by Calculated Risk on 1/18/2023 10:05:00 AM

Wednesday, January 18, 2023

NAHB: Builder Confidence Increased in January

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 35, up from 31 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Uptick Signals Turning Point for Housing Lies Ahead

A modest drop in interest rates helped to end a string of 12 straight monthly declines in builder confidence levels, although sentiment remains in bearish territory as builders continue to grapple with elevated construction costs, building material supply chain disruptions and challenging affordability conditions.

Builder confidence in the market for newly built single-family homes in January rose four points to 35, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.

“It appears the low point for builder sentiment in this cycle was registered in December, even as many builders continue to use a variety of incentives, including price reductions, to bolster sales,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “The rise in builder sentiment also means that cycle lows for permits and starts are likely near, and a rebound for home building could be underway later in 2023.”

“While NAHB is forecasting a decline for single-family starts this year compared to 2022, it appears a turning point for housing lies ahead,” said NAHB Chief Economist Robert Dietz. “In the coming quarters, single-family home building will rise off of cycle lows as mortgage rates are expected to trend lower and boost housing affordability. Improved housing affordability will increase housing demand, as the nation grapples with a structural housing deficit of 1.5 million units.”

...

All three HMI indices posted gains for the first time since December 2021. The HMI index gauging current sales conditions in January rose four points to 40, the component charting sales expectations in the next six months increased two points to 37 and the gauge measuring traffic of prospective buyers increased three points to 23.

Looking at the three-month moving averages for regional HMI scores, the West registered a one-point gain to 27, the South held steady at 36, the Northeast fell four points to 33 and the Midwest dropped two points to 32.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was above the consensus forecast.

Industrial Production Decreased 0.7 Percent in December

by Calculated Risk on 1/18/2023 09:25:00 AM

From the Fed: Industrial Production and Capacity Utilization

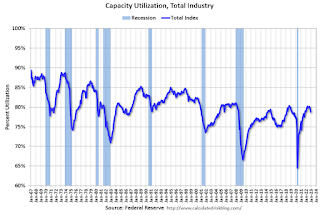

Industrial production decreased 0.7 percent in December and 1.7 percent at an annual rate in the fourth quarter. In December, manufacturing output fell 1.3 percent amid widespread declines across the sector. The index for utilities jumped 3.8 percent, as cold temperatures boosted the demand for heating, while the index for mining moved down 0.9 percent. At 103.4 percent of its 2017 average, total industrial production in December was 1.6 percent above its year-earlier level. Capacity utilization dropped 0.6 percentage point in December to 78.8 percent, a rate that is 0.8 percentage point below its long-run (1972–2021) average,

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.8% is 0.8% below the average from 1972 to 2021. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in December to 104.5. This is above the pre-pandemic level.

The change in industrial production was below consensus expectations.

Retail Sales Decreased 1.1% in December

by Calculated Risk on 1/18/2023 08:40:00 AM

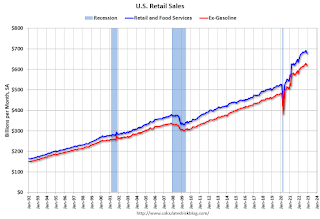

On a monthly basis, retail sales were down 1.1% from November to December (seasonally adjusted), and sales were up 6.0 percent from December 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for December 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $677.1 billion, down 1.1 percent from the previous month, but up 6.0 percent above December 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.8% in December.

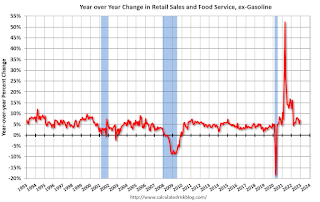

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 6.8% on a YoY basis.

Sales in December were below expectations, and sales in October and November were revised down, combined.

Sales in December were below expectations, and sales in October and November were revised down, combined.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/18/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 27.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 13, 2023.

... The Refinance Index increased 34 percent from the previous week and was 81 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 25 percent from one week earlier. The unadjusted Purchase Index increased 32 percent compared with the previous week and was 35 percent lower than the same week one year ago.

“Mortgage application activity rebounded strongly in the first full week of January, with both refinance and purchase activity increasing by double-digit percentages compared to last week, which included the New Year’s holiday observance,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Despite these gains, refinance activity remains more than 80% below last year’s pace and purchase volume remains 35% below year-ago levels.”

