by Calculated Risk on 9/08/2022 05:32:00 PM

Thursday, September 08, 2022

Leading Index for Commercial Real Estate "Dips" in August

From Dodge Data Analytics: Dodge Momentum Index Dips in August

The Dodge Momentum Index (DMI) ticked down by 1.2% in August to 171.9 from the revised July figure of 174.0.

The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year. In August, the commercial component of the Momentum Index rose 1%, while the institutional component fell 5.6%.

Commercial planning in August was led by an increase in hotel projects, while fewer healthcare projects drove the institutional component lower. Compared to August 2021, the Momentum Index was up 14%. The commercial component was 16% higher, and the institutional component was 10% higher than a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 171.9 in August, down from 174.0 in July.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a solid pickup in commercial real estate construction at the end of this year and into 2023.

FDIC: Problem Banks Unchanged, Residential REO Decreased Slightly in Q2 2022

by Calculated Risk on 9/08/2022 12:39:00 PM

The FDIC released the Quarterly Banking Profile for Q2 2022 this morning:

Quarterly net income totaled $64.4 billion in second quarter 2022, a reduction of $6.0 billion (8.5 percent) from the same quarter a year ago.

...

Loans and leases that are 30-89 days past due (past-due loan balances) increased from the year-ago quarter (up $11.4 billion, or 25.0 percent). Past-due consumer loans drove the increase from the year-ago quarter. The increase in past-due loan balances lifted the past due rate 6 basis points from the year-ago quarter to 0.48 percent. The past-due rate remained unchanged from the previous quarter, however, as loan growth outpaced the quarterly growth in past due loans. Despite the recent increase, the past-due rate remains below the pre-pandemic average of 0.66 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks was unchanged at 40.

The number of FDIC-insured institutions declined from 4,796 in first quarter 2022 to 4,771. In second quarter, 6 banks opened and 28 institutions merged with other FDIC-insured institutions. The number of banks on the FDIC’s “Problem Bank List” remained unchanged from first quarter at 40, the lowest level since QBP data collection began in 1984. Total assets of problem banks declined $2.7 billion to $170.4 billion. No banks failed in the second quarter.This graph from the FDIC shows the number of problem banks and assets at problem institutions.

Note: The number of assets for problem banks increased significantly back in 2018 when Deutsche Bank Trust Company Americas was added to the list. An even larger bank was added to the list last year, although the identity of the bank is unclear.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) decreased slightly from $788 million in Q1 2022 to $784 million in Q2 2022.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) decreased slightly from $788 million in Q1 2022 to $784 million in Q2 2022. This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

"Wholesale Used-Vehicle Prices Decline Substantially in August"

by Calculated Risk on 9/08/2022 10:41:00 AM

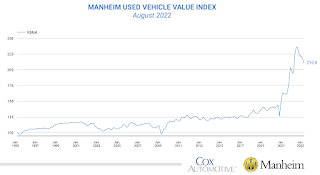

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decline Substantially in August

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 4.0% in August from July. The Manheim Used Vehicle Value Index declined to 210.8 but is up 8.4% from a year ago. The non-adjusted price change in August was a decline of 2.6% compared to July, leaving the unadjusted average price up 5.9% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Homebuilder Comments in August: Increased Incentives Helping Sales, "Construction cycle time has improved"

by Calculated Risk on 9/08/2022 09:17:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Homebuilder Comments in August: Increased Incentives Helping Sales

A brief excerpt:

Here are some interesting homebuilder comments from around the country. In August, builders have cut prices and increased incentives. And cycle times are improving with less demand.There many more comments in the article. You can subscribe at https://calculatedrisk.substack.com/

Homebuilder comments courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):

#Austin builder: “A lot of spec inventory to work through. August was a very poor month for sales across the board. Cancellations spiked from July and buyers showed no sense of urgency.”

#Baltimore builder: “Jumbo loan rates below 5% are helping buyers move forward in that segment.”

#Boise builder: “Construction cycle time has improved over the last 30 days.”

#Charlotte builder: “Sales were fairly strong in August. Increased incentives to help with closing costs and a buy down rate appear to be helping.”

#Cleveland builder: “Build cycle times have been improving over the last 4 or 5 months. Appointments have completely dropped off and traffic is very sparse at the models.”

Weekly Initial Unemployment Claims decrease to 222,000

by Calculated Risk on 9/08/2022 08:33:00 AM

The DOL reported:

In the week ending September 3, the advance figure for seasonally adjusted initial claims was 222,000, a decrease of 6,000 from the previous week's revised level. The previous week's level was revised down by 4,000 from 232,000 to 228,000. The 4-week moving average was 233,000, a decrease of 7,500 from the previous week's revised average. The previous week's average was revised down by 1,000 from 241,500 to 240,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 233,000.

