by Calculated Risk on 1/07/2023 02:11:00 PM

Saturday, January 07, 2023

Real Estate Newsletter Articles this Week: Early reports suggest NAR reported December sales could be lowest since 2010

At the Calculated Risk Real Estate Newsletter this week:

• 1st Look at Local Housing Markets in December Early reports suggest NAR reported sales could be lowest since 2010.

• Rents Continue to Decline More than Seasonally Normal

• Moody's: National Multifamily Supply and Demand at Lowest Levels since 2009

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of January 8, 2023

by Calculated Risk on 1/07/2023 08:11:00 AM

The key reports this week is December CPI.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for December.

9:00 AM: Discussion, Fed Chair Jerome Powell, Central Bank Independence, At the Sveriges Riksbank International Symposium on Central Bank Independence, Stockholm, Sweden

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 204 thousand last week.

8:30 AM: The Consumer Price Index for December from the BLS. The consensus is for 0,1% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 6.5% year-over-year and core CPI to be up 5.7% YoY.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for January).

Friday, January 06, 2023

COVID Jan 6, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 1/06/2023 08:45:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2🚩 | 470,699 | 404,932 | ≤35,0001 | |

| Hospitalized2🚩 | 39,688 | 34,884 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,731 | 2,522 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Annual Vehicle Sales decrease 8% in 2022; Heavy Trucks Sales up 2% YoY

by Calculated Risk on 1/06/2023 03:09:00 PM

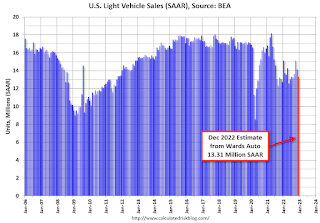

The BEA released their estimate of light vehicle sales for December. The BEA estimates sales of 13.31 million SAAR in December 2022 (Seasonally Adjusted Annual Rate), down 6.3% from the November sales rate, and up 4.7% from December 2021.

Click on graph for larger image.

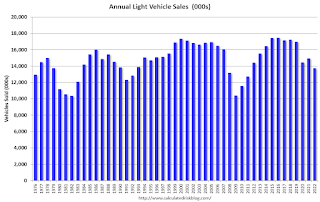

Click on graph for larger image.The first graph shows annual sales since 1976.

Light vehicle sales in 2022 were at 13.73 million, down 8.1% from 14.95 million in 2021.

Sales in 2022 were impacted significantly by supply chain disruptions, and sales were still down 19% from the 2019 level.

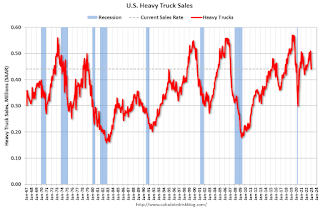

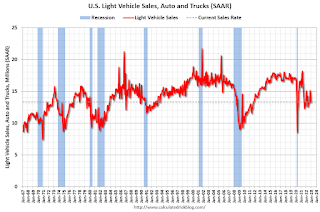

The second graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the December 2022 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

1st Look at Local Housing Markets in December

by Calculated Risk on 1/06/2023 12:41:00 PM

Today, in the Calculated Risk Real Estate Newsletter:

1st Look at Local Housing Markets in December

A brief excerpt:

This is the first look at local markets in December. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

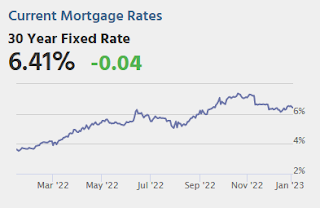

Closed sales in December were mostly for contracts signed in October and November. Since 30-year fixed mortgage rates were over 7% for most of October (no points) and averaged 6.8% in November (Freddie PMMS with points) closed sales were probably impacted significantly in December.

...

Median sales prices were unchanged year-over-year in Denver and Las Vegas, and up only 2% in San Diego.

...

In December, sales were down 47.6%. In November, these same markets were down 48.3% YoY Not Seasonally Adjusted (NSA).

