by Calculated Risk on 3/28/2023 01:58:00 PM

Tuesday, March 28, 2023

Las Vegas February 2023: Visitor Traffic Down 3.4% Compared to 2019; Convention Traffic Down 11.4%

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: February 2023 Las Vegas Visitor Statistics

With an easy comparison to the lingering COVID‐affected months of last year, Las Vegas saw visitation approach 3.1M in February 2023, up +17.8% over February 2022.

Overall hotel occupancy exceeded 82% for the month, +12.9 pts YoY and down ‐4.8 pts vs. 2019 while Weekend occupancy reached 89.3%, up 1.8 pts YoY and ‐2.6 pts vs. February 2019. Supported by the strengthening convention/group segment, Midweek occupancy reached 78.8%, + 18.1 pts vs. February 2022 and ‐5.8 pts vs. February 2019.

Robust room rates equated to overall ADR of approx. $177, +18.1% ahead of February 2022 and +35.8% vs. February 2019 while RevPAR exceeded $145, +40.1% YoY and +28.3% over February 2019.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (light blue), 2021 (purple), 2022 (orange), and 2023 (red).

Visitor traffic was down 3.4% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

Freddie Mac: Mortgage Serious Delinquency Rate declined in February

by Calculated Risk on 3/28/2023 01:01:00 PM

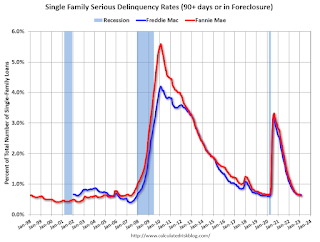

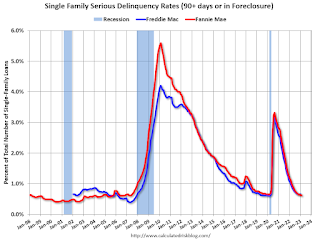

Freddie Mac reported that the Single-Family serious delinquency rate in February was 0.65%, down from 0.66% January. Freddie's rate is down year-over-year from 0.99% in February 2022.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

Fannie Mae reported earlier.

Comments on January Case-Shiller and FHFA House Prices

by Calculated Risk on 3/28/2023 09:56:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index "Declining Trend Continued" to 3.8% year-over-year increase in January

Excerpt:

Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for January were released today. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The Case-Shiller Home Price Indices for "January" is a 3-month average of November, December and January closing prices. November closing prices include some contracts signed in September, so there is a significant lag to this data.

The MoM decrease in the seasonally adjusted Case-Shiller National Index was at -0.25%. This was the seventh consecutive MoM decrease, and a slightly smaller decrease than in December.

On a seasonally adjusted basis, prices declined in 15 of 20 Case-Shiller cities on a month-to-month basis. The largest monthly declines seasonally adjusted were in Seattle (-1.5%), Las Vegas (-1.1%), and Denver (-1.0%). Seasonally adjusted, San Francisco has fallen 13.2% from the peak in May 2022 and Seattle is down 11.4% from the peak. All 20 cities have seen price declines from the recent peak (SA).

Case-Shiller: National House Price Index "Declining Trend Continued" to 3.8% year-over-year increase in January

by Calculated Risk on 3/28/2023 09:11:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3-month average of November, December and January closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Declining Trend Continued in January

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.8% annual gain in January, down from 5.6% in the previous month. The 10-City Composite annual increase came in at 2.5%, down from 4.4% in the previous month. The 20-City Composite posted a 2.5% year-over-year gain, down from 4.6% in the previous month.

Miami, Tampa, and Atlanta again reported the highest year-over-year gains among the 20 cities in January. Miami led the way with a 13.8% year-over-year price increase, followed by Tampa in second with a 10.5% increase, and Atlanta in third with an 8.4% increase. All 20 cities reported lower prices in the year ending January 2023 versus the year ending December 2022.

...

Before seasonal adjustment, the U.S. National Index posted a -0.5% month-over-month decrease in January, while the 10-City and 20-City Composites posted decreases of -0.5% and -0.6%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month decrease of -0.2%, while both the 10-City and 20-City Composites posted decreases of -0.4%.

In January, before seasonal adjustment, 19 cities reported declines with only Miami reporting an increase at 0.1%. After seasonal adjustment, 15 cities reported declines while Miami, Boston, Charlotte, and Cleveland had slight increases.

“2023 began as 2022 had ended, with U.S. home prices falling for the seventh consecutive month,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite declined by 0.5% in January, and now stands 5.1% below its peak in June 2022. On a trailing 12-month basis, the National Composite is only 3.8% ahead of its level in January 2022, a result also reflected in our 10- and 20-City Composites (both +2.5% year-over-year).

