by Calculated Risk on 1/04/2023 07:00:00 AM

Wednesday, January 04, 2023

MBA: Mortgage Applications Decreased Over Last Two Weeks

From the MBA: Mortgage Applications Decreased Over a Two-Week Period in Latest

MBA Weekly Survey

Mortgage applications decreased 13.2 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 30, 2022. The results include adjustments to account for the holidays.

... The holiday adjusted Refinance Index decreased 16.3 percent from the two weeks ago and was 87 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 12.2 percent from two weeks earlier. The unadjusted Purchase Index decreased 38.5 percent compared with the two weeks ago and was 42 percent lower than the same week one year ago.

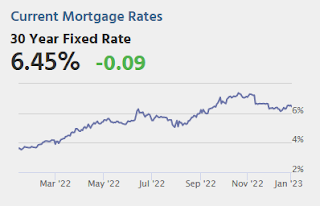

“The end of the year is typically a slower time for the housing market, and with mortgage rates still well above 6 percent and the threat of a recession looming, mortgage applications continued to decline over the past two weeks to the lowest level since 1996,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications have been impacted by slowing home sales in both the new and existing segments of the market. Even as home-price growth slows in many parts of the country, elevated mortgage rates continue to put a strain on affordability and are keeping prospective homebuyers out of the market.”

Added Kan, “Refinance applications remain less than a third of the market and were 87 percent lower than a year ago as rates remained close to double what they were in 2021. Mortgage rates are lower than October 2022 highs, but would have to decline substantially to generate additional refinance activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 6.58 percent from 6.42 percent, with points increasing to 0.73 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, January 03, 2023

Wednesday: Job Openings, ISM Mfg, Vehicle Sales, FOMC Minutes

by Calculated Risk on 1/03/2023 08:45:00 PM

For now, the average lender is moving back down below the 6.5% threshold for top tier 30yr fixed rates, but just barely. That number was getting close to 6.0% in early December and was more than half a point higher as of last week. [30 year fixed 6.45%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 10:00 AM, Job Openings and Labor Turnover Survey for October from the BLS.

• At 10:00, ISM Manufacturing Index for December. The consensus is for the ISM to be at 48.5, down from 49.0 in November.

• At 2:00 PM: FOMC Minutes, Meeting of December 13-14, 2022

• All day, Light vehicle sales for December. The Wards forecast is for 13.0 million SAAR in December, down from the BEA estimate of 14.1 million SAAR in November (Seasonally Adjusted Annual Rate).

Update: Framing Lumber Prices Down 67% YoY, Slightly Below Pre-Pandemic Levels

by Calculated Risk on 1/03/2023 02:51:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through January 3rd.

Prices are slightly below the pre-pandemic levels of around $400.

Click on graph for larger image.

Click on graph for larger image.It is unlikely we will see a significant runup in prices this Spring due to the housing slowdown.

Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

by Calculated Risk on 1/03/2023 11:48:00 AM

Today, in the Real Estate Newsletter: Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

A brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I'm adding some thoughts, and maybe some predictions for each question.

8) Residential Investment: Residential investment (RI) was a drag on growth in 2022 as the housing market slowed sharply. Through November, starts were down 1.2% year-to-date compared to the same period in 2021. New home sales were down 15.2% year-to-date through November. Note: RI is mostly investment in new single-family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI change in 2023? How about housing starts and new home sales in 2023?

...

Here is a table showing housing starts and new home sales since 2005. Note that starts and new home sales declined sharply for several years following the housing bubble. Since I don’t expect significant distressed sales in this downturn, I don’t think the decline in starts and new home sales will be anywhere near as persistent as during the housing bust.

...

The outlook for 2023 depends on several factors: the Fed, mortgage rates, whether or not there is a recession in 2023, and inventory levels (both existing and new home inventory). My sense is this downturn will be more like each of the downturns in the 1980 period, as opposed to the six years of declining new home sales during the housing bust (there were two recessions in the 1980 period so new home sales did decline for several years). ...

Construction Spending Increased 0.2% in November

by Calculated Risk on 1/03/2023 10:37:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during November 2022 was estimated at a seasonally adjusted annual rate of $1,807.5 billion, 0.2 percent above the revised October estimate of $1,803.2 billion. The November figure is 8.5 percent above the November 2021 estimate of $1,665.2 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,426.4 billion, 0.3 percent above the revised October estimate of $1,421.6 billion. ...

