by Calculated Risk on 8/06/2022 08:11:00 AM

Saturday, August 06, 2022

Schedule for Week of August 7, 2022

The key report this week is July CPI.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for July.

12:00 PM: (expected) MBA Q2 National Delinquency Survey

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for July from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.5% increase in core CPI. The consensus is for CPI to be up 8.8% year-over-year and core CPI to be up 6.1% YoY.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 263 thousand up from 260 thousand last week.

8:30 AM: The Producer Price Index for July from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.4% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for August).

Friday, August 05, 2022

COVID August 5, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 8/05/2022 09:09:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 114,830 | 125,797 | ≤5,0001 | |

| Hospitalized2 | 37,112 | 37,573 | ≤3,0001 | |

| Deaths per Day2 | 393 | 405 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

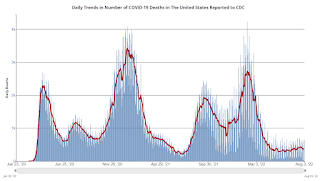

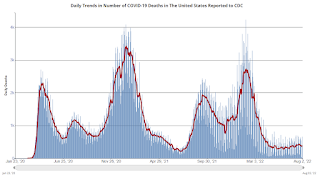

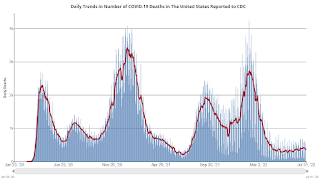

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

New Home Cancellations increased Sharply in Q2

by Calculated Risk on 8/05/2022 02:06:00 PM

Today, in the Calculated Risk Real Estate Newsletter: New Home Cancellations increased Sharply in Q2

A brief excerpt:

First, a few quotes from some Q2 SEC filings:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/"We believe the recent increases in interest rates during 2022 have caused buyer apprehension, affordability concerns, and an increase in cancellations.", Taylor Morrison Q2 SEC Filing

"The magnitude and speed of these recent rate increases has caused many buyers to pause and reconsider a home purchase, resulting in lower gross demand and higher cancellations during the second quarter.”, MDC Holdings Q2 SEC Filing

"New orders weakened during the second quarter of 2022 in many of our markets and we experienced a higher than normal cancellation rate during the second quarter of 2022", LGI Homes Q2 SEC Filing

emphasis addedHere is a table of selected public builders and the currently reported cancellation rate (I’m still gathering data). There is some seasonality to cancellation rates.

Disclaimer: the cancellation rates are from SEC filings only, and while deemed to be reliable is not guaranteed.

Cancellation rates clearly increased in Q2.

Used Vehicle Wholesale Prices Decreased 0.1% in July

by Calculated Risk on 8/05/2022 01:45:00 PM

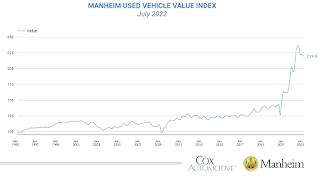

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decrease Minimally in July From Seasonal Adjustment

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 0.1% in July from June. The Manheim Used Vehicle Value Index declined to 219.6, up 12.5% from a year ago. The non-adjusted price change in July decreased 3.2% compared to June, leaving the unadjusted average price up 10.2% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Comments on July Employment Report

by Calculated Risk on 8/05/2022 10:38:00 AM

Today we celebrate the recovery of all the jobs lost in 2020, and the unemployment rate matching the lowest level since 1969.

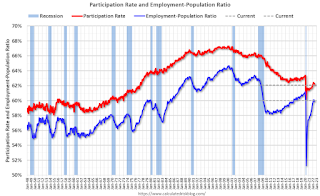

The headline jobs number in the July employment report was well above expectations, and employment for the previous two months was revised up by 28,000, combined. The participation rate decreased slightly, and the employment-population ratio increased slightly. The unemployment rate declined to 3.5%.

In July, the year-over-year employment change was 6.15 million jobs.

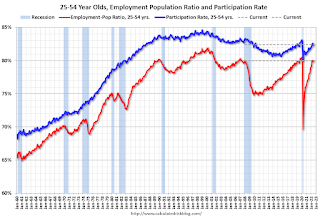

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate increased in July to 82.4% from 82.3% in June, and the 25 to 54 employment population ratio increased to 80.0% from 79.8% the previous month.

