by Calculated Risk on 1/12/2023 10:19:00 AM

Thursday, January 12, 2023

Current State of the Housing Market; Overview for mid-January

Today, in the Calculated Risk Real Estate Newsletter: Current State of the Housing Market; Overview for mid-January

A brief excerpt:

And here is a graph comparing the YoY change in the NAR median prices vs the Case-Shiller National Index (the median is distorted by the mix of homes sold, and also lagged since this is for closing prices).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The YoY change in the median price peaked at 25.2% in May 2021 and has now slowed to 3.5%. In general, the NAR median price leads the Case-Shiller index by 2 to 3 months. Note that the median price usually starts falling seasonally in July, so the 2.1% decline in November in the median price was partially seasonal, however the 10.4% decline over the last five months has been much larger than the usual seasonal decline.

It is likely the median price will be down year-over-year in a few months - and Case-Shiller will follow. I’m now forecasting a 10%+ decline in nominal house prices, see: House Prices: 7 Years in Purgatory.

...

On Friday, January 20th, the NAR will release existing home sales for December. This report will likely show another sharp year-over-year decline in sales for December, similar to the YoY decline in November. ... If national sales decline by the same percent as last month, the NAR will report sales for December under 4.0 million SAAR - below the 4.01 million in May 2020 (pandemic low) and the lowest sales rate since 2010.

Weekly Initial Unemployment Claims decrease to 205,000

by Calculated Risk on 1/12/2023 08:37:00 AM

The DOL reported:

In the week ending January 7, the advance figure for seasonally adjusted initial claims was 205,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 204,000 to 206,000. The 4-week moving average was 212,500, a decrease of 1,750 from the previous week's revised average. The previous week's average was revised up by 500 from 213,750 to 214,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 212,500.

The previous week was revised up.

Weekly claims were below the consensus forecast.

BLS: CPI decreased 0.1% in December; Core CPI increased 0.3%

by Calculated Risk on 1/12/2023 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in December on a seasonally adjusted basis, after increasing 0.1 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.5 percent before seasonal adjustment.CPI was below expectations and core CPI was at expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for gasoline was by far the largest contributor to the monthly all items decrease, more than offsetting increases in shelter indexes. The food index increased 0.3 percent over the month with the food at home index rising 0.2 percent. The energy index decreased 4.5 percent over the month as the gasoline index declined; other major energy component indexes increased over the month.

The index for all items less food and energy rose 0.3 percent in December, after rising 0.2 percent in November. Indexes which increased in December include the shelter, household furnishings and operations, motor vehicle insurance, recreation, and apparel indexes. The indexes for used cars and trucks, and airline fares were among those that decreased over the month.

The all items index increased 6.5 percent for the 12 months ending December; this was the smallest 12-month increase since the period ending October 2021. The all items less food and energy index rose 5.7 percent over the last 12 months. The energy index increased 7.3 percent for the 12 months ending December, and the food index increased 10.4 percent over the last year; all of these increases were smaller than for the 12-month period ending November.

emphasis added

Wednesday, January 11, 2023

Thursday: CPI, Unemployment Claims

by Calculated Risk on 1/11/2023 08:39:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 204 thousand last week.

• Also, at 8:30 AM, The Consumer Price Index for December from the BLS. The consensus is for 0.1% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 6.5% year-over-year and core CPI to be up 5.7% YoY.

Lawler: Freddie Mac “National” Home Price Index Down Again in November; Rents Continued to Slide

by Calculated Risk on 1/11/2023 02:41:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Freddie Mac “National” Home Price Index Down Again in November; Rents Continued to Slide

A brief excerpt:

Freddie Mac recently reported that its “National” Home Price Index (FMNHPI) declined for the fifth straight month on a seasonally adjusted basis in November, putting the FNNHPI down 2.06% from its June 2022 peak. Compared to a year earlier the November FMNHPI was up 6.27%, down from October’s 7.92% YOY gain. The November seasonally adjusted FMHPIs for 29 states plus DC were below their 2022 peaks, with five states showing declines of over 5% from their 2022 peak levels.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

CR Note: This is a repeat sales index using only loans purchased by Fannie and Freddie. Freddie has data for all states and many cities. Idaho is down 8.16% seasonally adjusted compared to the peak in 2022. Arizona is down 7.06%, and California is down 5.88%.

Question #3 for 2023: What will the unemployment rate be in December 2023?

by Calculated Risk on 1/11/2023 12:10:00 PM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

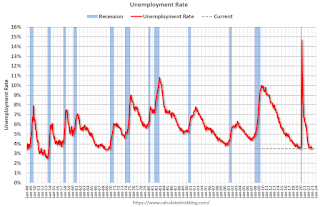

3) Unemployment Rate: The unemployment rate was at 3.5% in December, down 0.4 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will increase to the 4.4% to 4.7% range in Q4 2023. What will the unemployment rate be in December 2023?

