by Calculated Risk on 8/26/2022 08:36:00 AM

Friday, August 26, 2022

Personal Income increased 0.2% in July; Spending increased 0.1%

The BEA released the Personal Income and Outlays report for July:

Personal income increased $47.0 billion (0.2 percent) in July, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $37.6 billion (0.2 percent) and personal consumption expenditures (PCE) increased $23.7 billion (0.1 percent).The July PCE price index increased 6.3 percent year-over-year (YoY), down from 6.8 percent YoY in June.

The PCE price index decreased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent. Real DPI increased 0.3 percent in July and real PCE increased 0.2 percent; goods increased 0.2 percent and services increased 0.2 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through July 2022 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income and PCE were below expectations.

Thursday, August 25, 2022

Friday: Personal Income & Outlays, Fed Chair Powell

by Calculated Risk on 8/25/2022 09:08:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, July 2022. The consensus is for a 0.6% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 6.4% YoY, and core PCE prices up 4.7% YoY.

• At 10:00 AM, Speech, Fed Chair Jerome Powell, Economic Outlook, At the Jackson Hole Economic Policy Symposium

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 55.1.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 90,675 | 97,183 | ≤5,0001 | |

| Hospitalized2 | 32,903 | 35,314 | ≤3,0001 | |

| Deaths per Day2 | 389 | 441 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Freddie Mac: Mortgage Serious Delinquency Rate decreased in July

by Calculated Risk on 8/25/2022 07:31:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in July was 0.73%, down from 0.76% June. Freddie's rate is down year-over-year from 1.74% in July 2021.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

The Sellers Strike and Housing Inventory

by Calculated Risk on 8/25/2022 01:12:00 PM

Today, in the Calculated Risk Real Estate Newsletter: The Sellers Strike and Housing Inventory

A brief excerpt:

Starting in July, new listings declined year-over-year according to my local market data, and also Realtor.com and Redfin. Realtor.com economist Jiayi Xu noted today:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/New listings–a measure of sellers putting homes up for sale–were again down 12% from one year ago. This week marks a seventh straight week of year over year declines in the number of new listings coming up for sale and a second consecutive week with double digit declines, suggesting that homeowners are less eager to list homes for sale compared to last year, even though today’s median listing price is more than 14% higher.And from Redfin: Housing Market Update: Slowdown Starts to Ease as Drop in New Listings Hampers Supply

emphasis added

...

The bottom line is inventory is still increasing due to less demand, but inventory growth has slowed due to fewer new listings.

This could delay the return to more normal inventory levels (I’ve been comparing to 2019). As always, I’ll be watching inventory closely.

August Vehicle Sales Forecast: Unchanged at 13.3 million SAAR

by Calculated Risk on 8/25/2022 10:37:00 AM

From WardsAuto: August U.S. Light-Vehicle Sales Running Flat with July; Inventory Set to Increase (pay content). Brief excerpt:

"The overriding factor is that even without headwinds such as higher interest rates, low consumer confidence, elevated fuel prices and an inventory mix favoring more expensive models, the general lack of availability of new vehicles would keep sales from being significantly stronger."

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for August (Red).

The Wards forecast of 13.3 million SAAR, would be mostly unchanged from last month, and up 2% from a year ago (sales started to weaken in mid-2021, due to supply chain issues).

Q2 GDP Growth Revised Up to minus 0.6% Annual Rate

by Calculated Risk on 8/25/2022 08:41:00 AM

From the BEA: Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), Second Quarter 2022

Real gross domestic product (GDP) decreased at an annual rate of 0.6 percent in the second quarter of 2022, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 1.6 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 1.0% to 1.5%. Residential investment was revised down from -14.0% to -16.2%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the decrease in real GDP was 0.9 percent. The update primarily reflects upward revisions to consumer spending and private inventory investment that were partly offset by a downward revision to residential fixed investment

...

Real gross domestic income (GDI) increased 1.4 percent in the second quarter, compared with an increase of 1.8 percent in the first quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 0.4 percent in the second quarter, compared with an increase of 0.1 percent in the first quarter.

emphasis added

Weekly Initial Unemployment Claims decrease to 243,000

by Calculated Risk on 8/25/2022 08:34:00 AM

The DOL reported:

In the week ending August 20, the advance figure for seasonally adjusted initial claims was 243,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised down by 5,000 from 250,000 to 245,000. The 4-week moving average was 247,000, an increase of 1,500 from the previous week's revised average. The previous week's average was revised down by 1,250 from 246,750 to 245,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 247,000.

The previous week was revised down.

Weekly claims were below the consensus forecast.