In November, the estimated seasonally adjusted annual rate of public construction spending was $381.1 billion, 0.1 percent below the revised October estimate of $381.6 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 8.2% below the recent peak.

Non-residential (blue) spending is at a new peak.

Public construction spending is close to the recent peak.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 5.3%. Non-residential spending is up 12.6% year-over-year. Public spending is up 10.4% year-over-year.

CoreLogic: House Prices up 8.6% YoY in November; Declined 0.2% MoM in November NSA

by Calculated Risk on 1/03/2023 08:33:00 AM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Annual Home Price Growth Slows to Two-Year Low in November, CoreLogic Reports

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2022.

Year-over-year home price growth ended its 21-month streak of double-digit momentum in November, posting an 8.6% gain, the lowest rate of appreciation in exactly two years. Although 16 states bucked the national trend and saw annual double-digit increases, appreciation is decelerating in many popular housing markets across the country. Southeastern states still led the country for price growth in November but also saw some of the most pronounced cooling. Similarly, relatively more expensive Western areas also posted substantial combined declines in recent months since spring’s peak.

“Although home price growth has been slowing rapidly and will continue to do so in 2023, strong gains in the first half of last year suggest that total 2022 appreciation was only slightly lower than that recorded in 2021,” said Selma Hepp, executive, deputy chief economist at CoreLogic. “However, 2023 will present its own challenges, as consumers remain wary of both the housing market and the overall economic outlook.”

...

U.S. home prices (including distressed sales) increased 8.6% year over year in November 2022 compared to November 2021. On a month-over-month basis, home prices declined by 0.2% compared to October 2022.

emphasis added

Monday, January 02, 2023

Tuesday: Construction Spending

by Calculated Risk on 1/02/2023 07:08:00 PM

Weekend:

• Schedule for Week of January 1, 2023

Tuesday:

• At 8:00 AM ET, Corelogic House Price index for November.

• At 10:00 AM: Construction Spending for November. The consensus is for a 0.4% decrease in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 8, and DOW futures are up 75 (fair value).

Oil prices were mixed over the last week with WTI futures at $80.26 per barrel and Brent at $85.91 per barrel. A year ago, WTI was at $76, and Brent was at $78 - so WTI oil prices are up 4% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.18 per gallon. A year ago, prices were at $3.26 per gallon, so gasoline prices are down $0.08 per gallon year-over-year.

Question #9 for 2023: What will happen with house prices in 2023?

by Calculated Risk on 1/02/2023 01:47:00 PM

Today, in the Real Estate Newsletter: Question #9 for 2023: What will happen with house prices in 2023?

A brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I'm adding some thoughts, and maybe some predictions for each question.

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, FHFA, and CoreLogic) - will be up around 7% in 2022. What will happen with house prices in 2023?

The first question I’m always asked is what “Will happen with house prices?”. No one has a crystal ball, but it does appear house prices will decline in 2023.

...

The following graph - as of the NAR release last month - shows that Case-Shiller followed the median prices up and is now following the deceleration in median prices down. It is likely the median price will be down year-over-year in a few months - and Case-Shiller will follow.

Note: Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

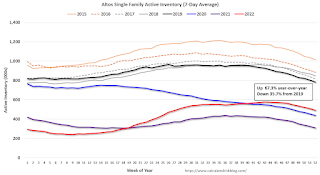

Housing January 2nd Weekly Update: Inventory Decreased 3.4% Week-over-week

by Calculated Risk on 1/02/2023 09:16:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, January 01, 2023

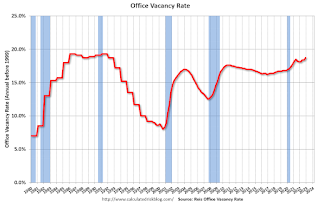

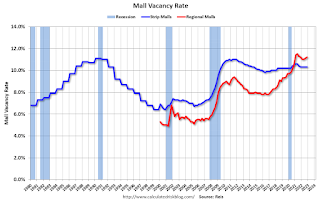

Reis: Office Vacancy Rate Increased in Q4 as "demand plummeted", Mall Vacancy Rate Unchanged

by Calculated Risk on 1/01/2023 09:56:00 AM

From Moody’s Analytics Senior Economist Lu Chen and economist Xiaodi Li: Apartment struck a balance, Office demand plummeted, and Retail remains flat

Corporate profits squeezed under macroeconomic uncertainties and flexible work arrangements weakened office demand and continued to transform the sector’s fundamental. Moreover, new office demand isn’t always reflected through direct leases. As office downsizing became more commonplace, sublet space inevitably followed to absorb new demand. Net absorption plummeted from over 3 million square feet (sqft) in Q3 to -7.13 million sqft in Q4.

