by Calculated Risk on 8/11/2022 03:59:00 PM

Thursday, August 11, 2022

Hotels: Occupancy Rate Down 5.7% Compared to Same Week in 2019

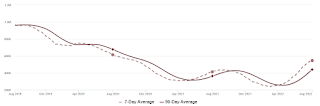

Following seasonal patterns, U.S. hotel performance fell slightly from the previous week, according to STR‘s latest data through Aug. 6.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

July 31 through Aug. 6, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 69.9% (-5.7%)

• Average daily rate (ADR): $154.48 (+15.1%)

• Revenue per available room (RevPAR): $108.04 (+8.5%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Current State of the Housing Market

by Calculated Risk on 8/11/2022 12:33:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Current State of the Housing Market

A brief excerpt:

This is a market overview for mid-August.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

The early local market reports for July show inventory up over 46% YoY for these markets! These same markets were up 20% YoY in May, so the NAR report for July will show further increases in inventory.

It is important to realize inventory is both increasing and still very low. Here is a graph from Realtor.com’s July Housing Trends Report. This shows their estimate of active inventory over the last six years. Currently inventory is rising, but still far below normal.

Since inventory was declining rapidly for most of 2020, and it is very likely that inventory will be up in August or September compared to 2020.

...

We are seeing a sharp slowdown in the housing market, with more price reductions, more inventory, and fewer sales. It will take some time to see the impact on house price growth, but that is coming too. However, inventory growth has slowed recently, and inventory is key for predicting house prices.

Next week, existing home sales will likely show a sharp year-over-year decline in sales for July - with sales below 5 million SAAR for the first time since the first few months of the pandemic. Housing starts will probably show further declines (and still a record number of homes under construction).

It is important to remember that housing is a key transmission mechanism for Federal Open Market Committee (FOMC) policy. As long as inflation remains elevated, the Fed will keep raising rates - and that will impact the housing market (although mortgage rates have already jumped in anticipation of the FOMC actions).

MBA: "Mortgage Delinquencies Decrease in the Second Quarter of 2022"

by Calculated Risk on 8/11/2022 10:45:00 AM

From the MBA: Mortgage Delinquencies Decrease in the Second Quarter of 2022

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.64 percent of all loans outstanding at the end of the second quarter of 2022, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate was down 47 basis points from the first quarter of 2022 and down 183 basis points from one year ago.

“At 3.64 percent, the mortgage delinquency rate in the second quarter fell to its lowest level since MBA’s survey began in 1979 – even beating out the previous pre-pandemic, survey low of 3.77 percent in the fourth quarter of 2019,” said Marina Walsh, MBA’s Vice President of Industry Analysis. “Most of the improvement across all product types – FHA, VA, and conventional loans - resulted from a decline in the loans that were 90 days or more delinquent but not in the foreclosure process.”

According to Walsh, of all the economic indicators that can lead to mortgage delinquencies, the U.S. unemployment rate seems to be the best gauge of loan performance. Despite inflationary pressures, stock market volatility, increases in mortgage rates, and two quarters of economic contraction – often defined as a recession – the job market remains incredibly strong. The unemployment rate was 3.5 percent in July – a half-century low that tracks closely with the record-low mortgage delinquency rate.

Added Walsh, “Foreclosure inventory levels and foreclosure starts remain well below historical averages for the survey – a strong indication that servicers are able to help delinquent borrowers find alternatives to foreclosure. Such alternatives include curing, loan workouts, home sales - with possible equity to spare, or cash-for-keys and deed-in-lieu options.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q2 to a record low.

From the MBA:

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding to 3.64 percent, the lowest level in the history of the survey dating back to 1979. By stage, the 30-day delinquency rate increased 7 basis points to 1.66 percent, the 60-day delinquency rate decreased 7 basis points to 0.49 percent, and the 90-day delinquency bucket decreased 47 basis points to 1.49 percent.This sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 0.59 percent, up 6 basis points from the first quarter of 2022 and 8 basis points higher than one year ago. The foreclosure inventory rate remains below the quarterly average of 1.43 percent dating back to 1979.

The percent of loans in the foreclosure process increased in Q2 with the end of the foreclosure moratoriums.

