by Calculated Risk on 8/22/2022 09:18:00 AM

Monday, August 22, 2022

Housing Inventory August 22nd Update: Growth has Slowed

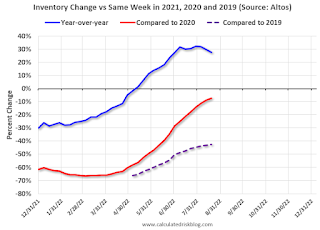

Inventory is still increasing, but the inventory build has slowed over the last month. Still, inventory is increasing faster than in 2019 at this time of year. Here are the same week inventory changes for the last four years:

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 7.1% according to Altos)

4. Inventory up compared to 2019 (currently down 42.6%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 8/22/2022 08:25:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices.

The TSA is providing daily travel numbers.

This data is as of August 21st.

Click on graph for larger image.

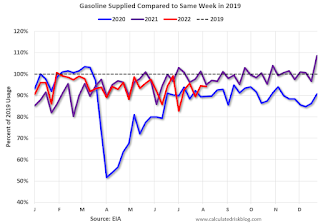

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 9.1% from the same day in 2019 (90.9% of 2019). (Dashed line)

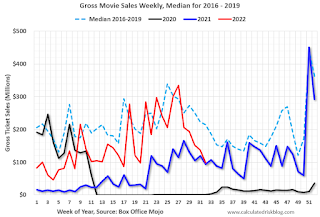

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $99 million last week, down about 54% from the median for the week.

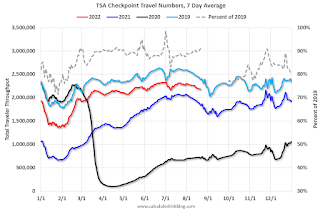

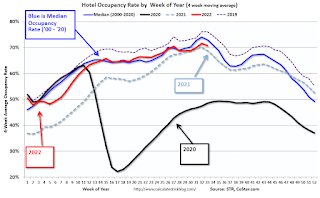

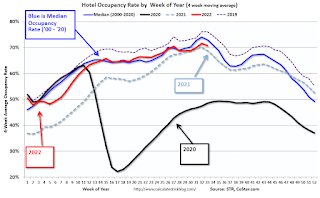

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through August 13th. The occupancy rate was down 4.6% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of August 12th, gasoline supplied was down 5.9% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 and 2021 levels.

Sunday, August 21, 2022

Sunday Night Futures

by Calculated Risk on 8/21/2022 07:03:00 PM

Weekend:

• Schedule for Week of August 21, 2022

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for July. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 11 and DOW futures are down 63 (fair value).

Oil prices were down over the last week with WTI futures at $89.62 per barrel and Brent at $95.60 per barrel. A year ago, WTI was at $62, and Brent was at $66 - so WTI oil prices are up 45% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.86 per gallon. A year ago, prices were at $3.14 per gallon, so gasoline prices are up $0.72 per gallon year-over-year.

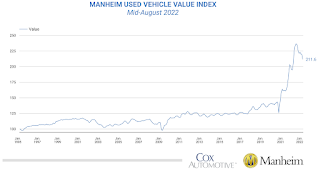

Used Vehicle Wholesale Prices Decreased 3.6% in First Half of August; Goldman Sees Sharp Decline in User Car PCE Inflation

by Calculated Risk on 8/21/2022 11:01:00 AM

First, from Goldman Sachs economists:

One wildcard for the core goods outlook is used car prices—particularly after the 3.6% drop in Manheim used car auction prices in the first half of August (mom sa). Coupled with the July rebound in auto production to late 2020 levels, we now expect used car PCE inflation to fall from +4% in June to -11% year-on-year in DecemberFrom Manheim Consulting: Wholesale Used-Vehicle Prices Decline in First Half of August

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 3.6% from July in the first 15 days of August. The Manheim Used Vehicle Value Index fell to 211.6, which was up 8.8% from August 2021. The non-adjusted price change in the first half of August was a decline of 2.0% compared to July, leaving the unadjusted average price up 6.6% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Saturday, August 20, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 8/20/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• July Housing Starts: Units Under Construction Declined Slightly

• NAR: Existing-Home Sales Decreased to 4.81 million SAAR in July

• 4th Look at Local Housing Markets in July, California Sales off 31%, July Forecast

• Slowdown in Showings Suggests a Further Decline in Existing Home Sales in August

• 3rd Look at Local Housing Markets in July, Sales Down Sharply

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of August 21, 2022

by Calculated Risk on 8/20/2022 08:11:00 AM

The key reports this week are the second estimate of Q2 GDP, July New Home sales, and Personal Income and Outlays for July.

