by Calculated Risk on 9/03/2022 02:11:00 PM

Saturday, September 03, 2022

Real Estate Newsletter Articles this Week

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller National House Price Index "Decelerated" to 18.0% year-over-year increase in June

• Inflation Adjusted House Prices Declined in June

• Pace of Rent Increases Continues to Slow

• Will House Prices Decline Nationally?

• Active vs Total Existing Home Inventory

• 30-Year Mortgage Rates Pushing 6% Again

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of September 4, 2022

by Calculated Risk on 9/03/2022 08:11:00 AM

This will be a light week for economic data.

All US markets will be closed in observance of the Labor Day holiday.

8:00 AM ET: Corelogic House Price index for July

10:00 AM: the ISM Services Index for August. The consensus is for a reading of 55.5, down from 56.7.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be $70.5 billion in July, from $79.6 billion in June.

At 12:35 PM: Speech, Fed Vice Chair Brainard, Economic Outlook and Monetary Policy, At The Clearing House and Bank Policy Institute Annual Conference, New York, N.Y.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 240 thousand from 232 thousand last week.

9:10AM: Discussion, Fed Chair Powell, At the Cato Institute’s 40th Annual Monetary Conference

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

Friday, September 02, 2022

COVID Sept 2, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 9/02/2022 09:09:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 83,939 | 91,017 | ≤5,0001 | |

| Hospitalized2 | 31,020 | 33,091 | ≤3,0001 | |

| Deaths per Day2 | 407 | 422 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

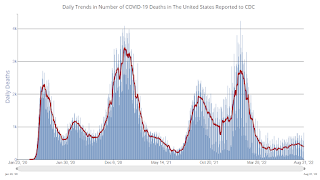

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Will House Prices Decline Nationally?

by Calculated Risk on 9/02/2022 02:35:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Will House Prices Decline Nationally?

Excerpt:

And yesterday, in an interview with Bilal Hafeez, Ivy Zelman, CEO of Zelman & Associates forecast national house price declines of 4% in 2023, and 5% in 2024: Ivy Zelman on the Coming US Housing Crisis (price discussion starts at around 20:00)There are some mortgage guard rails that could mitigate nationally a severe downturn, and yet the magnitude of the decline for us - the 4% that we are expecting in 2023, and 5% in 2024 -I feel like it is a starting point … the speed of the declines makes us feel like that maybe that could be conservative. But we could see double digit price corrections [in the] hot markets.There are some factors arguing against national price declines. ...

But there are also factors arguing for national price declines.

Q3 GDP Forecasts: Just Over 1%

by Calculated Risk on 9/02/2022 01:14:00 PM

From BofA:

Our 3Q US GDP tracking estimate rose to 1.3% q/q seasonally adjusted annualized rate (SAAR), up from from 0.5% q/q saar last wee [September 2nd estimate]From Goldman:

emphasis added

[D]ata on employment, auto sales, and factory orders caused our US 3Q GDP tracking estimate to fall by two-tenths, to 1.1% q/q saar, from 1.3% previously. [September 2nd estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.6 percent on September 1, up from 1.6 percent on August 26. [September 1st estimate]

Heavy Truck Sales Decline Slightly in August; Still Solid

by Calculated Risk on 9/02/2022 11:23:00 AM

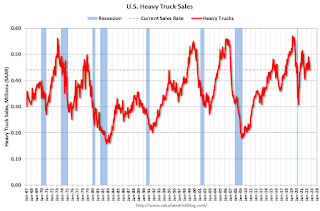

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the August 2022 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

Comments on August Employment Report

by Calculated Risk on 9/02/2022 09:16:00 AM

The headline jobs number in the August employment report was above expectations, however employment for the previous two months was revised down by 107,000, combined. The participation rate increased, pushing up the unemployment rate to 3.7%. And the employment-population ratio increased slightly.

