by Calculated Risk on 12/14/2022 09:02:00 PM

Wednesday, December 14, 2022

Thursday: Retail Sales, Unemployment Claims, Industrial Production

Thursday:

• At 8:30 AM ET, Retail sales for November will be released. The consensus is for a 0.2% decrease in retail sales.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, unchanged from 230 thousand last week.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of -1.0, down from 4.5.

• Also at 8:30 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of -12.0, up from -19.4.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to decrease to 79.8%.

FOMC Projections and Press Conference

by Calculated Risk on 12/14/2022 02:12:00 PM

Statement here.

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

Here are the projections. In September, the FOMC participants’ midpoint of the target level for the federal funds rate was 4.625%. The FOMC participants’ midpoint of the target range is now closer to 5.125%.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | 2025 |

| Dec 2022 | 0.4 to 0.5 | 0.4 to 1.0 | 1.3 to 2.0 | 1.6 to 2.0 |

| Sept 2022 | 0.1 to 0.3 | 0.5 to 1.5 | 1.4 to 2.0 | 1.6 to 2.0 |

The unemployment rate was at 3.7% in November. So far, the economic slowdown has barely pushed up the unemployment rate, and the FOMC revised down the 2022 projection but revised 2023 up.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | 2025 |

| Dec 2022 | 3.7 | 4.4 to 4.7 | 4.3 to 4.8 | 4.0 to 4.7 |

| Sept 2022 | 3.8 to 3.9 | 4.1 to 4.5 | 4.0 to 4.6 | 4.0 to 4.5 |

As of October 2022, PCE inflation was up 6.0% from October 2021. This was below the cycle high of 7.0% YoY in June. The FOMC revised up PCE inflation for 2022.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | 2025 |

| Dec 2022 | 5.6 to 5.8 | 2.9 to 3.5 | 2.3 to 2.7 | 2.0 to 2.2 |

| Sept 2022 | 5.3 to 5.7 | 2.6 to 3.5 | 2.1 to 2.6 | 2.0 to 2.2 |

PCE core inflation was up 5.0% in October year-over-year. This was below the cycle high of 5.4% YoY in February. Core inflation has picked up more than expected and the FOMC revised up their projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | 2025 |

| Dec 2022 | 4.7 to 4.8 | 3.2 to 3.7 | 2.3 to 2.7 | 2.0 to 2.2 |

| Sept 2022 | 4.4 to 4.6 | 3.0 to 3.4 | 2.2 to 2.5 | 2.0 to 2.2 |

FOMC Statement: Raise Rates 50 bp; "Ongoing increases appropriate"

by Calculated Risk on 12/14/2022 02:02:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

Russia's war against Ukraine is causing tremendous human and economic hardship. The war and related events are contributing to upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4-1/4 to 4-1/2 percent. The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lael Brainard; James Bullard; Susan M. Collins; Lisa D. Cook; Esther L. George; Philip N. Jefferson; Loretta J. Mester; and Christopher J. Waller.

emphasis added

Current State of the Housing Market; Overview for mid-December

by Calculated Risk on 12/14/2022 10:18:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Current State of the Housing Market; Overview for mid-December

A brief excerpt:

Over the last month …There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

1. New listings have declined further year-over-year (YoY).

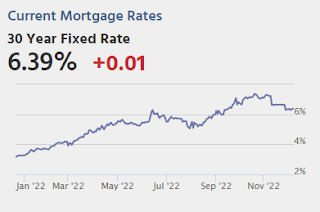

2. Mortgage rates have declined recently but are still up sharply YoY.

3. House prices are declining month-over-month (MoM) as measured by the Case-Shiller repeat sales index.

4. Rents are falling.

...

And here is a graph comparing the YoY change in the NAR median prices vs the Case-Shiller National Index (the median is distorted by the mix of homes sold, and also lagged since this is for closing prices).

The YoY change in the median price peaked at 25.2% in May 2021 and has now slowed to 6.6%. In general, the NAR median price leads the Case-Shiller index by 2 to 3 months, so I expect the Case-Shiller index to show significantly slower YoY growth over the next several months.

...

Next Wednesday, the NAR will release existing home sales for November. This report will likely show another sharp year-over-year decline in sales for November.

AIA: Architecture Billings Index Declines Further in November

by Calculated Risk on 12/14/2022 09:29:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Demand for design services continues to slow

Demand for design services from architecture firms continued to decrease in November, according to a new report from The American Institute of Architects (AIA).

The pace of decline during November accelerated from October, posting an Architecture Billings Index (ABI) score of 46.6 from 47.7 (any score below 50 indicates a decline in firm billings). The pace of inquiries into new projects slowed, but remained positive with a score of 52.0, however new design contracts remained in negative territory with a score of 46.9.