Weekly Initial Unemployment Claims increase to 262,000

by Calculated Risk on 8/11/2022 08:36:00 AM

The DOL reported:

In the week ending August 6, the advance figure for seasonally adjusted initial claims was 262,000, an increase of 14,000 from the previous week's revised level. The previous week's level was revised down by 12,000 from 260,000 to 248,000. The 4-week moving average was 252,000, an increase of 4,500 from the previous week's revised average. The previous week's average was revised down by 7,250 from 254,750 to 247,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 252,000.

The previous week was revised down.

Weekly claims were at the consensus forecast.

Wednesday, August 10, 2022

Thursday: Unemployment Claims, PPI

by Calculated Risk on 8/10/2022 08:27:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 263 thousand up from 260 thousand last week.

• Also at 8:30 AM, The Producer Price Index for July from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.4% increase in core PPI.

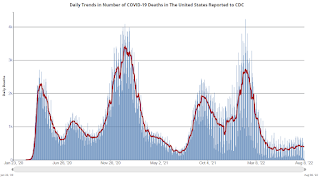

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 107,077 | 121,260 | ≤5,0001 | |

| Hospitalized2 | 36,663 | 37,632 | ≤3,0001 | |

| Deaths per Day2 | 395 | 422 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Homebuyers Hit Brakes in July, Sellers Hold Back

by Calculated Risk on 8/10/2022 01:15:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Homebuyers Hit Brakes in July, Sellers Hold Back

A brief excerpt:

The big story for July existing home sales is the sharp year-over-year (YoY) decline in sales. Another key story is that new listings are down YoY in July. Of course, active listings are up sharply.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3. Totals do not include Atlanta, Denver (included in state totals)

And here is a table for new listings in July. For these areas, new listings were down 8.6% YoY.

Last month, new listings in these markets were up 3.9% YoY. Overall, we aren’t seeing a pickup in new listings in these markets. In most markets, new listings are down YoY.

...

Much more to come!

Cleveland Fed: Median CPI increased 0.5% and Trimmed-mean CPI increased 0.4% in July

by Calculated Risk on 8/10/2022 11:13:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.5% in July. The 16% trimmed-mean Consumer Price Index increased 0.4% in July. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Motor Fuel" decreased at a 61% annualized rate in July!

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Early Look at 2023 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 8/10/2022 10:15:00 AM

The BLS reported this morning:

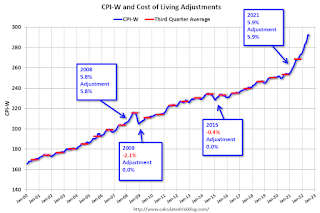

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 9.1 percent over the last 12 months to an index level of 292.219 (1982-84=100). For the month, the index declined 0.1 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2021, the Q3 average of CPI-W was 268.421.

The 2021 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 9.1% year-over-year in July, and although this is early - we need the data for July, August and September - my early guess is COLA will probably be around 8.5% to 9.0% this year, the largest increase since 11.2% in 1981 (and larger than the 7.4% increase in 1982).

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2021 yet, but wages probably increased again in 2021. If wages increased 4% in 2021, then the contribution base next year will increase to around $153,000 in 2023, from the current $147,000.

Remember - this is an early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

BLS: CPI Unchanged in July; Core CPI increased 0.3%

by Calculated Risk on 8/10/2022 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in July on a seasonally adjusted basis after rising 1.3 percent in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.5 percent before seasonal adjustment.The consensus was for 0.2% increase in CPI, and a 0.5% increase in core CPI. Both were below expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The gasoline index fell 7.7 percent in July and offset increases in the food and shelter indexes, resulting in the all items index being unchanged over the month. The energy index fell 4.6 percent over the month as the indexes for gasoline and natural gas declined, but the index for electricity increased. The food index continued to rise, increasing 1.1 percent over the month as the food at home index rose 1.3 percent.

The index for all items less food and energy rose 0.3 percent in July, a smaller increase than in April, May, or June. The indexes for shelter, medical care, motor vehicle insurance, household furnishings and operations, new vehicles, and recreation were among those that increased over the month. There were some indexes that declined in July, including those for airline fares, used cars and trucks, communication, and apparel.

The all items index increased 8.5 percent for the 12 months ending July, a smaller figure than the 9.1-percent increase for the period ending June. The all items less food and energy index rose 5.9 percent over the last 12 months. The energy index increased 32.9 percent for the 12 months ending July, a smaller increase than the 41.6-percent increase for the period ending June. The food index increased 10.9 percent over the last year, the largest 12-month increase since the period ending May 1979.

emphasis added

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 8/10/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 5, 2022.

