by Calculated Risk on 4/14/2023 01:40:00 PM

Friday, April 14, 2023

Q1 GDP Tracking: Around 2%

From BofA:

March industrial production was stronger than expected, along with upward revisions to February. Utilities production in March came in higher than expected at 8.4% m/m increasing our personal consumption tracking estimate for 1Q. Mining fell by 0.2% m/m. The components of support activities for mining that feed into our structures estimate were slightly higher than expected, pushing up our structures tracking estimate for 1Q. Business equipment tracking estimate came in lower than expected, thereby lowering our equipment spending tracking estimate for 1Q. Overall, this pushed up our 1Q US GDP tracking estimate from 1.5% q/q saar to 1.6% q/q saar.From Goldman:

However, the weaker inventories data took down our tracking estimate for the change in private inventories. As a result, inventories lowered our tracking estimate two-tenths to 1.4% q/q saar. [Apr 14th estimate]

emphasis added

We boosted our Q1 GDP tracking estimate by 0.1pp to +2.2% (qoq ar), reflecting stronger consumption but lower inventory investment. Our domestic final sales growth forecast stands at +3.9%. [Apr 14th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 2.5 percent on April 14, up from 2.2 percent on April 10. After recent releases the US Bureau of Labor Statistics, the US Census Bureau, the US Department of the Treasury's Bureau of the Fiscal Service, and the Federal Reserve Board of Governors, the nowcasts of first-quarter real gross private domestic investment growth and first-quarter real government spending growth increased from -6.5 percent and 2.2 percent, respectively, to -5.9 percent and 2.6 percent. [Apr 14th estimate]

Industrial Production Increased 0.4% in March

by Calculated Risk on 4/14/2023 09:23:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.4 percent in March and was little changed in the first quarter, increasing at an annual rate of 0.2 percent. In March, manufacturing and mining output each fell 0.5 percent. The index for utilities jumped 8.4 percent, as the return to more seasonal weather after a mild February boosted the demand for heating. At 103.0 percent of its 2017 average, total industrial production in March was 0.5 percent above its year-earlier level. Capacity utilization moved up to 79.8 percent in March, a rate that is 0.1 percentage point above its long-run (1972–2022) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 79.8% is 0.1% above the average from 1972 to 2022. This was above consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

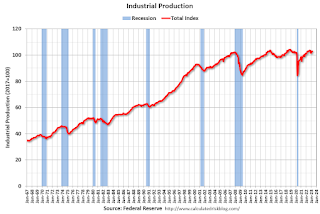

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was increased in March to 103.0. This is above the pre-pandemic level.

Industrial production was above consensus expectations and previous months were revised up.

Retail Sales Decreased 1.0% in March

by Calculated Risk on 4/14/2023 08:39:00 AM

On a monthly basis, retail sales were down 1.0% from February to March (seasonally adjusted), and sales were up 2.9 percent from March 2022.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for March 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $691.7 billion, down 1.0 percent from the previous month, but up 2.9 percent above March 2022. ... The January 2023 to February 2023 percent change was revised from down 0.4 percent to down 0.2 percent.

emphasis added

Click on graph for larger image.

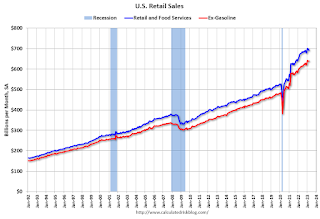

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were unchanged in March.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 5.6% on a YoY basis.

Sales in March were below expectations, and sales in January were revised down, however, sales in February were revised up.

Sales in March were below expectations, and sales in January were revised down, however, sales in February were revised up.

Thursday, April 13, 2023

Friday: Retail Sales, Industrial Production

by Calculated Risk on 4/13/2023 09:01:00 PM

Froday:

• At 8:30 AM ET, Retail sales for March is scheduled to be released. The consensus is for a 0.4% decrease in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to decrease to 79.0%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for April).

U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2022

by Calculated Risk on 4/13/2023 02:35:00 PM

Nine years ago, I wrote: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group.

Earlier the Census Bureau released the population estimates for July 2022 by age, and I've updated the table from the previous post.

The table below shows the top 10 cohorts by size for 2010, 2022 (released recently), and the most recent Census Bureau projections for 2030.

In 2022, the top 6 cohorts were under 45 (the Boomers are fading away), and by 2030 the top 10 cohorts will be the youngest 10 cohorts.

There will be plenty of "gray hairs" walking around in 2030, but the key for the economy is the population in the prime working age group is now increasing.

As I noted in 2014, this was positive for apartments, and more recently positive for housing.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2022 | 2030 | |

| 1 | 45 to 49 years | 30 to 34 years | 35 to 39 years | |

| 2 | 50 to 54 years | 20 to 24 years | 40 to 44 years | |

| 3 | 15 to 19 years | 35 to 39 years | 30 to 34 years | |

| 4 | 20 to 24 years | 25 to 29 years | 25 to 29 years | |

| 5 | 25 to 29 years | 15 to 19 years | 20 to 24 years | |

| 6 | 40 to 44 years | 40 to 44 years | 45 to 49 years | |

| 7 | 10 to 14 years | 60 to 64 years | 5 to 9 years | |

| 8 | 5 to 9 years | 55 to 59 years | 10 to 14 years | |

| 9 | Under 5 years | 10 to 14 years | Under 5 years | |

| 10 | 35 to 39 years | 50 to 54 years | 15 to 19 years | |

Click on graph for larger image.

