by Calculated Risk on 7/14/2022 09:06:00 PM

Thursday, July 14, 2022

Friday: Retail Sales, Industrial Production, NY Fed Mfg

Friday:

• At 8:30 AM ET, Retail sales for June is scheduled to be released. The consensus is for 0.8% increase in retail sales.

• Also, at 8:30 AM, The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of -2.6, down from -1.2.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a no change in Industrial Production, and for Capacity Utilization to decrease to 80.4%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for July).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2🚩 | 124,048 | 107,174 | ≤5,0001 | |

| Hospitalized2🚩 | 32,507 | 29,099 | ≤3,0001 | |

| Deaths per Day2🚩 | 351 | 312 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

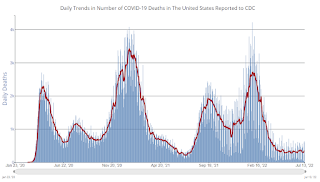

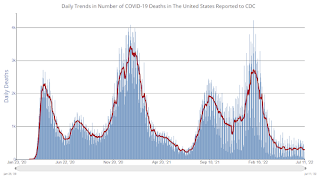

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Current State of the Housing Market

by Calculated Risk on 7/14/2022 01:59:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Current State of the Housing Market

A brief excerpt:

This is a market overview for mid-July.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a graph using the Altos inventory data of the trend comparing to 2020 and 2019. The dotted red line is the recent trend compared to 2020 - and at the current pace, inventory will be up compared to 2020 in late August. The dashed grey line is comparing to 2019, and based on the current trend, it is possible inventory will be back to 2019 levels by the beginning of 2023.

...We are seeing a clear slowing in the housing market, with more price reductions, more inventory, and fewer sales. It will take some time to see the impact on house price growth, but that is coming too.

Next week, existing home sales will likely show a sharp year-over-year decline in sales for June, and housing starts will probably show further declines (and still a record number of homes under construction).

It is important to remember that housing is a key transmission mechanism for Federal Open Market Committee (FOMC) policy. As long as inflation remains elevated, the Fed will keep raising rates - and that will impact the housing market (although mortgage rates have already jumped in anticipation of the FOMC actions).

Hotels: Occupancy Rate Down 14.5% Compared to Same Week in 2019

by Calculated Risk on 7/14/2022 12:57:00 PM

As expected on the negative side of a holiday calendar shift, U.S. hotel performance came in lower than the previous week, according to STR‘s latest data through July 9.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

July 3-9 2022 (percentage change from comparable week in 2019*):

• Occupancy: 63.3% (-14.5%)

• Average daily rate (ADR): $153.71 (+15.7%)

• Revenue per available room (RevPAR): $97.37 (-1.1%)

Whereas the previous week’s percentage changes were elevated on the favorable side of the calendar shift, the most recent week was skewed downward due to a comparison with a non-holiday week in 2019. After two consecutive weeks of lower demand around the Fourth of July holiday, the metrics are expected to strengthen for the remaining weeks of July.

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

LA Port Traffic: Mostly Steady in June

by Calculated Risk on 7/14/2022 10:17:00 AM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic increased 0.4% in June compared to the rolling 12 months ending in May. Outbound traffic was down 0.1% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Weekly Initial Unemployment Claims Increase to 244,000

by Calculated Risk on 7/14/2022 08:33:00 AM

The DOL reported:

In the week ending July 9, the advance figure for seasonally adjusted initial claims was 244,000, an increase of 9,000 from the previous week's unrevised level of 235,000. The 4-week moving average was 235,750, an increase of 3,250 from the previous week's unrevised average of 232,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 235,750.

The previous week was unrevised.

Weekly claims were higher than the consensus forecast

Wednesday, July 13, 2022

Thursday: Unemployment Claims, PPI

by Calculated Risk on 7/13/2022 08:52:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 230 thousand down from 235 thousand last week.

• Also, at 8:30 AM, The Producer Price Index for June from the BLS. The consensus is for a 0.8% increase in PPI, and a 0.5% increase in core PPI.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2🚩 | 123,365 | 108,028 | ≤5,0001 | |

| Hospitalized2🚩 | 31,993 | 28,720 | ≤3,0001 | |

| Deaths per Day2🚩 | 342 | 311 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Fed's Beige Book: "Housing demand weakened noticeably"

by Calculated Risk on 7/13/2022 02:09:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Atlanta based on information collected on or before July 13, 2022."

