by Calculated Risk on 10/17/2022 08:46:00 AM

Monday, October 17, 2022

Housing October 17th Weekly Update: Inventory Increased, New High for 2022

Click on graph for larger image.

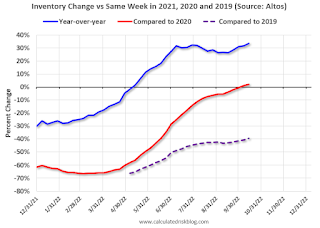

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 39.5%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 10/17/2022 08:25:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of October 15th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 6.9% from the same day in 2019 (93.1% of 2019). (Dashed line)

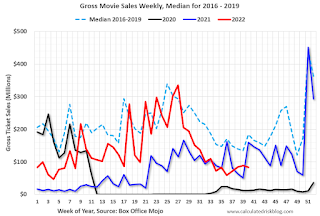

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $83 million last week, down about 55% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Oct 8th. The occupancy rate was down 3.5% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of October 7th, gasoline supplied was down 12.5% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, October 16, 2022

Sunday Night Futures

by Calculated Risk on 10/16/2022 07:13:00 PM

Weekend:

• Schedule for Week of October 16, 2022

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of -4.0, down from -1.5.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 15 and DOW futures are up 110 (fair value).

Oil prices were down over the last week with WTI futures at $86.18 per barrel and Brent at $92.32 per barrel. A year ago, WTI was at $82, and Brent was at $852 - so WTI oil prices are up 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.86 per gallon. A year ago, prices were at $3.30 per gallon, so gasoline prices are up $0.56 per gallon year-over-year.

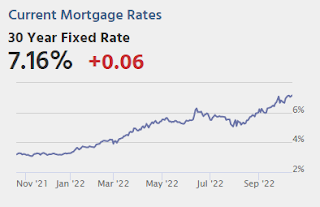

Monthly Mortgage Payments Up Record Year-over-year

by Calculated Risk on 10/16/2022 10:59:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Monthly Mortgage Payments Up Record Year-over-year

Excerpt:

The following graph shows the year-over-year change in principal & interest (P&I) assuming a fixed loan amount since 1977. Currently P&I is up about 59% year-over-year for a fixed amount (this doesn’t take into account the change in house prices).

This is above the previous record increase of 50% in 1980. This assumed a fixed loan amount - if we add in the year-over-year increase in house prices, payments would be up over 70% YoY for the same house.

This is one of the reasons I've argued Housing: Don't Compare the Current Housing Boom to the Bubble and Bust, Look instead at the 1978 to 1982 period for lessons.

...

In the 1980 period, new home sales fell about 40% YoY and about 60% from the peak in the 1970s to the trough in 1980. A similar decline might push new home sales down to around 400 thousand SAAR in coming months. ... Even though we can expect significant further declines in new home sales and single-family housing starts, the good news for the homebuilders is activity usually picks up quickly following an interest rate induced slowdown (as opposed to following the housing bust when the recovery took many years).

Saturday, October 15, 2022

Real Estate Newsletter Articles this Week: Current State of the Housing Market

by Calculated Risk on 10/15/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Current State of the Housing Market

• House Prices to National Average Wage Index

• 2nd Look at Local Housing Markets in September

• MBA: Mortgage Credit Availability was Never Excessive During the Recent Housing Boom

• Housing Discussion with Fortune's Lance Lambert

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of October 16, 2022

by Calculated Risk on 10/15/2022 08:11:00 AM

The key economic reports this week are September Housing Starts and Existing Home sales.

For manufacturing, September Industrial Production, and the October New York and Philly Fed surveys will be released this week.

8:30 AM ET: The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of -4.0, down from -1.5.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 80.0%.