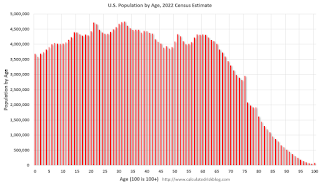

This graph, based on the 2022 population estimate, shows the U.S. population by age in July 2022 according to the Census Bureau.

Note that the largest age group is in the early-to-mid 30s. There is also a large cohort in their early 20s.

And below is a table showing the ten most common ages in 2010, 2021, and 2030 (projections are from the Census Bureau, 2017).

Note the younger baby boom generation dominated in 2010. In 2022 the millennials had taken over and the boomers are off the list.

This is why - a number of years ago - I was so positive on housing. And this is a positive for the economy.

| Population: Most Common Ages by Year | ||||

|---|---|---|---|---|

| 2010 | 2022 | 2030 | ||

| 1 | 50 | 32 | 39 | |

| 2 | 49 | 31 | 40 | |

| 3 | 19 | 21 | 38 | |

| 4 | 48 | 30 | 37 | |

| 5 | 47 | 22 | 36 | |

| 6 | 46 | 33 | 41 | |

| 7 | 20 | 29 | 35 | |

| 8 | 45 | 34 | 30 | |

| 9 | 18 | 28 | 34 | |

| 10 | 52 | 23 | 33 | |

Realtor.com Reports Weekly Active Inventory Up 44% YoY; New Listings Down 32% YoY

by Calculated Risk on 4/13/2023 01:49:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Apr 8, 2023

• Active inventory growth continued to climb, but at a notably lower rate, with for-sale homes up 44% above one year ago. One of 2023’s biggest bright spots for buyers has dimmed again, with active inventories registering just 44% above 2022’s record lows for the first part of the year. With homeowners increasingly likely to sit on the sidelines instead of selling, homebuyers still outnumber new sellers in a market with a smaller number of both buyers and sellers.

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 32% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 40 weeks. This past week, the gap from last year increased more significantly, perhaps due in part to shifts in religious holidays that fell earlier in 2023. If this is the case, we will likely see some improvement in the next week.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed recently.

Hotels: Occupancy Rate Down 7.4% Year-over-year

by Calculated Risk on 4/13/2023 01:18:00 PM

Affected by both the Easter and Passover calendar shift, U.S. hotel performance reflected lower year-over-year comparisons from the previous week, according to STR‘s latest data through April 8.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

April 2-8, 2023 (percentage change from comparable week in 2022):

• Occupancy: 61.3% (-7.4%)

• Average daily rate (ADR): $153.30 (+0.8%)

• Revenue per available room (RevPAR): $94.00 (-6.7%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Current State of the Housing Market; Overview for mid-April

by Calculated Risk on 4/13/2023 10:08:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Current State of the Housing Market; Overview for mid-April

A brief excerpt:

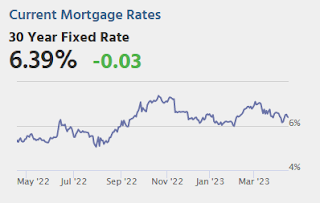

The following graph from MortgageNewsDaily.com shows mortgage rates since January 1, 2020. 30-year mortgage rates were at 6.42% on April 12th, up from 6.0% in early February, and down from the recent high of over 7% in early March - and still up sharply year-over-year.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

A year ago, the payment on a $500,000 house, with a 20% down payment and 4.98% 30-year mortgage rates, would be around $2,142 for principal and interest. The monthly payment for the same house, with house prices up 2% YoY and mortgage rates at 6.42%, would be $2,582 - an increase of 20%.

But if we compare to two years ago, there is huge difference in monthly payments. In April 2021, the payment on a $500,000 house, with a 20% down payment and 3.06% 30-year mortgage rates, would be around $1,699 for principal and interest. The monthly payment for the same house, with house prices up 23% over two years and mortgage rates at 6.42%, would be $3,084 - an increase of 81%.

This increase in mortgage rates is probably the key reason new listings have declined sharply year-over-year - especially since a large number of homeowners refinanced at lower rates in 2020, 2021 and early 2022.

This is very different from the housing bust, when many homeowners were forced to sell as their teaser rates expired and they could not afford the fully amortized mortgage payment. The current situation is similar to the 1980 period, when rates increased quickly.

Weekly Initial Unemployment Claims increase to 239,000

by Calculated Risk on 4/13/2023 08:34:00 AM

The DOL reported:

In the week ending April 8, the advance figure for seasonally adjusted initial claims was 239,000, an increase of 11,000 from the previous week's unrevised level of 228,000. This is the highest level for initial claims since January 15, 2022 when it was 251,000. The 4-week moving average was 240,000, an increase of 2,250 from the previous week's unrevised average of 237,750. This is the highest level for this average since November 20, 2021 when it was 249,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 240,000.