Economic activity expanded at a modest pace, on balance, since mid-May; however, several Districts reported growing signs of a slowdown in demand, and contacts in five Districts noted concerns over an increased risk of a recession. Most Districts reported that consumer spending moderated as higher food and gas prices diminished households' discretionary income. Due to continued low inventory levels, new auto sales remained sluggish across most Districts. Hospitality and tourism contacts cited healthy leisure travel activity with some noting an uptick in business and group travel. Manufacturing activity was mixed, and many Districts reported that supply chain disruptions and labor shortages continued to hamper production. Non-financial services firms experienced stable to slightly higher demand, and some firms reported that revenues exceeded expectations. Housing demand weakened noticeably as growing concerns about affordability contributed to non-seasonal declines in sales, resulting in a slight increase in inventory and more moderate price appreciation. Commercial real estate conditions slowed. Loan demand was mixed across most Districts; some financial institutions reported increased customer usage of revolving credit lines, while others reported weakening residential loan demand amid higher mortgage interest rates. Demand for transportation services was mixed and reports on agriculture conditions across reporting Districts varied. While demand for energy products was robust and oil and gas drilling activity picked up, production remained constrained by labor availability and supply chain bottlenecks for critical components. Similar to the previous report, the outlook for future economic growth was mostly negative among reporting Districts, with contacts noting expectations for further weakening of demand over the next six to twelve months.

emphasis added

Lawler on Demographics: Observations and Updated Population Projections

by Calculated Risk on 7/13/2022 12:55:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler on Demographics: Observations and Updated Population Projections

A brief excerpt:

CR Note: This is a technical post, but the key take away for housing is: “the “demographics” are not nearly as positive over the next several years as the Census 2017 projections would have suggested.”There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Way back in 2015, I projected a surge in homebuying in the 2020s based on demographics. The surge has happened, but the demographics are not as positive as originally predicted. Many analysts are repeating my earlier analysis without adjusting for less net international migration (NIM), and more deaths.

From housing economist Tom Lawler:

Analysts who rely on US population projections (total and by characteristics) to project other economic variables (including those housing related) have been frustrated by the lack of any credible official projections. The last official intermediate and long term population projections from Census was done in 2017, and (which I’ve written about before) those projections significantly over-predicted US births, significantly under-predicted deaths, and significantly over-predicted net international migration (NIM). On the latter score it’s not clear the extent of the over-prediction of NIM in the Census 2017 projections, as Census has not released updated NIM estimates for the 2010-2020 period. The last such NIM estimates were in the “Vintage 2020” population estimates, which did NOT incorporate the Census 2020 results, and the Vintage 2020 population estimate for April 1, 2020 was about 2.05 million below the Census 2020 tally. Presumably most of the Vintage 2020 “miss” reflected higher NIM over the past decade than that shown in the Vintage 2020 estimates, though the yearly differences in NIM are unknown, and Census has not yet released updated intercensal population estimates for the 2010-2020 period that are consistent with the Census 2020 results.

... some analysts like to look at projections of the number of 30 to 39 year olds, as that age group would likely include a large number of potential first-time home buyers. The Census 2017 Projections predicted that from July 1, 2020 to July 1, 2025 the number of 30-39 year olds would increase by 2,571,433, with a 697,200 increase in 2021. This updated projection has the number of 30-39 year olds increasing by only a third of that amount (864,670), with a 291,209 increase (from Vintage 2021) in 2021. The reasons for the big differences are (1) a different starting age distribution; (2) significantly higher deaths; and (3) significantly lower NIM. Obviously, the “demographics” are not nearly as positive over the next several years as the Census 2017 projections would have suggested.

Cleveland Fed: Median CPI increased 0.7% and Trimmed-mean CPI increased 0.8% in June

by Calculated Risk on 7/13/2022 11:41:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

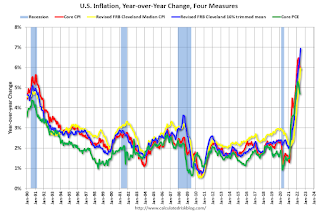

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.7% in June. The 16% trimmed-mean Consumer Price Index increased 0.8% in June. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Motor Fuel" increased at 251% annualized rate in June!