For manufacturing, the August Richmond and Kansas City Fed surveys will be released.

Fed Chair Jerome Powell will speak on the "Economic Outlook" at the Jackson Hole Symposium on Friday.

The BLS will release the preliminary employment benchmark revision on Wednesday.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

10:00 AM: New Home Sales for July from the Census Bureau.

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 575 thousand SAAR, down from 590 thousand in June.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for July. The consensus is for a 3.8% decrease in the index.

10:00 AM: the Bureau of Labor Statistics (BLS) will release the 2022 Preliminary Benchmark Revision to Establishment Survey Data.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

8:30 AM: Gross Domestic Product, 2nd quarter 2022 (second estimate). The consensus is that real GDP decreased 0.8% annualized in Q2, up from the advance estimate of -0.9% in Q2.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 253 thousand from 250 thousand last week.

11:00 AM: the Kansas City Fed manufacturing survey for August.

8:30 AM ET: Personal Income and Outlays, July 2022. The consensus is for a 0.6% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 6.4% YoY, and core PCE prices up 4.7% YoY.

10:00 AM: Speech, Fed Chair Jerome Powell, Economic Outlook, At the Jackson Hole Economic Policy Symposium

10:00 AM: University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 55.1.

Friday, August 19, 2022

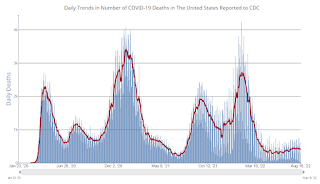

COVID August 19, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 8/19/2022 09:03:00 PM

On COVID (focus on hospitalizations and deaths):

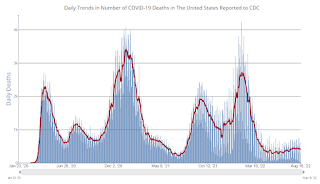

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 93,741 | 105,118 | ≤5,0001 | |

| Hospitalized2 | 34,740 | 36,762 | ≤3,0001 | |

| Deaths per Day2 | 392 | 443 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Realtor.com Reports Weekly Inventory Up 27% Year-over-year; New Listings Down 15%

by Calculated Risk on 8/19/2022 02:20:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released yesterday from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Aug 13, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, but the pace slipped to 27% above one year ago. The rate of improvement actually slipped again this week as the number of new listings continues to come in lower

...

• New listings–a measure of sellers putting homes up for sale–were again down 15% from one year ago. This week marks a sixth straight week of year over year declines in the number of new listings coming up for sale, suggesting that homeowners are less eager to list homes for sale compared to last year even though today’s median listing price is more than 13% higher.

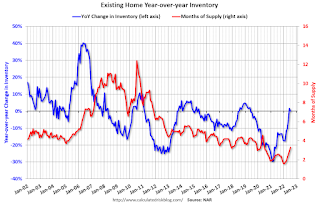

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

Slowdown in Showings Suggests a Further Decline in Existing Home Sales in August

by Calculated Risk on 8/19/2022 11:30:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Slowdown in Showings Suggests a Further Decline in Existing Home Sales in August

A brief excerpt:

The following data is courtesy of David Arbit, Director of Research at the Minneapolis Area REALTORS® and NorthstarMLS (posted with permission). Here is a link to their data.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows the 7-day average showings for the Twin Cities area for 2019, 2020, 2021, and 2022. The 7-day average showings (red) are currently off 22% from 2019.

...

Click on graph for larger image.

In the existing home sales report for July released yesterday, closed sales, not seasonally adjusted (NSA) were down 22.4% year-over-year. July sales were mostly for contracts signed in May and June. May showings were only down about 13% year-over-year.

This slowdown in showings suggests further declines in closed sales in August - since August sales will be mostly for contracts signed in June and July when showings were down sharply. This early data for August might suggest that September closed sales will see a similar year-over-year decline as in August.