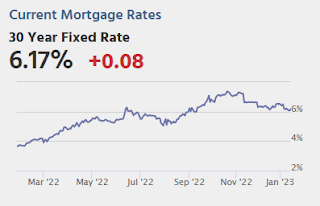

Added Fratantoni, “Mortgage rates are now at their lowest level since September 2022, and about a percentage point below the peak mortgage rate last fall. As we enter the beginning of the spring buying season, lower mortgage rates and more homes on the market will help affordability for first-time homebuyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.23 percent from 6.42 percent, with points decreasing to 0.67 from 0.73 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Tuesday, January 17, 2023

Wednesday: Retail Sales, PPI, Industrial Production, Homebuilder Confidence, Fed's Beige Book

by Calculated Risk on 1/17/2023 08:33:00 PM

By the middle of December, bond yields made a convincing move down from decades-long highs and settled in a sideways range on CPI/Fed week. We re-entered that same sideways range after last week's CPI (3.42-3.62 in 10yr yields), and now wait for a slew of mid-tier reports to see if they're up to the task of informing a new range breakout. [30 year fixed 6.17%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for December is scheduled to be released. The consensus is for a 0.8% decrease in retail sales.

• Also 8:30 AM, The Producer Price Index for December from the BLS. The consensus is for a 0.1% decrease in PPI, and a 0.1% increase in core PPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 79.6%.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 31, unchanged from 31 in December. Any number below 50 indicates that more builders view sales conditions as poor than good.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Homebuilder Price Cuts

by Calculated Risk on 1/17/2023 03:32:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Homebuilder Price Cuts

A brief excerpt:

A short note on homebuilder price cuts courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

From Palacios on Twitter:

Nationally, just 16% of home builders haven't had to drop prices since the market peaked in March 2022. Most builders have dropped prices -6% to -10%. Very different story when you break it out by region however...

Update: The Inland Empire

by Calculated Risk on 1/17/2023 08:18:00 AM

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

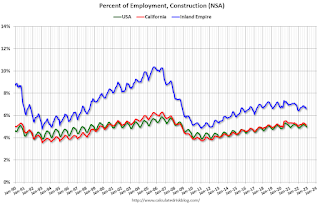

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate was falling before the pandemic and was down to 3.6% (down from 14.4% in 2010). During the pandemic, the unemployment rate increased to 15.6%, but is down to 4.2% (NSA).

So, the Inland Empire economy isn't as heavily depending on construction as during the bubble - and will not be as hard hit by the current housing slowdown.

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S.

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S.Clearly the Inland Empire is more dependent on construction than most areas.

Monday, January 16, 2023

Tuesday: NY Fed Mfg

by Calculated Risk on 1/16/2023 08:20:00 PM

Weekend:

• Schedule for Week of January 15, 2023

Tuesday:

• 8:30 AM: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of -8.7, up from -11.2.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $78.85 per barrel and Brent at $84.06 per barrel. A year ago, WTI was at $84, and Brent was at $79 - so WTI oil prices are DOWN 6% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.29 per gallon. A year ago, prices were at $3.27 per gallon, so gasoline prices are up $0.02 per gallon year-over-year.

The Housing Bubble and Mortgage Debt as a Percent of GDP

by Calculated Risk on 1/16/2023 10:38:00 AM

Today, in the Calculated Risk Real Estate Newsletter: The Housing Bubble and Mortgage Debt as a Percent of GDP

A brief excerpt:

In a 2005 post, I included a graph of household mortgage debt as a percent of GDP. Several readers asked if I could update the graph.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

First, from February 2005 (18 years ago!):The following chart shows household mortgage debt as a % of GDP. Although mortgage debt has been increasing for years, the last four years have seen a tremendous increase in debt. Last year alone mortgage debt increased close to $800 Billion - almost 7% of GDP. ...And a serious problem is what happened!

Many homeowners have refinanced their homes, in essence using their homes as an ATM.It wouldn't take a RE bust to impact the general economy. Just a slowdown in both volume (to impact employment) and in prices (to slow down borrowing) might push the general economy into recession. An actual bust, especially with all of the extensive sub-prime lending, might cause a serious problem.