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Early Look at 2023 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 7/13/2022 09:14:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 9.8 percent over the last 12 months to an index level of 292.542 (1982-84=100). For the month, the index rose 1.6 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2021, the Q3 average of CPI-W was 268.421.

The 2021 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 9.8% year-over-year in June, and although this is very early - we need the data for July, August and September - my very early guess is COLA will probably be over 9% this year - and COLA could be double digits - the largest increase since 11.2% in 1981.

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2021 yet, but wages probably increased again in 2021. If wages increased 4% in 2021, then the contribution base next year will increase to around $153,000 in 2023, from the current $147,000.

Remember - this is a very early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

BLS: CPI increased 1.3% in June; Core CPI increased 0.7%

by Calculated Risk on 7/13/2022 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.3 percent in June on a seasonally adjusted basis after rising 1.0 percent in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 9.1 percent before seasonal adjustment.The consensus was for 1.1% increase in CPI, and a 0.6% increase in core CPI. Both were above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The increase was broad-based, with the indexes for gasoline, shelter, and food being the largest contributors. The energy index rose 7.5 percent over the month and contributed nearly half of the all items increase, with the gasoline index rising 11.2 percent and the other major component indexes also rising. The food index rose 1.0 percent in June, as did the food at home index.

The index for all items less food and energy rose 0.7 percent in June, after increasing 0.6 percent in the preceding two months. While almost all major component indexes increased over the month, the largest contributors were the indexes for shelter, used cars and trucks, medical care, motor vehicle insurance, and new vehicles. The indexes for motor vehicle repair, apparel, household furnishings and operations, and recreation also increased in June. Among the few major component indexes to decline in June were lodging away from home and airline fares.

The all items index increased 9.1 percent for the 12 months ending June, the largest 12-month increase since the period ending November 1981. The all items less food and energy index rose 5.9 percent over the last 12 months. The energy index rose 41.6 percent over the last year, the largest 12-month increase since the period ending April 1980. The food index increased 10.4 percent for the 12-months ending June, the largest 12-month increase since the period ending February 1981.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 7/13/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

— Mortgage applications decreased 1.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 8, 2022. This week’s results include an adjustment for the observance of Independence Day.

... The Refinance Index increased 2 percent from the previous week and was 80 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 14 percent compared with the previous week and was 18 percent lower than the same week one year ago.

"Mortgage rates were mostly unchanged, but applications declined for the second straight week. Purchase applications for both conventional and government loans continue to be weaker due to the combination of much higher mortgage rates and the worsening economic outlook,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “After reaching a record $460,000 in March 2022, the average purchase loan size was $415,000 last week, pulled lower by the potential moderation of home-price growth and weaker purchase activity at the upper end of the market.”

Added Kan, “Refinance applications increased slightly last week, driven by an uptick in conventional and FHA refinances. The overall refinance index remained 5 percent below the average level reported in June. With the 30-year fixed rate 265 basis points higher than a year ago, refinance applications are expected to remain depressed.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) remained at 5.74 percent, with points decreasing to 0.59 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 18% year-over-year unadjusted.

According to the MBA, purchase activity is down 18% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, July 12, 2022

Wednesday: CPI, Beige Book

by Calculated Risk on 7/12/2022 09:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for June from the BLS. The consensus is for a 1.1% increase in CPI, and a 0.6% increase in core CPI. The consensus is for CPI to be up 8.8% year-over-year and core CPI to be up 5.8% YoY.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 67.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.5 | --- | ≥2321 | |

| New Cases per Day3🚩 | 118,026 | 105,890 | ≤5,0002 | |

| Hospitalized3🚩 | 31,036 | 28,508 | ≤3,0002 | |

| Deaths per Day3 | 306 | 325 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Leading Index for Commercial Real Estate "Slight Gain In June"

by Calculated Risk on 7/12/2022 02:19:00 PM

From Dodge Data Analytics: Dodge Momentum Index Hits 14-Year High With Slight Gain In June

The Dodge Momentum Index (DMI) increased less than one percentage point in June to 173.6 (2000=100) from the revised May reading of 173.1, pushing the measure to a 14-year high.

The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning. The index is shown to lead construction spending for nonresidential buildings by a full year. In June, the commercial component of the Momentum Index rose 4.1%, while the institutional component fell 6.2%.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 173.6 in June, up from 173.1 in May.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggested a decline in Commercial Real Estate construction through most of 2021, but a solid pickup this year and into 2023.