Affected by the overall office sector sentiment, new delivery dwindled to slightly above 2 million sqft nationwide, the lowest quarterly delivery in our more than 20 years of tracking history. Vacancy climbed for the fourth straight quarter to 18.7%, 20 bps higher than the previous quarter or 60 bps higher than the same time last year. Compared to Q3, asking rent in Q4 increased by 0.3% (from $35.05 to $35.14), and effective rent edged up 0.1% (from $28.00 to $28.04).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

And from Reis on Retail:

Bolstered by consumer spending, neighborhood and community shopping center net absorption was up 44% in Q4 as compared to last quarter. New construction delivery fell under 600,000 sqft and caused the inventory to grow just above 3 million sqft for the year, less than half of 2019’s record. Given the relative balance between supply and demand, national vacancy for neighborhood and community shopping centers stayed flat at 10.3% for the fifth straight quarter. Asking/effective rents were up slightly by 0.2%/0.2% in Q4 and remained in the $21/$18-per-sqft range, a level unchanged since 2018. Regional mall properties, on the other hand, continue to be the most at-risk retail subtype according to our commercial mortgage delinquency data, driving overall delinquency behavior among retail assets. Regional and super regional malls’ vacancy ticked up 10 bps to 11.2%, identical to the same time last year.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.3% in Q4, unchanged from 10.3% in Q3, and unchanged from 10.3% in Q4 2021. For strip malls, the vacancy rate peaked during the pandemic at 10.6% in both Q1 and Q2 2021.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis. In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

In the last several years, even prior to the pandemic, the regional mall vacancy rates increased significantly from an already elevated level.

Q4 2022 Update: Unofficial Problem Bank list Decreased to 49 Institutions; Search for "Whale" Continues

by Calculated Risk on 1/01/2023 09:01:00 AM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources only, and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here are the quarterly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List through December, 2022. Since the last update at the end of September 2022, the list decreased by two to 49 institutions after four additions and six removals. Assets decreased by $401 million to $51.1 billion, with the change primarily resulting from a $1.3 billion decrease from updated asset figures through September 30, 2021. A year ago, the list held 57 institutions with assets of $56.6 billion. Added during the fourth quarter of 2022 was Union County Savings Bank, Elizabeth, NJ ($1.8 billion); Union State Bank, Pell City, AL ($266 million); Citizens Savings Bank and Trust Company, Nashville, TN ($140 million); and Wabash Savings Bank, Mount Carmel, IL ($9.8 million). Removals during the quarter because of action termination included Quontic Bank, New York, NY ($793 million); Cecil Bank, Elkton, MD ($243 million); Neighborhood National Bank, San Diego, CA ($119 million); The First National Bank of Hope, Hope, KS ($82 million); and Home Bank of Arkansas, Portland, AR ($65 million). Ashton State Bank, Ashton, NE ($20 million) found their way off this list through a voluntary merger.

With the conclusion of the fourth quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since we first published the Unofficial Problem Bank List on August 7, 2009 with 389 institutions, 1,789 institutions have appeared on a weekly or monthly list since then. Only 2.7 percent of the banks that have appeared on a list remain today as 1,740 institutions have transitioned through the list. Departure methods include 1,029 action terminations, 411 failures, 281 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 3 or less than 1.0 percent, still have a troubled designation more than ten years later. The 411 failures represent 23 percent of the 1,789 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