... The Refinance Index increased 4 percent from the previous week and was 82 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 19 percent lower than the same week one year ago.

“Mortgage rates remained volatile last week – after drops in the previous two weeks, mortgage rates ended up rising four basis points. Mortgage applications were relatively flat, with a decline in purchase activity offset by an increase in refinance applications,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The purchase market continues to experience a slowdown, despite the strong job market. Activity has now fallen in five of the last six weeks, as buyers remain on the sidelines due to still-challenging affordability conditions and doubts about the strength of the economy.”

Added Kan, “Refinance applications increased over three percent but remained more than 80 percent lower than a year ago in this higher rate environment.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.47 percent from 5.43 percent, with points increasing to 0.80 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, August 09, 2022

Wednesday: CPI

by Calculated Risk on 8/09/2022 09:02:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for July from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.5% increase in core CPI. The consensus is for CPI to be up 8.8% year-over-year and core CPI to be up 6.1% YoY.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 107,515 | 122,190 | ≤5,0001 | |

| Hospitalized2 | 36,644 | 37,661 | ≤3,0001 | |

| Deaths per Day2 | 382 | 409 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

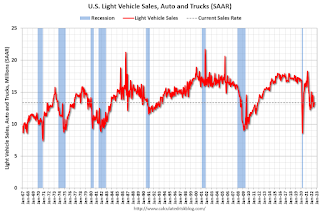

Vehicle Sales: Fleet Turnover Ratio and the Inflation Impact

by Calculated Risk on 8/09/2022 03:14:00 PM

Back in early 2009, I wrote a couple of posts arguing there would be an increase in auto sales - Vehicle Sales (Jan 2009) and Looking for the Sun (Feb 2009). This was an out-of-the-consensus call and helped me call the bottom for the US economy in mid-2009.

I wrote an update in 2014, and argued vehicle sales would "mostly move sideways" for the next few years.

Here is another update to the U.S. fleet turnover graph.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate through July 2022 - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age or the composition of the fleet). Note: the number of registered vehicles is estimated for 2021 and 2022.

The wild swings in 2009 were due to the "cash for clunkers" program.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The estimated ratio for July is close to 21 years - well above the normal level.

Note: in 2009, I argued the turnover ratio would "probably decline to 15 or so eventually" and that happened - and will likely happen again.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is current estimated sales rate.

The current sales rate is still low mostly due to pandemic related supply constraints.

The current sales rate is still low mostly due to pandemic related supply constraints.Light vehicle sales were at a 13.35 million seasonally adjusted annual rate (SAAR) in July.

I expect vehicle sales to increase over the next couple of years.

Leading Index for Commercial Real Estate increases in July

by Calculated Risk on 8/09/2022 11:32:00 AM

From Dodge Data Analytics: Dodge Momentum Index Moves Higher In July

The Dodge Momentum Index (DMI) increased 2.9% in July to 178.7 from the revised June figure of 173.6.

The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning. The index is shown to lead construction spending for nonresidential buildings by a full year. In July, the commercial component of the Momentum Index rose 5.5%, while the institutional component fell 2.0%.

Commercial planning in July was led by an increase in data center, office and warehouse projects, while fewer education and healthcare projects drove the institutional component lower. Compared to July 2021, the Momentum Index was 8%. The commercial component was 15% higher, while the institutional component was 3% lower than a year ago.July 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 178.7 in July, up from 173.6 in June.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggested a decline in Commercial Real Estate construction through most of 2021, but a solid pickup this year and into 2023.

1st Look at Local Housing Markets in July

by Calculated Risk on 8/09/2022 08:22:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in July

A brief excerpt:

This is the first look at local markets in July. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

We are seeing a significant change in inventory, but no pickup in new listings. Most of the increase in inventory so far has been due to softer demand - likely because of higher mortgage rates.

...

And a table of July sales. Sales in these areas were down 32.4% YoY, Not Seasonally Adjusted (NSA). Contracts for sales in July were mostly signed in May and June, and we are seeing the impact of higher mortgage rates on July closings.

Last month, these six markets were down 21.3% YoY NSA, so there appears to have been a significant further sales decline in July (this is just a few early markets).

Much more to come!

