by Calculated Risk on 7/25/2022 03:09:00 PM

Monday, July 25, 2022

Will Housing Inventory Follow the Normal Seasonal Pattern?

Today, in the Calculated Risk Real Estate Newsletter: Will Housing Inventory Follow the Normal Seasonal Pattern?

A brief excerpt:

The next couple of months will be important for housing inventory. Will inventory follow the normal seasonal pattern and peak in the summer? Or will inventory peak later in the year (like October or November)?There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

My current outlook on house prices assumes that inventory will continue to increase into the Fall.

...

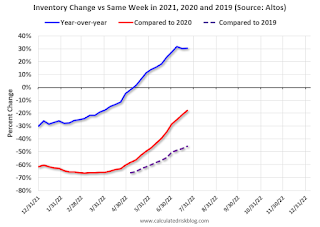

The second graph uses the Altos inventory data and shows the trend comparing to the same week in 2020 and 2019. The dotted red line is the recent trend compared to 2020 - and at the current pace, inventory will be up compared to 2020 in late August. The dashed grey line is comparing to 2019, and based on the current trend, it is possible inventory will be back to 2019 levels by the beginning of 2023.

Black Knight: Mortgage Delinquency Rate increased in June; Remains Well below Pre-Pandemic Levels

by Calculated Risk on 7/25/2022 11:19:00 AM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies and Foreclosure Starts Edge Higher in June but Remain Well Below Pre-Pandemic Levels

• The national delinquency rate rose nine basis points from May to reach 2.84% after hitting consecutive record lows in each of the prior three monthsAccording to Black Knight's First Look report, the percent of loans delinquent increased 3.3% in June compared to May and decreased 35% year-over-year.

• Increases were broad-based – the number of borrowers a single payment past due rose 5%, while 90-day delinquencies broke a 21-month streak of improvement with a modest 1% uptick from the prior month

• Foreclosure starts were also up 27% in June – still 40% below pre-pandemic levels – marking a 441% year-over-year increase, a significant rise from pandemic-driven lows

• Starts also represented the highest share (4%) of serious delinquencies since March 2020, but less than half the rate in the years leading up to the pandemic

• Active foreclosure inventory rose by 16K in the month as volumes continue to slowly come off the record lows brought on by widespread moratoriums and forbearance protections in 2020/21

• Prepayment activity was down another 7% in June with prepays now down by 64% from the same time last year as rising rates put downward pressure on both purchase and refinance lending

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.84% in June, up from 2.75% in May.

The percent of loans in the foreclosure process increased in June to 0.53%, from 0.50% in May. This is increasing from very low levels due to the foreclosure moratoriums.

The number of delinquent properties, but not in foreclosure, is down 809,000 properties year-over-year, and the number of properties in the foreclosure process is up 45,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| June 2022 | May 2022 | June 2021 | June 2020 | |

| Delinquent | 2.84% | 2.75% | 4.37% | 7.59% |

| In Foreclosure | 0.53% | 0.50% | 0.27% | 0.36% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,511,000 | 1,461,000 | 2,320,000 | 4,034,000 |

| Number of properties in foreclosure pre-sale inventory: | 190,000 | 174,000 | 145,000 | 192,000 |

| Total Properties | 1,700,000 | 1,635,000 | 2,466,000 | 4,226,000 |

Housing Inventory July 25th Update: Up 30.5% Year-over-year

by Calculated Risk on 7/25/2022 09:05:00 AM

Inventory is increasing rapidly. Inventory bottomed seasonally at the beginning of March 2022 and is now up 118% since then. More than double!

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 17.9% according to Altos)

4. Inventory up compared to 2019 (currently down 45.8%).

Five High Frequency Indicators for the Economy

by Calculated Risk on 7/25/2022 08:16:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of July 24th.

Click on graph for larger image.

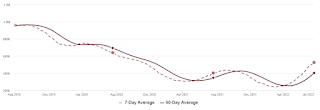

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.1% from the same day in 2019 (87.9% of 2019). (Dashed line)

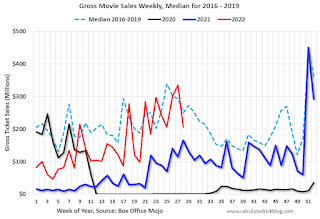

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $206 million last week, down about 18% from the median for the week.