Note that in December 2022, there were the same number of selling days as in December 2021, so the SA decline will be similar to the NSA decline. This is a similar YoY decline as in November for these early reporting markets. If national sales decline by the same percent as last month, the NAR will report sales for December under 4.0 million SAAR - below the 4.01 million in May 2020 (pandemic low) and the lowest sales rate since 2010.

Many more local markets to come!

Comments on December Employment Report

by Calculated Risk on 1/06/2023 09:26:00 AM

With 4.50 million jobs added, 2022 was the 2nd best year for job growth in US history behind only 2021 with 6.74 million.

The headline jobs number in the December employment report was above expectations, however employment for the previous two months was revised down by 28,000, combined. The participation rate increased, and the unemployment rate decreased to 3.5%. Another solid report.

In December, the year-over-year employment change was 4.50 million jobs.

Seasonal Retail Hiring

Typically, retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then, seasonal hiring had increased back close to more normal levels. However, seasonal retail hiring was down in 2022.

This graph really shows the collapse in retail hiring in 2008. Since then, seasonal hiring had increased back close to more normal levels. However, seasonal retail hiring was down in 2022.Retailers hired 98 thousand workers Not Seasonally Adjusted (NSA) net in December.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate increased in December to 82.4% from 82.3% in November, and the 25 to 54 employment population ratio increased to 80.1% from 79.7% the previous month.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 3.9 million, changed little in December. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in December to 3.878 million from 3.688 million in November. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 6.5% from 6.7% in the previous month. This is down from the record high in April 22.9% and is the lowest level on record (seasonally adjusted) (series started in 1994). This measure is below the level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.069 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.215 million the previous month.

This is below pre-pandemic levels.

Summary:

The headline monthly jobs number was above expectations; however, employment for the previous two months was revised down by 28,000, combined.

December Employment Report: 223 thousand Jobs, 3.5% Unemployment Rate

by Calculated Risk on 1/06/2023 08:43:00 AM

From the BLS:

Total nonfarm payroll employment increased by 223,000 in December, and the unemployment rate edged down to 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, health care, construction, and social assistance.

...

The change in total nonfarm payroll employment for October was revised down by 21,000, from +284,000 to +263,000, and the change for November was revised down by 7,000, from +263,000 to +256,000. With these revisions, employment gains in October and November combined were 28,000 lower than previously reported.

emphasis added

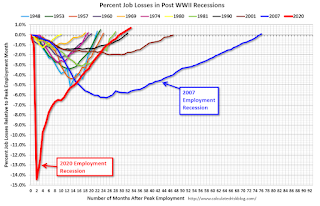

Click on graph for larger image.

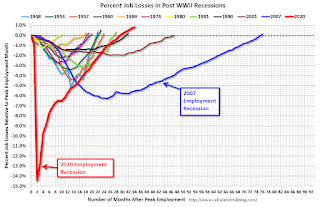

Click on graph for larger image.The first graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In December, the year-over-year change was 4.53 million jobs. Employment was up significantly year-over-year.

Total payrolls increased by 223 thousand in December. Private payrolls increased by 220 thousand, and public payrolls increased 3 thousand.

Payrolls for October and November were revised down 28 thousand, combined.

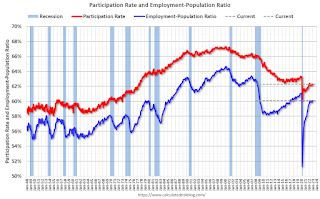

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 62.3% in December, from 62.2% in November. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 62.3% in December, from 62.2% in November. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 60.1% from 59.9% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

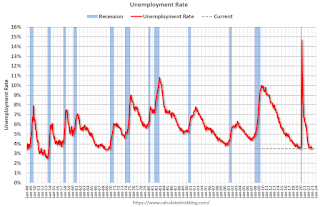

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was decreased in December to 3.5% from 3.6% in November.

This was above consensus expectations; however, October and November payrolls were revised down by 28,000 combined.

Thursday, January 05, 2023

Friday: Employment Report

by Calculated Risk on 1/05/2023 08:53:00 PM

Friday:

• At 8:30 AM ET, Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

• At 10:00 AM, the ISM Services Index for December.