Here is a graph of the unemployment rate over time:

Click on graph for larger image.

Click on graph for larger image.The unemployment rate is from the household survey (CPS), and the rate decreased gradually in 2022. The unemployment rate decreased in December to 3.5%, down from 3.9% in December 2021. This tied the lowest unemployment rate since 1969.

Forecasting the unemployment rate includes forecasts for economic and payroll growth, and also for changes in the participation rate (previous question).

Here is a table of the participation rate and unemployment rate since 2008.

| Unemployment and Participation Rate for December each Year | |||

|---|---|---|---|

| December of | Participation Rate | Change in Participation Rate (percentage points) | Unemployment Rate |

| 2008 | 65.8% | 7.3% | |

| 2009 | 64.6% | -1.2 | 9.9% |

| 2010 | 64.3% | -0.3 | 9.3% |

| 2011 | 64.0% | -0.3 | 8.5% |

| 2012 | 63.7% | -0.3 | 7.9% |

| 2013 | 62.9% | -0.8 | 6.7% |

| 2014 | 62.8% | -0.1 | 5.6% |

| 2015 | 62.7% | -0.1 | 5.0% |

| 2016 | 62.7% | 0.0 | 4.7% |

| 2017 | 62.7% | 0.0 | 4.1% |

| 2018 | 63.0% | 0.3 | 3.9% |

| 2019 | 63.3% | 0.3 | 3.6% |

| 2020 | 61.5% | -1.8 | 6.7% |

| 2021 | 62.0% | 0.5 | 3.9% |

| 2022 | 62.3% | 0.3 | 3.5% |

Depending on the estimate for the participation rate and job growth (next question), my guess is the unemployment rate will increase to around 4% in December 2023 from the current 3.5%. (Lower than the FOMC forecast of 4.4% to 4.7%).

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?

Question #4 for 2023: What will the participation rate be in December 2023?

by Calculated Risk on 1/11/2023 09:21:00 AM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

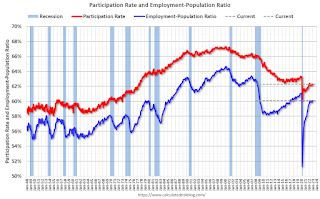

4) Participation Rate: In December 2022, the overall participation rate was at 62.3%, up year-over-year from 62.0% in December 2021, but still below the pre-pandemic level of 63.4%. Long term, the BLS is projecting the overall participation rate will decline to 60.1% by 2031 due to demographics. What will the participation rate be in December 2023?

The overall labor force participation rate is the percentage of the working age population (16 + years old) in the labor force. A large portion of the decline in the participation rate since 2000 was due to demographics and long-term trends.

The second graph shows the participation rate for "prime age" workers (25 to 54 years old). The 25 to 54 participation rate was at 82.4% in December 2022 (Red), down from the pre-pandemic level of 83.0%. This suggests we might see some further increase in the prime participation rate, however most of the prime age workers have returned to the labor force.

The second graph shows the participation rate for "prime age" workers (25 to 54 years old). The 25 to 54 participation rate was at 82.4% in December 2022 (Red), down from the pre-pandemic level of 83.0%. This suggests we might see some further increase in the prime participation rate, however most of the prime age workers have returned to the labor force.Here are the Ten Economic Questions for 2023 and a few predictions:

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/11/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 6, 2023.

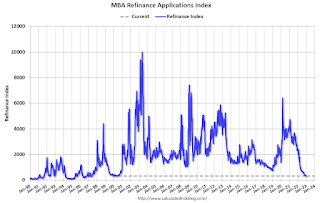

... The Refinance Index increased 5 percent from the previous week and was 86 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index increased 47 percent compared with the previous week and was 44 percent lower than the same week one year ago.