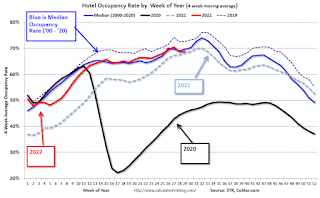

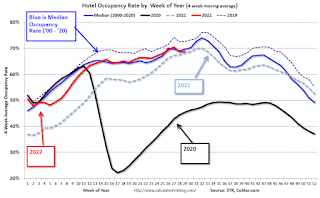

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through July 16th. The occupancy rate was down 7.4% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of July 15th, gasoline supplied was down 7.5% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. Currently traffic is less than half of normal.

This data is through Friday, July 22nd.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, July 24, 2022

Sunday Night Futures

by Calculated Risk on 7/24/2022 06:41:00 PM

Weekend:

• Schedule for Week of July 24, 2022

• FOMC Preview: 75bp Hike

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for July.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 5 and DOW futures are down 55 (fair value).

Oil prices were mixed over the last week with WTI futures at $95.51 per barrel and Brent at $104.18 per barrel. A year ago, WTI was at $72, and Brent was at $74 - so WTI oil prices are up 33% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.33 per gallon. A year ago, prices were at $3.15 per gallon, so gasoline prices are up $1.18 per gallon year-over-year.

FOMC Preview: 75bp Hike

by Calculated Risk on 7/24/2022 09:46:00 AM

Expectations are the FOMC will announce a 75bp rate increase in the federal funds rate at the meeting this week.

"We look for the Fed to lift the target range for the federal funds rate by 75bp to 2.25-2.5% while keeping its balance sheet normalization policies in place. ... We look for Chair Powell to repeat similar messages from the June FOMC meeting; namely that inflation is too high, the Fed is committed to restoring price stability, and some pain may be needed to bring inflation lower. Looking ahead, we expect another 50bp increase in September and two additional 25bp rate hikes by year end, which would bring the target range for the federal funds rate to 3.25-3.50%."From Goldman Sachs:

"We expect a 75bp rate hike at the July FOMC meeting next week. ... The key question for next week is what guidance Chair Powell will give about the size of a likely rate hike in September. We expect that Fed officials will want to keep their options open and will avoid any strong guidance. ... We continue to expect a 50bp hike in September and 25bp hikes in November and December to a terminal rate of 3.25-3.5%."

Wall Street forecasts have been revised down further since June due to the ongoing negative impacts from the pandemic. the war in Ukraine and financial tightening. For example, from BofA:

"We now forecast 1.1% GDP growth for 2022 and expect growth to slow to -0.2% in 2023"

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 1.5 to 1.9 | 1.3 to 2.0 | 1.5 to 2.0 | |

| Mar 2022 | 2.5 to 3.0 | 2.1 to 2.5 | 1.8 to 2.0 | |

The unemployment rate was at 3.6% in June. So far, the economic slowdown has not pushed up the unemployment rate.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 3.6 to 3.8 | 3.8 to 4.1 | 3.9 to 4.1 | |

| Mar 2022 | 3.4 to 3.6 | 3.3 to 3.6 | 3.2 to 3.7 | |

As of May 2022, PCE inflation was up 6.3% from May 2021. This was below the cycle high of 6.6% YoY in March. Analysts are expecting inflation to decline slowly.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 5.0 to 5.3 | 2.4 to 3.0 | 2.0 to 2.5 | |

| Mar 2022 | 4.1 to 4.7 | 2.3 to 3.0 | 2.1 to 2.4 | |

PCE core inflation was up 4.7% in May year-over-year. This was below the cycle high of 5.3% YoY in February.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 4.2 to 4.5 | 2.5 to 3.2 | 2.1 to 2.5 | |

| Mar 2022 | 3.9 to 4.4 | 2.4 to 3.0 | 2.1 to 2.4 | |

Saturday, July 23, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 7/23/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Final Look at Local Housing Markets in June

• NAR: Existing-Home Sales Decreased to 5.12 million SAAR in June

• Slowdown in Showings Suggests Further Declines in Existing Home Sales in Coming Months

• June Housing Starts: All-Time Record Housing Units Under Construction

• 3rd Look at Local Housing Markets in June, Sales Down Sharply, Inventory "Surged"

• Record Single Family Investor Buying in Q1, Possible evidence of Slowdown in Q2

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of July 24, 2022

by Calculated Risk on 7/23/2022 08:11:00 AM

The key report this week is the advance estimate of Q2 GDP.