Housing January 16th Weekly Update: Inventory Increased 0.3% Week-over-week

by Calculated Risk on 1/16/2023 08:13:00 AM

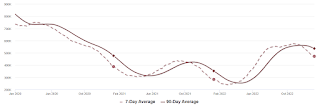

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, January 15, 2023

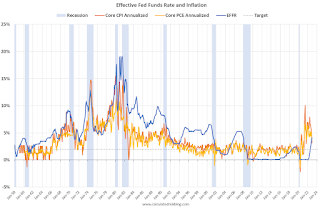

Effective Fed Funds Rate and Inflation

by Calculated Risk on 1/15/2023 10:33:00 AM

This graph shows the Effective Fed Funds Rate (blue) since 1958.

The graph shows two measures of inflation using a month-over-month change annualized (using a three-month average to smooth the graph). For example, for December 2022, I used an average of December, November and October 2022, divided by the average of November, October and September 2022. (This was just for smoothing).

In 1974, the Fed started cutting rates before inflation peaked. However, in the Volcker period, the Fed waited until after inflation peaked.

The good news is the inflation has clearly peaked. And since rents are falling faster than seasonally normal - due to the pandemic related changes in household formation - it makes sense for the short term to use core CPI ex-shelter. And that is actually negative for the last 3 months!

NOTE: There was a surge in household formation during the pandemic, pushing up rents sharply, and now household formation has slowed sharply just as more supply will be coming on the market.

Saturday, January 14, 2023

Real Estate Newsletter Articles this Week: A Sharp Decline in Sales, House Prices and Rents Falling

by Calculated Risk on 1/14/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 3rd Look at Local Housing Markets in December

• Current State of the Housing Market; Overview for mid-January

• Lawler: Freddie Mac “National” Home Price Index Down Again in November; Rents Continued to Slide

• Mortgage Rate Update

• 2nd Look at Local Housing Markets in December

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of January 15, 2023

by Calculated Risk on 1/14/2023 08:11:00 AM

The key reports this week are December retail sales, housing starts and existing home sales.

For manufacturing, the December Industrial Production report and the January New York and Philly Fed manufacturing surveys will be released.

All US markets will be closed in observance of Martin Luther King Jr. Day

8:30 AM: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of -8.7, up from -11.2.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.8% decrease in retail sales.

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.8% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM ET: The Producer Price Index for December from the BLS. The consensus is for a 0.1% decrease in PPI, and a 0.1% increase in core PPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This graph shows industrial production since 1967.

The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 79.6%.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 31, unchanged from 31 in December. Any number below 50 indicates that more builders view sales conditions as poor than good.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 212 thousand initial claims, up from 205 thousand last week.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.358 million SAAR, down from 1.427 million SAAR.

8:30 AM: the Philly Fed manufacturing survey for January.

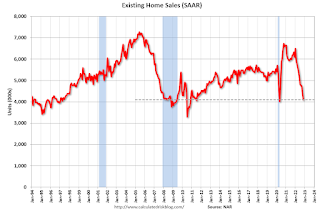

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 3.95 million SAAR, down from 4.09 million.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 3.95 million SAAR, down from 4.09 million.The graph shows existing home sales from 1994 through the report last month.

Friday, January 13, 2023

COVID Jan 13, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 1/13/2023 08:58:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 414,721 | 477,230 | ≤35,0001 | |

| Hospitalized2 | 38,840 | 39,925 | ≤3,0001 | |

| Deaths per Week2🚩 | 3,907 | 2,705 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/13/2023 04:18:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.96 million in December, down 3.2% from November’s preliminary pace and down 35.0%% from last December’s seasonally adjusted pace. Sales on an unadjusted basis should show a slightly larger YOY decline.

On an unadjusted basis the YOY % decline in sales was once again the largest in the West.

Local realtor reports, as well as reports from national inventory trackers, suggest that the inventory of existing homes for sale last month was up substantially from a year earlier, and that the YOY % gain was higher than that seen in November. However, the NAR’s estimate may not show the same increase as these reports suggest, as most of these reports exclude listings with pending contracts. E.g., the Realtor.com report for November showed that the average number of listings excluding those with pending contracts was up 54.7% from last December compared to a YOY increase of 46.8% in November, while average listings including pending contracts were up just 6.0% YOY in December compared to an 3.0% rise in November. The NAR’s inventory estimate for the end of November was up 2.7% from a year earlier. The NAR’s inventory estimate has tracked the Realtor.com total inventory measure much more closely than the “ex-pendings” inventory measure, and appears to include pending listings, which are down sharply from a year ago. Just as the NAR inventory numbers understated the decline in “effective” homes for sale during much of last year, they are now significantly understating the recent increase in effective inventory.

