI is a clear sign of a slowing housing market in a high inflation, slow growth economic environment,” said NAHB Chairman Jerry Konter, a builder and developer from Savannah, Ga. “The entry-level market has been particularly affected by declines for housing affordability and builders are adopting a more cautious stance as demand softens with higher mortgage rates. Government officials need to enact policies that will support the supply-side of the housing market as costs continue to climb.”

“The housing market faces both demand-side and supply-side challenges,” said NAHB Chief Economist Robert Dietz. “Residential construction material costs are up 19% year-over-year with cost increases for a variety of building inputs, except for lumber, which has experienced recent declines due to a housing slowdown. On the demand-side of the market, the increase for mortgage rates for the first half of 2022 has priced out a significant number of prospective home buyers, as reflected by the decline for the traffic measure of the HMI.”

...

All three HMI indices posted declines in June. The component charting traffic of prospective buyers fell five points to 48, marking the first time this gauge has fallen below the breakeven level of 50 since June 2020. The HMI index gauging current sales conditions fell one point to 77 and the gauge measuring sales expectations in the next six months fell two points to 61.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 71, the Midwest dropped six points to 56, the South fell two points to 78 and the West posted a nine-point decline to 74.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was slightly below the consensus forecast, but still historically a decent reading.

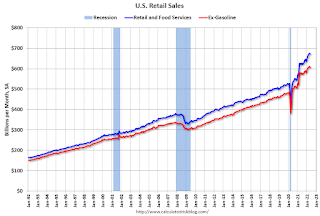

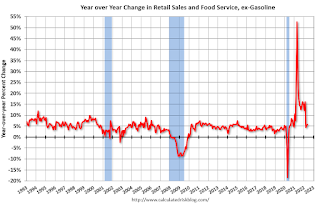

Retail Sales Decreased 0.3% in May

by Calculated Risk on 6/15/2022 08:37:00 AM

On a monthly basis, retail sales were decreased 0.3% from April to May (seasonally adjusted), and sales were up 8.1 percent from May 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for May 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $672.9 billion, a decrease of 0.3 percent from the previous month, but 8.1 percent above May 2021. ... The March 2022 to April 2022 percent change was revised from up 0.9 percent to up 0.7 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.7% in May.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 5.7% on a YoY basis.

Sales in May were below expectations, and sales in March and April were revised down, combined.

Sales in May were below expectations, and sales in March and April were revised down, combined.

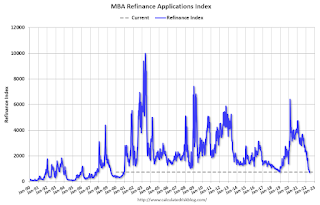

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 6/15/2022 07:00:00 AM

Note: This was before the recent surge in 3-year mortgage rates to over 6%.

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 6.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 10, 2022. Last week’s results are compared to the prior week, which included an adjustment for the Memorial Day holiday.

... The Refinance Index increased 4 percent from the previous week and was 76 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 8 percent from one week earlier. The unadjusted Purchase Index increased 18 percent compared with the previous week and was 16 percent lower than the same week one year ago.

"Mortgage rates increased for all loan types, with the 30-year fixed rate last week jumping 25 basis points to 5.65 percent – the highest level since 2008. Mortgage rates followed Treasury yields up in response to higher-than-expected inflation and anticipation that the Federal Reserve will need to raise rates at a faster pace,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite the increase in rates, application activity rebounded following the Memorial Day holiday week but remained 0.29 percent below pre-holiday levels. With mortgage rates well above 5 percent, refinance activity continues to run more than 70 percent lower than last year.”

Added Kan, “Purchase applications were down more than 15 percent compared to last year, as ongoing inventory shortages and affordability challenges have cooled demand, coinciding with the rapid jump in mortgage rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.65 percent from 5.40 percent, with points increasing to 0.71 from 0.60 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 16% year-over-year unadjusted.

According to the MBA, purchase activity is down 16% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, June 14, 2022

Wednesday: Retail Sales, Homebuilder Confidence, FOMC Statement

by Calculated Risk on 6/14/2022 09:05:00 PM

Note: it seemed that the Fed was going to raise rates 50bp, but now many participants think the Fed will raise rates 75bp.