Q3 GDP Forecasts: Around 1%

by Calculated Risk on 8/19/2022 09:45:00 AM

From BofA:

Data this week have been a positive for GDP tracking in 2Q and 3Q. We took our 2Q GDP tracking up to -0.3% q/q saar from -0.9% owing to a strong upward revision to May retail sales. ... Meanwhile, we initiated our 3Q GDP tracking at 0.5% q/q saar [August 19 estimate]From Goldman:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +1.3% (qoq ar). [August 18 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 1.6 percent on August 17, down from 1.8 percent on August 16. [August 17 estimate]

LA Port Traffic: Mostly Steady in July

by Calculated Risk on 8/19/2022 08:31:00 AM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

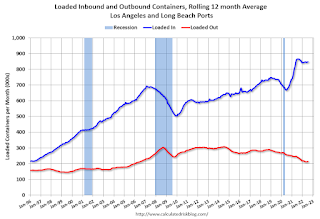

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic increased 0.5% in July compared to the rolling 12 months ending in June. Outbound traffic was increased 0.1% compared to the rolling 12 months ending the previous month.

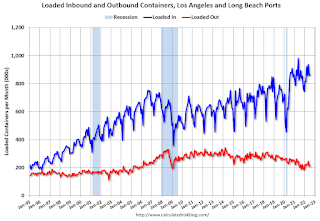

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Thursday, August 18, 2022

Hotels: Occupancy Rate Down 4.6% Compared to Same Week in 2019

by Calculated Risk on 8/18/2022 02:50:00 PM

Showing continued alignment with seasonal patterns, U.S. hotel performance fell slightly from the previous week, but showed improved comparisons with 2019, according to STR‘s latest data through Aug. 13.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Aug. 7-13, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 68.5% (-4.6%)

• Average daily rate (ADR): $152.34 (+15.8%)

• Revenue per available room (RevPAR): $104.30 (+10.5%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

More Analysis on July Existing Home Sales

by Calculated Risk on 8/18/2022 10:46:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.81 million SAAR in July

Excerpt:

ales in July (4.81 million SAAR) were down 5.9% from the previous month and were 20.2% below the July 2021 sales rate. Sales are now below pre-pandemic levels and, excluding the pandemic decline, sales are the lowest level since 2014.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

...

The third graph shows existing home sales for each month, Not Seasonally Adjusted (NSA), for a few selected periods. Black and light Purple are the maximum sales per month during the bubble (2005) and the minimum sales during the bust (2008 - 2011). The most recent four years are shown (2019 through 2022).

Sales NSA in July (453,000) were 22.4% below sales in July 2021 (584,000). Sales NSA year-to-date are down 10.3% compared to the same period in 2021.

This decrease, NSA, was similar to change in the markets I track each month.

...

Key point on Timing of Sales

Existing home sales are reported when the transaction closes. Sales in July were mostly for contracts signed in June and July. Recent data shows a significant slowdown in activity starting in May and decelerating further in June.

My sense is contracts for sales really declined in June, and that will show up as closed sales in July and August - so we should expect a further decline in existing home sales next month.

NAR: Existing-Home Sales Decreased to 4.81 million SAAR in July

by Calculated Risk on 8/18/2022 10:12:00 AM

From the NAR: Existing-Home Sales Retreated 5.9% in July

Existing-home sales sagged for the sixth straight month in July, according to the National Association of REALTORS®. All four major U.S. regions recorded month-over-month and year-over-year sales declines.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, slipped 5.9% from June to a seasonally adjusted annual rate of 4.81 million in July. Year-over-year, sales fell 20.2% (6.03 million in July 2021).

...

Total housing inventory registered at the end of July was 1,310,000 units, an increase of 4.8% from June and unchanged from the previous year. Unsold inventory sits at a 3.3-month supply at the current sales pace, up from 2.9 months in June and 2.6 months in July 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July (4.81 million SAAR) were down 5.9% from the previous month and were 20.2% below the July 2021 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.31 million in July from 1.25 million in June.

According to the NAR, inventory increased to 1.31 million in July from 1.25 million in June.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was unchanged year-over-year (blue) in July compared to July 2021.

Inventory was unchanged year-over-year (blue) in July compared to July 2021. Months of supply (red) increased to 3.3 months in July from 2.9 months in June.

This was below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims decrease to 250,000

by Calculated Risk on 8/18/2022 08:34:00 AM

The DOL reported:

In the week ending August 13, the advance figure for seasonally adjusted initial claims was 250,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised down by 10,000 from 262,000 to 252,000. The 4-week moving average was 246,750, a decrease of 2,750 from the previous week's revised average. The previous week's average was revised down by 2,500 from 252,000 to 249,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 246,750.

The previous week was revised down.

Weekly claims were below the consensus forecast.