“Given the slowdown in new project work, many architecture firms will rely on their near record levels of backlogs to support revenue,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Still, firm leaders remain largely optimistic about future business trends. Almost two-thirds of architecture firms project that 2023 will be either a good year or great year for their firm.”

...

• Regional averages: South (50.5); Midwest (47.6); West (45.8); Northeast (42.4)

• Sector index breakdown: mixed practice (51.5); institutional (47.7); multi-family residential (46.1); commercial/industrial (44.2)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 46.6 in November, down from 47.7 in October. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index had been positive for 20 consecutive months but indicated a decline the last two months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a pickup in CRE investment in early 2023, but if the weakness persists - a slowdown in CRE investment later in 2023.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 12/14/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications increased 3.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 9, 2022.

... The Refinance Index increased 3 percent from the previous week and was 85 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 38 percent lower than the same week one year ago.

“Mortgage rates increased slightly after a month of declines, as financial markets reacted to mixed signals regarding inflation and the Federal Reserve’s next policy moves. The 30-year fixed rate inched to 6.42 percent, which is still close to the lowest rate in a month,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Overall applications increased, driven by increases in purchase and refinance activity. However, with rates more than three percentage points higher than a year ago, both purchase and refinance applications are still well behind last year’s pace.”

Added Kan, “The ongoing moderation in home-price growth, along with further declines in mortgage rates, may encourage more buyers to return to the market in the coming months.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 6.42 percent from 6.41 percent, with points increasing to 0.64 from 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, December 13, 2022

Wednesday: FOMC Statement and Press Conference

by Calculated Risk on 12/13/2022 09:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to announce a 50 bp hike in the Fed Funds rate.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

CoreLogic: 1.1 million Homeowners with Negative Equity in Q3 2022

by Calculated Risk on 12/13/2022 02:38:00 PM

Note: This was released last Friday. From CoreLogic: CoreLogic: US Home Equity Gains Rose Annually in Q3 but Fell Sharply From Q2

CoreLogic® ... today released the Homeowner Equity Report (HER) for the third quarter of 2022. The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw equity increase by 15.8% year over year, representing a collective gain of $2.2 trillion, for an average of $34,300 per borrower, since the third quarter of 2021.

Nationwide, annual home equity gains began to slow in the third quarter of 2022, with the average borrower netting $34,300, compared with the nearly $60,000 year-over-year gain recorded in the second quarter. Slowing prices also caused an additional 43,000 properties to fall underwater. The quarter-over-quarter decline in equity is partially due to cooling home price growth across the country, as annual appreciation fell from about 18% in June to just slightly more than 10% in October. As home price gains are projected to relax into single digits for the rest of 2022, then possibly move into negative territory by the spring of 2023, equity increases will likely decline accordingly in some parts of the country.

“At 43.6%, the average U.S. loan-to-value (LTV) ratio is only slightly higher than in the past two quarters and still significantly lower than the 71.3% LTV seen moving into the Great Recession in the first quarter of 2010,” said Selma Hepp, interim lead of the Office of the Chief Economist at CoreLogic. “Therefore, today’s homeowners are in a much better position to weather the current housing slowdown and a potential recession than they were 12 years ago.”

“Weakening housing demand and the resulting decline in home prices since the spring’s peak reduced annual home equity gains and pushed an additional number of properties underwater in the third quarter,” said Hepp. “Nevertheless, while these negative impacts are concentrated in Western states such as California, homeowners with a mortgage there still average more than $580,000 in home equity.”

Negative equity, also referred to as underwater or upside-down mortgages, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the third quarter of 2022, the quarterly and annual changes in negative equity were:

• Quarterly change: From the second quarter of 2022 to the third quarter of 2022, the total number of mortgaged homes in negative equity increased by 4% to 1.1 million homes or 1.9% of all mortgaged properties.

• Annual change: In the third quarter of 2021, 1.2 million homes, or 2.2% of all mortgaged properties, were in negative equity. This number declined by 9.8% in the third quarter of 2022, to 1.1 million homes or 1.9% of all mortgage properties.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q3 2022 to Q2 2022 equity distribution by LTV. There are still a few properties with LTV over 125%. But most homeowners have a significant amount of equity. This is a very different picture than at the start of the housing bust when many homeowners had little equity.

On a year-over-year basis, the number of homeowners with negative equity has declined from 1.2 million to 1.1 million.