“January’s market weakness was broadly based. Before seasonal adjustment, 19 cities registered a decline; the seasonally adjusted picture is a bit brighter, with only 15 cities declining. With or without seasonal adjustment, most cities’ January declines were less severe than their December counterparts.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is down 0.4% in January (SA) and down 4.5% from the recent peak in June 2022.

The Composite 20 index is down 0.4% (SA) in January and down 4.7% from the recent peak in June 2022.

The National index is down 0.2% (SA) in January and is down 3.0% from the peak in June 2022.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 2.5% year-over-year. The Composite 20 SA is up 2.5% year-over-year.

The National index SA is up 3.8% year-over-year.

Annual price increases were at expectations. I'll have more later.

Monday, March 27, 2023

Tuesday: Case-Shiller House Prices

by Calculated Risk on 3/27/2023 08:26:00 PM

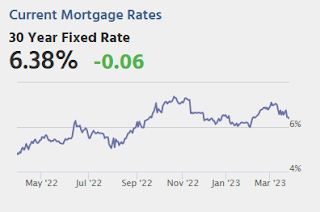

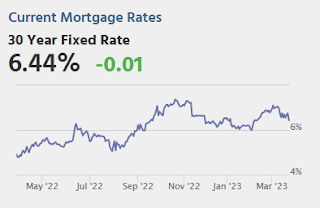

Mortgage rates hit their lowest levels in just over 6 weeks on Friday as investors braced for bad news in the banking sector. Such fears tend pull money out of the stock market and into bonds. Excess bond demand means lower rates, all other things being equal.Tuesday:

After a weekend without any new bank drama, investors were able to move back in the other direction. News regarding the sale of most of Silicon Valley Bank's deposits and loans only added to the momentum.

...

The average lender was down below 6.5% for a flawless 30yr fixed scenario on Friday, but is now back above. [30 year fixed 6.54%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. The consensus is for a 2.5% year-over-year increase in the Comp 20 index for January, down from 4.6% YoY in December.

• Also at 9:00 AM, FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in February

by Calculated Risk on 3/27/2023 04:23:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.62% in February from 0.64% in January. The serious delinquency rate is down from 1.11% in February 2022. This is below the pre-pandemic levels.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 2.04% are seriously delinquent (down from 2.11% in January).

Mortgages in forbearance were counted as delinquent in this monthly report, but they were not reported to the credit bureaus.

DOT: Vehicle Miles Driven Increased 5.6% year-over-year in January

by Calculated Risk on 3/27/2023 02:42:00 PM

This is something I check occasionally.

The Department of Transportation (DOT) reported:

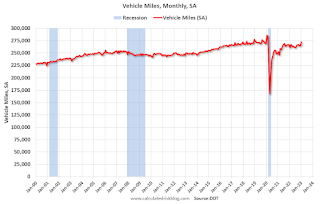

Travel on all roads and streets changed by +5.6% (+13.2 billion vehicle miles) for January 2023 as compared with January 2022. Travel for the month is estimated to be 247.3 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for January 2023 is 272.5 billion miles, a 4.5% (11.6 billion vehicle miles) change over January 2022. It also represents a 3.1% change (8.1 billion vehicle miles) compared with December 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly total vehicle miles driven, seasonally adjusted.

Miles driven declined sharply in March 2020, and really collapsed in April 2020. After recovering, miles driven were softer early in 2022 due to higher gasoline prices but have increased since gasoline prices are now down sharply year-over-year.

Housing March 27th Weekly Update: Inventory Decreased 0.3% Week-over-week

by Calculated Risk on 3/27/2023 08:34:00 AM

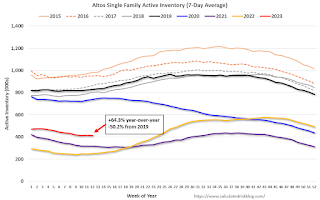

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, March 26, 2023

Sunday Night Futures

by Calculated Risk on 3/26/2023 08:42:00 PM

Weekend:

• Schedule for Week of March 26, 2023

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for March.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 13 and DOW futures are up 100 (fair value).

Oil prices were up over the last week with WTI futures at $69.26 per barrel and Brent at $74.99 per barrel. A year ago, WTI was at $116, and Brent was at $123 - so WTI oil prices are DOWN 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.42 per gallon. A year ago, prices were at $4.23 per gallon, so gasoline prices are down $0.81 per gallon year-over-year.

Off-Topic: This is Personal

by Calculated Risk on 3/26/2023 05:12:00 PM

A friend’s brother was brutally murdered and his killer sentenced to death. Here is a piece from my friend Eric in Newsweek and a few comments about the family’s ongoing fight for justice: 'My Brother's Horrific Murder Shocked Police. His Killer Is Up for Parole'

Like Charles Manson and Sirhan Sirhan, the murderer’s sentence was changed to life imprisonment WITH the possibility of parole after the death penalty was abolished in California. This was the 2nd harshest penalty in the ‘70s. Now the harshest penalty is life in prison without parole.

