by Calculated Risk on 2/21/2023 08:24:00 AM

Tuesday, February 21, 2023

CoreLogic: "US Annual Rent Price Growth Dropped by Nearly Half in December"

CoreLogic: US Annual Rent Price Growth Dropped by Nearly Half in December

Rent price gains declined in December for the eighth straight month on an annual basis, but the 6.4% national increase remained higher than pre-pandemic levels. ...

“U.S. single-family rental price growth closed out 2022 at about half of what it was one year ago,” said Molly Boesel, principal economist at CoreLogic. “However, while rent growth has been slowing, it still rose at more than double the pre-pandemic rate. Rental price gains began increasing near the end of 2020 and have risen by about an average of $300 in the past two years. Annual single-family rent growth is projected to slow throughout 2023, but it will likely not decline by enough to wipe out gains from the past two years.”

emphasis added

Click on graph for larger image.

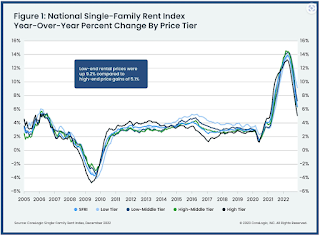

Click on graph for larger image.This graph from CoreLogic shows the year-over-year change in rents for several price tiers.

This index was reported to be up 6.4% YoY in December, after rising 7.5% YoY in November and 8.8% YoY in October.

Monday, February 20, 2023

Tuesday: Existing Home Sales

by Calculated Risk on 2/20/2023 06:21:00 PM

Weekend:

• Schedule for Week of February 19, 2023

Tuesday:

• At 10:00 AM ET, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, up from 4.02 million.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 10 and DOW futures are down 85 (fair value).

Oil prices were up over the last week with WTI futures at $77.13 per barrel and Brent at $83.90 per barrel. A year ago, WTI was at $91, and Brent was at $99 - so WTI oil prices are DOWN 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.36 per gallon. A year ago, prices were at $3.48 per gallon, so gasoline prices are down $0.12 per gallon year-over-year.

Fannie "Real Estate Owned" inventory increased in Q4; Expected to increase further in 2023

by Calculated Risk on 2/20/2023 01:37:00 PM

Fannie reported results for Q4 2022. Here is some information on single-family Real Estate Owned (REOs).

"In response to the COVID-19 pandemic, a number of legislative and executive actions were taken by the federal government and state and local governments to assist affected borrowers and renters and to slow the spread of the pandemic, including actions that applied to the loans we guarantee. While most of these actions are no longer in effect, the COVID-19 national emergency remains in place. In January 2023, the Administration announced it intends to extend the COVID-19 national emergency to May 11, 2023, and end the emergency on that date. We continue to offer forbearance relief and other home retention solutions to borrowers affected by the COVID-19 pandemic ..."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie Real Estate Owned (REO).

This is well below a normal level of REOs for Fannie, and REO levels will increase further in 2023, but there will not be a huge wave of foreclosures.

First time ever more "Built-for-Rent" Units started Quarterly than "Built-for-Sale"

by Calculated Risk on 2/20/2023 10:37:00 AM

Today, in the Calculated Risk Real Estate Newsletter: First time ever more "Built-for-Rent" Units started Quarterly than "Built-for-Sale"

A brief excerpt:

Along with the monthly housing starts report for January last week, the Census Bureau released Housing Units Started by Purpose and Design through Q4 2022.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and multi-family built for sale.Single family starts built for sale (red) were down 34% in Q4 2022 compared to Q4 2021. And owner built starts (orange) were down 10% year-over-year.

Multi-family built for sale decreased and are still low.The 'units built for rent' (blue) and were up 15% in Q4 2022 compared to Q4 2021. For the first time since this series started in 1974, there were more units built-for-rent started in Q4 2022 than single family units built-for-sale started.

Housing February 20th Weekly Update: Inventory Decreased 1.5% Week-over-week

by Calculated Risk on 2/20/2023 08:32:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, February 19, 2023

LA Port Inbound Traffic Down 22% YoY in January

by Calculated Risk on 2/19/2023 08:30:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 1.9% in January compared to the rolling 12 months ending in December. Outbound traffic decreased 0.6% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 2/19/2023 12:14:00 PM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for almost 13 years. He has graciously allowed me to share his predictions with the readers of this blog.

The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales. Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Over the last 12+ years, the consensus average miss was 144 thousand (median 110 thousand), and Lawler's average miss was 72 thousand (median 60 thousand).