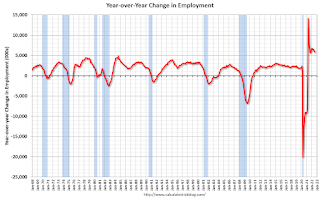

In August, the year-over-year employment change was 5.84 million jobs.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

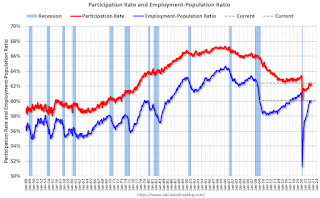

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate increased in August to 82.8% from 82.4% in July, and the 25 to 54 employment population ratio increased to 80.3% from 80.0% the previous month.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons was little changed at 4.1 million in August. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full- time jobs."The number of persons working part time for economic reasons increased in August to 4.149 million from 3.924 million in July. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.0% from 6.7% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure is at the same level as in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.137 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.067 million the previous month.

This is back to pre-pandemic levels.

Summary:

The headline monthly jobs number was above expectations; however, employment for the previous two months was revised down by 107,000, combined.

August Employment Report: 315 thousand Jobs, 3.7% Unemployment Rate

by Calculated Risk on 9/02/2022 08:43:00 AM

From the BLS:

Total nonfarm payroll employment increased by 315,000 in August, and the unemployment rate rose to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in professional and business services, health care, and retail trade.

...

The change in total nonfarm payroll employment for June was revised down by 105,000, from +398,000 to +293,000, and the change for July was revised down by 2,000, from +528,000 to +526,000. With these revisions, employment in June and July combined is 107,000 lower than previously reported.

emphasis added

Click on graph for larger image.

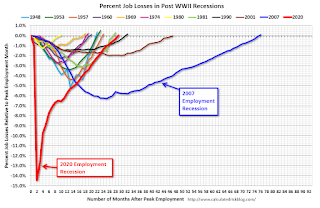

Click on graph for larger image.The first graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In August, the year-over-year change was 5.84 million jobs. Employment was up significantly year-over-year.

Total payrolls increased by 315 thousand in August. Private payrolls increased by 308 thousand, and public payrolls increased 7 thousand.

Payrolls for June and July were revised down 107 thousand, combined.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 62.4% in August, from 62.1% in July. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 62.4% in August, from 62.1% in July. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 60.1% from 60.0% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was increased in August to 3.7% from 3.5% in July.

This was above consensus expectations; however, June and July payrolls were revised down by 107,000 combined.

Thursday, September 01, 2022

Friday: Employment Report

by Calculated Risk on 9/01/2022 09:00:00 PM

Friday:

• At 8:30 AM ET, Employment Report for August. The consensus is for 280,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 85,761 | 91,773 | ≤5,0001 | |

| Hospitalized2 | 31,114 | 33,384 | ≤3,0001 | |

| Deaths per Day2 | 403 | 426 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Vehicles Sales Decreased to 13.18 million SAAR in August

by Calculated Risk on 9/01/2022 07:37:00 PM

Wards Auto released their estimate of light vehicle sales for August. Wards Auto estimates sales of 13.18 million SAAR in August 2022 (Seasonally Adjusted Annual Rate), down 1.1% from the July sales rate, and up 0.7% from August 2021.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for August (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Goldman August Payrolls Preview

by Calculated Risk on 9/01/2022 04:07:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose by 350k in August (mom sa) ... We estimate the unemployment rate edged down to 3.4% in August ...CR Note: The consensus is for 280 thousand jobs added, and for the unemployment rate to be unchanged at 3.5%.

emphasis added

August Employment Preview

by Calculated Risk on 9/01/2022 02:52:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for August. The consensus is for 280,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

Click on graph for larger image.

Click on graph for larger image.• First, as of July there 32 thousand more jobs than in February 2020 (the month before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms. As of July 2022, all of the jobs have returned.

This doesn't include the preliminary benchmark revision that showed there were 462 thousand more jobs than originally reported in March 2022.