This has made the victim’s family relive this horrific event over and over. On April 25, 2023, the killer will be up for parole again. This will be the 18th time my friend’s family will provide a victim’s statement at a parole hearing.

Here is a Facebook page: Justice for Frank. If you can help, please write a letter to the parole board.

Legendary San Francisco police officer Frank Falzon caught the case and describes it in his book:

“Barbaric. Atrocious. Savage. Horrendous.If parole is granted, there will be a full court press on the Governor to deny parole (like for Sirhan).

These are the words used when people talk about what happened at Frank and Annette Carlson's Potrero Hills home on the night of April 18, 1974.

None is adequate. Not even using them all together. Truly, there are no words to describe it. I know I've said it before, as a homicide inspector you never know what you're walking into at a crime scene. But this was beyond the worst ... still rank it among the worst crimes in San Francisco history.”

It’s horrible that my friend has to relive this every few years. Letters to the parole board will help.

Fed: Q4 2022 Household Debt Service Ratio Still Low

by Calculated Risk on 3/26/2023 10:52:00 AM

The Fed's Household Debt Service ratio through Q4 2022 was released last week: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The Household debt service ratio was at 13.2% in 2007 and has fallen to under 10% now, and the DSR for mortgages (blue) are near the lowest level for the last 35 years.

This data suggests aggregate household cash flow is in a solid position.

Saturday, March 25, 2023

Real Estate Newsletter Articles this Week: "Median Existing Home Prices Declined YoY"

by Calculated Risk on 3/25/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Increased to 4.58 million SAAR in February; Median Prices Declined YoY

• New Home Sales at 640,000 Annual Rate in February

• Final Look at Local Housing Markets in February

• House Prices: Rust or Bust?

• More Good News for Homebuilders

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of March 26, 2023

by Calculated Risk on 3/25/2023 08:11:00 AM

The key reports scheduled for this week include the 3rd estimate of Q4 GDP, February Personal Income & Outlays, and January Case-Shiller house prices.

For manufacturing, the March Dallas and Richmond Fed surveys will be released.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

9:00 AM: S&P/Case-Shiller House Price Index for January.

9:00 AM: S&P/Case-Shiller House Price Index for January.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.5% year-over-year increase in the Comp 20 index for January, down from 4.6% YoY in December.

9:00 AM: FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 3.0% decrease in the index.

8:30 AM, Gross Domestic Product, 4th Quarter and Year 2022 (Third Estimate), GDP by Industry, and Corporate Profits. The consensus is that real GDP increased 2.7% annualized in Q4, unchanged from the second estimate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 196 thousand initial claims, up from 191 thousand last week.

8:30 AM ET: Personal Income and Outlays for February. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.4%. PCE prices are expected to be up 5.1% YoY, and core PCE prices up 4.7% YoY.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 43.6, unchanged from 43.6 in February.

10:00 AM: University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 63.4.

Friday, March 24, 2023

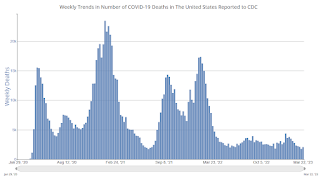

COVID Mar 24, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 3/24/2023 09:21:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 133,521 | 153,183 | ≤35,0001 | |

| Hospitalized2 | 15,705 | 17,594 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,060 | 1,753 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

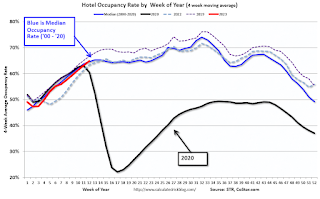

Hotels: Occupancy Rate Down 2.5% Compared to Same Week in 2019

by Calculated Risk on 3/24/2023 03:01:00 PM

Helped by spring break travel, U.S. hotel performance increased from the previous week, according to STR‘s latest data through 18 March.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

March 12-18, 2023 (percentage change from comparable weeks in 2022, 2019):

• Occupancy: 67.6% (+1.3%, -2.5%)

• Average daily rate (ADR): $167.04 (+8.9%, +23.9%)

• Revenue per available room (RevPAR): $112.89 (+10.4%, +20.8%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Q1 GDP Tracking: Wide Range

by Calculated Risk on 3/24/2023 01:24:00 PM

Note: The FOMC is projecting Q4-over-Q4 GDP growth of 0.0% to 0.8%. Here is a table of the low, middle and high FOMC projections for Q2 through Q4 based on the GDP tracking estimates below for Q1.

| Estimated FOMC Projection Q2 - Q4 | ||||

|---|---|---|---|---|

| Q1 | Low 0.0% | Middle 0.4% | High 0.8% | |

| BofA | 0.8% | -0.3% | 0.3% | 0.8% |

| Goldman | 2.4% | -0.8% | -0.3% | 0.3% |

| GDPNow | 3.2% | -1.0% | -0.5% | 0.0% |

Based on the GDP tracking estimates, the FOMC's GDP projection for Q4-over-Q4 and the FOMC unemployment projections, many analysts pointed out that the FOMC is essentially projecting a recession in the 2nd half of 2023.