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | 5.51 |

| Mar-19 | 5.30 | 5.40 | 5.21 |

| Apr-19 | 5.36 | 5.31 | 5.19 |

| May-19 | 5.29 | 5.40 | 5.34 |

| Jun-19 | 5.34 | 5.25 | 5.27 |

| Jul-19 | 5.39 | 5.40 | 5.42 |

| Aug-19 | 5.38 | 5.42 | 5.49 |

| Sep-19 | 5.45 | 5.36 | 5.38 |

| Oct-19 | 5.49 | 5.36 | 5.46 |

| Nov-19 | 5.45 | 5.43 | 5.35 |

| Dec-19 | 5.43 | 5.40 | 5.54 |

| Jan-20 | 5.45 | 5.42 | 5.46 |

| Feb-20 | 5.50 | 5.58 | 5.77 |

| Mar-20 | 5.30 | 5.25 | 5.27 |

| Apr-20 | 4.30 | 4.17 | 4.33 |

| May-20 | 4.38 | 3.80 | 3.91 |

| Jun-20 | 4.86 | 4.65 | 4.72 |

| Jul-20 | 5.39 | 5.85 | 5.86 |

| Aug-20 | 6.00 | 5.92 | 6.00 |

| Sep-20 | 6.25 | 6.38 | 6.54 |

| Oct-20 | 6.45 | 6.63 | 6.85 |

| Nov-20 | 6.70 | 6.50 | 6.69 |

| Dec-20 | 6.55 | 6.62 | 6.76 |

| Jan-21 | 6.60 | 6.48 | 6.69 |

| Feb-21 | 6.51 | 6.29 | 6.22 |

| Mar-21 | 6.17 | 6.02 | 6.01 |

| Apr-21 | 6.09 | 5.96 | 5.85 |

| May-21 | 5.74 | 5.78 | 5.80 |

| Jun-21 | 5.90 | 5.79 | 5.86 |

| Jul-21 | 5.84 | 5.86 | 5.99 |

| Aug-21 | 5.88 | 5.90 | 5.88 |

| Sep-21 | 6.06 | 6.20 | 6.29 |

| Oct-21 | 6.20 | 6.34 | 6.34 |

| Nov-21 | 6.20 | 6.45 | 6.46 |

| Dec-21 | 6.45 | 6.33 | 6.18 |

| Jan-22 | 6.12 | 6.36 | 6.50 |

| Feb-22 | 6.16 | 5.97 | 6.02 |

| Mar-22 | 5.80 | 5.74 | 5.77 |

| Apr-22 | 5.62 | 5.57 | 5.61 |

| May-22 | 5.41 | 5.35 | 5.41 |

| Jun-22 | 5.40 | 5.12 | 5.12 |

| Jul-22 | 4.88 | 4.90 | 4.81 |

| Aug-22 | 4.70 | 4.84 | 4.80 |

| Sep-22 | 4.69 | 4.82 | 4.71 |

| Oct-22 | 4.39 | 4.49 | 4.43 |

| Nov-22 | 4.20 | 4.16 | 4.09 |

| Dec-22 | 3.95 | 3.96 | 4.02 |

| Jan-22 | 4.10 | 4.18 | NA |

| 1NAR initially reported before revisions. | |||

Saturday, February 18, 2023

Real Estate Newsletter Articles this Week: "Near Record Number of Housing Units Under Construction"

by Calculated Risk on 2/18/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 3rd Look at Local Housing Markets in January Lawler: Early Read on Existing Home Sales in January

• January Housing Starts: Near Record Number of Housing Units Under Construction

• Current State of the Housing Market: Overview for mid-February

• Update: Some "Good News" for Homebuilders

• 2nd Look at Local Housing Markets in January

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of February 19, 2023

by Calculated Risk on 2/18/2023 08:11:00 AM

The key reports this week are January New and Existing Home sales, the second estimate of Q4 GDP and Personal Income and Outlays for January.

All US markets will be closed in observance of the Presidents' Day holiday.

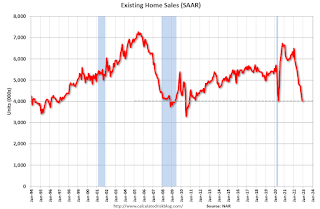

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, up from 4.02 million.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, up from 4.02 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.18 million SAAR for January.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of January 31-February 1, 2023

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 200 thousand initial claims, up from 194 thousand last week.

8:30 AM: Gross Domestic Product, 4th quarter 2022 (Second estimate). The consensus is that real GDP increased 2.9% annualized in Q4, unchanged from the advance estimate of 2.9%.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

11:00 AM: the Kansas City Fed manufacturing survey for February.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 0.9% increase in personal income, and for a 1.3% increase in personal spending. And for the Core PCE price index to increase 0.4%. PCE prices are expected to be up 4.9% YoY, and core PCE prices up 4.3% YoY.

