by Calculated Risk on 3/20/2023 12:32:00 AM

Monday, March 20, 2023

Sunday Night Futures

Weekend:

• Schedule for Week of March 19, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures and DOW futures are unchanged (fair value).

Oil prices were down over the last week with WTI futures at $66.37 per barrel and Brent at $72.57 per barrel. A year ago, WTI was at $105, and Brent was at $114 - so WTI oil prices are DOWN 37% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.40 per gallon. A year ago, prices were at $4.23 per gallon, so gasoline prices are down $0.83 per gallon year-over-year.

Sunday, March 19, 2023

FOMC Preview: Uncertainty, Likely 25bp Hike, Maybe Pause

by Calculated Risk on 3/19/2023 11:48:00 AM

There is uncertainty regarding FOMC policy this month due to the banking issues. Just two weeks ago, the debate appeared to be between a 25bp hike and a 50 bp hike at the March meeting. On March 7th, Fed Chair Powell said:

… the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.However, expectations are now that the FOMC will announce a 25bp rate increase in the federal funds rate at the FOMC meeting this week, and they might even pause.

emphasis added

"[W]e look for the Fed to raise its target range for the federal funds rate by 25bp to 4.75-5.0%. The recent market turbulence stemming from distress in several regional banks certainly calls for more caution ... In the absence of further events, policymakers are likely to conclude that inflation stability remains a key monetary policy priority and, given that the economic data point to real side resilience and inflation persistence, a view a 25bp rate hike is warranted. Forward guidance, however, is likely to be somewhat dovish, highlighting the emergence of downside risk to the outlook and the policy rate path."

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Dec 2022 | 0.4 to 1.0 | 1.3 to 2.0 | 1.6 to 2.0 | |

The unemployment rate was at 3.6% in February, just above the 50-year low. The FOMC has been criticized for projecting a significant employment recession this year, and they will probably revise down their projected unemployment rate for Q4 2023.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Dec 2022 | 4.4 to 4.7 | 4.3 to 4.8 | 4.0 to 4.7 | |

As of January 2023, PCE inflation was up 5.4% year-over-year from January 2022, and, in general, inflation has been close to expectations. However, after accounting for the unusual dynamics related to the pandemic, inflation is likely lower than expected. The FOMC will likely leave their inflation projections mostly unchanged.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Dec 2022 | 2.9 to 3.5 | 2.3 to 2.7 | 2.0 to 2.2 | |

PCE core inflation was up 4.7% in January year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Dec 2022 | 3.2 to 3.7 | 2.3 to 2.7 | 2.0 to 2.2 | |

Saturday, March 18, 2023

Real Estate Newsletter Articles this Week: "Average Length of Time from Start to Completion increased Sharply in 2022"

by Calculated Risk on 3/18/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Pandemic Economics, Housing and Monetary Policy: Part 2

• Current State of the Housing Market; Overview for mid-March

• Lawler: Early Read on Existing Home Sales in February

• February Housing Starts: Average Length of Time from Start to Completion increased Sharply in 2022

• Q4 Update: Delinquencies, Foreclosures and REO

• 2nd Look at Local Housing Markets in February

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of March 19, 2023

by Calculated Risk on 3/18/2023 08:11:00 AM

The key reports this week are February New and Existing Home Sales.

The FOMC meets this week, and there is some uncertainty on rate hikes due to the recent banking issues.

No major economic releases scheduled.

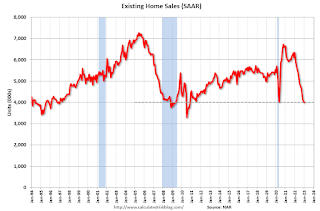

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 4.15 million SAAR, up from 4.00 million.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 4.15 million SAAR, up from 4.00 million.The graph shows existing home sales from 1994 through the report last month.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 25bps at this meeting, although there is some uncertainty due to the bank issues.

2:00 PM: FOMC Projections. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with updated economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 190 thousand initial claims, down from 192 thousand last week.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 650 thousand SAAR, down from 670 thousand in January.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.2% increase in durable goods orders.