• ADP Report: The ADP employment report showed 132,000 private sector jobs were added in September. This is the first release of ADP's new methodology, and this suggests a weaker than expected employment report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in August to 54.2%, up from 49.9% last month. This would suggest about 5,000 jobs added in manufacturing.

The ISM® services employment index has not yet been released.

• Unemployment Claims: The weekly claims report showed an increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 261,000 in July to 245,000 in August. This would usually suggest fewer layoffs in August than in July. In general, weekly claims were lower than expectations in August.

Active vs Total Existing Home Inventory

by Calculated Risk on 9/01/2022 11:54:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Active vs Total Existing Home Inventory

Excerpt:

Over a year ago, housing economist Tom Lawler noted the divergence in the change in total inventory vs the change in active inventory. He wrote:As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for many of the reports sent to the NAR (referred to as the “NAR Report!”), Since the middle of last Spring inventory measures excluding pending listings have fallen much more sharply than inventory measures including such listings, and this latter inventory measure understates the decline in the effective inventory of homes for sale over the last several months.This is important since it is active inventory that is the available inventory for buyers. ...

Today, Sabrina Speianu and Danielle Hale at Realtor.com released their monthly report for August. This report has graphs for both total inventory and active inventory. ...

And here is their data on active listings:Nationally, the inventory of homes actively for sale on a typical day in August increased by 26.6% over the past year. … However, driven by a decline in seller sentiment, the inventory growth rate in August was lower than July’s historical growth rate of 30.7%, which was the largest increase in inventory in the data history.... The bottom-line is active inventory is the key metric to follow.

Construction Spending Decreased 0.4% in July

by Calculated Risk on 9/01/2022 10:17:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during July 2022 was estimated at a seasonally adjusted annual rate of $1,777.3 billion, 0.4 percent below the revised June estimate of $1,784.3 billion. The July figure is 8.5 percent above the July 2021 estimate of $1,637.3 billion.Private spending decreased and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,424.2 billion, 0.8 percent below the revised June estimate of $1,436.4 billion. ...

In July, the estimated seasonally adjusted annual rate of public construction spending was $353.1 billion, 1.5 percent above the revised June estimate of $347.9 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 36% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential (blue) spending is 21% above the bubble era peak in January 2008 (nominal dollars).

Public construction spending is 8% above the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 14.1%. Non-residential spending is up 3.1% year-over-year. Public spending is up 3.3% year-over-year.

ISM® Manufacturing index Unchanged at 52.8% in August

by Calculated Risk on 9/01/2022 10:03:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 52.8% in August, unchanged from 52.8% in July. The employment index was at 54.2%, up from 49.9% last month, and the new orders index was at 51.3%, up from 48.0%.

From ISM: Manufacturing PMI® at 52.8% August 2022 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in August, with the overall economy achieving a 27th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing expanded at the same pace in August as in July. This was above the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The August Manufacturing PMI® registered 52.8 percent, the same reading as recorded in July. This figure indicates expansion in the overall economy for the 27th month in a row after contraction in April and May 2020. For a second straight month, the Manufacturing PMI® figure is the lowest since June 2020, when it registered 52.4 percent. The New Orders Index registered 51.3 percent, 3.3 percentage points higher than the 48 percent recorded in July. The Production Index reading of 50.4 percent is a 3.1-percentage point decrease compared to July’s figure of 53.5 percent. The Prices Index registered 52.5 percent, down 7.5 percentage points compared to the July figure of 60 percent; this is the index’s lowest reading since June 2020 (51.3 percent). The Backlog of Orders Index registered 53 percent, 1.7 percentage points above the July reading of 51.3 percent. After three straight months of contraction, the Employment Index expanded at 54.2 percent, 4.3 percentage points higher than the 49.9 percent recorded in July. The Supplier Deliveries Index reading of 55.1 percent is 0.1 percentage point lower than the July figure of 55.2 percent. The Inventories Index registered 53.1 percent, 4.2 percentage points lower than the July reading of 57.3 percent. The New Export Orders Index contracted at 49.4 percent, down 3.2 percentage points compared to July’s figure of 52.6 percent. The Imports Index remained in expansion territory at 52.5 percent, but 1.9 percentage points below the July reading of 54.4 percent.”