Housing, Inflation and Why the Fed Should Consider a Pause

by Calculated Risk on 12/13/2022 09:38:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing, Inflation and Why the Fed Should Consider a Pause

A brief excerpt:

Expectations are the FOMC will announce a 50bp rate increase in the federal funds rate tomorrow and increase the "terminal rate" to 5-5.25%.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

However, it appears the Fed is missing the recent sharp slowdown in household formation. The surge in household formation during the pandemic was unrelated to monetary policy (it was mostly due to work-from-home and the pickup in divorces). And the recent slowdown in household formation is also unrelated to monetary policy.

This “dramatic shift” in household formation is leading to Rents Falling Faster than "Seasonality Alone". Since rents are falling - and will likely continue to fall - it probably makes sense to look at inflation ex-shelter for monetary policy over the next several months.

This graph shows the year-over-year change in Core CPI ex-Shelter (blue), and the one month change annualized (red). The year-over-year change was at 5.2% in November, down from 5.9% in October. And the annualized one-month change was negative in both October and November! Core CPI ex-shelter fell at 1.5% annual rate in November.

BLS: CPI increased 0.1% in November; Core CPI increased 0.2%

by Calculated Risk on 12/13/2022 08:31:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in November on a seasonally adjusted basis, after increasing 0.4 percent in October, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.1 percent before seasonal adjustment.Both CPI and core CPI were below expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter was by far the largest contributor to the monthly all items increase, more than offsetting decreases in energy indexes. The food index increased 0.5 percent over the month with the food at home index also rising 0.5 percent. The energy index decreased 1.6 percent over the month as the gasoline index, the natural gas index, and the electricity index all declined.

The index for all items less food and energy rose 0.2 percent in November, after rising 0.3 percent in October. The indexes for shelter, communication, recreation, motor vehicle insurance, education, and apparel were among those that increased over the month. Indexes which declined in November include the used cars and trucks, medical care, and airline fares indexes.

The all items index increased 7.1 percent for the 12 months ending November; this was the smallest 12-month increase since the period ending December 2021. The all items less food and energy index rose 6.0 percent over the last 12 months. The energy index increased 13.1 percent for the 12 months ending November, and the food index increased 10.6 percent over the last year; all of these increases were smaller than for the period ending October.

emphasis added

Monday, December 12, 2022

Tuesday: CPI

by Calculated Risk on 12/12/2022 08:08:00 PM

It's been more than a month since the last CPI report sent mortgage rates lower at the fastest single-day pace on record. Since then, apart from one interesting reaction to Powell's speech two weeks ago, the main order of business has been to wait for the next CPI report and the Fed announcement that would follow a day later. As the new week begins, we're a mere 24 hours away. That makes today a placeholder of the highest order. Volatility is possible, especially after the 1pm 10yr Treasury auction, but it pales in comparison to what tomorrow may bring. [30 year fixed 6.39%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for November.

• At 8:30 AM, The Consumer Price Index for November from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 7.3% year-over-year and core CPI to be up 6.1% YoY.

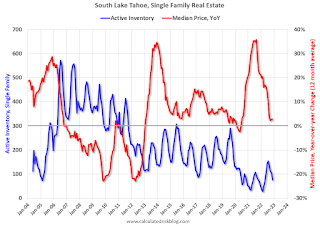

Second Home Market: South Lake Tahoe in November

by Calculated Risk on 12/12/2022 02:18:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through November 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but still up almost 3-fold from the record low set in February 2022, and up 12% year-over-year. Prices are up 2.9% YoY (and the YoY change has been mostly trending down).

2nd Look at Local Housing Markets in November; Another step down in sales in November

by Calculated Risk on 12/12/2022 11:41:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in November

A brief excerpt:

This is the second look at local markets in November. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in November were mostly for contracts signed in September and October. Mortgage rates moved higher in September, and 30-year mortgage rates were over 7% for most of October (no points), and that likely impacted closed sales in November and December.

...

Here is a summary of active listings for these housing markets in November.

Inventory in these markets were down 35% YoY in January and are now up 87% YoY! So, this is a significant change from earlier this year, and a larger YoY inventory increase than in October (up 75% YoY).

...

Many more local markets to come!

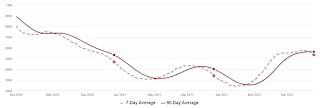

Housing December 12th Weekly Update: Inventory Decreased 2.5% Week-over-week

by Calculated Risk on 12/12/2022 09:19:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 34.1%).

Mike Simonsen discusses this data regularly on Youtube.

Four High Frequency Indicators for the Economy

by Calculated Risk on 12/12/2022 08:56:00 AM

These indicators are mostly for travel and entertainment. It was interesting to watch these sectors recover as the pandemic impact subsided.

The TSA is providing daily travel numbers.