On December 1, 2022, the FDIC released third quarter results and provided an update on the Official Problem Bank List. While FDIC did not make a comment within its press release on the Official Problem Bank List, they provided details in an attachment that listed 42 institutions with assets of $164 billion. In its 2022 first quarter release, the FDIC list had a material $119 billion increase in assets. Since that release, none of the prudential banking regulators – FDIC, Federal Reserve, and OCC – have publicly released an enforcement action detailing an enforcement action against a large institution. The Financial Institutions Reform, Recovery and Enforcement Act (FIRREA) passed by Congress in 1989 requires publication of enforcement actions. See “Supervisory Enforcement Actions Since FIRREA and FDICIA,” published by the Federal reserve Bank of Minneapolis for further details. Prior to FIRREA, enforcement actions were not published by the prudential banking regulators. Section 913 of FIRREA requires public disclosures of enforcement actions. Section 913(2) does allow a delay in the enforcement action publication if “exceptional circumstances” exist. The prudential regulator must make a written determination that publication “would seriously threaten the safety & soundness of an insured depository institution.” The prudential regulator “may delay the publication of such order for a reasonable time.” The section does not define “a reasonable time.” It has been more than six months since that enforcement action was issued, so it seems the primary regulator considers this a “reasonable time” before it informs the public of a large troubled institution.

Saturday, December 31, 2022

Real Estate Newsletter Articles this Week: Houses are the least “affordable” since 1982

by Calculated Risk on 12/31/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index "Continued to Decline" to 9.2% year-over-year increase in October

• Final Look at Local Housing Markets in November

• Inflation Adjusted House Prices 3.8% Below Peak. Houses are the least “affordable” since 1982 when 30-year mortgage rates were over 14%

• Question #10 for 2023: Will inventory increase further in 2023?

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of January 1, 2023

by Calculated Risk on 12/31/2022 08:11:00 AM

Happy New Year! Wishing you all the best in 2023.

The key report this week is the December employment report on Friday.

Other key indicators include the December ISM manufacturing, December vehicle sales, the November trade deficit, and November Job Openings.

The NYSE and the NASDAQ will be closed in observance of the New Year’s Day holiday

8:00 AM ET: Corelogic House Price index for November.

10:00 AM: Construction Spending for November. The consensus is for a 0.4% decrease in construction spending.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

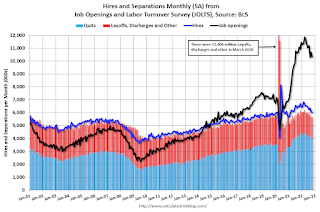

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in October to 10.334 million from 10.687 million in September

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 48.5, down from 49.0 in November.

2:00 PM: FOMC Minutes, Meeting of December 13-14, 2022

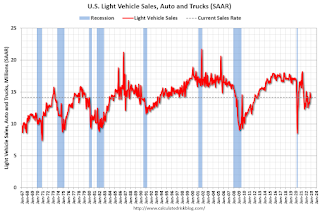

All day: Light vehicle sales for December.

All day: Light vehicle sales for December.The Wards forecast is for 13.0 million SAAR in December, down from the BEA estimate of 14.1 million SAAR in November (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 145,000, up from 127,000 jobs added in November.

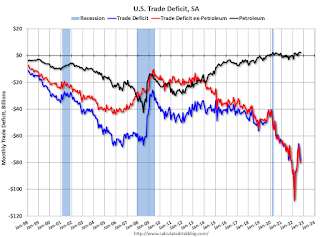

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $76.1 billion. The U.S. trade deficit was at $78.2 billion in October.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, up from 225 thousand last week.

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

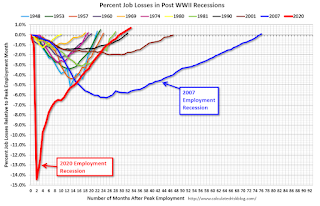

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.There were 263,000 jobs added in November, and the unemployment rate was at 3.7%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, as of August 2022, the total number of jobs had returned and are now 1.044 million above pre-pandemic levels.

10:00 AM: the ISM Services Index for December.

Friday, December 30, 2022

COVID Dec 30, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 12/30/2022 08:46:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 402,525 | 486,627 | ≤35,0001 | |

| Hospitalized2🚩 | 34,116 | 33,788 | ≤3,0001 | |

| Deaths per Week2 | 2,530 | 2,932 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Realtor.com Reports Weekly Active Inventory Up 63% YoY; New Listings Down 6% YoY

by Calculated Risk on 12/30/2022 03:06:00 PM

Realtor.com has monthly and weekly data on the existing home market.

For the week ending December 24th, active inventory was up 63.1% year-over-year (YoY), up from 58.1% YoY last week.

New listings were down 5.7% YoY, the smallest YoY decrease since July. This small YoY decrease in new listings might be related to the holidays.

Last year, inventory was at record lows during the Winter. So, it is no surprise that YoY inventory measures are still increasing.