Goldman December Payrolls Preview

by Calculated Risk on 1/05/2023 05:25:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose by 225k in December (mom sa) ... We estimate the unemployment rate was unchanged at 3.7% ... We estimate a 0.35% increase in average hourly earnings (mom sa) that lowers the year-on-year rate to 4.95%

emphasis added

December Employment Preview

by Calculated Risk on 1/05/2023 02:10:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

Click on graph for larger image.

Click on graph for larger image.• First, as of November there were 1.044 million more jobs than in February 2020 (the month before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms. As of August 2022, the total number of jobs had returned.

This doesn't include the preliminary benchmark revision that showed there were 462 thousand more jobs than originally reported in March 2022.

• ADP Report: The ADP employment report showed 235,000 private sector jobs were added in December. This is the fifth release of ADP's new methodology, and this suggests job gains above consensus expectations.

• ISM Surveys: Note that the ISM indexes are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in December to 51.4%, up from 48.4% last month. This would suggest the number of manufacturing jobs was mostly unchanged in December.

The ISM® services employment index for December has not been released yet.

• Unemployment Claims: The weekly claims report showed a decrease in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 223,000 in November to 216,000 in December. This would usually suggest fewer layoffs in December than in November. In general, weekly claims were close to expectations in December.

Rents Continue to Decline More than Seasonally Normal

by Calculated Risk on 1/05/2023 09:49:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Rents Continue to Decline More than Seasonally Normal

A brief excerpt:

OER and rent of primary residence have mostly moved together. The Zillow index started in 2014, the ApartmentList index started in 2017, and CoreLogic in 2004.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through November 2022, except CoreLogic is through October and Apartment List is through December 2022.

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures are picking up.

The CoreLogic measure is up 8.8% YoY in October, down from 10.2% in September, and down from a peak of 13.9% in April 2022.

The Zillow measure is up 8.4% YoY in November, down from 9.6% YoY in October, and down from a peak of 17.1% YoY in February 2022.

The ApartmentList measure is up 3.9% YoY as of December, down from 4.5% in November, and down from a peak of 18.1% YoY November 2021.

Trade Deficit decreased to $61.5 Billion in November

by Calculated Risk on 1/05/2023 08:52:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $61.5 billion in November, down $16.3 billion from $77.8 billion in October, revised.

November exports were $251.9 billion, $5.1 billion less than October exports. November imports were $313.4 billion, $21.5 billion less than October imports

emphasis added

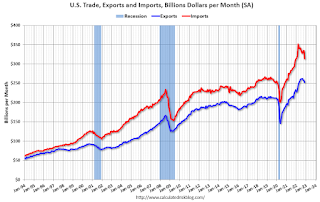

Click on graph for larger image.

Click on graph for larger image.Exports and imports decreased in November.

Exports are up 10% year-over-year; imports are up 2% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back. Both have decreased recently.

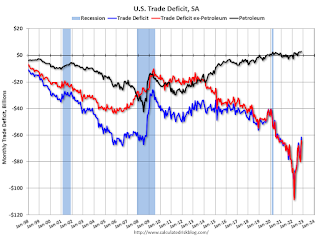

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are slightly positive.

The trade deficit with China decreased to $21.3 billion in November, from $32.5 billion a year ago.

Weekly Initial Unemployment Claims decrease to 204,000

by Calculated Risk on 1/05/2023 08:33:00 AM

The DOL reported:

In the week ending December 31, the advance figure for seasonally adjusted initial claims was 204,000, a decrease of 19,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 225,000 to 223,000. The 4-week moving average was 213,750, a decrease of 6,750 from the previous week's revised average. The previous week's average was revised down by 500 from 221,000 to 220,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 213,750.

The previous week was revised down.

Weekly claims were well below the consensus forecast.

ADP: Private Employment Increased 235,000 in December

by Calculated Risk on 1/05/2023 08:20:00 AM

Private sector employment increased by 235,000 jobs in December and annual pay was up 7.3 percent year-over-year, according to the December ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).This was well above the consensus forecast of 145,000. The BLS report will be released Friday, and the consensus is for 200 thousand non-farm payroll jobs added in December.

...

“The labor market is strong but fragmented, with hiring varying sharply by industry and establishment size,” said Nela Richardson, chief economist, ADP. “Business segments that hired aggressively in the first half of 2022 have slowed hiring and in some cases cut jobs in the last month of the year.”

emphasis added

Wednesday, January 04, 2023

Thursday: Trade Deficit, ADP Employment, Unemployment Claims

by Calculated Risk on 1/04/2023 09:01:00 PM

Thursday:

• At 8:15 AM ET, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 145,000, up from 127,000 jobs added in November.

• At 8:30 AM, Trade Balance report for November from the Census Bureau. The consensus is the trade deficit to be $76.1 billion. The U.S. trade deficit was at $78.2 billion in October.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, up from 225 thousand last week.

Vehicles Sales Declined to 13.31 million SAAR in December

by Calculated Risk on 1/04/2023 07:01:00 PM

Wards Auto released their estimate of light vehicle sales for December: Fullsize Trucks Lift December U.S. Light-Vehicle Sales Above Expectations; Calendar 2022 Ends at 11-Year Low (pay site).

Wards Auto estimates sales of 13.31 million SAAR in December 2022 (Seasonally Adjusted Annual Rate), down 5.9% from the November sales rate, and up 4.7% from December 2021.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for December (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic). However, sales decreased late last year due to supply issues. It appears the "supply chain bottom" was in September 2021.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. FOMC Minutes: Participants continued to anticipate ongoing rate increases

by Calculated Risk on 1/04/2023 02:08:00 PM

From the Fed: Minutes of the Federal Open Market Committee, December 13–14, 2022. Excerpt:

In discussing the policy outlook, participants continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate to achieve the Committee's objectives. In determining the pace of future increases in the target range, participants judged that it would be appropriate to take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. With inflation staying persistently above the Committee's 2 percent goal and the labor market remaining very tight, all participants had raised their assessment of the appropriate path of the federal funds rate relative to their assessment at the time of the September meeting. No participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023. Participants generally observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time. In view of the persistent and unacceptably high level of inflation, several participants commented that historical experience cautioned against prematurely loosening monetary policy.

In light of the heightened uncertainty regarding the outlooks for both inflation and real economic activity, most participants emphasized the need to retain flexibility and optionality when moving policy to a more restrictive stance. Participants generally noted that the Committee's future decisions regarding policy would continue to be informed by the incoming data and their implications for the outlook for economic activity and inflation, and that the Committee would continue to make decisions meeting by meeting.

Participants reaffirmed their strong commitment to returning inflation to the Committee's 2 percent objective. A number of participants emphasized that it would be important to clearly communicate that a slowing in the pace of rate increases was not an indication of any weakening of the Committee's resolve to achieve its price-stability goal or a judgment that inflation was already on a persistent downward path. Participants noted that, because monetary policy worked importantly through financial markets, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the Committee's reaction function, would complicate the Committee's effort to restore price stability. Several participants commented that the medians of participants' assessments for the appropriate path of the federal funds rate in the Summary of Economic Projections, which tracked notably above market-based measures of policy rate expectations, underscored the Committee's strong commitment to returning inflation to its 2 percent goal.

Participants discussed a number of risk-management considerations related to the conduct of monetary policy. Many participants highlighted that the Committee needed to continue to balance two risks. One risk was that an insufficiently restrictive monetary policy could cause inflation to remain above the Committee's target for longer than anticipated, leading to unanchored inflation expectations and eroding the purchasing power of households, especially for those already facing difficulty making ends meet. The other risk was that the lagged cumulative effect of policy tightening could end up being more restrictive than is necessary to bring down inflation to 2 percent and lead to an unnecessary reduction in economic activity, potentially placing the largest burdens on the most vulnerable groups of the population. Participants generally indicated that upside risks to the inflation outlook remained a key factor shaping the outlook for policy. A couple of participants noted that risks to the inflation outlook were becoming more balanced. Participants generally observed that maintaining a restrictive policy stance for a sustained period until inflation is clearly on a path toward 2 percent is appropriate from a risk-management perspective. emphasis added

ISM® Manufacturing index Declined to 48.4% in December, Price Index Lowest Since April 2020

by Calculated Risk on 1/04/2023 10:35:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 48.4% in December, down from 49.0% in November. The employment index was at 51.4%, up from 48.4% last month, and the new orders index was at 45.2%, down from 47.2%.