Other key reports include June New Home Sales, Personal Income and Outlays for June, and Case-Shiller house prices for May.

For manufacturing, the July Richmond, Dallas and Kansas City Fed manufacturing surveys will be released.

The FOMC meets this week and is expected to raise rates 75 bp.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for July.

9:00 AM: S&P/Case-Shiller House Price Index for May.

9:00 AM: S&P/Case-Shiller House Price Index for May.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 21.0% year-over-year increase in the Comp 20 index for May.

9:00 AM: FHFA House Price Index for May. This was originally a GSE only repeat sales, however there is also an expanded index.

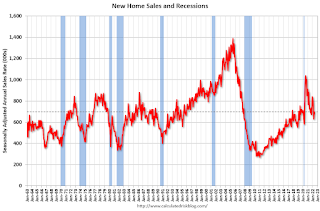

10:00 AM: New Home Sales for June from the Census Bureau.

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 666 thousand SAAR, down from 696 thousand in May.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.5% decrease in durable goods orders.

10:00 AM: Pending Home Sales Index for June. The consensus is for a 3.7% decrease in the index.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise rates 75 bps, increasing the target range for the federal funds rate to 2‑1/4 to 2-1/2 percent.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 248 thousand down from 251 thousand last week.

8:30 AM: Gross Domestic Product, 2nd quarter (advance estimate), and annual update. The consensus is that real GDP increased 0.4% annualized in Q2, up from -1.6% in Q1.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for July. This is the last of the regional surveys for July.

8:30 AM ET: Personal Income and Outlays, June 2022. The consensus is for a 0.5% increase in personal income, and for a 0.9% increase in personal spending. And for the Core PCE price index to increase 0.5%. PCE prices are expected to be up 6.6% YoY, and core PCE prices up 4.7% YoY.

9:45 AM: Chicago Purchasing Managers Index for July.

10:00 AM: University of Michigan's Consumer sentiment index (Final for July). The consensus is for a reading of 51.1.

Friday, July 22, 2022

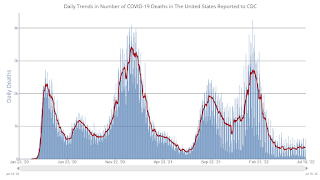

COVID July 22, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 7/22/2022 09:26:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 126,128 | 128,126 | ≤5,0001 | |

| Hospitalized2🚩 | 35,362 | 33,246 | ≤3,0001 | |

| Deaths per Day2 | 355 | 378 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

BLS: Eight States Set New Record Series Low Unemployment rates in June

by Calculated Risk on 7/22/2022 03:13:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in June in 10 states and the District of Columbia, higher in 2 states, and stable in 38 states, the U.S. Bureau of Labor Statistics reported today. All 50 states and the District had jobless rate decreases from a year earlier.

...

Minnesota had the lowest jobless rate in June, 1.8 percent, closely followed by Nebraska, 1.9 percent. The next lowest rates were in New Hampshire and Utah, 2.0 percent each. The rates in Minnesota and New Hampshire set new series lows, as did the rates in the following six states (all state series begin in 1976): Alabama (2.6 percent), Georgia (2.9 percent), Kentucky (3.7 percent), Louisiana (3.8 percent), Mississippi (3.8 percent), and Missouri (2.8 percent). The District of Columbia had the highest unemployment rate, 5.5 percent, followed by New Mexico, 4.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006.

Q2 GDP Forecasts: Slightly Negative

by Calculated Risk on 7/22/2022 10:58:00 AM

The advance estimate of Q2 GDP will be released next week, and the consensus is for real GDP to increase 0.4% in Q2.