Finally, local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 2.2% from last December. While median prices on existing home sales can be significantly impacted by the mix of home sales and may not reflect changes in typical home values, it is worth noting that median sales prices in quite of few areas of the country last month were flat to down compared to a year ago, including but not limited to a large number of California counties, Phoenix, Austin, Ada County (includes Boise), Illinois, Denver, Colorado Springs, Northwest Washington, Spokane, Portland, Las Vegas, Reno, Houston, Des Moines, DC (city), and Memphis.

On a separate note: While I’ve been unable to produce national estimates of the NAR’s Pending Home Sales Index (not all local realtor reports include new pending sales, and many that do often revise their numbers significantly), I did notice that the majority of realtor reports that show new pending sales showed somewhat smaller YOY declines in December relative to November. As such, it’s possible that the PHSI may show a “bump” in December from November’s especially low level.

CR Note: The National Association of Realtors (NAR) is scheduled to release December existing home sales on Friday, January 20, 2023, at 10:00 AM ET. The consensus is for 3.95 million SAAR.

Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

by Calculated Risk on 1/13/2023 02:08:00 PM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

1) Economic growth: Economic growth was probably close to 1% in 2022 as the economy slowed following the economic rebound in 2021. The FOMC is expecting growth of just 0.4% to 1.0% Q4-over-Q4 in 2023. How much will the economy grow in 2023? Will there be a recession in 2023?

One of the leading indicators for recessions is the yield curve. Here is a graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED.

One of the leading indicators for recessions is the yield curve. Here is a graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED.Click here for interactive graph at FRED.

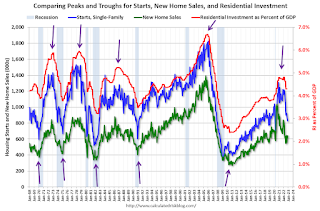

My yield-curve indicator has gone Code Red. It is 8 for 8 in forecasting recessions since 1968 —with no false alarms. I have reasons to believe, however, that it is flashing a false signal.One of my favorite models for business cycle forecasting uses new home sales (also housing starts and residential investment). The purpose of the mext graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

...

The yield curve has now inverted for a ninth time since 1968. Does it spell doom? I am not so sure.

...

These circumstances raise the possibility of dodging the bullet. Ideally, we avoid the hard-landing recession and realize slow growth or minor negative growth. If a recession arrives, it will be mild.

The major wildcard is the Fed, who was late in raising rates. The Fed cannot err twice by overshooting-i.e., continuing to increase rates well beyond when they should have stopped. I believe the time to end the tightening is now.

The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent peak.

The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent peak.New home sales and single-family starts turned down last year, but that was partly due to the huge surge in sales during the pandemic - and then rebounded somewhat. Now both new home sales and single-family starts have turned down in response to higher mortgage rates. Residential investment has also peaked.

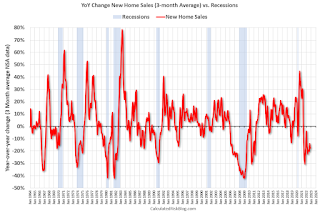

This third graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 18% year-over-year.

This third graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 18% year-over-year.Here is a table of the annual change in real GDP since 2005. Prior to the pandemic, economic activity was mostly in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%..

Note: This table includes both annual change and q4 over the previous q4 (two slightly different measures). For 2022, I used a 2.6% annual growth rate in Q4 2022 (this gives -2.2% Q4 over Q4 or -3.4% real annual growth). This is based on Goldman Sachs estimate: "We left our Q4 GDP tracking estimate unchanged at +2.6% (qoq ar)."