From ISM: Manufacturing PMI® at 48.4% December 2022 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in December for the second consecutive month following a 29-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in December. This was close to the consensus forecast. Note that prices are falling quickly.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The December Manufacturing PMI® registered 48.4 percent, 0.6 percentage point lower than the 49 percent recorded in November. Regarding the overall economy, this figure indicates contraction after 30 straight months of expansion. The Manufacturing PMI® figure is the lowest since May 2020, when it registered 43.5 percent. The New Orders Index remained in contraction territory at 45.2 percent, 2 percentage points lower than the 47.2 percent recorded in November. The Production Index reading of 48.5 percent is a 3-percentage point decrease compared to November’s figure of 51.5 percent. The Prices Index registered 39.4 percent, down 3.6 percentage points compared to the November figure of 43 percent; this is the index’s lowest reading since April 2020 (35.3 percent). The Backlog of Orders Index registered 41.4 percent, 1.4 percentage points higher than the November reading of 40 percent. The Employment Index returned to expansion territory (51.4 percent, up 3 percentage points) after contracting in November (48.4 percent). The Supplier Deliveries Index reading of 45.1 percent is 2.1 percentage points lower than the November figure of 47.2 percent; this is the index’s lowest reading since March 2009 (43.2 percent). The Inventories Index registered 51.8 percent, 0.9 percentage point higher than the November reading of 50.9 percent. The New Export Orders Index reading of 46.2 percent is down 2.2 percentage points compared to November’s figure of 48.4 percent. The Imports Index continued in contraction territory at 45.1 percent, 1.5 percentage points below the November reading of 46.6 percent.”

emphasis added

BLS: Job Openings "Little Changed" at 10.5 million in November

by Calculated Risk on 1/04/2023 10:24:00 AM

From the BLS: Job Openings and Labor Turnover Summary

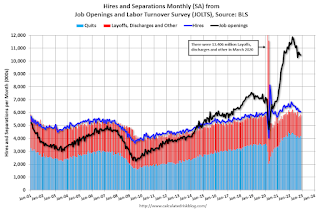

The number of job openings was little changed at 10.5 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations changed little at 6.1 million and 5.9 million, respectively. Within separations, quits (4.2 million) and layoffs and discharges (1.4 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November the employment report this Friday will be for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in November to 10.458 million from 10.512 million in October.

The number of job openings (black) were down 4% year-over-year.

Quits were down 7% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Moody's: National Multifamily Supply and Demand at Lowest Levels since 2009

by Calculated Risk on 1/04/2023 08:27:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Moody's: National Multifamily Supply and Demand at Lowest Levels since 2009

A brief excerpt:

The big story here is that demand for apartments fell off a cliff in Q4 2022, but that new supply was also very low, even though there are a large number of apartments currently under construction.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

First, from Moody’s Analytics Senior Economist Lu Chen and economist Xiaodi Li: Apartment struck a balance, Office demand plummeted, and Retail remains flatNational multifamily supply and demand both cooled to their lowest levels since 2009. Net absorption and new construction leveled off at just around 10,000 units in Q4, keeping the national multifamily vacancy flat at 4.4%. … Total construction delivery and net absorption only reached 100,470 units and 135,472 units for the year respectively, the weakest record over the past decade....Moody’s Analytics (Reis) reported that the apartment vacancy rate was at 4.4% in Q4 2022, unchanged from 4.4% in Q3, and down from a pandemic peak of 5.4% in both Q1 and Q2 2021.

This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Moody’s Analytics is just for large cities.