Wednesday, August 24, 2022

Thursday: GDP, Unemployment Claims

by Calculated Risk on 8/24/2022 08:58:00 PM

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2022 (second estimate). The consensus is that real GDP decreased 0.8% annualized in Q2, up from the advance estimate of -0.9% in Q2.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for an increase to 253 thousand from 250 thousand last week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

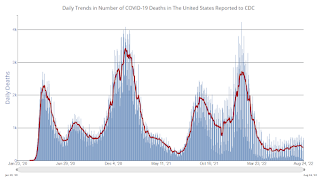

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 89,698 | 99,736 | ≤5,0001 | |

| Hospitalized2 | 33,247 | 35,597 | ≤3,0001 | |

| Deaths per Day2 | 390 | 443 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Update: Housing Completions will Increase Sharply in Late 2022 and Early 2023

by Calculated Risk on 8/24/2022 01:22:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Update: Housing Completions will Increase Sharply in Late 2022 and Early 2023

A brief excerpt:

Even as housing starts slow, there will be a sharp increase in new supply in 2022 (and into 2023) including both single family homes and apartments.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows total housing completions and placements since 1968 with an estimate for 2022. Note that the net additional to the housing stock is less because of demolitions and destruction of older housing units.

My current estimate is total completions (single family, multi-family, manufactured homes) will increase about 10% in 2022 to almost 1.6 million. If correct, this would be the same level of completions as in 2007.

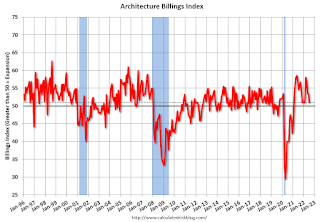

AIA: Architecture Billings Index "slows but remains healthy" in July

by Calculated Risk on 8/24/2022 12:42:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index slows but remains healthy

For the eighteenth consecutive month architecture firms reported increasing demand for design services in July, according to a new report today from The American Institute of Architects (AIA).

The AIA Architecture Billings Index (ABI) score for July was 51.0. While this score is down from June’s score of 53.2, it still indicates stable business conditions for architecture firms (any score above 50 indicates an increase in billings from the prior month). Also in July, both the new project inquiries and design contracts indexes moderated from June but remained strong with scores of 56.1 and 52.9 respectively.

“Despite architecture services employment recently surpassing pre-pandemic levels, the ABI score this month reflects the slowest growth since January, and marks the fourth straight month with a lower score than the previous month, indicating a slowing trajectory in billings activity,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “With a variety of economic storm clouds continuing to gather, we are likely looking at a period of slower growth going forward.”

...

• Regional averages: South (53.6); Midwest (52.2); West (51.7); Northeast (48.4)

• Sector index breakdown: multi-family residential (52.8); commercial/industrial (52.2); mixed practice (52.1); institutional (49.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.0 in July, down from 53.2 in June. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been positive for 18 consecutive months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a pickup in CRE investment in 2022 and into 2023.

Employment: Preliminary annual benchmark revision shows upward adjustment of 462,000 jobs

by Calculated Risk on 8/24/2022 10:10:00 AM

The BLS released the preliminary annual benchmark revision showing 462,000 more payroll jobs as of March 2022. The final revision will be published when the January 2023 employment report is released in February 2023. Usually, the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued in February 2023 with the publication of the January 2023 Employment Situation news release.Using the preliminary benchmark estimate, this means that payroll employment in March 2022 was 462,000 higher than originally estimated. In February 2023, the payroll numbers will be revised up to reflect the final estimate. The number is then "wedged back" to the previous revision (March 2021).

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For National CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus one-tenth of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates an upward adjustment to March 2022 total nonfarm employment of 462,000 (0.3 percent).

emphasis added

Construction was revised up by 62,000 jobs, and manufacturing revised up by 22,000 jobs.

This preliminary estimate showed 571,000 more private sector jobs, and 109,000 fewer government jobs (as of March 2022) than originally estimated.

NAR: Pending Home Sales Decreased 1.0% in July

by Calculated Risk on 8/24/2022 10:05:00 AM

From the NAR: Pending Home Sales Slipped 1.0% in July

Pending home sales declined for the second consecutive month in July, and for the eighth time in the last nine months, according to the National Association of REALTORS®. Three out of four major regions registered month-over-month decreases, though the West notched a minor gain. Year-over-year, all four regions saw double-digit percentage slides, the largest of which occurred in the West.This was less of a decline than expected for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, slid 1.0% to 89.8 in July. Year-over-year, pending transactions sank 19.9%. An index of 100 is equal to the level of contract activity in 2001.

"In terms of the current housing cycle, we may be at or close to the bottom in contract signings," said NAR Chief Economist Lawrence Yun. "This month's very modest decline reflects the recent retreat in mortgage rates. Inventories are growing for homes in the upper price ranges, but limited supply at lower price points is hindering transaction activity."

...