“Mortgage rates declined last week as markets reacted to data showing a weakening economy and slowing wage growth. All loan types in the survey saw a decline in rates, with the 30-year fixed rate falling to 6.42 percent. Purchase applications continued to be hampered by broader weakness in the housing market and declined slightly over the week, with the index slipping to its lowest level since 2014,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “There was an increase in refinance activity as a result of the 16-basis-point decline in rates, as both conventional and government refinance applications increased. However, the overall pace of refinance applications was lower than November and December’s 2022 averages, and over 80 percent lower than a year ago. Refinances were about 30 percent of all applications last week — well below the past decade’s average of 58 percent.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 6.42 percent from 6.58 percent, with points remaining at 0.73 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, January 10, 2023

Mortgage Rate Update

by Calculated Risk on 1/10/2023 02:04:00 PM

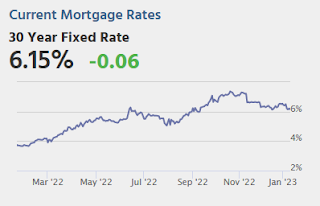

Today, in the Calculated Risk Real Estate Newsletter: Mortgage Rate Update

A brief excerpt:

A year ago, I wrote Mortgage Rates: Moving on Up and 30-year mortgage rates had only increased to 3.625%!There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Now, Mortgage News Daily reports that the most prevalent 30-year fixed rate is now at 6.14% for top tier scenarios. Usually there is a fairly steady spread between the ten-year Treasury yield and 30-year mortgage rates, although - as housing economist Tom Lawler explained in Mortgage/Treasury Spreads, Part I and Part II - the spread has widened due to several factors including volatility and pre-payment speeds.

Second Home Market: South Lake Tahoe in December

by Calculated Risk on 1/10/2023 01:15:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through December 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but still up almost 2-fold from the record low set in February 2022, and up 6% year-over-year. Prices are up 1.3% YoY (and the YoY change has been trending down).

Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

by Calculated Risk on 1/10/2023 08:51:00 AM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

5) Inflation: Core PCE was up 4.7% YoY through November. This was down from a peak of 5.4% in early 2022. The FOMC is forecasting the YoY change in core PCE will be in the 3.2% to 3.7% range in Q4 2023. Will the core inflation rate decrease in 2023, and what will the YoY core inflation rate be in December 2023?

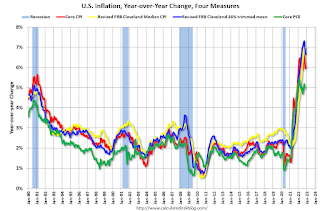

Although there are different measure for inflation, they all show inflation well above the Fed's 2% inflation target.

Note: I follow several measures of inflation, including median CPI and trimmed-mean CPI from the Cleveland Fed. Also core PCE prices (monthly from the BEA) and core CPI (from the BLS).

This graph shows the year-over-year change for these four key measures of inflation. The recent spike in inflation is obvious, and inflation appears to have peaked.

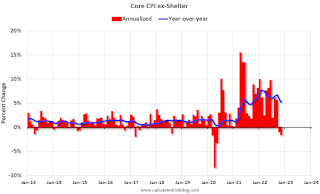

This “dramatic shift” in household formation is leading to Rents Falling Faster than "Seasonality Alone". Since rents are falling - and will likely continue to fall - it probably makes sense to look at inflation ex-shelter for monetary policy over the next several months.

This graph shows the year-over-year change in Core CPI ex-Shelter (blue), and the one month change annualized (red). The year-over-year change was at 5.2% in November, down from 5.9% in October. And the annualized one-month change was negative in both October and November! Core CPI ex-shelter fell at 1.5% annual rate in November.

This graph shows the year-over-year change in Core CPI ex-Shelter (blue), and the one month change annualized (red). The year-over-year change was at 5.2% in November, down from 5.9% in October. And the annualized one-month change was negative in both October and November! Core CPI ex-shelter fell at 1.5% annual rate in November.Here are the Ten Economic Questions for 2023 and a few predictions:

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?

Monday, January 09, 2023

Tuesday: Fed Chair Powell on "Central Bank Independence"

by Calculated Risk on 1/09/2023 09:05:00 PM

[W]hile there was arguably a small amount of push-back in the overnight session, it was quickly erased, and with minimal volatility to boot. This helps legitimize the levels achieved last Friday--especially with Treasury auctions on deck and another high risk event in the form of the CPI data on Thursday. [30 year fixed 6.14%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for December.

• At 9:00 AM: Discussion, Fed Chair Jerome Powell, Central Bank Independence, At the Sveriges Riksbank International Symposium on Central Bank Independence, Stockholm, Sweden

Leading Index for Commercial Real Estate Increases in December

by Calculated Risk on 1/09/2023 04:31:00 PM

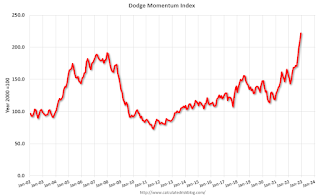

From Dodge Data Analytics: Dodge Momentum Index Wraps up 2022 with December Growth

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, improved 6.6% (2000=100) in December to 222.2 from the revised November reading of 208.3. In December, the commercial component of the DMI rose 8.4%, and the institutional component ticked up 2.7%.