10:00 AM: State Employment and Unemployment (Monthly), February 2023

Friday, March 17, 2023

COVID Mar 17, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 3/17/2023 08:45:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

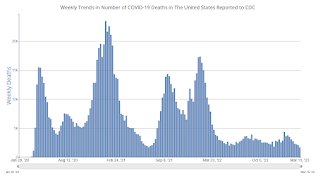

| New Cases per Week2 | 149,955 | 186,793 | ≤35,0001 | |

| Hospitalized2 | 17,348 | 19,629 | ≤3,0001 | |

| Deaths per Week2 | 1,706 | 2,100 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

LA Port Inbound Traffic Down Sharply YoY in February

by Calculated Risk on 3/17/2023 03:16:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

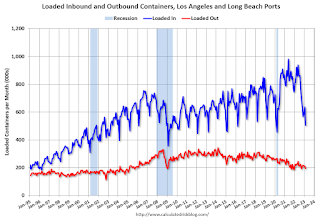

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 3.4% in February compared to the rolling 12 months ending in January. Outbound traffic decreased 0.8% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.Lawler: Early Read on Existing Home Sales in February

by Calculated Risk on 3/17/2023 01:12:00 PM

Today, in the Calculated Risk Real Estate Newsletter:

Lawler: Early Read on Existing Home Sales in February 3rd Look at Local Housing Markets in February

A brief excerpt:

This is the third look at local markets in February. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

California doesn’t report monthly inventory numbers, but they do report the change in months of inventory. Here is the press release from the California Association of Realtors® (C.A.R.): More favorable interest rates perk up California home sales for third straight month in February, C.A.R. reports• Existing, single-family home sales totaled 284,010 in February on a seasonally adjusted annualized rate, up 17.6 percent from January and down 33.2 percent from February 2022....

• February’s statewide median home price was $735,480, down 2.1 percent from January and down 4.8 percent from February 2022.

In February, sales in these markets were down 23.7%. In January, these same markets were down 34.1% YoY Not Seasonally Adjusted (NSA).

This is a significantly smaller YoY decline NSA than in January for these early reporting markets.

This data suggests NAR reported sales will rebound in February. This will still be a significant YoY decline, and the 18th consecutive month with a YoY decline.

...

More local markets to come!

Q1 GDP Tracking: Wide Range

by Calculated Risk on 3/17/2023 10:33:00 AM

From BofA:

On net, since the last weekly publication, this pushed up our 1Q US GDP tracking estimate from 0.7% q/q saar to 0.9% q/q saar and left 4Q unchanged at 2.9% q/q saar. [Mar 17th estimate]From Goldman:

emphasis added

We left our Q1 GDP tracking estimate unchanged at 2.6% (qoq ar). [Mar 16th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 3.2 percent on March 16, unchanged from March 15 after rounding. After this morning's releases from the US Census Bureau and the US Bureau of Labor Statistics, an increase in the nowcast of first-quarter real net exports was offset by a decrease in the nowcast of first-quarter real residential investment growth. [Mar 16th estimate]

Industrial Production Unchanged in February

by Calculated Risk on 3/17/2023 09:21:00 AM

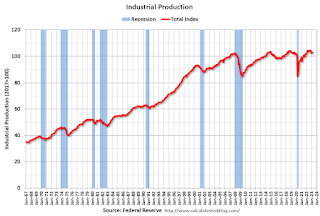

From the Fed: Industrial Production and Capacity Utilization

Industrial production was unchanged in February, and manufacturing output edged up 0.1 percent. The index for mining fell 0.6 percent, while the index for utilities rose 0.5 percent. At 102.6 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization was unchanged in February at 78.0 percent, a rate that is 1.6 percentage points below its long-run (1972–2022) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.0% is 1.6% below the average from 1972 to 2021. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in February at 102.6. This is above the pre-pandemic level.

Industrial production was below consensus expectations and previous months were revised down.

Thursday, March 16, 2023

Friday: Industrial Production

by Calculated Risk on 3/16/2023 09:01:00 PM

Friday:

• At 9:15 AM ET, The Fed will release Industrial Production and Capacity Utilization for February. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.5%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for March).

Realtor.com Reports Weekly Active Inventory Up 61% YoY; New Listings Down 16% YoY

by Calculated Risk on 3/16/2023 02:59:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Mar 11, 2023

• Active inventory growth continued to climb with for-sale homes up 61% above one year ago. Inventories of for-sale homes rose, tying last week’s gain, which was the lowest we’ve seen since December. Instead of new sellers driving these increases, longer time on market is pushing the number of homes for sale higher. Of note, active listings at this time last year were at or near long-term lows.