The Northeast PHSI dipped 1.9% from last month to 79.3, down 15.4% from July 2021. The Midwest index retracted 2.7% to 91.2 in July, a 13.4% decline from a year ago.

The South PHSI decreased 1.1% to 106.6 in July, a pullback of 20.0% from the previous year. The West index increased 2.2% in July to 70.0, down 30.1% from July 2021.

emphasis added

Black Knight: Mortgage Delinquency Rate increased in July

by Calculated Risk on 8/24/2022 08:36:00 AM

From Black Knight: lack Knight’s First Look: Foreclosure Starts Pull Back in July, Holding Well Below Pre-Pandemic Levels, While Early-Stage Delinquencies Edge Slightly Higher

• The national delinquency rate edged up to 2.89% in July – driven by a 4% increase in early-stage delinquencies – but remains just 14 basis points higher than the record low set in May of this yearAccording to Black Knight's First Look report, the percent of loans delinquent increased 1.9% in July compared to June and decreased 30% year-over-year.

• Serious delinquencies – loans 90 or more days past due, but not yet in active foreclosure – pulled back in July after worsening for the first time in 22 months in June

• The number of seriously delinquent loans curing to current has dropped steadily over recent months, from 104K in March to 58K in July, indicating that the easiest workouts have likely been completed

• Foreclosure starts retreated 25% from June for a total of 17.7K starts – some 55% below pre-pandemic levels for the month of July – equating to just 3% of 90+ day past-due loans

• Though still up from record lows that came from widespread moratoriums and forbearance protections last year, the number of loans in active foreclosure declined slightly by 6K in July

• Prepayment activity dropped by another 18% in July and is now down by 67% from the same time last year as rising rates put downward pressure on both purchase and refinance lending

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.89% in July, up from 2.84% in June.

The percent of loans in the foreclosure process decreased in July to 0.35%, from 0.36% in June.

The number of delinquent properties, but not in foreclosure, is down 663,000 properties year-over-year, and the number of properties in the foreclosure process is up 44,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| July 2022 | June 2022 | July 2021 | July 2020 | |

| Delinquent | 2.89% | 2.84% | 4.14% | 6.91% |

| In Foreclosure | 0.35% | 0.36% | 0.26% | 0.36% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,543,000 | 1,511,000 | 2,206,000 | 3,692,000 |

| Number of properties in foreclosure pre-sale inventory: | 184,000 | 190,000 | 140,000 | 190,000 |

| Total Properties | 1,728,000 | 1,700,000 | 2,346,000 | 3,881,000 |

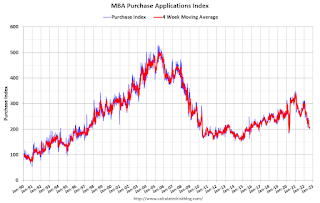

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/24/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 19, 2022.

... The Refinance Index decreased 3 percent from the previous week and was 83 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 21 percent lower than the same week one year ago.

“Mortgage applications continued to remain at a 22-year low, held down by significantly reduced refinancing demand and weak home purchase activity. Last week’s purchase results varied, with conventional applications declining 2 percent and government applications increasing 4 percent, which is potentially a sign of more first-time homebuyer activity. The average purchase loan size continued to trend lower, as purchase activity at the high end of the market is weakening,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Mortgage rates increased for all loan types last week, with the benchmark 30-year fixed rate jumping 20 basis points to 5.65 percent – the highest in nearly a month. The spread between conforming fixed-rate loans and ARM loans narrowed to 84 basis points from over 100 basis points the prior week. This movement made fixed rate loans relatively more attractive than ARMs, thereby reducing the ARM share further from highs seen earlier this year.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.65 percent from 5.45 percent, with points increasing to 0.68 from 0.57 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, August 23, 2022

Wednesday: Durable Goods, Pending Home Sales, Preliminary Employment Benchmark Revision

by Calculated Risk on 8/23/2022 08:56:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for July from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for July. The consensus is for a 3.8% decrease in the index.

• Also at 10:00 AM, the Bureau of Labor Statistics (BLS) will release the 2022 Preliminary Benchmark Revision to Establishment Survey Data.

• During the day, The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

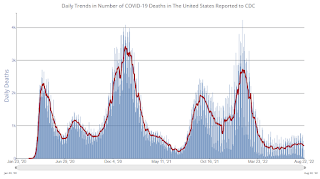

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 89,580 | 101,176 | ≤5,0001 | |

| Hospitalized2 | 33,379 | 35,761 | ≤3,0001 | |

| Deaths per Day2 | 387 | 443 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

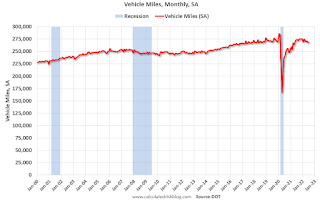

DOT: Vehicle Miles Driven Decreased year-over-year in June

by Calculated Risk on 8/23/2022 02:21:00 PM

This is something to watch with higher gasoline prices.