The previous week was revised down.

Weekly claims were below the consensus forecast.

Wednesday, September 07, 2022

Thursday: Unemployment Claims, Fed Chair Powell

by Calculated Risk on 9/07/2022 08:56:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 240 thousand from 232 thousand last week.

• At 9:10 AM, Discussion, Fed Chair Powell, At the Cato Institute’s 40th Annual Monetary Conference

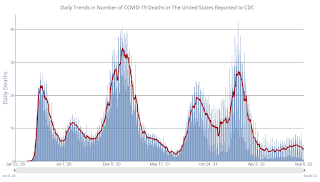

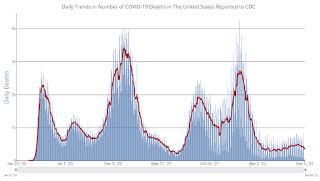

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 74,803 | 88,644 | ≤5,0001 | |

| Hospitalized2 | 29,491 | 31,842 | ≤3,0001 | |

| Deaths per Day2 | 336 | 414 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Fed's Beige Book: "Residential real estate conditions weakened noticeably as home sales fell in all twelve Districts"

by Calculated Risk on 9/07/2022 02:06:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of San Francisco based on information collected on or before August 29, 2022."

Economic activity was unchanged, on balance, since early July, with five Districts reporting slight to modest growth in activity and five others reporting slight to modest softening. Most Districts reported steady consumer spending as households continued to trade down and to shift spending away from discretionary goods and toward food and other essential items. Auto sales remained muted across most Districts, reflecting limited inventories and elevated prices. Hospitality and tourism contacts highlighted overall solid leisure travel activity with some reporting an uptick in business and group travel. Manufacturing activity grew in several Districts, although there were some reports of declining output as supply chain disruptions and labor shortages continued to hamper production. Despite some reports of strong leasing activity, residential real estate conditions weakened noticeably as home sales fell in all twelve Districts and residential construction remained constrained by input shortages. Commercial real estate activity softened, particularly demand for office space. Loan demand was mixed; while financial institutions reported generally strong demand for credit cards and commercial and industrial loans, residential loan demand was weak amid elevated mortgage interest rates. Nonfinancial services firms experienced stable to slightly higher demand. Demand for transportation services was mixed and reports on agriculture conditions across reporting Districts varied. While demand for energy products was robust, production remained constrained by supply chain bottlenecks for critical components. The outlook for future economic growth remained generally weak, with contacts noting expectations for further softening of demand over the next six to twelve months.

emphasis added

Black Knight Mortgage Monitor: "Total market leverage was just 42% of mortgaged homes’ values, the lowest on record"

by Calculated Risk on 9/07/2022 10:43:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: "Total market leverage was just 42% of mortgaged homes’ values, the lowest on record"

A brief excerpt:

Most homeowners have a significant amount of equity and will not be “underwater” if house prices decline. This is an important difference compared to the housing bubble when many millions of borrowers had little or no equity even before house prices declined. As Black Knight notes in their monthly Mortgage Monitor report released this morning:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/Overall, the market is on strong footing to weather a correction; total market leverage as of Q2 – including both first and second liens – was just 42% of mortgaged homes’ values, the lowest on recordThe first graph shows Black Knight’s estimate of tappable equity.

• Tappable equity – the amount a homeowner can borrow against while keeping a 20% equity stake – hit its 10th consecutive quarterly record high in Q2 2022 at $11.5T but appears to have peaked in May of this year

• Escalating declines in June and July have total tappable equity down 5% over the past two months, suggesting a sizeable reduction is likely in Q3, which would mark the first quarterly decline in three years

Trade Deficit decreased to $70.6 Billion in July

by Calculated Risk on 9/07/2022 08:39:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $70.6 billion in July, down $10.2 billion from $80.9 billion in June, revised.

July exports were $259.3 billion, $0.5 billion more than June exports. July imports were $329.9 billion, $9.7 billion less than June imports.

emphasis added

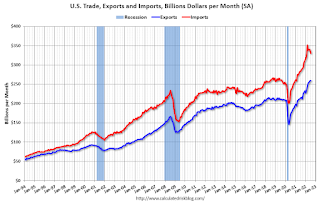

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in July.

Exports are up 21% year-over-year; imports are up 16% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and have now bounced back.