Yes, mortgage rates really moved above 6% yesterday for the first time since 2008. ... The average lender is quoting top tier 30yr fixed rates in the 6.25-6.375% range, but as we discussed yesterday, it's cheaper than normal to buy one's rate down. That means rates in the high 5's are still being quoted, but those quotes imply higher upfront costs (aka "points"). [30 year fixed 6.28%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for May is scheduled to be released. The consensus is for a 0.2% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of 4.5, up from -11.6.

• At 10:00 AM, The June NAHB homebuilder survey. The consensus is for a reading of 68, down from 69 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 50bp at this meeting.

• Also at 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.8 | --- | ≥2321 | |

| New Cases per Day3🚩 | 106,246 | 105,846 | ≤5,0002 | |

| Hospitalized3🚩 | 23,509 | 23,205 | ≤3,0002 | |

| Deaths per Day3 | 283 | 294 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

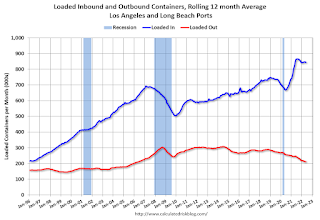

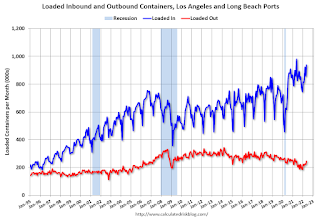

LA Port Traffic: Steady in May

by Calculated Risk on 6/14/2022 04:03:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic was declines 0.4% in May compared to the rolling 12 months ending in April. Outbound traffic was down 0.1% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Comparing the Current Housing Market to the 1978 to 1982 period

by Calculated Risk on 6/14/2022 11:34:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Comparing the Current Housing Market to the 1978 to 1982 period

A brief excerpt:

In the 1978 to 1982 period, demographics were very favorable for homebuying as the baby boomers moved into the first-time homebuying age group (similar to the millennials now).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows the longer-term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap). This graph is from 1960 to 2060 (all data from Census: current to 2060 is projected).

We can see the surge in the 20 to 29 age group last decade (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group peaked in 2018 / 2019 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak around 2023.

For buying, the 30 to 39 age group (blue) is important. The population in this age group is increasing and will increase further over this decade.

When we look back at the 1978 to 1982 period, the 30 to 39 age group (blue) was increasing even more than today.

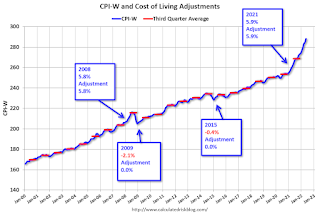

A Very Early Look at 2023 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 6/14/2022 09:55:00 AM

The BLS reported on Friday:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 9.3 percent over the last 12 months to an index level of 288.022 (1982-84=100). For the month, the index rose 1.2 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2021, the Q3 average of CPI-W was 268.421.

The 2021 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 9.3% year-over-year in May, and although this is very early - we need the data for July, August and September - my very early guess is COLA will probably be close to 9% this year, the largest increase since 11.2% in 1981.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2021 yet, but wages probably increased again in 2021. If wages increased 4% in 2021, then the contribution base next year will increase to around $153,000 in 2023, from the current $147,000.

Remember - this is a very early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

BLS: PPI increased 0.8% in May; Core PPI increased 0.5%

by Calculated Risk on 6/14/2022 08:33:00 AM

The Producer Price Index for final demand increased 0.8 percent in May, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. ... On an unadjusted basis, final demand prices moved up 10.8 percent for the 12 months ended in May.The consensus was for 0.8% increase in PPI, and a 0.6% increase in core PPI. PPI was at expectations, and core PPI was slightly below expectations.

...

Prices for final demand less foods, energy, and trade services moved up 0.5 percent in May after increasing 0.4 percent in April. For the 12 months ended in May, the index for final demand less foods, energy, and trade services rose 6.8 percent.

emphasis added