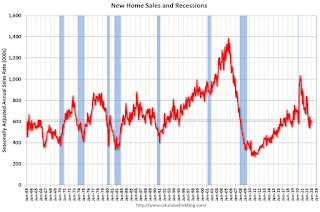

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

10:00 AM: University of Michigan's Consumer sentiment index (Final for February). The consensus is for a reading of 66.4.

Friday, February 17, 2023

COVID Feb 17, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 2/17/2023 09:00:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 259,339 | 282,901 | ≤35,0001 | |

| Hospitalized2 | 22,059 | 23,937 | ≤3,0001 | |

| Deaths per Week2 | 2,838 | 3,166 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

3rd Look at Local Housing Markets in January; Lawler: Early Read on Existing Home Sales in January

by Calculated Risk on 2/17/2023 03:20:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in January

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.18 million in January, up 4.0% from December’s preliminary pace and down 35.6% from last January’s seasonally adjusted pace....In January, sales were down 33.9% in these markets. In December, these same markets were down 37.5% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline than in December for these markets. This data suggests NAR reported sales will rebound in January from 4.02 million SAAR in December.

This will still be a significant YoY decline, and the 17th consecutive month with a YoY decline.

Realtor.com Reports Weekly Active Inventory Up 70% YoY; New Listings Down 13% YoY

by Calculated Risk on 2/17/2023 12:42:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Feb 11, 2023

• Active inventory growth continued to climb with for-sale homes up 70% above one year ago. Inventories of for-sale homes rose again, on par with the yearly gains we saw last week. Still-low buyer interest amid high costs rather than an influx of sellers is driving this increase. Even after these huge gains, January data show that nationwide there are still more than 40% fewer homes for sale than were available pre-pandemic,

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 13% from one year ago. For 32 weeks now, fewer homeowners put their homes on the market for sale than at this time last year. After smaller declines in the first few weeks of the year, the gap has widened for a third week, indicating lower seller interest than we saw one year ago.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. In early 2022, inventory was declining rapidly, so the year-over-year change is up sharply.

Q1 GDP Tracking: Around 1.5%

by Calculated Risk on 2/17/2023 09:40:00 AM

From BofA:

On net,this week’s data initiated our 1Q US GDP tracking estimate at 1.5% q/q saar, somewat above our official forecast of 1.0%. The data also reduced our 4Q US GDP tracking estimate from 3.2% q/q saar to 2.9%. [Feb 17th estimate]From Goldman:

emphasis added

We left our Q1 GDP tracking estimate unchanged at +1.4% (qoq ar) and our domestic final sales forecast unchanged at +1.9%. We also left our past-quarter GDP tracking estimate for Q4 unchanged at +3.0%, compared to +2.9% as originally reported. [Feb 16th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 2.5 percent on February 16, up from February 15. After this morning’s housing starts report from the US Census Bureau, the nowcast of first-quarter real residential investment growth increased from -10.4 percent to -8.1 percent. [Feb 16th estimate]

Hotels: Occupancy Rate Down 8.7% Compared to Same Week in 2019

by Calculated Risk on 2/17/2023 08:34:00 AM

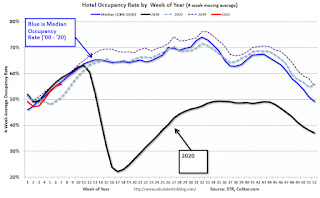

U.S. hotel performance increased from the previous week, according to STR‘s latest data through Feb. 11.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Feb. 5-11, 2023 (percentage change from comparable week in 2019*):

• Occupancy: 57.8% (-8.7%)

• Average daily rate (ADR): $150.97 (+13.4%)

• Revenue per available room (RevPAR): $87.21 (+3.6%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019. Year-over-year comparisons will once again become standard after the first quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Thursday, February 16, 2023

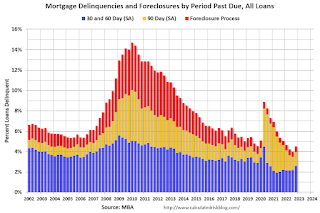

MBA: "Mortgage Delinquencies Increase in the Fourth Quarter of 2022"

by Calculated Risk on 2/16/2023 01:42:00 PM

From the MBA: Mortgage Delinquencies Increase in the Fourth Quarter of 2022

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.96 percent of all loans outstanding at the end of the fourth quarter of 2022, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was up 51 basis points from the third quarter of 2022 but still down 69 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the fourth quarter fell by 1 basis point to 0.14 percent.