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 44, down from 46 in September. Any number below 50 indicates that more builders view sales conditions as poor than good.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

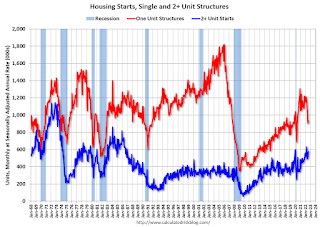

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.478 million SAAR, down from 1.575 million SAAR.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 232 thousand from 228 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of -4.5, up from -9.9.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 4.69 million SAAR, down from 4.80 million in August.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 4.69 million SAAR, down from 4.80 million in August.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for September 2022

Friday, October 14, 2022

COVID Oct 14, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 10/14/2022 08:56:00 PM

NOTE: COVID stats are updated on Fridays.

On COVID (focus on hospitalizations and deaths):

Average daily deaths bottomed in July 2021 at 214 per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 37,808 | 42,593 | ≤5,0001 | |

| Hospitalized2 | 19,625 | 21,607 | ≤3,0001 | |

| Deaths per Day2 | 332 | 368 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

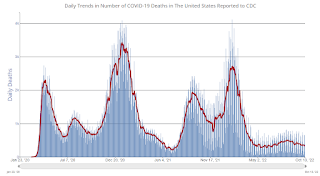

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Q3 GDP Tracking: Moving on Up

by Calculated Risk on 10/14/2022 12:36:00 PM

From BofA:

On net, today's data on retail sales and import and export prices pushed up our 3Q US GDP tracking estimate by 0.2pp to 1.9% q/q saar, from 1.7% previously. [October 14th estimate]From Goldman:

emphasis added

Following today’s data, we boosted our Q3 GDP tracking estimate by 0.4pp to +2.3% (qoq ar). [October 14th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.8 percent on October 14, down from 2.9 percent on October 7. After recent releases from the US Bureau of Labor Statistics and the US Census Bureau, the nowcast of third-quarter real personal consumption expenditures growth decreased from 1.3 percent to 1.2 percent. [October 14th estimate]

Hotels: Occupancy Rate Down 3.5% Compared to Same Week in 2019

by Calculated Risk on 10/14/2022 10:35:00 AM

U.S. hotel performance increased from the previous week but produced mixed comparisons with 2019, according to STR‘s latest data through Oct. 8.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Oct. 2-8, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 68.2% (-3.5%)

• Average daily rate (ADR): $153.79 (+16.9%)

• Revenue per available room (RevPAR): $104.83 (+12.8%)

While weekday performance showed an expected decline due to Yom Kippur, school breaks and the extended holiday weekend helped lift levels on Friday and Saturday. Performance levels in Florida were also lifted by post-Hurricane Ian demand. ...

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Retail Sales Unchanged in September

by Calculated Risk on 10/14/2022 08:37:00 AM

On a monthly basis, retail sales were unchanged from August to September (seasonally adjusted), and sales were up 8.2 percent from September 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $684.0 billion, virtually unchanged from the previous month, but 8.2 percent above September 2021. ... The July 2022 to August 2022 percent change was revised from up 0.3% to up 0.4 percent (±0.2 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 7.2% on a YoY basis.

Sales in September were below expectations, however sales in July and August were revised up, combined.

Sales in September were below expectations, however sales in July and August were revised up, combined.

Thursday, October 13, 2022

Friday: Retail Sales

by Calculated Risk on 10/13/2022 08:37:00 PM

Realtor.com Reports Weekly Active Inventory Up 31% Year-over-year; New Listings Down 15%

by Calculated Risk on 10/13/2022 03:31:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from economist Jiayi Xu: Weekly Housing Trends View — Data Week Ending Oct 8, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, increasing 31% above one year ago.

Highlighting the roller coaster ride that the housing market and its participants have been on in the last few years, one’s take on the current number of homes for sale depends very much on the comparison point. After a period of unusually hot activity, financial conditions are cooling demand in the housing market and there are substantially more homes for-sale compared to one year ago. However, the market still falls short of pre-pandemic inventory levels by an even greater amount.

...

• New listings–a measure of sellers putting homes up for sale–were again down, dropping 15% from one year ago.