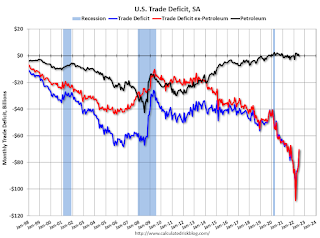

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $34.4 billion in July, from $28.6 billion a year ago.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/07/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

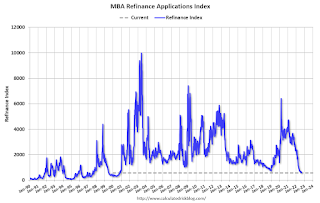

Mortgage applications decreased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 2, 2022.

... The Refinance Index decreased 1 percent from the previous week and was 83 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 23 percent lower than the same week one year ago.

“Mortgage rates moved higher over the course of last week as markets continued to re-assess the prospects for the economy and the path of monetary policy, with expectations for short-term rates to move and stay higher for longer,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “With the 30-year fixed rate rising to the highest level since mid-June, application volumes for both purchase and refinance loans dropped. Recent economic data will likely prevent any significant decline in mortgage rates in the near term, but the strong job market depicted in the August data should support housing demand. There is no sign of a rebound in purchase applications yet, but the robust job market and an increase in housing inventories should lead to an eventual increase in purchase activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.94 percent from 5.80 percent, with points increasing to 0.79 from 0.71 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, September 06, 2022

Wednesday: Trade Deficit, Beige Book

by Calculated Risk on 9/06/2022 09:14:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Trade Balance report for July from the Census Bureau. The consensus is for the U.S. trade deficit to be $70.5 billion in July, from $79.6 billion in June.

• At At 12:35 PM, Speech, Fed Vice Chair Brainard, Economic Outlook and Monetary Policy, At The Clearing House and Bank Policy Institute Annual Conference, New York, N.Y.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 69,828 | 88,606 | ≤5,0001 | |

| Hospitalized2 | 26,072 | 32,120 | ≤3,0001 | |

| Deaths per Day2 | 342 | 423 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Lawler: Are “National” Home Prices Already Falling?

by Calculated Risk on 9/06/2022 03:37:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Are “National” Home Prices Already Falling?

Excerpt:

A short but important note from housing economist Tom Lawler ...

However, some recent home price reports actually suggest that “national” home prices may already have started to decline, and they certainly show that home prices in some areas of the country have already begun to fall.

...

Given the lagged nature of some of these HPIs – and considering that closed transactions typically represent contract activity in the previous one or two months – it seems quite possible that home prices contemporaneously measured may in fact have already reached a peak for the year. Indeed, my own view is that a “base case” projection would be that all of these HPIs will show a December level that is below the June level.

The Sharp Slowdown in Year-over-year House Price Growth

by Calculated Risk on 9/06/2022 12:26:00 PM

Today, in the Calculated Risk Real Estate Newsletter: The Sharp Slowdown in Year-over-year House Price Growth

Excerpt:

And Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close. From Zillow Research: June 2022 Case-Shiller Results & Forecast: Moving Towards Rebalance ...

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be 15.9% in July. This would the lowest year-over-year increase since April 2021. This Case-Shiller National index was up 20.6% YoY in April, 19.9% in May, 18.0% in June, and Zillow is forecasting 15.9% in July. This is a sharp slowdown in YoY price increases.

For the most part, this deceleration was before the most recent rate increases (current 30-year mortgage rates are at 6.25%). Whether this means prices will stall on a national basis or decline something like 5% to 10% remains to be seen. It is clear there will be some double-digit regional declines, but I don’t expect cascading price declines this time since lending standards have been reasonably solid.

ISM® Services Index Increased to 56.9% in August

by Calculated Risk on 9/06/2022 10:03:00 AM

(Posted with permission). The ISM® Services index was at 56.9%, up from 56.7% last month. The employment index increased to 50.2%, from 49.1%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 56.9% August 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in August for the 27th month in a row — with the Services PMI® registering 56.9 percent — say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®.This was above expectations.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In August, the Services PMI® registered 56.9 percent, 0.2 percentage point higher than July’s reading of 56.7 percent. The Business Activity Index registered 60.9 percent, an increase of 1 percentage point compared to the reading of 59.9 percent in July. The New Orders Index figure of 61.8 percent is 1.9 percentage points higher than the July reading of 59.9 percent.

emphasis added

CoreLogic: House Prices up 15.8% YoY in July

by Calculated Risk on 9/06/2022 08:00:00 AM

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: US Year-Over-Year Home Price Growth Dips Again in July as Higher Mortgage Rates Cool Demand

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for July 2022.