“As expected, the overall national mortgage delinquency rate increased in the fourth quarter of 2022 from its previous quarterly survey low,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The weaker economy and ongoing inflationary pressures contributed to the uptick in delinquencies. The delinquency rate – while still low – increased from the previous quarter across all loan types and across all stages of delinquency.”

According to Walsh, for the past 15 years, mortgage delinquencies have tracked very closely with employment conditions. Despite recent indicators of resiliency in the job market, including the unemployment rate declining to 3.4 percent in January, MBA still forecasts for slower hiring and rising unemployment, with the rate rising to 5.2 percent by the end of the year. This will likely mean further increases in mortgage delinquencies.

Added Walsh, “Notwithstanding the fourth-quarter increase in mortgage delinquencies, the foreclosure starts rate of 0.14 percent was well below the historical quarterly average of 0.40 percent. Many distressed homeowners have loss mitigation options available to them and have accumulated home equity, which can ease financial hardship and avert foreclosure actions.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies increased in Q4 from a record low in Q3.

From the MBA:

Compared to last quarter, the seasonally adjusted mortgage delinquency rate increased for all loans outstanding. By stage, the 30-day delinquency rate increased 26 basis points to 1.92 percent, the 60-day delinquency rate increased 13 basis points to 0.66 percent, and the 90-day delinquency bucket increased 11 basis points to 1.38 percent.The sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.57 percent, up 1 basis point from the third quarter of 2022 and 15 basis points higher than one year ago.

The percent of loans in the foreclosure process increased year-over-year in Q4 with the end of the foreclosure moratoriums but are still historically low.

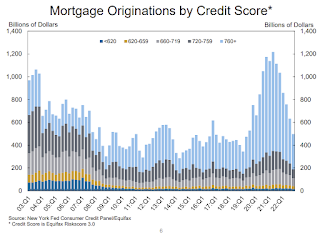

NY Fed Q4 Report: Household Debt Increases, Mortgage and Auto Loan Growth Slows

by Calculated Risk on 2/16/2023 11:21:00 AM

From the NY Fed: Total Household Debt Reaches $16.90 trillion in Q4 2022; Mortgage and Auto Loan Growth Slows

The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows an increase in total household debt in the fourth quarter of 2022, increasing by $394 billion (2.4%) to $16.90 trillion. Balances now stand $2.75 trillion higher than at the end of 2019, before the pandemic recession. The report is based on data from the New York Fed's nationally representative Consumer Credit Panel.

Mortgage balances rose by $254 billion in the fourth quarter of 2022 and stood at $11.92 trillion at the end of December, marking a nearly $1 trillion increase in mortgage balances in 2022.

Credit card balances increased $61 billion in the fourth quarter to $986 billion, surpassing the pre-pandemic high of $927 billion. Auto loan balances increased by $28 billion in the fourth quarter, consistent with the upward trajectory seen since 2011. Student loan balances now stand at $1.60 trillion, up by $21 billion from the previous quarter. In total, non-housing balances grew by $126 billion.

Mortgage originations, which include refinances, fell to $498 billion in the fourth quarter, representing a return to lower levels last seen in 2019. The volume of newly originated auto loans was $186 billion, representing a slight increase from the previous quarter. Aggregate limits on credit card accounts increased by $88 billion in the fourth quarter and now stand at $4.4 trillion.

The share of current debt becoming delinquent increased again in the fourth quarter for nearly all debt types, following two years of historically low delinquency transitions. The delinquency transition rate for credit cards and auto loans increased by 0.6 and 0.4 percentage points, respectively.

"Credit card balances grew robustly in the 4th quarter, while mortgage and auto loan balances grew at a more moderate pace, reflecting activity consistent with pre-pandemic levels," said Wilbert van der Klaauw, economic research advisor at the New York Fed. "Although historically low unemployment has kept consumer's financial footing generally strong, stubbornly high prices and climbing interest rates may be testing some borrowers' ability to repay their debts."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows aggregate consumer debt increased in Q4. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $394 billion in the fourth quarter of 2022, a 2.4% rise from 2022Q3. Balances now stand at $16.90 trillion and have increased by $2.75 trillion since the end of 2019, just before the pandemic recession.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate decreased in Q4. From the NY Fed:

Aggregate delinquency rates decreased in the fourth quarter of 2022 and remained low, after declining sharply through the beginning of the pandemic, although there has been some shift in the composition, with increases in the share of balances that are 30- 59 days past due and declines in seriously delinquent balances. As of December, 2.5% of outstanding debt was in some stage of delinquency, 2.2 percentage points lower than last quarter of 2019, just before the COVID-19 pandemic hit the United States.