Note: We've seen two consecutive quarters of negative GDP before without a recession (that isn't the definition). If Q2 is negative, it will mostly be due to inventory and trade issues. No worries. My view is the US economy is not currently in a recession, see: Predicting the Next Recession

From BofA:

In next week’s advance estimate of 2Q US GDP, we expect the BEA to report that the economy contracted by 1.5% qoq saar, marking the second consecutive decline in quarterly output. [July 22 estimate]From Goldman:

emphasis added

[W]e lowered our Q2 GDP tracking estimate by 0.1pp to +0.5% (qoq ar). [July 20 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -1.6 percent on July 19, down from -1.5 percent on July 15. [July 19 estimate]

Hotels: Occupancy Rate Down 7.4% Compared to Same Week in 2019

by Calculated Risk on 7/22/2022 08:26:00 AM

After two consecutive weeks of lower demand around the Fourth of July holiday, U.S. hotel performance bounced back from the previous week, according to STR‘s latest data through July 16.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

July 10-16, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 72.0% (-7.4%)

• Average daily rate (ADR): US$157.23 (+14.9%)

• Revenue per available room (RevPAR): US$113.28 (+6.4%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Thursday, July 21, 2022

Realtor.com Reports Weekly Inventory Up 29% Year-over-year

by Calculated Risk on 7/21/2022 03:37:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released yesterday from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending July 16, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, rising 29% above one year ago. With fewer owners listing homes for sale this week and last, the rapid recent run-up in active inventory has stalled somewhat. Inventory was roughly even with last year’s levels at the beginning of May and the gains mounted each week until early July. Since then, the market has stabilized just shy of a 30% increase over year ago levels. This is a welcome improvement for shoppers, but the market still lags what was once normal.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change, from down 30% at the beginning of the year, to up 29% YoY now.

Final Look at Local Housing Markets in June, Inventory Up, Sales Down Sharply, New Listings Picking Up

by Calculated Risk on 7/21/2022 12:23:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in June

A brief excerpt:

And here is a table for new listings in June. For these areas, new listings were up 4.4% YoY.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Last month, new listings in these markets were up 5.9% YoY. New listings have increased over the last two months - new listing were down YoY as recently as April - but overall, we aren’t seeing a huge increase in new listings in these markets.

However, several markets are seeing a surge in new listings - Austin, Las Vegas, Phoenix and mid-Florida (Tampa, Orlando) are examples. A combination of less demand, and more new listings, is really pushing up inventory in these areas.

These are all formerly “hot” markets and perhaps some people are just trying to cash out in these markets after the huge increase in prices. Or it could be a leading indicator of more listings to come in other areas. This is something to watch.

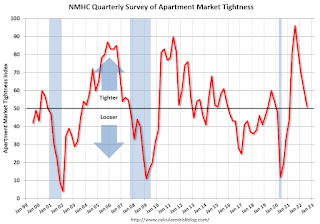

NMHC: July Apartment Market Survey shows "Barely" Tighter Conditions

by Calculated Risk on 7/21/2022 10:29:00 AM

From the National Multifamily Housing Council (NMHC): Higher Interest Rates Begin to Impact Multifamily

Apartment sales volume fell while both equity and debt financing became more costly, according to the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for July 2022. However, demand in most markets was still strong relative to supply.

“Continued interest rate hikes from the Fed have translated into higher longer-term rates and a higher cost of both debt and equity,” noted NMHC’s Chief Economist, Mark Obrinsky. “While these higher rates have cut into investor proceeds, many sellers are reluctant to lower prices, causing a sharp drop in sales volume.”

“The apartment market recorded its sixth consecutive quarter of tightening conditions, if just barely. Fifty-six percent of respondents reported unchanged conditions, while those reporting tighter conditions slightly outpaced those reporting looser market conditions.”

...

Market Tightness Index came in at 51, just above the breakeven level of 50. This indicates that market conditions have become tighter, albeit with considerable variation by market. Twenty-three percent of respondents reported markets to be tighter than three months ago compared to 21% of respondents who observed looser conditions in the markets they watch. Meanwhile, over half of respondents (56%) thought that apartment market conditions were unchanged from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter.

Weekly Initial Unemployment Claims Increase to 251,000

by Calculated Risk on 7/21/2022 08:34:00 AM

The DOL reported:

In the week ending July 16, the advance figure for seasonally adjusted initial claims was 251,000, an increase of 7,000 from the previous week's unrevised level of 244,000. The 4-week moving average was 240,500, an increase of 4,500 from the previous week's revised average. The previous week's average was revised up by 250 from 235,750 to 236,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 240,500.