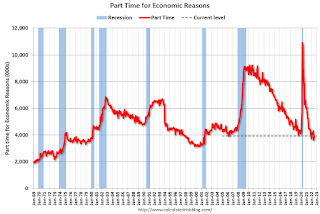

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons increased by 303,000 to 3.9 million in July. This rise reflected an increase in the number of persons whose hours were cut due to slack work or business conditions. The number of persons employed part time for economic reasons is below its February 2020 level of 4.4 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in July to 3.924 million from 3.621 million in June. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 6.7% from 6.7% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure is lower than the 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.067 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.336 million the previous month.

This is back to pre-pandemic lows.

Summary:

The headline monthly jobs number was well above expectations and employment for the previous two months was revised up by 28,000, combined.

July Employment Report: 528 thousand Jobs, 3.5% Unemployment Rate

by Calculated Risk on 8/05/2022 08:43:00 AM

From the BLS:

Total nonfarm payroll employment rose by 528,000 in July, and the unemployment rate edged down to 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care. Both total nonfarm employment and the unemployment rate have returned to their February 2020 pre-pandemic levels.

...

The change in total nonfarm payroll employment for May was revised up by 2,000, from +384,000 to +386,000, and the change for June was revised up by 26,000, from +372,000 to +398,000. With these revisions, employment in May and June combined is 28,000 higher than previously reported.

emphasis added

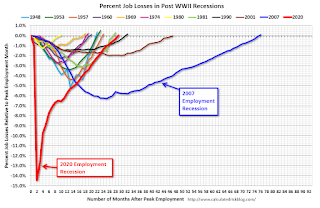

Click on graph for larger image.

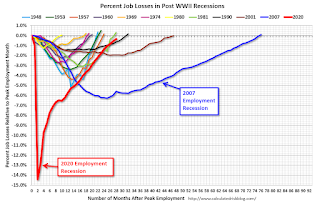

Click on graph for larger image.The first graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In July, the year-over-year change was 6.15 million jobs. This was up significantly year-over-year.

Total payrolls increased by 528 thousand in July. Private payrolls increased by 471 thousand, and public payrolls increased 57 thousand.

Payrolls for May and June were revised up 28 thousand, combined.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 62.1% in July, from 62.2% in June. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 62.1% in July, from 62.2% in June. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 60.0% from 59.9% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was decreased in July to 3.5% from 3.6% in June.

This was well above consensus expectations; and May and June payrolls were revised up by 28,000 combined.

Thursday, August 04, 2022

Friday: Employment Report

by Calculated Risk on 8/04/2022 08:48:00 PM

Goldman July Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for July. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 117,350 | 126,536 | ≤5,0001 | |

| Hospitalized2 | 37,220 | 37,451 | ≤3,0001 | |

| Deaths per Day2 | 377 | 397 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Goldman July Payrolls Preview

by Calculated Risk on 8/04/2022 04:44:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose by 225k in July (mom sa) ... The July seasonal factors have become significantly more restrictive—even more so than in June—and the seasonal adjustment algorithm may be overfitting to the reopening-related job strength in the summers of 2020 and 2021. ... We estimate that the unemployment rate was unchanged at 3.6% in July ...CR Note: The consensus is for 250 thousand jobs added, and for the unemployment rate to be unchanged at 3.6%.

emphasis added

Hotels: Occupancy Rate Down 3.8% Compared to Same Week in 2019

by Calculated Risk on 8/04/2022 03:37:00 PM

U.S. hotel performance dipped slightly from the previous week, which was the traditional summer travel peak, according to STR‘s latest data through July 30.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

July 24-30, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 71.9% (-3.8%)

• Average daily rate (ADR): $158.32 (+18.3%)

• Revenue per available room (RevPAR): $113.90 (+13.9%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Denver Real Estate in July: Sales Off 31.6% YoY, Inventory Up 81.5%

by Calculated Risk on 8/04/2022 01:13:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Denver Real Estate in July: Sales Off 31.6% YoY, Inventory Up 81.5%