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by -1.7% (-4.8 billion vehicle miles) for June 2022 as compared with June 2021. Travel for the month is estimated to be 282.1 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for June 2022 is 268.0 billion miles, a -1.80% ( -4.8 billion vehicle miles) change over June 2021. It also represents a -1.0% change (-2.7 billion vehicle miles) compared with May 2022.

Cumulative Travel for 2022 changed by +2.8% (+43.2 billion vehicle miles). The cumulative estimate for the year is 1,587.1 billion vehicle miles of travel.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly total vehicle miles driven, seasonally adjusted.

Miles driven declined sharply in March 2020, and really collapsed in April 2020. After recovering, miles driven might have softened due to higher gasoline prices.

New Home Sales Decrease Sharply, Record Months of Unsold Inventory Under Construction

by Calculated Risk on 8/23/2022 10:48:00 AM

Today, in the Calculated Risk Real Estate Newsletter: https://calculatedrisk.substack.com/p/new-home-sales-decrease-sharply-record-02a

Brief excerpt:

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.You can subscribe at https://calculatedrisk.substack.com/.

There are 1.06 months of completed supply (red line). This is about two-thirds of the normal level.

The inventory of new homes under construction is at 7.33 months (blue line) - a new record and well above the normal level. This elevated level of homes under construction is due to supply chain constraints.

And a record 107 thousand homes have not been started - about 2.51 months of supply (grey line) - more than double the normal level. Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices and demand.

...

This suggests we will see a sharp increase in completed inventory over the next several months - and that will put pressure on new home prices.

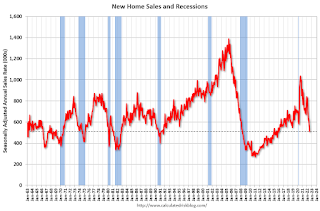

New Home Sales Decrease Sharply to 511,000 Annual Rate in July

by Calculated Risk on 8/23/2022 10:09:00 AM

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 511 thousand.

The previous three months were revised down slightly, combined.

Sales of new single‐family houses in July 2022 were at a seasonally adjusted annual rate of 511,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 12.6 percent below the revised June rate of 585,000 and is 29.6 percent below the July 2021 estimate of 726,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are now well below pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply increased in July to 10.9 months from 9.2 months in June.

The months of supply increased in July to 10.9 months from 9.2 months in June. The all-time record high was 12.1 months of supply in January 2009. The all-time record low was 3.5 months, most recently in October 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of July was 464,000. This represents a supply of 10.9 months at the current sales rate."

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2022 (red column), 42 thousand new homes were sold (NSA). Last year, 62 thousand homes were sold in July.

The all-time high for July was 117 thousand in 2005, and the all-time low for July was 26 thousand in 2010.

This was well below expectations, and sales in the three previous months were revised down slightly, combined. I'll have more later today.

Monday, August 22, 2022

Tuesday: New Home Sales, Richmond Fed Mfg

by Calculated Risk on 8/22/2022 08:36:00 PM

The average 30yr fixed rate is back in the upper 5% range with some lenders already in the low 6's. ... Rather than view the recent rate spike as the product of one or two individual events, it's better thought of as a general correction to the overly-aggressive drop in July [30 year fixed 5.72%]Tuesday:

emphasis added

• At 10:00 AM ET, New Home Sales for July from the Census Bureau. The consensus is for 575 thousand SAAR, down from 590 thousand in June.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for August.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 88,063 | 101,009 | ≤5,0001 | |

| Hospitalized2 | 30,764 | 36,029 | ≤3,0001 | |

| Deaths per Day2 | 390 | 443 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Final Look at Local Housing Markets in July

by Calculated Risk on 8/22/2022 12:32:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in July

A brief excerpt:

And a table of July sales. Sales in these areas were down 22.8% YoY, Not Seasonally Adjusted (NSA). Contracts for sales in July were mostly signed in May and June, and we are seeing the impact of higher mortgage rates on July closings.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

In June, all local markets I track were down 15.9% YoY, NSA. So, this was another step down in sales, although there was one less selling day in July this year than in July 2021. The NAR reported July sales down 22.4% YoY NSA, and down 20.2% Seasonally Adjusted (SA).

Looking ahead: In August 2022, there is one more selling day than in August 2021, so the SA decline in sales will be larger than the NSA decline.

Here is a table comparing the year-over-year Not Seasonally Adjusted (NSA) declines in sales this year from the National Association of Realtors® (NAR) with the local markets I track. So far, these measures have tracked closely.