The previous week was unrevised.

Weekly claims were higher than the consensus forecast.

Wednesday, July 20, 2022

Thursday: Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 7/20/2022 09:39:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 235 thousand down from 244 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of 5.5, up from -3.1.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2🚩 | 126,018 | 123,525 | ≤5,0001 | |

| Hospitalized2🚩 | 34,511 | 32,288 | ≤3,0001 | |

| Deaths per Day2 | 353 | 366 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

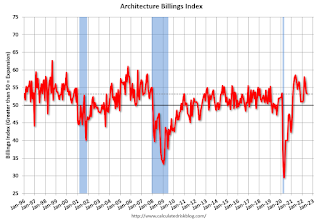

AIA: Architecture Billings Index shows "increasing demand" in June

by Calculated Risk on 7/20/2022 01:33:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index continues to stabilize but remains healthy

Architecture firms reported increasing demand for design services in June, according to a new report today from The American Institute of Architects (AIA).

The ABI score for June was 53.2. While this score is down slightly from May’s score of 53.5, it still indicates moderately strong business conditions overall (any score above 50 indicates an increase in billings from the prior month). Also in June, both the new project inquiries and design contracts indexes moderated from May but continued to show growth, posting scores of 58.2 and 52.2 respectively.

“Ongoing project activity at architecture firms as well as new work coming online remains strong, pushing project backlogs up to seven months on average nationally,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “In spite of heavy workloads, employment at architecture firms has stabilized, suggesting that adding new employees is becoming even more challenging as the building construction sector continues to recover.”

...

• Regional averages: West (57.8); Midwest (54.8); South (51.5); Northeast (48.7)

• Sector index breakdown: institutional (53.5); mixed practice (52.8); multi-family residential (52.6); commercial/industrial (52.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.2 in June, down from 53.5 in May. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been positive for 17 consecutive months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a pickup in CRE investment in 2022 and into 2023.

More Analysis on June Existing Home Sales

by Calculated Risk on 7/20/2022 10:54:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 5.12 million SAAR in June

Excerpt:

Sales in June (5.12 million SAAR) were down 5.4% from the previous month and were 14.2% below the June 2021 sales rate. Sales are now below pre-pandemic levels.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

...

The second graph shows existing home sales by month for 2021 and 2022.

Sales declined 14.2% year-over-year compared to June 2021. This was the tenth consecutive month with sales down year-over-year.

...

Key point on Timing of Sales

Existing home sales are reported when the transaction closes. Sales in June were mostly for contracts signed in April and May. Recent data shows a significant slowdown in activity starting in May and decelerating further in June.

My sense is contracts for sales really declined in June, and that will show up as closed sales in July and August - so we should expect a further decline in existing home sales over the next few months.

NAR: Existing-Home Sales Decreased to 5.12 million SAAR in June

by Calculated Risk on 7/20/2022 10:13:00 AM

From the NAR: Existing-Home Sales Slid 5.4% in June

Existing-home sales dropped for the fifth straight month in June, according to the National Association of REALTORS®. Three out of four major U.S. regions experienced month-over-month sales declines and one region held steady. Year-over-year sales sank in all four regions.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dipped 5.4% from May to a seasonally adjusted annual rate of 5.12 million in June. Year-over-year, sales fell 14.2% (5.97 million in June 2021).

...

Total housing inventory registered at the end of June was 1,260,000 units, an increase of 9.6% from May and a 2.4% rise from the previous year (1.23 million). Unsold inventory sits at a 3.0-month supply at the current sales pace, up from 2.6 months in May and 2.5 months in June 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (5.12 million SAAR) were down 5.4% from the previous month and were 14.2% below the June 2021 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.26 million in June from 1.15 million in May.

According to the NAR, inventory increased to 1.26 million in June from 1.15 million in May.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 2.4% year-over-year (blue) in June compared to June 2021.

Inventory was up 2.4% year-over-year (blue) in June compared to June 2021. Months of supply (red) increased to 3.0 months in June from 2.6 months in May.

This was well below the consensus forecast. I'll have more later.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |