by Calculated Risk on 10/31/2022 08:29:00 AM

Monday, October 31, 2022

Four High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of October 30th.

This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is about at the same level as in 2019 (100.3% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $147 million last week, down about 7% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Oct 22nd. The occupancy rate was down 0.5% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of October 21st, gasoline supplied was down 6.9% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, October 30, 2022

Sunday Night Futures

by Calculated Risk on 10/30/2022 07:15:00 PM

Weekend:

• Schedule for Week of October 30, 2022

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for October. The consensus is for a reading of 47.2, up from 45.7 in September.

• At 10:00 AM, The Q3 Housing Vacancies and Homeownership report from the Census Bureau.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for October. This is the last regional Fed survey for October.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $87.90 per barrel and Brent at $95.77 per barrel. A year ago, WTI was at $84, and Brent was at $84 - so WTI oil prices are up 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.72 per gallon. A year ago, prices were at $3.39 per gallon, so gasoline prices are up $0.33 per gallon year-over-year.

FOMC Preview: 75bp Hike

by Calculated Risk on 10/30/2022 10:28:00 AM

Expectations are the FOMC will announce a 75bp rate increase in the federal funds rate at the meeting this week.

"We expect the Fed to raise its target range for the federal funds rate by 75bp in November ... In our view, based on the median policy rate path as expressed in the September SEPs and communication from some FOMC participants like San Francisco Fed President Mary Daly, the committee is likely to engage in a debate on the appropriateness of slowing the pace of policy rate hikes beginning in December.From Goldman Sachs:

Communicating that the discussion took place should be enough to open the door for a step down to a 50bp rate hike in December, as we currently expect. That said, we expect Chair Powell to say that no decision was taken and the committee remains data dependent. With two employment reports and one CPI report between the November FOMC meeting and the December blackout period, the Fed will be reluctant to pre- commit to a smaller rate hike this far in advance. Data still need to cooperate.

By reaffirming the September median policy rate path, repeating consensus FOMC views that risks to the outlook for inflation still reside to the upside, and emphasizing a willingness to err on the side of tightening to much over tightening too little, we think the Fed can be successful in pushing back against any interpretation that a slower pace of rate hikes implies a lower terminal rate or a quicker pivot to rate cuts. In other words, it is now about the destination, not the journey."

"The FOMC is set to deliver a fourth 75bp hike at its November meeting next week, raising the target range for the fed funds rate to 3.75-4%. The focus will be on what comes next, and we expect Chair Powell to hint that the FOMC will likely slow the pace to 50bp in December ... We expect the FOMC to eventually pair that slowdown to 50bp in December with a somewhat higher projected peak funds rate in the December dot plot. We are adding another 25bp hike to our own forecast—which now calls for hikes of 75bp in November, 50bp in December, 25bp in February, and 25bp in March—and now see the funds rate peaking at 4.75-5%."

Current Wall Street forecasts are for GDP to increase slightly in 2022 Q4 over Q4 in line with FOMC projections. For example, BofA is projecting:

We now forecast GDP growth to slow to 0.2% in 2022 (4Q/4Q) and expect growth to slow to -0.9% in 2023 (4Q/4Q) as the lagged effects of tighter monetary policy and financial conditions cool the economy.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 0.1 to 0.3 | 0.5 to 1.5 | 1.4 to 2.0 | |

| June 2022 | 1.5 to 1.9 | 1.3 to 2.0 | 1.5 to 2.0 | |

The unemployment rate was at 3.5% in September. So far, the economic slowdown has not pushed up the unemployment rate.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 3.8 to 3.9 | 4.1 to 4.5 | 4.0 to 4.6 | |

| June 2022 | 3.6 to 3.8 | 3.8 to 4.1 | 3.9 to 4.1 | |

As of September 2022, PCE inflation was up 6.2% from September 2021. This was below the cycle high of 7.0% YoY in June. There was a surge of inflation in Q4 2021, so with less inflation in Q4 this year, it is possible inflation will decline to the projected year-over-year range in Q4.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 5.3 to 5.7 | 2.6 to 3.5 | 2.1 to 2.6 | |

| June 2022 | 5.0 to 5.3 | 2.4 to 3.0 | 2.0 to 2.5 | |

PCE core inflation was up 5.1% in September year-over-year. This was below the cycle high of 5.4% YoY in February. Core inflation has picked up more than expected and will likely be above the Q4 projected range.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 4.4 to 4.6 | 3.0 to 3.4 | 2.2 to 2.5 | |

| June 2022 | 4.2 to 4.5 | 2.5 to 3.2 | 2.1 to 2.5 | |

Saturday, October 29, 2022

Real Estate Newsletter Articles this Week: National House Price Index "Continued to Decelerate"

by Calculated Risk on 10/29/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index "Continued to Decelerate" to 13.0% year-over-year increase in August

• New Home Sales Decreased in September; Completed Inventory Increased

• Lawler: Update on the Household “Conundrum”

• Inflation Adjusted House Prices 2.3% Below Peak

• Final Look at Local Housing Markets in September

• Lawler: Selected Operating Results, Large Home Builders

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of October 30, 2022

by Calculated Risk on 10/29/2022 08:11:00 AM

Boo!

The key report this week is the October employment report on Friday.

Other key indicators include the October ISM manufacturing and services indexes, October vehicle sales, and the September trade deficit.

The FOMC meets this week and is expected to raise rates 75 bp.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 47.2, up from 45.7 in September.

10:00 AM: The Q3 Housing Vacancies and Homeownership report from the Census Bureau.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for October. This is the last regional Fed survey for October.

8:00 AM ET: Corelogic House Price index for September.

10:00 AM: ISM Manufacturing Index for October. The consensus is for 49.9, down from 50.9.

10:00 AM: Construction Spending for September. The consensus is for 0.5% decrease in spending.

All day: Light vehicle sales for October.

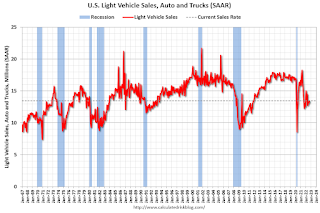

All day: Light vehicle sales for October.The consensus is for sales of 14.3 million SAAR, up from 13.5 million SAAR in September (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 200,000 jobs added, down from 208,000 in September.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise rates 75bp at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 222 thousand from 217 thousand last week.

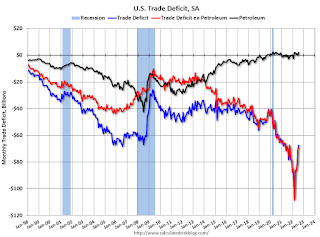

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $72.1 billion in September, from $67.4 billion in August.

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $72.1 billion in September, from $67.4 billion in August.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

10:00 AM: the ISM Services Index for October. The consensus is for a decrease to 55.5 from 56.7.

8:30 AM: Employment Report for October. The consensus is for 200,000 jobs added, and for the unemployment rate to increase to 3.6%.

8:30 AM: Employment Report for October. The consensus is for 200,000 jobs added, and for the unemployment rate to increase to 3.6%.There were 263,000 jobs added in September, and the unemployment rate was at 3.5%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, all of the jobs have returned.

Friday, October 28, 2022

COVID Oct 28, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 10/28/2022 09:12:00 PM

NOTE: COVID stats are updated on Fridays.

On COVID (focus on hospitalizations and deaths). Data has switched to weekly.

Weekly deaths bottomed in July 2021 at 1,666.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2🚩 | 265,893 | 261,315 | ≤35,0001 | |

| Hospitalized2 | 20,938 | 21,078 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,649 | 2,591 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Hotels: Occupancy Rate Down 0.5% Compared to Same Week in 2019

by Calculated Risk on 10/28/2022 05:28:00 PM

U.S. hotel performance decreased slightly from the previous week but showed improved comparisons with 2019, according to STR‘s latest data through Oct. 22.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Oct. 16-22, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 69.9% (-0.5%)

• Average daily rate (ADR): $157.43 (+16.7%)

• Revenue per available room (RevPAR): $110.11 (+16.1%)

Among the Top 25 Markets, Tampa reported the largest increases over 2019 in occupancy (+7.4% to 75.9%) and RevPAR (+39.2% to $117.28). Tampa has been one of the markets in Florida that have seen a performance lift associated with post-Hurricane Ian demand. ...

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Lawler: Selected Operating Results, Large Home Builders; Cancellation Rates Increasing Sharply

by Calculated Risk on 10/28/2022 01:42:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Selected Operating Results, Large Home Builders

Excerpt:

Below are some selected operating results from some large home builders for last quarter. Note that the sales cancellations number are derived from reported sales cancellations rates and may be off by a bit due to rounding.

Deliveries and Average Sales Price

...

One of the more striking statistics on orders and cancellations was from MDC Holdings, where gross orders totaled 1,569 while sales cancellations totaled 1,270!!!! And in its “Mountain” division (Colorado, Idaho, and Utah), net orders were NEGATIVE 3 homes!

NMHC: Survey shows "Apartment Market Softens" in October

by Calculated Risk on 10/28/2022 11:42:00 AM

From the National Multifamily Housing Council (NMHC): Apartment Market Softens, Sales Put on Hold Amidst Rising Rates and Economic Uncertainty

Rising interest rates caused by the Federal Reserve’s ongoing efforts to combat inflation continue to impact the multifamily business. However, it is worth noting that the overall apartment market has begun to revert to pre-pandemic trends as rent growth is decreasing.

Apartment market conditions weakened in the National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions for October 2022, as the Market Tightness (20), Sales Volume (6), Equity Financing (13), and Debt Financing (5) indices all came in well below the breakeven level (50).

“The Fed’s continued interest rate hikes have resulted in higher costs of both debt and equity and a higher degree of economic uncertainty," noted NMHC’s Chief Economist Mark Obrinsky. “This has caused the market for apartment transactions to come to a virtual standstill, as buyers seek a higher rate of return that sellers are unwilling to accommodate via lower prices.”

“The physical apartment market is also starting to normalize after six consecutive quarters of tightening conditions, with a majority of survey respondents reporting higher vacancy and lower rent growth compared to the three months prior.”

...

• Market Tightness Index came in at 20 this quarter — well below the breakeven level (50) — indicating looser market conditions for the first time in six quarters. The majority of respondents (66%) reported markets to be looser than three months ago, while only 5% thought markets have become tighter. The remaining 29% of respondents thought that market conditions were unchanged over the past three months, a considerable decline from the 56% of respondents who said the same in July.

...

It is important to remember that the index does not measure the magnitude of change but, rather, the degree to which respondents agree on the direction of change. For instance, an index value of 0 in market tightness would indicate that all respondents believe market conditions have become looser, but this does not tell us how much looser markets have become.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter.

NAR: Pending Home Sales Decreased 10.2% in September, Year-over-year Down 31%

by Calculated Risk on 10/28/2022 10:03:00 AM

From the NAR: Pending Home Sales Waned 10.2% in September

Pending home sales trailed off for the fourth consecutive month in September, according to the National Association of REALTORS®. All four major regions recorded month-over-month and year-over-year declines in transactions.This was a much larger decline than expected for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, slumped 10.2% to 79.5 in September. Year-over-year, pending transactions slid by 31.0%. An index of 100 is equal to the level of contract activity in 2001.

"Persistent inflation has proven quite harmful to the housing market," said NAR Chief Economist Lawrence Yun. "The Federal Reserve has had to drastically raise interest rates to quell inflation, which has resulted in far fewer buyers and even fewer sellers."

...

The Northeast PHSI descended 16.2% from last month to 64.2, a decline of 30.1% from September 2021. The Midwest index retracted 8.8% to 80.7 in September, down 26.7% from one year ago.

The South PHSI faded 8.1% to 97.0 in September, a drop of 30.0% from the prior year. The West index slipped by 11.7% in September to 62.7, down 38.7% from September 2021.

emphasis added

Personal Income increased 0.4% in September; Spending increased 0.6%

by Calculated Risk on 10/28/2022 08:38:00 AM

The BEA released the Personal Income and Outlays report for June:

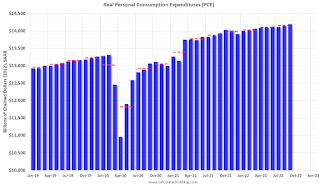

Personal income increased $78.9 billion (0.4 percent) in September, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $71.3 billion (0.4 percent) and personal consumption expenditures (PCE) increased $113.0 billion (0.6 percent).The September PCE price index increased 6.2 percent year-over-year (YoY), unchanged 6.2 percent YoY in August, and down from 7.0 percent in June.

The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.5 percent. Real DPI increased less than 0.1 percent in September and Real PCE increased 0.3 percent; goods increased 0.4 percent and services increased 0.3 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through September 2022 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income and the increase in PCE were both above expectations.

Thursday, October 27, 2022

Friday: Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 10/27/2022 08:59:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.5%. PCE prices are expected to be up 6.2% YoY, and core PCE prices up 5.2% YoY.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is 5.0% decrease in the index.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for October). The consensus is for a reading of 59.8.

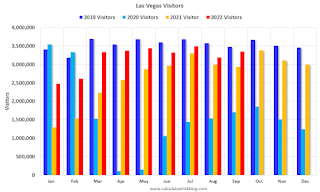

Las Vegas September 2022: Visitor Traffic Down Just 3.5% Compared to 2019

by Calculated Risk on 10/27/2022 02:25:00 PM

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: August 2022 Las Vegas Visitor Statistics

September saw strong visitation of 3.35M visitors, just ‐3.5% behind September 2019, with notable weekend holidays and events from Labor Day to the Life Is Beautiful festival, the Canelo/GGG fight, Mexican Independence Day, the Raiders/Cardinals home game, Bad Bunny World's Hottest Tour and the iHeartRadio Music festival.

Overall hotel occupancy reached 83.1%, +10.1 pts ahead of last September but down ‐5.2 pts vs. September 2019. Weekend occupancy reached 92.1% (up +3.0 pts YoY but down ‐3.5 pts vs. September 2019), while Midweek occupancy reached 78.6% (up +12.5 pts YoY but down ‐6.5 pts vs. September 2019).

Strong weekend demand supported by major events translated to record monthly ADR levels as September ADR approached $187, +20.1% YoY and +36.5% ahead of September 2019 while RevPAR neared $156 for the month, +36.8% YoY and +28.5% over September 2019

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 3.5% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

Realtor.com Reports Weekly Active Inventory Up 36% Year-over-year; New Listings Down 13%

by Calculated Risk on 10/27/2022 12:33:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Oct 22, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

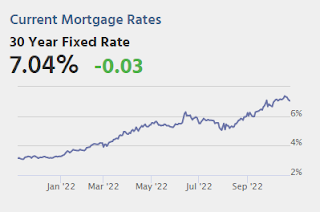

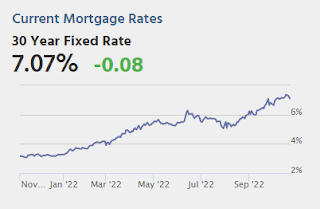

• Active inventory continued to grow, increasing 36% above one year ago. In last week’s Housing Trends View, which marked the first big increase in the active inventory trend since July, we gave a helpful summary of the historical context and timing of recent inventory developments. This week we saw another sizable step up in the active inventory trend (from 34% last week to 36% this week), even as new listings remain low, and the driving factor is the same: climbing mortgage rates, which were very near 7% last week and are likely to top that mark this week.

...

• New listings–a measure of sellers putting homes up for sale–were again down, dropping 13% from one year ago. This week marks the sixteenth straight week of year over year declines in the number of new listings coming up for sale. This week’s decline was somewhat smaller than last week’s, but still means fewer fresh options for home shoppers in the market. Seasonally, fewer homeowners contemplate a home sale as the temperature cools and the holidays approach, but this kind of change in the year over year trend signals a cooling that’s more than just seasonal.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

Inflation Adjusted House Prices 2.3% Below Peak

by Calculated Risk on 10/27/2022 10:12:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 2.3% Below Peak

Excerpt:

It has been over 16 years since the bubble peak. In the Case-Shiller release Tuesday, the seasonally adjusted National Index (SA), was reported as being 64% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 13% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is about 4% above the bubble peak.

Both indexes have declined for three consecutive months in real terms (inflation adjusted).

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be almost $338,000 today adjusted for inflation (69% increase). That is why the second graph below is important - this shows "real" prices. ...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices. In real terms, the National index is 2.3% below the recent peak, and the Composite 20 index is 3.0% below the recent peak in early 2006.

In real terms, house prices are still above the bubble peak levels. There is an upward slope to real house prices, and it has been over 16 years since the previous peak, but real prices are historically high.

Weekly Initial Unemployment Claims increase to 217,000

by Calculated Risk on 10/27/2022 08:39:00 AM

The DOL reported:

In the week ending October 22, the advance figure for seasonally adjusted initial claims was 217,000, an increase of 3,000 from the previous week's unrevised level of 214,000. The 4-week moving average was 219,000, an increase of 6,750 from the previous week's unrevised average of 212,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 219,000.