Question #10 for 2023: Will inventory increase further in 2023?

by Calculated Risk on 12/30/2022 09:35:00 AM

Today, in the Real Estate Newsletter: Question #10 for 2023: Will inventory increase further in 2023?

Brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I'm adding some thoughts, and maybe some predictions for each question.

10) Housing Inventory: Housing inventory decreased sharply during the pandemic to record lows in early 2022. Since then, inventory has increased, but is still well below pre-pandemic levels. Will inventory increase further in 2023?

...

First, a brief history. Here are a few times when watching existing home inventory helped my analysis.

Starting in January 2005, I was very bearish on housing, but I wasn’t sure when the market would turn. Speculative bubbles can go on and on. However, the increase in inventory in late 2005 (see red arrow on graph) helped me call the top for house prices in 2006.Several years later, in early 2012, when many people were still bearish on housing, the plunge in inventory in 2011 (blue arrow on graph below) helped me call the bottom for house prices in early 2012 (see The Housing Bottom is Here).

...

It seems likely that mortgage rates will remain well above the pandemic lows, and therefore new listings will be depressed again in 2023.

The bottom line is inventory will probably increase year-over-year in 2023. However, with the dearth of new listings, it still seems unlikely - but not impossible - that inventory will be back up to the 2017 - 2019 levels. Inventory is always something to watch!

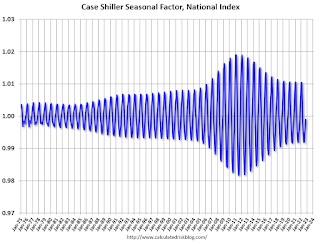

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/30/2022 08:18:00 AM

Two key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

For in depth description of these issues, see Jed Kolko's article from 2014 "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through October 2022). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the recent price surge changed the month-over-month pattern.

The swings in the seasonal factors have decreased, and the seasonal factors had been moving back towards more normal levels.

Thursday, December 29, 2022

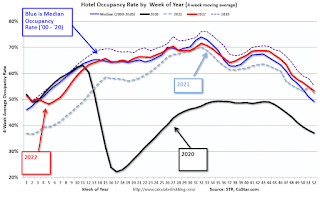

Hotels: Occupancy Rate Down 9.7% Compared to Same Week in 2019

by Calculated Risk on 12/29/2022 08:44:00 PM

U.S. hotel performance came in lower than the previous week and showed weakened comparisons to 2019 on the unfavorable side of a holiday calendar shift, according to STR‘s latest data through Dec. 24. At the same time, occupancy on the 24th was the highest for any Christmas Eve on record.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Dec. 18-24, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 43.9% (-9.7%)

• Average daily rate (ADR): $132.29 (+2.3%)

• Revenue per available room (RevPAR): $58.04 (-7.6%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Las Vegas November 2022: Visitor Traffic Down 7.0% Compared to 2019; Convention Traffic Down 3.4%

by Calculated Risk on 12/29/2022 02:00:00 PM

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: November 2022 Las Vegas Visitor Statistics

Even with typical late fall/early winter seasonal volume decreases kicking in after a stellar October, November 2022 saw visitation of approx. 3.27M, about 5% ahead of last November and ‐7% shy of November 2019 tallies, supported by a variety of events including the Automotive After Market Week and the Raiders vs. Colts home game.

Overall hotel occupancy reached 81.2% (+3.6 pts YoY and down ‐7.0 pts vs. Nov 2019). Weekend occupancy came in at 89.6% (‐1.1 pts of last November and ‐4.5 pts below November 2019), while Midweek occupancy reached 77.5%, up 5.6 pts vs. last November but down ‐7.3 pts vs. November 2019's tally.

The trend of strong room rates continued during the month as ADR approached $187, up roughly 20% YoY and +38% ahead of November 2019 while RevPAR surpassed $151 for the month, +25% YoY and +27% over November 2019.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 7.0% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

Philly Fed: State Coincident Indexes Increased in 30 States in November

by Calculated Risk on 12/29/2022 12:54:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2022. Over the past three months, the indexes increased in 35 states, decreased in 11 states, and remained stable in four, for a three-month diffusion index of 48. Additionally, in the past month, the indexes increased in 30 states, decreased in 13 states, and remained stable in seven, for a one-month diffusion index of 34.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three-month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is mostly positive on a three-month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In November, 34 states had increasing activity including minor increases.