| Real GDP Growth | ||

|---|---|---|

| Year | Annual GDP | Q4 / Q4 |

| 2005 | 3.5% | 3.0% |

| 2006 | 2.8% | 2.6% |

| 2007 | 2.0% | 2.2% |

| 2008 | 0.1% | -2.5% |

| 2009 | -2.6% | 0.1% |

| 2010 | 2.7% | 2.8% |

| 2011 | 1.5% | 1.5% |

| 2012 | 2.3% | 1.6% |

| 2013 | 1.8% | 2.5% |

| 2014 | 2.3% | 2.6% |

| 2015 | 2.7% | 1.9% |

| 2016 | 1.7% | 2.0% |

| 2017 | 2.2% | 2.8% |

| 2018 | 2.9% | 2.3% |

| 2019 | 2.3% | 2.6% |

| 2020 | -2.8% | -1.5% |

| 2021 | 5.9% | 5.7% |

| 20221 | 2.0% | 0.9% |

| 1 2022 estimate based on 2.6% Q4 SAAR annualized real growth rate. | ||

My sense is growth will stay sluggish in 2023, but the economy will avoid recession. Although monetary policy is restrictive, the fiscal policy drag is probably over. Vehicle sales will probably pick up in 2023, but housing will stay low.

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?

Q4 GDP Tracking: Solid Q4

by Calculated Risk on 1/13/2023 01:00:00 PM

From BofA:

Overall, our 4Q GDP tracking estimate moved from 1.5% q/q saar as of our last weekly publication to 2.6% q/q saar after our batch update [Jan 6th estimate]From Goldman:

emphasis added

We left our Q4 GDP tracking estimate unchanged at +2.6% (qoq ar). [Jan 10th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.1 percent on January 10, up from 3.8 percent on January 5. [Jan 10th estimate]

3rd Look at Local Housing Markets in December

by Calculated Risk on 1/13/2023 09:57:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in December

A brief excerpt:

This is the third look at local markets in December. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in December were mostly for contracts signed in October and November. Since 30-year fixed mortgage rates were over 7% for most of October (no points) and averaged 6.8% in November (Freddie PMMS with points) closed sales were probably impacted significantly in December.

From the Houston Association of REALTORS®: The Economic Headwinds of 2022 Bring Houston’s Home Sales Hot Streak to an EndFor the month of December, single-family home sales dropped 32.6 percent. That marks the ninth straight monthly decline of 2022 and the steepest. … The median price of a single-family home – the figure at which half of the homes sold for more and half sold for less – was $330,000 in December. That is the third straight month it has held at that level and is 3.8 percent higher than last December.

emphasis addedHere is a summary of active listings for these housing markets in December.

Inventory in these markets were down 30% YoY in January 2022 and are now up 76% YoY! So, this is a significant change from early in 2022, and about the same YoY inventory increase as in November (up 72% YoY).

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle), Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) Totals do not include Atlanta, or Denver (included in state totals)

...

Many more local markets to come!

Thursday, January 12, 2023

Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

by Calculated Risk on 1/12/2023 02:55:00 PM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

2) Employment: The economy added 4.5 million jobs in 2022. This makes 2022 the second-best year for job growth in US history, only behind the 6.7 million jobs added in 2021. How much will job growth slow in 2023? Or will the economy lose jobs?

| Job Changes During Recessions | ||

|---|---|---|

| Year | Job Change | Recession |

| 1974 | -379 | '73-'75 |

| 1975 | 365 | '73-'75 |

| 1980 | 271 | '80 |

| 1981 | -48 | '81-'82 |

| 1982 | -2,124 | '81-'82 |

| 1990 | 330 | '90-'91 |

| 1991 | -838 | '90-91 |

| 2001 | -1,727 | '01 |

| 2002 | -510 | '01 |

| 2008 | -3,553 | '07-'09 |

| 2009 | -5,051 | '07-'09 |

| 2020 | -9,292 | '20 |

Here are the Ten Economic Questions for 2023 and a few predictions:

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?

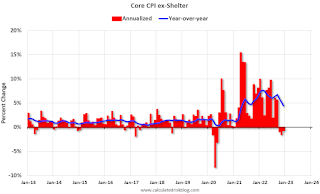

Cleveland Fed: Median CPI increased 0.4% and Trimmed-mean CPI increased 0.4% in December

by Calculated Risk on 1/12/2023 11:58:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.4% in December. The 16% trimmed-mean Consumer Price Index increased 0.4% in December. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Fuel oil and other fuels" decreased at a 78% annualized rate in December, and "Used Cars" decreased at a 27% annualized rate.