A brief excerpt:

Every month I track about 35 local housing markets in the US, and I usually post several markets at a time. But this is worth noting. Sales in Denver were off almost 32% year-over-year in July, compared to down 23.6% in June. This early reporting market suggests existing home sales will be even weaker in July than in June.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

From the DMAR: DMAR Real Estate Market Trends ReportThe data confirms that the Denver Metro area is no longer in a shifting market. Instead, it has shifted, and the real estate market is more balanced. …DMAR reports total residential active inventory (detached and attached) was 7,361 at the end of July, up 21.5% from 6,057 at the end of June, and up 81.5% year-over-year from 4,056 in July 2021.

Every indicator points to the market shifting closer to a buyer’s market ....

July Employment Preview

by Calculated Risk on 8/04/2022 11:01:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 500 thousand fewer jobs than in February 2020 (the month before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 28 months after the onset, has recovered quicker than the previous two recessions.

• ADP Report: The ADP employment report has been "paused" and is being retooled.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in July to 49.9%, up from 47.3% last month. This would suggest about 20,000 jobs lost in manufacturing.

The ISM® services employment index increased in July to 49.1%, up from 47.4% last month. This would suggest service employment was increased about 50,000 in July.

Combined, the ISM surveys suggest only 30,000 jobs added in July.

• Unemployment Claims: The weekly claims report showed an increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 233,000 in June to 261,000 in July. This would usually suggest a few more layoffs in June than in May. In general, weekly claims were above expectations in July.

Trade Deficit decreased to $79.6 Billion in June

by Calculated Risk on 8/04/2022 08:49:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $79.6 billion in June, down $5.3 billion from $84.9 billion in May, revised.

June exports were $260.8 billion, $4.3 billion more than May exports. June imports were $340.4 billion, $1.0 billion less than May imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in June.

Exports are up 23% year-over-year; imports are up 20% year-over-year.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $36.9 billion in June, from $27.7 billion a year ago.

Weekly Initial Unemployment Claims increase to 260,000

by Calculated Risk on 8/04/2022 08:37:00 AM

The DOL reported:

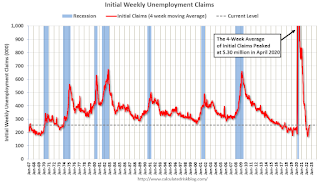

In the week ending July 30, the advance figure for seasonally adjusted initial claims was 260,000, an increase of 6,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 256,000 to 254,000. The 4-week moving average was 254,750, an increase of 6,000 from the previous week's revised average. The previous week's average was revised down by 500 from 249,250 to 248,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 254,750.

The previous week was revised down.

Weekly claims were lower than the consensus forecast.

Wednesday, August 03, 2022

Thursday: Trade Deficit, Unemployment Claims

by Calculated Risk on 8/03/2022 09:17:00 PM

• At 8:30 AM ET, Trade Balance report for June from the Census Bureau. The consensus is the trade deficit to be $80.1 billion. The U.S. trade deficit was at $85.5 Billion the previous month.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 265 thousand up from 256 thousand last week.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 119,034 | 126,812 | ≤5,0001 | |

| Hospitalized2 | 37,132 | 37,286 | ≤3,0001 | |

| Deaths per Day2 | 387 | 396 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Heavy Truck Sales Solid in July

by Calculated Risk on 8/03/2022 02:28:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the July 2022 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2023?

by Calculated Risk on 8/03/2022 11:54:00 AM

Today, in the Calculated Risk Real Estate Newsletter: How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2023?

A brief excerpt:

With house prices up sharply again over the last year, an interesting question is: How much will the Fannie & Freddie conforming loan limits (CLL) increase for 2023? And how much will the FHA insured loan limits increase?There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

First, there are different loan limits for various geographical areas. There are also different loan limits depending on the number of units (from 1 to 4 units). For example, currently the CLL is $647,200 for one-unit properties in low-cost areas. For Los Angeles County, the CLL is $970,800 for one-unit properties (50% higher than the baseline CLL).

...