2nd Look at Local Housing Markets in June, Sales Down Sharply Year-over-year

by Calculated Risk on 7/12/2022 11:10:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in June

A brief excerpt:

We are seeing a significant change in inventory, and maybe a pickup in new listings. So far, most of the increase in inventory has been due to softer demand - likely because of higher mortgage rates - but we need to keep an eye on new listings too.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

We are also seeing a sharp decline in closings in June, and this might be due to buyers cancelling escrow because of the increase in mortgage rates. Here is a table comparing the year-over-year Not Seasonally Adjusted (NSA) declines in sales this year from the National Association of Realtors® (NAR) with the local markets I track. So far, these measures have tracked closely, and the preliminary data below suggests a sharp decline in sales in June.

On cancellations, Lily Katz and Ben Walzer at Redfin wrote yesterday: The Deal Is Off: Home Sales Are Getting Canceled at the Highest Rate Since the Start of the Pandemic

Nationwide, roughly 60,000 home-purchase agreements fell through in June, equal to 14.9% of homes that went under contract that month. That’s the highest percentage on record with the exception of March and April 2020, when the housing market all but ground to a halt due to the onset of the coronavirus pandemic. It compares with 12.7% a month earlier and 11.2% a year earlier.

Reis: Office Vacancy Rate Increased in Q2, Mall Vacancy Rate Unchanged

by Calculated Risk on 7/12/2022 08:11:00 AM

From Moody’s Analytics Senior Economist Lu Chen: Apartment sets new record, Office continued its bumpy ride, and Retail stayed flat

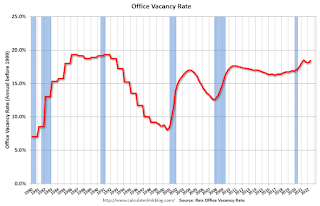

Given the intriguing supply and demand dynamics, office vacancy trended up 30 bps and finished the2nd quarter at 18.4%, merely 10 bps lower than its pandemic high in Q2 2021. On the rent front, both asking and effective rents edged up 0.4% during the quarter – these are the highest growth rates since the pandemic began. .

...

Our data shows the national vacancy for neighborhood and community shopping center has stayed flat at 10.3%, while asking rent is virtually unchanged and effective rent inched up 0.1% in the second quarter. Trend data on regional and super regional malls tells a similar story. Vacancy stayed flat at 11% and effective rent was up 0.1% this quarter.

emphasis added

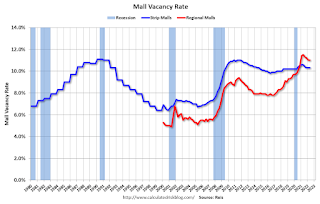

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis also reported that office effective rents were increased 0.4% in Q2; rents are about at the same as in early 2019.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.3% in Q2, unchanged from 10.3% in Q1, and down from 10.6% in Q2 2021. For strip malls, the vacancy rate peaked during the pandemic at 10.6% in both Q1 and Q2 2021.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis. In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

In the last several years, even prior to the pandemic, the regional mall vacancy rates increased significantly from an already elevated level.

Monday, July 11, 2022

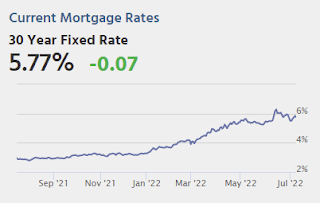

Key Week for Inflation and Mortgage Rates

by Calculated Risk on 7/11/2022 09:31:00 PM

Ultimately, the week will depend on the outcome of several inflation reports. The first one, Wednesday's CPI, is also by far the most important. Producer prices follow on Thursday and the inflation expectation component of the Consumer Sentiment data hit on Friday morning. If CPI hasn't already sent a strong enough message by mid-week, this trifecta of reports should go a long way toward helping the market pick a winner between 50bps and 75bps for the next Fed rate hike. It should also offer a strong comment on how high or low the ceiling should be for the trading range in bond yields. [30 year fixed 5.77%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for June.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 67.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.5 | --- | ≥2321 | |

| New Cases per Day3 | 103,907 | 112,666 | ≤5,0002 | |

| Hospitalized3🚩 | 28,320 | 28,238 | ≤3,0002 | |

| Deaths per Day3 | 281 | 352 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Q2 2022 Update: Unofficial Problem Bank list Decreased to 52 Institutions; Search for "Whale" Continues