emphasis added

Weekly Initial Unemployment Claims decrease to 232,000

by Calculated Risk on 9/01/2022 08:38:00 AM

The DOL reported:

In the week ending August 27, the advance figure for seasonally adjusted initial claims was 232,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised down by 6,000 from 243,000 to 237,000. The 4-week moving average was 241,500, a decrease of 4,000 from the previous week's revised average. The previous week's average was revised down by 1,500 from 247,000 to 245,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 241,500.

The previous week was revised down.

Weekly claims were below the consensus forecast.

Wednesday, August 31, 2022

Thursday: Unemployment Claims, ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 8/31/2022 09:12:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 250 thousand from 243 thousand last week.

• At 10:00 AM, ISM Manufacturing Index for August. The consensus is for the ISM to be at 52,1, down from 52.8 in July.

• Also at 10:00 AM, Construction Spending for July. The consensus is for a 0.1% decrease in construction spending.

• Late, Light vehicle sales for August. The consensus is for light vehicle sales to be 13.6 million SAAR in August, up from 13.34 million in July (Seasonally Adjusted Annual Rate).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 88,286 | 90,064 | ≤5,0001 | |

| Hospitalized2 | 31,517 | 33,640 | ≤3,0001 | |

| Deaths per Day2 | 383 | 423 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in July

by Calculated Risk on 8/31/2022 04:10:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.76% in July from 0.81% in June. The serious delinquency rate is down from 1.94% in July 2021. This is almost back to pre-pandemic levels.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 2.60% are seriously delinquent (down from 2.75% in June).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

The pandemic related increase in delinquencies was very different from the increase in delinquencies following the housing bubble. Lending standards had been fairly solid over the previous decade, and most of these homeowners had equity in their homes - and the vast majority of these homeowners have been able to restructure their loans once they were employed.

Freddie Mac reported earlier.

Inflation Adjusted House Prices Declined in June

by Calculated Risk on 8/31/2022 11:13:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices Declined in June

Excerpt:

It has been over 16 years since the bubble peak. In the Case-Shiller release yesterday, the seasonally adjusted National Index (SA), was reported as being 66% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 16% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is about 7% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). As an example, if a house price was $200,000 in January 2000, the price would be almost $339,000 today adjusted for inflation (69.5% increase). That is why the second graph below is important - this shows "real" prices (adjusted for inflation). ...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices. In real terms, the National index is 14.6% above the bubble peak, and the Composite 20 index is 6.1% above the bubble peak in early 2006.

Note that real prices declined in June, with nominal prices increasing less than inflation.

ADP: Private Employment Increased 132,000 in August

by Calculated Risk on 8/31/2022 08:27:00 AM

Note: This is the first release of a new methodology. Historical data based on the new methodology is available.

From ADP: ADP National Employment Report: Private Sector Employment Increased by

132,000 Jobs in August; Annual Pay was Up 7.6%

Private sector employment increased by 132,000 jobs in August and annual pay was up 7.6% according to the August ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).The BLS report will be released Friday, and the consensus is for 280 thousand non-farm payroll jobs added in August.

The jobs report and pay insights use ADP’s fine-grained anonymized and aggregated payroll data of over 25 million U.S. employees to provide a representative picture of the labor market. The report details the current month’s total private employment change, and weekly job data from the previous month. ADP’s pay measure uniquely captures the earnings of a cohort of almost 10 million employees over a 12-month period.

“Our data suggests a shift toward a more conservative pace of hiring, possibly as companies try to decipher the economy's conflicting signals,” said Nela Richardson, chief economist, ADP. “We could be at an inflection point, from super-charged job gains to something more normal.”

emphasis added