This graph shows the CLL since 1979. The CLL was unchanged from 2006 though 2016.

...

The adjustment is based on the House Price Index value in Q3 divided by Q3 in the prior year. The FHFA index is a repeat sales index, similar to Case-Shiller.

...

Currently we only have data for Q1 2022 for the quarterly index (up 17.5% from Q1 2021), and the Purchase-Only index was up 18.3% through May 2022.

...

We need the house price data through September 2022 to calculate the conforming loan limit for 2023. This quarterly data will be released in late November.

Based on the current year-over-year house price change, the CLL could be close to $760,000 in 2023. However, year-over-year (YoY) house price growth is clearly slowing, and it is possible the CLL will be in the low-to-mid $700 thousand range for 2023.

ISM® Services Index Increased to 56.7% in July, Employment Contracted

by Calculated Risk on 8/03/2022 10:06:00 AM

(Posted with permission). The ISM® Services index was at 56.7%, up from 55.3% last month. The employment index increased to 49.1%, from 47.4%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 56.7% July 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in July for the 26th month in a row — with the Services PMI® registering 56.7 percent — say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.This was well above expectations.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In July, the Services PMI® registered 56.7 percent, 1.4 percentage points higher than June’s reading of 55.3 percent. The Business Activity Index registered 59.9 percent, an increase of 3.8 percentage points compared to the reading of 56.1 percent in June. The New Orders Index figure of 59.9 percent is 4.3 percentage points higher than the June reading of 55.6 percent.

...

The Employment Index (49.1 percent) contracted for the second consecutive month ...

emphasis added

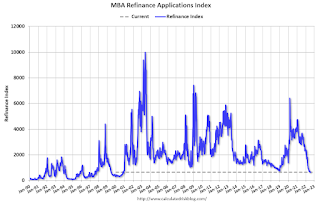

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 8/03/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

— Mortgage applications increased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 29, 2022.

... The Refinance Index increased 2 percent from the previous week and was 82 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 16 percent lower than the same week one year ago.

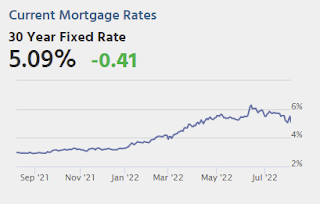

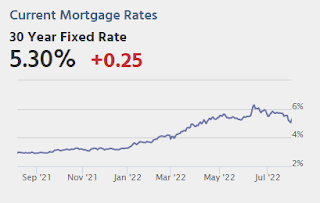

“Mortgage rates declined last week following another announcement of tighter monetary policy from the Federal Reserve, with the likelihood of more rate hikes to come. Treasury yields dropped as a result, as investors continue to expect a weaker macroeconomic environment in the coming months. The 30-year fixed rate saw the largest weekly decline since 2020, falling 31 basis points to 5.43 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The drop in rates led to increases in both refinance and purchase applications, but compared to a year ago, activity is still depressed. Lower mortgage rates, combined with signs of more inventory coming to the market, could lead to a rebound in purchase activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 5.43 percent from 5.74 percent, with points increasing to 0.65 from 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, August 02, 2022

Wednesday: ISM Services

by Calculated Risk on 8/02/2022 11:56:00 PM

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, the ISM Services Index for July. The consensus is for a reading of 53.5, down from 55.3.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 114,021 | 127,727 | ≤5,0001 | |

| Hospitalized2 | 36,835 | 37,034 | ≤3,0001 | |

| Deaths per Day2 | 357 | 415 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

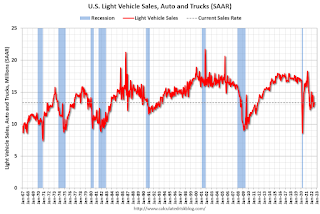

Vehicles Sales Increased to 13.35 million SAAR in July

by Calculated Risk on 8/02/2022 07:45:00 PM

Wards Auto released their estimate of light vehicle sales for July. Wards Auto estimates sales of 13.35 million SAAR in July 2022 (Seasonally Adjusted Annual Rate), up 2.7% from the June sales rate, and down 9.0% from July 2021.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for July (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.