by Calculated Risk on 7/11/2022 04:11:00 PM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources only, and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here are the quarterly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List through June 30, 2022. Since the last update at the end of March 2022, the list decreased by two to 52 institutions after an addition and three removals. Assets decreased by $6.1 billion to $54.4 billion, with the change primarily resulting from a $6.1 billion decrease from updated asset figures through March 31, 2021. A year ago, the list held 65 institutions with assets of $51.8 billion. Added during the second quarter was St. Landry Bank and Trust Company, Opelousas, LA ($324 million). Removals during the quarter because of unassisted mergers included First National Bank of Muscatine, Muscatine, IA ($368 million); Lincoln 1st Bank, Lincoln Park, NJ ($261 million); and First National Bank in Fairfield, Fairfield, IA ($154 million).

With the conclusion of the second quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since we first published the Unofficial Problem Bank List on August 7, 2009 with 389 institutions, 1,784 institutions have appeared on a weekly or monthly list since then. Only 2.9 percent of the banks that have appeared on a list remain today as 1,732 institutions have transitioned through the list. Departure methods include 1,022 action terminations, 411 failures, 280 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 3 or less than 1.0 percent, still have a troubled designation more than ten years later. The 411 failures represent 23.1 percent of the 1,784 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

On June 21, 2022, the FDIC released first quarter results and provided an update on the Official Problem Bank List. While FDIC did not make a comment within its press release on the Official Problem Bank List, they provided details in an attachment that listed 40 institutions with assets of $173 billion. The FDIC list had a material $119 billion increase in assets during the first quarter of 2022. None of the prudential banking regulators – FDIC, Federal Reserve, and OCC – have publicly released an enforcement action detailing the large institution added. The Financial Institutions Reform, Recovery and Enforcement Act (FIRREA) passed by Congress in 1989 requires publication of enforcement actions. See “Supervisory Enforcement Actions Since FIRREA and FDICIA,” published by the Federal reserve Bank of Minneapolis for further details. Prior to FIRREA, enforcement actions were not published by the prudential banking regulators. Section 913 of FIRREA requires public disclosures of enforcement actions. Section 913(2) does allow a delay in the enforcement action publication if “exceptional circumstances” exist. The prudential regulator must make a written determination that publication “would seriously threaten the safety & soundness of an insured depository institution.” The prudential regulator “may delay the publication of such order for a reasonable time.” The section does not define “a reasonable time.” It has been nearly six months since that enforcement action was issued, so it is unknown what constitutes “reasonable time.”

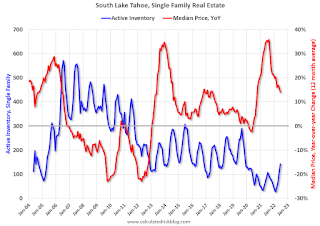

Second Home Market: South Lake Tahoe in June

by Calculated Risk on 7/11/2022 02:02:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through June 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but up 5-fold from the record low set in February 2022, and up 54% year-over-year. Prices are up 14.0% YoY (but the YoY change has been trending down).

The graph shows weekly 2nd home mortgage count.

The graph shows weekly 2nd home mortgage count.The pandemic boom is obvious, and it now appears that 2nd home buying has declined to 2019 levels.

Homebuilder Comments in June: “Someone turned out the lights on our sales in June!"

by Calculated Risk on 7/11/2022 11:00:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Homebuilder Comments in June: “Someone turned out the lights on our sales in June!""

A brief excerpt:

Read these builder comments from around the country. Sales have declined sharply in June.There many more comments in the article. You can subscribe at https://calculatedrisk.substack.com/

Some homebuilder comments courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):

#Atlanta builder: “Someone turned out the lights on our sales in June!”

#Austin builder: “Sales have fallen off a cliff. We’re selling 1/3 of what we sold in March and April. Trades are more willing to negotiate pricing since market has adjusted significantly past 60 days.”

#Birmingham builder: “Sales have fallen 75% the last two months in a further out community.”

#Boise builder: “Sales have slowed tremendously. Builders are dropping prices and halting new starts. Seeing prices drop on labor due to slowing of home starts. Expecting 15% to 20% reduction in most costs.”