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 18% from one year ago. For 36 weeks, fewer homeowners put their homes on the market for sale than at this time one year ago. This week’s gap was smaller than last week’s, but the lack of new sellers is still a drag on home sales.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up sharply year-over-year; however, the YoY increase has slowed recently.

Hotels: Occupancy Rate Down 7.5% Compared to Same Week in 2019

by Calculated Risk on 3/16/2023 02:07:00 PM

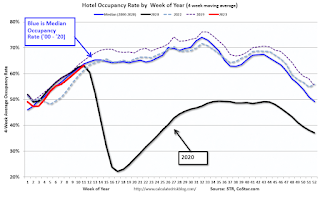

Helped by the onset of spring break travel, U.S. hotel performance increased from the previous week, according to STR‘s latest data through March 11.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

March 5-11, 2023 (percentage change from comparable weeks in 2022, 2019):

• Occupancy: 64.7% (+2.8%, -7.5%)

• Average daily rate (ADR): $158.20 (+8.1%, +16.6%)

• Revenue per available room (RevPAR): $102.38 (+11.1%, +7.8%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

February Housing Starts: Average Length of Time from Start to Completion increased Sharply in 2022

by Calculated Risk on 3/16/2023 09:32:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: February Housing Starts: Average Length of Time from Start to Completion increased Sharply in 2022

Excerpt:

Census released the annual data on the length of time from start to completion, and this showed construction delays in 2022.There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

In 2022, it took an average of 8.3 months from start to completion for single family homes, up from already elevated 7.2 months in 2021. For 2+ unit buildings, it took 17.0 months for buildings with 2 or more units in 2022, up from 15.4 months in 2021. This will be even longer for multi-family in 2023 as many of these units that have been under construction are completed this year.

The delays following the housing bubble were due to many projects being mothballed for several years. The recent delays were due to pandemic related supply constraints.

From Authorization to Start, it took 1.3 months in 2022 for single family homes, up from 1.3 months in 2021, and it took 2.8 months in 2021 for 2+ Unit buildings, up from 2.2 months.

...

The weakness in 2022 was mostly for single family starts. I expect multi-family starts to turn down in 2023.

Housing Starts Increased to 1.450 million Annual Rate in February

by Calculated Risk on 3/16/2023 08:40:00 AM

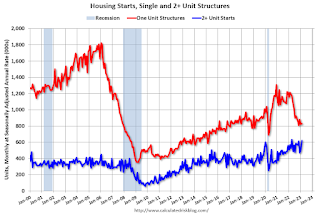

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in February were at a seasonally adjusted annual rate of 1,450,000. This is 9.8 percent above the revised January estimate of 1,321,000, but is 18.4 percent below the February 2022 rate of 1,777,000. Single‐family housing starts in February were at a rate of 830,000; this is 1.1 percent above the revised January figure of 821,000. The February rate for units in buildings with five units or more was 608,000.

Building Permits:

Privately‐owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,524,000. This is 13.8 percent above the revised January rate of 1,339,000, but is 17.9 percent below the February 2022 rate of 1,857,000. Single‐family authorizations in February were at a rate of 777,000; this is 7.6 percent above the revised January figure of 722,000. Authorizations of units in buildings with five units or more were at a rate of 700,000 in February.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) decreased in February compared to January. Multi-family starts were up 9.9% year-over-year in February.

Single-family starts (red) increased slightly in February and were down 31.6% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse in single-family starts.

Total housing starts in February were above expectations, however, starts in December and January were revised down, combined.

I'll have more later …

Weekly Initial Unemployment Claims decrease to 192,000

by Calculated Risk on 3/16/2023 08:33:00 AM

The DOL reported:

In the week ending March 11, the advance figure for seasonally adjusted initial claims was 192,000, a decrease of 20,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 211,000 to 212,000. The 4-week moving average was 196,500, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 250 from 197,000 to 197,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 196,500.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Wednesday, March 15, 2023

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 3/15/2023 08:37:00 PM

Thursday:

• At 8:30 AM ET, Housing Starts for February. The consensus is for 1.310 million SAAR, up from 1.309 million SAAR.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 205 thousand initial claims, down from 211 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for March. The consensus is for a reading of -14.8, up from -24.3.