This data is as of December 11th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 5.3% below the same week in 2019 (94.7% of 2019). (Dashed line)

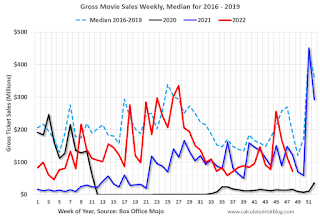

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $72 million last week, down about 63% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Dec 3rd. The occupancy rate was down 7.7% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of December 2nd, gasoline supplied was down 7.5% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, December 11, 2022

Sunday Night Futures

by Calculated Risk on 12/11/2022 06:13:00 PM

Weekend:

• Schedule for Week of December 11, 2022

• FOMC Preview: 50bp Hike, Increase "Terminal Rate"

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $71.02 per barrel and Brent at $76.10 per barrel. A year ago, WTI was at $71, and Brent was at $74 - so WTI oil prices are unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.21 per gallon. A year ago, prices were at $3.33 per gallon, so gasoline prices are down $0.12 per gallon year-over-year.

FOMC Preview: 50bp Hike, Increase "Terminal Rate"

by Calculated Risk on 12/11/2022 10:21:00 AM

Expectations are the FOMC will announce a 50bp rate increase in the federal funds rate at the meeting this week and increase the "terminal rate" to 5-5.25%.

"A relatively soft November inflation report is unlikely to affect the Fed’s decision. It has clearly telegraphed a 50bp hike in December, which would take the federal funds rate to 4.25-4.5%. The big question is where the Fed goes next. We expect another 50bp rate hike in February and then a 25bp hike in March for a terminal rate of 5.0-5.25%. We think the Fed will need to see material weakening in the labor market to stop hiking."From Goldman Sachs:

emphasis added

"Aside from a widely expected 50bp rate hike, the main event at the December FOMC meeting is likely to be an increase in the projected peak for the funds rate in 2023. We expect the median dot to rise 50bp to a new peak of 5-5.25% ... We continue to expect three 25bp hikes in 2023 to a peak of 5-5.25%, though the risks are tilted toward 50bp in February."

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 0.1 to 0.3 | 0.5 to 1.5 | 1.4 to 2.0 | |

The unemployment rate was at 3.7% in November. So far, the economic slowdown has barely pushed up the unemployment rate, and the FOMC will likely revised down the 2022 projection but might revise 2023 up slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 3.8 to 3.9 | 4.1 to 4.5 | 4.0 to 4.6 | |

As of October 2022, PCE inflation was up 6.0% from October 2021. This was below the cycle high of 7.0% YoY in June. There was a surge of inflation in Q4 2021, so with less inflation in Q4 this year, it is possible inflation will decline to the top of the projected year-over-year range in Q4.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 5.3 to 5.7 | 2.6 to 3.5 | 2.1 to 2.6 | |

PCE core inflation was up 5.0% in October year-over-year. This was below the cycle high of 5.4% YoY in February. Core inflation has picked up more than expected and will likely be above the September Q4 projected range.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 4.4 to 4.6 | 3.0 to 3.4 | 2.2 to 2.5 | |

Saturday, December 10, 2022

Real Estate Newsletter Articles this Week: Mortgage Equity Withdrawal Still Solid in Q3

by Calculated Risk on 12/10/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Mortgage Equity Withdrawal Still Solid in Q3

• 2023 Housing Forecasts

• 1st Look at Local Housing Markets in November

• Q3 Update: Delinquencies, Foreclosures and REO

• Black Knight Mortgage Monitor: Home Prices Declined in October; Down 3.2% since June

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of December 11, 2022

by Calculated Risk on 12/10/2022 08:11:00 AM

The key economic reports this week are November CPI and Retail Sales.

For manufacturing, November Industrial Production, and the December New York and Philly Fed surveys, will be released this week.

The FOMC meets this week, and the FOMC is expected to announce a 50 bp hike in the Fed Funds rate.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for November.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 7.3% year-over-year and core CPI to be up 6.1% YoY.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to announce a 50 bp hike in the Fed Funds rate.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.2% decrease in retail sales.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.2% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, unchanged from 230 thousand last week.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of -1.0, down from 4.5.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of -12.0, up from -19.4.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to decrease to 79.8%.

No major economic releases scheduled.

Friday, December 09, 2022

COVID Dec 9, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 12/09/2022 09:16:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2🚩 | 458,986 | 306,773 | ≤35,0001 | |

| Hospitalized2🚩 | 29,598 | 26,015 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,981 | 1,844 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

NOTE: The data is probably catching up from the low levels during the holiday week, but this is the most cases since September, and the most deaths since early October.