Monday, August 08, 2022

Housing Inventory Growth Has Slowed in Recent Weeks

by Calculated Risk on 8/08/2022 12:34:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Housing Inventory Growth Has Slowed in Recent Weeks

A brief excerpt:

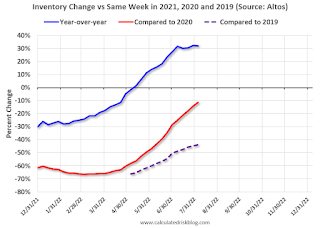

The third graph uses the Altos inventory data and shows the trend comparing to the same week in 2020 and 2019. The dotted red line is the recent trend compared to 2020 - and at the current pace, inventory will be up compared to 2020 in September. The dashed grey line is comparing to 2019, and based on the current trend, it is possible inventory will be back to 2019 levels in the first half of 2023. However, if inventory growth stalls, then it might take much longer to reach normal inventory levels.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

The current situation is very different from the post-bubble period. Following the housing bubble, many homeowners were forced to sell because they had little or no equity in their homes, and loans that they could no longer afford when teaser rates expired. This led to a huge surge in inventory starting in late 2005.

Now most homeowners have substantial equity, and fixed rate loans with low interest rates. This suggests there will be little forced selling, even if prices decline in some areas.

Some people will always need to sell due to death, divorce, moving for work, etc., and some speculators might be forced to sell, but it is unlikely we will see a huge surge in inventory like in late-2005.

I’ve been expecting inventory to return to 2019 levels in early 2023 with low demand and some normal levels of new listings. However, it is possible that it might take much longer to return to more normal inventory levels - inventory will tell the tale!

August 8th Update: Housing Inventory Increases Slow

by Calculated Risk on 8/08/2022 08:49:00 AM

Inventory is still increasing, but the inventory build has slowed. Here are the same week inventory changes for the last four years:

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 11.2% according to Altos)

4. Inventory up compared to 2019 (currently down 43.7%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 8/08/2022 08:13:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices.

The TSA is providing daily travel numbers.

This data is as of August 7th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 11.0% from the same day in 2019 (89.0% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $151 million last week, down about 40% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through July 30th. The occupancy rate was down 3.8% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of July 29th, gasoline supplied was down 10.6% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

Sunday, August 07, 2022

Sunday Night Futures

by Calculated Risk on 8/07/2022 08:01:00 PM

Weekend:

• Schedule for Week of August 7, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 11 and DOW futures are down 70 (fair value).

Oil prices were down over the last week with WTI futures at $89.01 per barrel and Brent at $94.92 per barrel. A year ago, WTI was at $68, and Brent was at $71 - so WTI oil prices are up 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.03 per gallon. A year ago, prices were at $3.16 per gallon, so gasoline prices are up $0.87 per gallon year-over-year.

AAR: July Rail Carloads Up Slightly Year-over-year, Intermodal Down

by Calculated Risk on 8/07/2022 08:11:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Rail traffic in July was evenly balanced between commodities with carload gains and those with declines. As such, it doesn’t provide definitive evidence regarding the state of the overall economy. Moreover, the traffic category historically most highly correlated with GDP is “industrial products,” a combination of seven other categories. Carloads of industrial products have fallen for four straight months, but the declines have all been extremely small.

emphasis added

Click on graph for larger image.

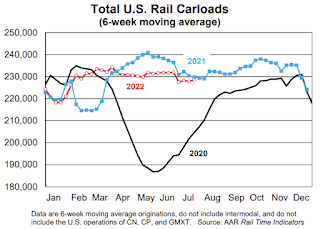

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

In July 2022, U.S. railroads originated 906,903 total carloads — up 0.2% (2,213 carloads) over July 2021. The year-over-year gain was not large, but it was the first gain of any size in four months. Intermodal is not included in carload totals.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):U.S railroads also originated 1.03 million intermodal containers and trailers in July 2022, down 3.0% (32,094 units) from last year. July marked the 11th decline in the past 12 months, but it’s also the smallest percentage decline in those 11 months.

Saturday, August 06, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 8/06/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Cancellations increased Sharply in Q2

• Denver Real Estate in July: Sales Off 31.6% YoY, Inventory Up 81.5%

• How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2023?

• Will 5% Mortgage Rates Cushion the Housing Market?

• Black Knight Mortgage Monitor: "Record-Setting Slowdown in Home Price Growth

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/