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

Mortgage originations, measured as appearances of new mortgages on consumer credit reports, declined to $498 billion in 2022Q4, back to the lower levels seen in 2019. ... The median credit score of newly originated mortgages declined again, to 766, down from a series high in 2021Q1 of 788 and returning to pre-covid levels which remain very high and reflect continuing high lending standards. The median credit score on newly originated auto loans was down slightly, to 711, but remained about level with the past two years.There is much more in the report.

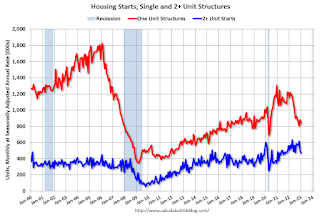

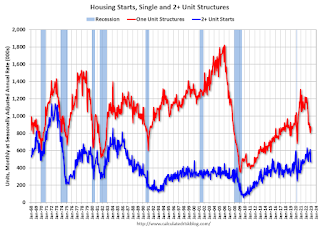

January Housing Starts: Near Record Number of Housing Units Under Construction

by Calculated Risk on 2/16/2023 09:26:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: January Housing Starts: Near Record Number of Housing Units Under Construction

Excerpt:

Possibly Important: Multi-family permits averaged 547,000 SAAR over the last three months after averaging close to 650,000 SAAR over the previous 8 months. This decline in permits is a possible signal that the expected decline in multi-family starts has begun (although permits aren’t a perfect leading indicator for starts).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

...

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).

Red is single family units. Currently there are 752 thousand single family units (red) under construction (SA). This was down in January compared to December, and 76 thousand below the recent peak in April and May 2022. Single family units under construction have peaked since single family starts are now declining. The reason there are still so many homes under construction is probably due to supply constrain

Blue is for 2+ units. Currently there are 948 thousand multi-family units under construction. This is the highest level since November 1973! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are 1.700 million units under construction, just below the all-time record of 1.711 million set in October 2022.

...

The weakness in 2022 was mostly for single family starts; however, it appears the expected decline in multi-family starts has begun.

Housing Starts Decreased to 1.309 million Annual Rate in January

by Calculated Risk on 2/16/2023 08:42:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in January were at a seasonally adjusted annual rate of 1,309,000. This is 4.5 percent below the revised December estimate of 1,371,000 and is 21.4 percent below the January 2022 rate of 1,666,000. Single‐family housing starts in January were at a rate of 841,000; this is 4.3 percent below the revised December figure of 879,000. The January rate for units in buildings with five units or more was 457,000.

Building Permits:

Privately‐owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,339,000. This is 0.1 percent above the revised December rate of 1,337,000, but is 27.3 percent below the January 2022 rate of 1,841,000. Single‐family authorizations in January were at a rate of 718,000; this is 1.8 percent below the revised December figure of 731,000. Authorizations of units in buildings with five units or more were at a rate of 563,000 in January

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) decreased in January compared to December. Multi-family starts were down 8.1% year-over-year in January.

Single-family starts (red) decreased in January and were down 27.3% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse in single-family starts.

Total housing starts in January were below expectations, however, starts in November and December were revised up slightly, combined.

I'll have more later …

Weekly Initial Unemployment Claims decrease to 194,000

by Calculated Risk on 2/16/2023 08:30:00 AM

The DOL reported:

In the week ending February 11, the advance figure for seasonally adjusted initial claims was 194,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 196,000 to 195,000. The 4-week moving average was 189,500, an increase of 500 from the previous week's revised average. The previous week's average was revised down by 250 from 189,250 to 189,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 189,500.

The previous week was revised down.

Weekly claims were below the consensus forecast.

Wednesday, February 15, 2023

Thursday: Housing Starts, Unemployment Claims, PPI, Philly Fed Mfg, NY Fed Household Debt and Credit

by Calculated Risk on 2/15/2023 08:53:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 200 thousand initial claims, up from 196 thousand last week.

• Also at 8:30 AM, Housing Starts for January. The consensus is for 1.361 million SAAR, down from 1.382 million SAAR.

• Also at 8:30 AM, The Producer Price Index for December from the BLS. The consensus is for a 0.4% increase in PPI, and a 0.3% increase in core PPI.

• Also at 8:30 AM, the Philly Fed manufacturing survey for February. The consensus is for a reading of -6.7, up from -8.9.

• At 11:00 AM, NY Fed: Q4 Quarterly Report on Household Debt and Credit