This week marks the fourteenth straight week of year over year declines in the number of new listings coming up for sale. As mortgage rates near 7 percent, which is a level not seen in more than two decades, sellers who are also trying to buy a home, nearly 3 of every 4 potential sellers, have had to alter their trade-up plans. It appears that many have put selling on hold despite record levels of home equity, as higher mortgage rates and home prices sap purchasing power.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

House Prices to National Average Wage Index

by Calculated Risk on 10/13/2022 01:07:00 PM

Today, in the Calculated Risk Real Estate Newsletter: House Prices to National Average Wage Index

A brief excerpt:

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately, most income data is released with a significantly lag, and there are always questions about which income data to use (the average total income is skewed by the income of a few people).There is more in the article.

...

The National Average Wage Index increased to $60,575.07 in 2021, up 8.89% from $55,628.60 in 2020. This was the largest percentage increase in wages since 1981 - another reason to compare the current housing cycle to the 1978 to 1982 period (not the housing bubble and bust).

As of 2022, house prices were well above the median historical ratio - and at the level of the bubble peak - even though wages increased sharply in 2021. This suggests house prices are too high based on fundamentals, and I expect house prices to spend 7 years in purgatory.

Cleveland Fed: Median CPI increased 0.7% and Trimmed-mean CPI increased 0.6% in September

by Calculated Risk on 10/13/2022 11:17:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.7% in September. The 16% trimmed-mean Consumer Price Index increased 0.6% in September. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details here: "Motor Fuel" decreased at a 45% annualized rate in September.

Cost of Living Adjustment increases 8.7% in 2023, Contribution Base increased to $160,200

by Calculated Risk on 10/13/2022 08:55:00 AM

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2023.

From Social Security: Social Security Announces 8.7 Percent Benefit Increase for 2023

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 8.7 percent in 2023, the Social Security Administration announced today. On average, Social Security benefits will increase by more than $140 per month starting in January.Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is a discussion from Social Security on the current calculation (8.7% increase) and a list of previous Cost-of-Living Adjustments.

The 8.7 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 65 million Social Security beneficiaries in January 2023. Increased payments to more than 7 million SSI beneficiaries will begin on December 30, 2022. (Note: some people receive both Social Security and SSI benefits). The Social Security Act ties the annual COLA to the increase in the Consumer Price Index as determined by the Department of Labor’s Bureau of Labor Statistics.

...

Some other adjustments that take effect in January of each year are based on the increase in average wages. Based on that increase, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $160,200 from $147,000.

The contribution and benefit base will be $160,200 in 2023.

The National Average Wage Index increased to $60,575.07 in 2021, up 8.89% from $55,628.60 in 2020 (used to calculate contribution base). This was the largest percentage increase in wages since the early '80s.

Weekly Initial Unemployment Claims increase to 228,000

by Calculated Risk on 10/13/2022 08:36:00 AM

The DOL reported:

In the week ending October 8, the advance figure for seasonally adjusted initial claims was 228,000, an increase of 9,000 from the previous week's unrevised level of 219,000. The 4-week moving average was 211,500, an increase of 5,000 from the previous week's unrevised average of 206,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 211,500.

The previous week was unrevised.

Weekly claims were close to the consensus forecast.

BLS: CPI increased 0.4% in September; Core CPI increased 0.6%

by Calculated Risk on 10/13/2022 08:31:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in September on a seasonally adjusted basis after rising 0.1 percent in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.2 percent before seasonal adjustment.Both CPI and core CPI were above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Increases in the shelter, food, and medical care indexes were the largest of many contributors to the monthly seasonally adjusted all items increase. These increases were partly offset by a 4.9-percent decline in the gasoline index. The food index continued to rise, increasing 0.8 percent over the month as the food at home index rose 0.7 percent. The energy index fell 2.1 percent over the month as the gasoline index declined, but the natural gas and electricity indexes increased.

The index for all items less food and energy rose 0.6 percent in September, as it did in August. The indexes for shelter, medical care, motor vehicle insurance, new vehicles, household furnishings and operations, and education were among those that increased over the month. There were some indexes that declined in September, including those for used cars and trucks, apparel, and communication.