The previous week was unrevised.

Weekly claims were lower than the consensus forecast.

BEA: Real GDP increased at 2.6% Annualized Rate in Q3

by Calculated Risk on 10/27/2022 08:34:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2022 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the third quarter of 2022, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 0.6 percent. ...PCE increased at a 1.4% rate, and residential investment decreased at a 26.4% rate. The advance Q3 GDP report, with 2.6% annualized increase, was above expectations.

The increase in real GDP reflected increases in exports, consumer spending, nonresidential fixed investment, federal government spending, and state and local government spending, that were partly offset by decreases in residential fixed investment and private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

The increase in exports reflected increases in both goods and services. Within exports of goods, the leading contributors to the increase were industrial supplies and materials (notably petroleum and products as well as other nondurable goods), and nonautomotive capital goods. Within exports of services, the increase was led by travel and "other" business services (mainly financial services). Within consumer spending, an increase in services (led by health care and "other" services) was partly offset by a decrease in goods (led by motor vehicles and parts as well as food and beverages). Within nonresidential fixed investment, increases in equipment and intellectual property products were partly offset by a decrease in structures. The increase in federal government spending was led by defense spending. The increase in state and local government spending primarily reflected an increase in compensation of state and local government employees.

Within residential fixed investment, the leading contributors to the decrease were new single-family construction and brokers' commissions. The decrease in private inventory investment primarily reflected a decrease in retail trade (led by "other" retailers). Within imports, a decrease in imports of goods (notably consumer goods) was partly offset by an increase in imports of services (mainly travel).

Real GDP turned up in the third quarter, increasing 2.6 percent after decreasing 0.6 percent in the second quarter. The upturn primarily reflected a smaller decrease in private inventory investment, an acceleration in nonresidential fixed investment, and an upturn in federal government spending that were partly offset by a larger decrease in residential fixed investment and a deceleration in consumer spending. Imports turned down.

emphasis added

I'll have more later ...

Wednesday, October 26, 2022

Thursday: GDP, Unemployment Claims, Durable Goods

by Calculated Risk on 10/26/2022 08:29:00 PM

On Q3 GDP from Goldman: "The September new home sales and inventory data were slightly better than our previous assumptions on net, and we boosted our Q3 GDP tracking estimate by one tenth to +2.5% (qoq ar) ahead of tomorrow’s report."

From BofA: "The trade and inventory data lowered our 3Q GDP tracking estimate from 2.5% q/q saar to 2.0% q/q saar."

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for an increase to 225 thousand from 214 thousand last week.

• Also, at 8:30 AM, Gross Domestic Product, 3rd quarter 2022 (advance estimate). The consensus is that real GDP increased 2.4% annualized in Q3, up from -0.6% in Q2.

• Also, at 8:30 AM, Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

• At 11:00 AM: Kansas City Fed Survey of Manufacturing Activity for October.

Philly Fed: State Coincident Indexes Increased in 38 States in September

by Calculated Risk on 10/26/2022 01:48:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2022. Over the past three months, the indexes increased in 44 states, decreased in four states, and remained stable in two, for a three-month diffusion index of 80. Additionally, in the past month, the indexes increased in 38 states, decreased in 10 states, and remained stable in two, for a one-month diffusion index of 56. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 1.0 percent over the past three months and 0.4 percent in September.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three-month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is mostly positive on a three-month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In September 39 states had increasing activity including minor increases.

New Home Sales Decreased in September; Completed Inventory Increased

by Calculated Risk on 10/26/2022 10:52:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Decreased in September; Completed Inventory Increased

Brief excerpt:

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.You can subscribe at https://calculatedrisk.substack.com/.

There are 1.1 months of completed supply (red line). This is about two-thirds of the normal level.

The inventory of new homes under construction is at 6.0 months (blue line). This elevated level of homes under construction is due to supply chain constraints.

And a record 105 thousand homes have not been started - about 2.1 months of supply (grey line) - about double the normal level. Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices and demand.

...

First, as I discussed last month, the Census Bureau overestimates sales, and underestimates inventory when cancellation rates are rising, see: New Home Sales and Cancellations: Net vs Gross Sales. So, take the headline sales number with a large grain of salt - the actual negative impact on the homebuilders is greater than the headline number suggests!

...

There are a large number of homes under construction, and this suggests we will see a sharp increase in completed inventory over the next several months - and that will put pressure on new home prices.