Weather Boosted Employment by About 65,000 in February

by Calculated Risk on 3/15/2023 03:13:00 PM

The BLS also reported 493 thousand people that are usually full-time employees were working part time in January due to bad weather. The average for February over the previous 10 years was 1.57 million (median was 708 thousand). This series suggests weather positively impacted employment more than usual (boosting seasonally adjusted employment).

The San Francisco Fed estimates Weather-Adjusted Change in Total Nonfarm Employment (monthly change, seasonally adjusted). They use local area weather to estimate the impact on employment. For February, the San Francisco Fed estimated that weather boosted employment by 65 to 95 thousand jobs.

This is the second consecutive month with an employment boost from better than normal weather, and we should expect some negative payback in coming months.

Current State of the Housing Market: Overview for mid-March

by Calculated Risk on 3/15/2023 12:14:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Current State of the Housing Market; Overview for mid-March

A brief excerpt:

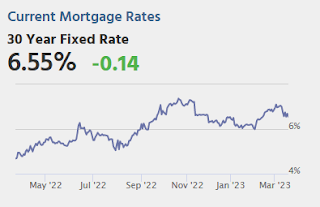

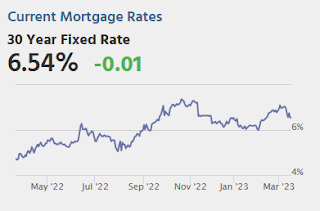

The following graph from MortgageNewsDaily.com shows mortgage rates since January 1, 2020. 30-year mortgage rates were at 6.75% on March 14th, up from 6.0% in early February, and down from the recent high of over 7.0% - and still up sharply year-over-year.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

A year ago, the payment on a $500,000 house, with a 20% down payment and 3.76% 30-year mortgage rates, would be around $1,855 for principal and interest. The monthly payment for the same house, with house prices up 3% YoY and mortgage rates at 6.75%, would be $2,672 - an increase of 44%! Monthly payments are still up sharply year-over-year.

There are always some people that need to sell; death, divorce, moving for employment are a few reasons. However, homeowners with a low mortgage rate will be reluctant to sell, and then buy a new home, when their monthly payment will be much higher for the new home. The sharp increase in mortgage rates is probably the key reason new listings have declined sharply year-over-year.

This is very different from the housing bust, when many homeowners were forced to sell as their teaser rates expired and they could not afford the fully amortized mortgage payment. The current situation is similar to the 1980 period, when rates increased quickly.

NAHB: Builder Confidence Increased in March

by Calculated Risk on 3/15/2023 10:13:00 AM

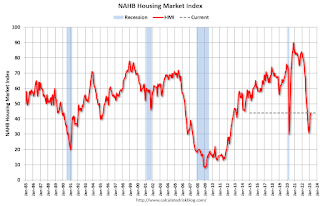

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 44, up from 42 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Edges Higher in March but Future Outlook Uncertain

Although high construction costs and elevated interest rates continue to hamper housing affordability, builders expressed cautious optimism in March as a lack of existing inventory is shifting demand to the new home market.

Builder confidence in the market for newly built single-family homes in March rose two points to 44, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This is the third straight monthly increase in builder sentiment levels..

...

The HMI index gauging current sales conditions in March rose two points to 49 and the gauge measuring traffic of prospective buyers increased three points to 31. This is the highest traffic reading since September of last year. The component charting sales expectations in the next six months fell one point to 47.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose five points to 42, the Midwest edged one-point higher to 34, the South increased five points to 45 and the West moved four points higher to 34.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was above the consensus forecast.

Retail Sales Decreased 0.4% in February

by Calculated Risk on 3/15/2023 08:42:00 AM

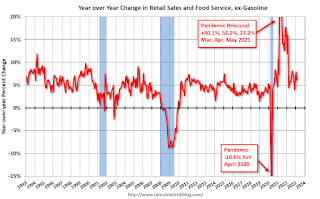

On a monthly basis, retail sales were down 0.4% from January to February (seasonally adjusted), and sales were up 5.4 percent from February 2022.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for February 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $697.9 billion, down 0.4 percent from the previous month, but up 5.4 percent above February 2022. ... The December 2022 to January 2023 percent change was revised from up 3.0 percent to up 3.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.4% in February.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 6.1% on a YoY basis.

Sales in February were slightly below expectations, however, sales in December and January were revised up.

Sales in February were slightly below expectations, however, sales in December and January were revised up.