“One of the key construction storylines for 2022 was the return of enthusiasm and optimism in prospects for nonresidential growth,” stated Richard Branch, chief economist for Dodge Construction Network. “While some of that will likely erode in 2023 as economic growth wanes, increased demand for some building types like data centers, labs, and healthcare buildings will provide a solid floor for the construction sector.”

Commercial planning in December was supported by broad-based increases across office, warehouse, retail and hotel planning. Meanwhile, institutional growth focused on recreation and public building, with education and healthcare planning activity remaining flat. On a year-over-year basis, the DMI was 40% higher than in December 2021; the commercial component was up 51%, and institutional planning was 20% higher.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 222.2 in December, up from 208.3 in November.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a solid pickup in commercial real estate construction into 2023.

2nd Look at Local Housing Markets in December

by Calculated Risk on 1/09/2023 12:59:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in December

A brief excerpt:

This is the second look at local markets in December. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in December were mostly for contracts signed in October and November. Since 30-year fixed mortgage rates were over 7% for most of October (no points) and averaged 6.8% in November (Freddie PMMS with points) closed sales were probably impacted significantly in December.

...

In the Northwest, median sales prices were down slightly year-over-year. From the Northwest MLS: For Northwest MLS brokers, December ends with a “whimper,” and 2022 was “a tale of two housing markets”The median sales price was $570,000, down $2,900 (-0.51%) from the year-ago figure of $572,900. Last year’s median price overall peaked in May 2022, at $660,000.In Charlotte, the median sales price was $373,625, up 6.8% year-over-year.

...

In December, sales were down 43.5%. In November, these same markets were down 43.7% YoY Not Seasonally Adjusted (NSA).

Note that in December 2022, there were the same number of selling days as in December 2021, so the SA decline will be similar to the NSA decline.

This is a similar YoY decline as in November for these early reporting markets. If national sales decline by the same percent as last month, the NAR will report sales for December under 4.0 million SAAR - below the 4.01 million in May 2020 (pandemic low) and the lowest sales rate since 2010.

Many more local markets to come!

AAR: December Rail Carloads and Intermodal Down Year-over-year

by Calculated Risk on 1/09/2023 12:04:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

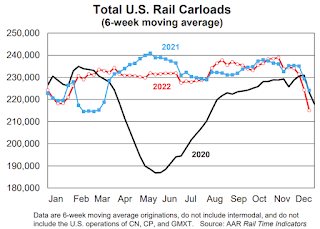

In 2022, U.S. railroads originated 11.98 million total carloads, down 0.3% (34,001 carloads) from 2021 and up 6.2% (697,444 carloads) over 2020. Since 1988, when our U.S. rail data begin, only 2020 had fewer total carloads than 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

December is typically one of the lowest volume months of the year, and 2022 was no exception. Total carloads averaged 210,543 per week in December 2022, the fewest for any month in 2022 and down 4.4% from December 2021. The 4.4% decline in total carloads was the biggest for any month since February 2021.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):U.S. intermodal originations in 2022 were 13.45 million, down 4.9% (686,580 units) from 2021 and down 0.02% (3,131 units) from 2020. U.S. intermodal volume in 2022 was the sixth most ever, but also the lowest since 2016. In 2022, containers accounted 93.7% of U.S. intermodal shipments, a record high.

Wholesale Used Car Prices Down 14.9% Year-over-year; Largest Annual Decline on Record

by Calculated Risk on 1/09/2023 09:15:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Increase in December

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) increased 0.8% in December from November. The Manheim Used Vehicle Value Index (MUVVI) rose to 219.3, down 14.9% from a year ago. This was the largest annualized decline in the series’ history. December’s increase was driven by the seasonal adjustment. The non-adjusted price change in December was a decline of 1.9% compared to November, moving the unadjusted average price down 13.1% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

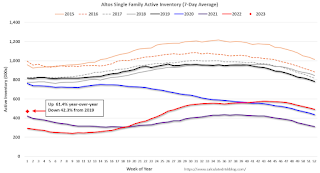

Housing January 9th Weekly Update: Inventory Decreased 4% Week-over-week

by Calculated Risk on 1/09/2023 08:32:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, January 08, 2023

Sunday Night Futures

by Calculated Risk on 1/08/2023 07:09:00 PM

Weekend:

• Schedule for Week of January 8, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 6, and DOW futures are up 39 (fair value).

Oil prices were down over the last week with WTI futures at $73.77 per barrel and Brent at $78.57 per barrel. A year ago, WTI was at $79, and Brent was at $82 - so WTI oil prices are DOWN 6% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.28 per gallon. A year ago, prices were at $3.27 per gallon, so gasoline prices are up $0.01 per gallon year-over-year.