Annual home price growth slowed for the third consecutive month in July but remained elevated at 15.8%. As 30-year, fixed-rate mortgages neared 6% this summer, some prospective homebuyers pulled back, helping ease overheated and unsustainable price growth. Notably, home prices declined by 0.3% from June to July, a trend not seen between 2010 and 2019, when price increases averaged 0.5% between those two months, according to CoreLogic’s historic data. Looking ahead, CoreLogic expects to see a more balanced housing market, with year-over-year appreciation slowing to 3.8% by July 2023.

“Following June’s surge in mortgage rates and the resulting dampening effect on housing demand, price growth is taking a decisive turn,” said Selma Hepp, interim lead of the Office of the Chief Economist at CoreLogic. “And even though annual price growth remains in double digits, the month-over-month decline suggests further deceleration on the horizon. The higher cost of homeownership has clearly eroded affordability, as inflation-adjusted monthly mortgage expenses are now even higher than they were at their former peak in 2006.”

emphasis added

Monday, September 05, 2022

Tuesday: CoreLogic House Prices, ISM Services

by Calculated Risk on 9/05/2022 07:03:00 PM

Weekend:

• Schedule for Week of September 4, 2022

Tuesday:

• At 8:00 AM ET, Corelogic House Price index for July

• At 10:00 AM, the ISM Services Index for August. The consensus is for a reading of 55.5, down from 56.7.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 19 and DOW futures are up 162 (fair value).

Oil prices were down over the last week with WTI futures at $88.93 per barrel and Brent at $95.74 per barrel. A year ago, WTI was at $69, and Brent was at $73 - so WTI oil prices are up 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.75 per gallon. A year ago, prices were at $3.17 per gallon, so gasoline prices are up $0.58 per gallon year-over-year.

Summer Teen Employment

by Calculated Risk on 9/05/2022 01:40:00 PM

Here is a look at the change in teen employment over time.

The graph below shows the employment-population ratio for teens (6 to 19 years old) since 1948.

The graph is Not Seasonally Adjusted (NSA), to show the seasonal hiring of teenagers during the summer.

A few observations:

1) Although teen employment has recovered some since the great recession, overall teen employment had been trending down. This is probably because more people are staying in school (a long term positive for the economy).

2) Teen employment was significantly impacted in 2020 by the pandemic.

3) A smaller percentage of teenagers are obtaining summer employment. The seasonal spikes are smaller than in previous decades.

3) The decline in teenager participation is one of the reasons the overall participation rate has declined (of course, the retiring baby boomers is the main reason the overall participation rate has declined over the last 20+ years).

Housing September 5th Update: Inventory Dips Slightly

by Calculated Risk on 9/05/2022 10:42:00 AM

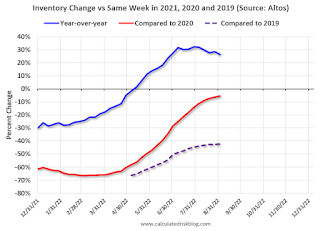

Inventory decreased slightly last week. Still, inventory decreased less than in 2019 at this time of year. Here are the same week inventory changes for the last four years:

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 5.4% according to Altos)

4. Inventory up compared to 2019 (currently down 42.2%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 9/05/2022 08:21:00 AM

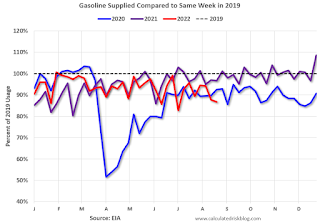

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices.

The TSA is providing daily travel numbers.

This data is as of September 4th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 3.4% from the same day in 2019 (90.9% of 2019). (Dashed line)

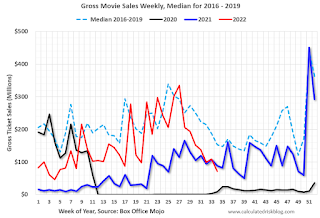

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $78 million last week, down about 53% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through August 27th. The occupancy rate was down 2.5% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of August 26th, gasoline supplied was down 13.2% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, September 04, 2022

Hotels: Occupancy Rate Down 2.5% Compared to Same Week in 2019

by Calculated Risk on 9/04/2022 09:01:00 AM

U.S. hotel performance came in lower than the previous week and showed mixed comparisons with 2019, according to STR‘s latest data through Aug. 27.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Aug. 21-27, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 65.0% (-2.5%)

• Average daily rate (ADR): $147.16 (+15.0%)

• Revenue per available room (RevPAR): $95.62 (+12.1%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).