Wednesday, August 17, 2022

Thursday: Unemployment Claims, Philly Fed Mfg, Existing Home Sales

by Calculated Risk on 8/17/2022 09:02:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 265 thousand up from 262 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for August. The consensus is for a reading of -5.0, up from -12.3.

• At 10:00 AM, Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 4.88 million SAAR, down from 5.12 million last month.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 98,940 | 107,899 | ≤5,0001 | |

| Hospitalized2 | 35,139 | 37,092 | ≤3,0001 | |

| Deaths per Day2 | 398 | 426 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

FOMC Minutes "Participants anticipated that this slowdown in housing activity would continue"

by Calculated Risk on 8/17/2022 02:10:00 PM

From the Fed: Minutes of the Federal Open Market Committee, July 26-27, 2022. Excerpt on housing and policy:

Participants also observed that housing activity had weakened notably, reflecting the impact of higher mortgage interest rates and house prices on home affordability. Participants anticipated that this slowdown in housing activity would continue and also expected higher borrowing costs to lead to a slowing in other interest-sensitive household expenditures, such as purchases of durable goods.

...

In their assessment of the policy outlook, market participants expected significant policy tightening in coming meetings as the Committee continued to respond to the current elevated level of inflation. Nearly all respondents to the Desk survey anticipated a 75 basis point increase in the target range at the current meeting, and most expected a 50 basis point increase in September to follow.

emphasis added

4th Look at Local Housing Markets in July, California Sales off 31%, July Forecast

by Calculated Risk on 8/17/2022 12:45:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in July, California Sales off 31%, July Forecast

A brief excerpt:

California Home Sales Down 31% in July, Prices DeclineThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 295,460 in July, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. … July’s sales pace was down 14.4 percent on a monthly basis from 344,970 in June and down 31.1 percent from a year ago, when 428,980 homes were sold on an annualized basis. July marked the fourth consecutive monthly decline and the 13th straight annual decline....

...

California’s median home price declined 3.5 percent in July to $833,910 from the $863,790 recorded in June. The July price was 2.8 percent higher than the $811,170 recorded last July and was the smallest year-over-year price gain in more than two years.

And a table of July sales. Sales in these areas were down 24.3% YoY, Not Seasonally Adjusted (NSA). Contracts for sales in July were mostly signed in May and June, and we are seeing the impact of higher mortgage rates on July closings.

Last month, all local markets I track were down 15.9% YoY, NSA. This appears to be another step down in sales, although there was one less selling day in July this year than in July 2021.

...

More local markets to come!

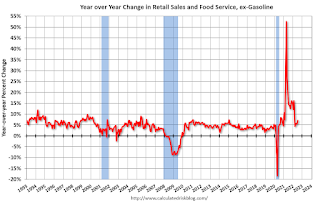

Retail Sales "Unchanged" in July

by Calculated Risk on 8/17/2022 08:39:00 AM

On a monthly basis, retail sales were unchanged from June to July (seasonally adjusted), and sales were up 10.3 percent from July 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for July 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $682.8 billion, virtually unchanged from the previous month, but 10.3 percent above July 2021. ... The May 2022 to June 2022 percent change was revised from up 1.0 percent to up 0.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.2% in July.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 7.1% on a YoY basis.

Sales in July were slightly below expectations, and sales in May and June were revised down, combined.

Sales in July were slightly below expectations, and sales in May and June were revised down, combined.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/17/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 12, 2022.

... The Refinance Index decreased 5 percent from the previous week and was 82 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 18 percent lower than the same week one year ago.

“Mortgage application activity was lower last week, with overall applications declining over two percent to their lowest level since 2000. Home purchase applications continued to be held down by rapidly drying up demand, as high mortgage rates, challenging affordability, and a gloomier outlook of the economy kept buyers on the sidelines,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “However, if home price growth slows more significantly and mortgage rates move lower, we might see some purchase activity return later in the year. The 30-year fixed rate stayed more than two percentage points higher than a year ago at 5.45 percent but was down over 50 basis points from the June 2020 high of 5.98 percent, providing some relief for buyers in the market. The refinance index, however, fell five percent to its lowest level since November 2000, driven by a six percent drop in conventional refinance applications.”

Added Kan, “Refinance applications increased over three percent but remained more than 80 percent lower than a year ago in this higher rate environment.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 5.45 percent from 5.47 percent, with points decreasing to 0.57 from 0.80 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).