Question #6 for 2023: What will the Fed Funds rate be in December 2023?

by Calculated Risk on 1/08/2023 12:22:00 PM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

6) Monetary Policy: In response to the increase in inflation, the FOMC raised the federal funds rate from "0 to 1/4 percent" in January 2022, to "4-1/4 to 4-1/2 percent" in December. A majority of FOMC participants expect three or even four 25 bp rate hikes in 2023. What will the Fed Funds rate be in December 2023?

"In my view, however, it will be appropriate to continue to raise rates at least at the next few meetings until we are confident inflation has peaked.And Wall Street economists are expecting three or more rate hikes this year. From Goldman Sachs on January 6, 2023:

Once we reach that point, then the second step of our inflation fighting process, as I see it, will be pausing to let the tightening we have already done work its way through the economy. I have us pausing at 5.4 percent ..."

"We continue to expect 25bp fed funds rate hikes each in February, March, and May. We continue to expect no rate cuts in 2023."From BofA on Jan 6, 2023:

"We continue to expect the Fed to lift the target range to 5.0-5.25% early this year, a view that the Fed appeared to tentatively endorse. We expect a 50bp rate hike in February and 25bp increase in March."

| 25 bp Rate Hikes | FOMC Members 2023 |

|---|---|

| No Change | 0 |

| One Rate Hike | 0 |

| Two Rate Hikes | 2 |

| Three Rate Hikes | 10 |

| Four Rate Hikes | 5 |

| Five Rate Hikes | 2 |

Clearly the main view of the FOMC is three or even four rate hikes in 2023.

In summary, we find evidence for a shorter lag in the peak response of inflation to a policy shock in the post-2009 period even after we adjust the shock definition to incorporate forward guidance and balance sheet policy.

There are two reasons why we believe the lags from monetary policy to growth are short while many others believe they are long. First, in our framework a tightening in financial conditions starts to affect the economy when financial markets react to expected policy changes instead of when rate hikes are delivered. Second, many commentators confuse lags from monetary policy to GDP growth with lags to GDP levels.However, employment changes still lag policy. How many construction jobs have been lost so far? None. In fact, construction employment is at an all-time high since there are a record number of housing units under construction! These job losses are already in train with a longer than normal lag due to supply chain issues, and this will increase unemployment and slow wage growth.

The next FOMC meeting ends on February 1st, and it appears the Fed is poised to raise rates 25 bp at this meeting (maybe even 50 bp). However, based on slowing wage growth, core inflation ex-shelter already being negative for two consecutive months, and overall inflation slowing quickly, I think there will be fewer increases this year than most analysts currently expect. My guess is there will be around 2 rate hikes in 2023, and if there are more, the FOMC will be under pressure later in 2023 to cut rates putting the Fed Funds rate under 5% at the end of 2023.

Here are the Ten Economic Questions for 2023 and a few predictions:

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?

Question #7 for 2023: How much will wages increase in 2023?

by Calculated Risk on 1/08/2023 09:39:00 AM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

7) Wage Growth: Wage growth was strong in 2022 (up 5.1% year-over-year as of November). How much will wages increase in 2023?

The most followed wage indicator is the “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. There was a huge increase at the beginning of the pandemic as lower paid employees were let go, and then the pandemic related spike reversed a year later.

Real wage growth has trended down after peaking at 5.6% YoY in March 2022 and was at 4.6% YoY in December 2022.

There are two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation. All three data series are different, and most of the focus recently has been the CES series (used in the graph above).

By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid).

The Atlanta Fed Wage tracker showed nominal wage growth increased sharply in 2021 and for most of 2022. In November 2022, the smoothed 3-month average wage growth was at 6.4% year-over-year, down from 6.7% earlier in the year.

This graph from Indeed, shows posted wage growth.

The Wage Tracker shows US posted wages grew in November at a robust 6.5% year-over-year pace, up from 3.1% in November 2019.Clearly wage growth is slowing and I expect to see some further decreases in both the Average hourly earnings from the CES, and in the Atlanta Fed Wage Tracker. My sense is nominal wages will increase in the 3.0% to 3.5% YoY range in 2023 according to the CES. This depends on the Fed (next question) and if the economy slides into a recession.

Nevertheless, year-over-year posted wage growth has declined substantially in recent months, falling from a peak of 9% in March 2022, a signal employers now face less-steep competition for new hires.

The deceleration is broad-based, with wage growth in 82% of job sectors lower in November than six months earlier.

emphasis added

Here are the Ten Economic Questions for 2023 and a few predictions:

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?