The all items index increased 8.2 percent for the 12 months ending September, a slightly smaller figure than the 8.3-percent increase for the period ending August. The all items less food and energy index rose 6.6 percent over the last 12 months. The energy index increased 19.8 percent for the 12 months ending September, a smaller increase than the 23.8-percent increase for the period ending August. The food index increased 11.2 percent over the last year.

emphasis added

Wednesday, October 12, 2022

Thursday: CPI, Unemployment Claims

by Calculated Risk on 10/12/2022 08:29:00 PM

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 225 thousand from 219 thousand last week (likely impact from Hurricane Ian).

• Also at 8:30 AM, The Consumer Price Index for September from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.5% increase in core CPI. The consensus is for CPI to be up 8.1% year-over-year and core CPI to be up 6.5% YoY.

FOMC Minutes "Purposefully moving to a restrictive policy stance in the near term"

by Calculated Risk on 10/12/2022 02:06:00 PM

In their assessment of the effects of policy actions and communications to date, participants concurred that the Committee's actions to raise expeditiously the target range for the federal funds rate demonstrated its resolve to lower inflation to 2 percent and to keep inflation expectations anchored at levels consistent with that longer-run goal. Participants noted that the Committee's commitment to restoring price stability, together with its purposeful policy actions and communications, had contributed to a notable tightening of financial conditions over the past year that would likely help reduce inflation pressures by restraining aggregate demand. Participants observed that this tightening had led to substantial increases in real interest rates across the maturity spectrum. Most participants remarked that, although some interest-sensitive categories of spending—such as housing and business fixed investment—had already started to respond to the tightening of financial conditions, a sizable portion of economic activity had yet to display much response. They noted also that inflation had not yet responded appreciably to policy tightening and that a significant reduction in inflation would likely lag that of aggregate demand. Participants observed that a period of real GDP growth below its trend rate, very likely accompanied by some softening in labor market conditions, was required. They agreed that, by moving its policy purposefully toward an appropriately restrictive stance, the Committee would help ensure that elevated inflation did not become entrenched and that inflation expectations did not become unanchored. These policy moves would therefore prevent the far greater economic pain associated with entrenched high inflation, including the even tighter policy and more severe restraint on economic activity that would then be needed to restore price stability.

In light of the broad-based and unacceptably high level of inflation, the intermeeting news of higher-than-expected inflation, and upside risks to the inflation outlook, participants remarked that purposefully moving to a restrictive policy stance in the near term was consistent with risk-management considerations. Many participants emphasized that the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action. Several participants underlined the need to maintain a restrictive stance for as long as necessary, with a couple of these participants stressing that historical experience demonstrated the danger of prematurely ending periods of tight monetary policy designed to bring down inflation. Several participants observed that as policy moved into restrictive territory, risks would become more two-sided, reflecting the emergence of the downside risk that the cumulative restraint in aggregate demand would exceed what was required to bring inflation back to 2 percent. A few of these participants noted that this possibility was heightened by factors beyond the Committee's actions, including the tightening of monetary policy stances abroad and the weakening global economic outlook, that were also likely to restrain domestic economic activity in the period ahead.

emphasis added

2nd Look at Local Housing Markets in September

by Calculated Risk on 10/12/2022 11:07:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in September

A brief excerpt:

This is the second look at local markets in September. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

We are seeing a sharp decline in closed sales, and inventory is up significantly year-over-year. Also, new listings are down as the sellers’ strike continues. The increase in inventory so far has been due to softer demand because of higher mortgage rates.

In September, sales were down 22.5%. In August, sales in these same markets were down 20.2% YoY Not Seasonally Adjusted (NSA).

Note that in September 2022, there were the same number of selling days as in September 2021, so the SA decline will be similar to the NSA decline. Last month, in August 2022, there was one more selling day than in August 2021 - so seasonally adjusted, the decline in sales in September will be about the same as in August for these markets.

Closed sales in September were mostly for contracts signed in July and August when 30-year mortgage rates averaged about 5.3%. Rates increased to around 6% in September and that will impact closed sales in October and November. In early October 30-year rates have jumped to over 7%.

Many more local markets to come!