From BofA:

Core capital orders and shipments in February came in lower than expected at 0.2% m/m and 0.0% m/m, respectively. This modestly reduced our tracking estimate for equipment spending in 1Q. Inventories for nondurable goods also came in lower in February, thereby reducing our inventory tracking estimate. On net, this decreased our 1Q US GDP tracking estimate from 1.0% q/q saar to 0.8% q/q saar. [Mar 24th estimate]From Goldman:

emphasis added

Durable goods orders declined against consensus expectations for a small increase, while core capital goods orders edged higher. The report covers February activity and therefore predates the recent banking stresses. The capex shipments details of the durable goods report were weaker than our previous assumptions. We lowered our Q1 GDP tracking estimate by two tenths to +2.4% (qoq ar) and our domestic final sales growth estimate by 0.1pp to +2.9%. [Mar 24th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 3.2 percent on March 24, unchanged from March 16 after rounding. An increase in the nowcast of GDP growth from 3.2 percent to 3.5 percent following the March 21 existing-home sales release from the National Association of Realtors was reversed after this morning’s advance manufacturing report from the US Census Bureau. [Mar 24th estimate]

Final Look at Local Housing Markets in February

by Calculated Risk on 3/24/2023 10:10:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in February

A brief excerpt:

The big story for February existing home sales was the sharp year-over-year (YoY) decline in sales, and also the rebound from the low level of sales in December and January. Also, active inventory increased sharply YoY, but is still historically low - and new listings are down YoY.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the final look at local markets in February. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I update these tables throughout each month as additional data is released.

First, here is a table comparing the year-over-year Not Seasonally Adjusted (NSA) declines in sales this year from the National Association of Realtors® (NAR) with the local markets I track. So far, these measures have tracked closely. The NAR reported sales were down 23.0% NSA YoY in February.

...

Note: Even if existing home sales activity bottomed in December (4.03 million SA) and January (4.00 million SA), there are usually two bottoms for housing - the first for activity and the second for prices. See Has Housing "Bottomed"?

My early expectation is we will see a similar YoY sales decline in March as in February, since mortgage rates for contracts signed in January and February were about the same level as contracts that closed in February.

More local data coming in April for activity in March!

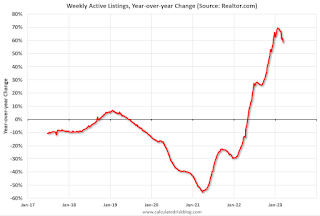

Realtor.com Reports Weekly Active Inventory Up 59% YoY; New Listings Down 20% YoY

by Calculated Risk on 3/24/2023 08:33:00 AM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released yesterday from Sabrina Speianu: Weekly Housing Trends View — Data Week Ending Mar 18, 2023

• Active inventory growth continued to climb with for-sale homes up 59% above one year ago. Inventories of for-sale homes rose, but at a slightly slower pace than last week’s gain, as new sellers on the market held back more. With a lack of newly listed homes compared to the same time last year, growth in the number of homes for sale is driven by longer time on market. However, it is important to note that this time last year, time on market was near all-time lows.

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 20% from one year ago. For 37 weeks, fewer homeowners put their homes on the market for sale than at the same time a year prior. This week’s gap was larger than last week’s, and the lack of new sellers continues to be a drag on existing home sales, which declined by 22.8% compared to February of last year, according to the National Association of Realtors..

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up sharply year-over-year - from record lows - however, the YoY increase has slowed recently.

Thursday, March 23, 2023

Friday: Durable Goods

by Calculated Risk on 3/23/2023 09:04:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.2% increase in durable goods orders.

• At 10:00 AM, State Employment and Unemployment (Monthly), February 2023

Vehicle Sales Forecast: Vehicle Sales to be up Year-over-year in March

by Calculated Risk on 3/23/2023 04:02:00 PM

From WardsAuto: March U.S. Light-Vehicle Sales, Inventory Pegged for Solid Gains; First-Quarter Deliveries to Rise 7% (pay content). Brief excerpt:

Though gradually improving, inventory remains the story behind why sales remain low by historical standards. There are underlying crosscurrents related to the economy, rising interest rates and geopolitics, among others, that are helping stanch demand, but lack of inventory is the main reason growth is not significantly stronger (and even largely why prices are stuck at elevated levels - though that headwind is lessening as inventory rises).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for March (Red).

The Wards forecast of 14.4 million SAAR, would be down 3% from last month, and up 6.2% from a year ago.