The previous week was unrevised.

Weekly claims were above the consensus forecast.

Wednesday, April 12, 2023

Thursday: Unemployment Claims, PPI

by Calculated Risk on 4/12/2023 08:43:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 233 thousand initial claims, up from 228 thousand last week.

• Also at 8:30 AM, The Producer Price Index for March from the BLS. The consensus is for a 0.0% increase in PPI, and a 0.3% increase in core PPI.

FOMC Minutes: "some additional policy firming may be appropriate"; Staff Predicts Recession

by Calculated Risk on 4/12/2023 02:08:00 PM

This meeting the FOMC "members anticipated that some additional policy firming may be appropriate", whereas at the previous meeting "all participants continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate".

For some time, the forecast for the U.S. economy prepared by the staff had featured subdued real GDP growth for this year and some softening in the labor market. Given their assessment of the potential economic effects of the recent banking-sector developments, the staff's projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.From the Fed: Minutes of the Federal Open Market Committee March 21–22, 2023. Excerpt:

In their discussion of monetary policy for this meeting, members agreed that recent indicators pointed to modest growth in spending and production. They also concurred that job gains had picked up in recent months and were running at a robust pace, that the unemployment rate had remained low, and that inflation remains elevated. Members concurred that the U.S. banking system is sound and resilient. They also agreed that recent developments were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation, but that the extent of these effects was uncertain. Members also concurred that they remained highly attentive to inflation risks.

Members agreed that the Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, members agreed to raise the target range for the federal funds rate to 4-3/4 to 5 percent. Members agreed that they would closely monitor incoming information and assess the implications for monetary policy. Given recent developments, members anticipated that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. Members concurred that, in determining the extent of future increases in the target range, they would take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, members agreed that they would continue reducing the Federal Reserve's holdings of Treasury securities and agency debt and agency MBS, as described in its previously announced plans. All members affirmed that they remained strongly committed to returning inflation to its 2 percent objective.

emphasis added

Cleveland Fed: Median CPI increased 0.4% and Trimmed-mean CPI increased 0.2% in March

by Calculated Risk on 4/12/2023 11:23:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.4% in March. The 16% trimmed-mean Consumer Price Index increased 0.2% in March. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

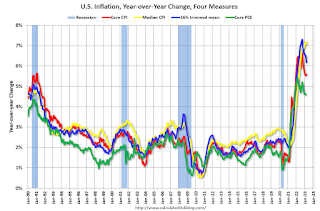

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Motor fuel" decreased at a 44% annualized rate in March, and "Car and truck rental" decreased at a 37% annualized rate.

Remote Work and Household Formation

by Calculated Risk on 4/12/2023 10:55:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Remote Work and Household Formation

A brief excerpt:

Back in September 2021, I wrote Household Formation Drives Housing DemandThere is more in the article. You can subscribe at https://calculatedrisk.substack.com/So what is driving demand for both homeownership and rentals? Household formation!Over time, housing economist Tom Lawler and I unraveled the household formation mystery. A key driver of household formation was work-from-home. And this analysis has some significant implications for the housing market and the Federal Reserve (see articles at the bottom of this note).

...

Today, economists Adam Ozimek and Eric Carlson published new research: Remote Work and Household Formation

Another important basic fact of housing markets during the pandemic is that there was a rapid expansion of household formation. As Figure 3 shows, household formation surged 2.5% in 2021, more than double the fastest pace post Great Recession.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 4/12/2023 09:06:00 AM

Here a few measures of inflation:

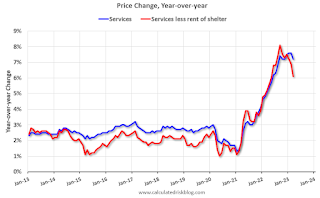

The first graph is the one Fed Chair Powell has been mentioning.

This graph shows the YoY price change for Services and Services less rent of shelter through March 2023.

Services less rent of shelter was up 6.1% YoY in March, down from 6.9% YoY in February.

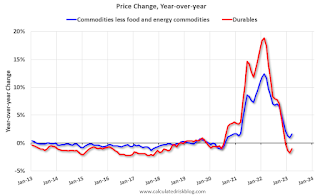

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were up 1.6% YoY in March, up from 1.0% YoY in February.

Here is a graph of the year-over-year change in shelter from the CPI report (through March) and housing from the PCE report (through February 2023)

Here is a graph of the year-over-year change in shelter from the CPI report (through March) and housing from the PCE report (through February 2023)Shelter was up 8.2% year-over-year in March, up from 8.1% in February. Housing (PCE) was up 8.2% YoY in February.

The BLS noted this morning: "The index for shelter was by far the largest contributor to the monthly all items increase."

BLS: CPI increased 0.1% in March; Core CPI increased 0.4%

by Calculated Risk on 4/12/2023 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a seasonally adjusted basis, after increasing 0.4 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 5.0 percent before seasonal adjustment.CPI was lower than expected and core CPI was at expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter was by far the largest contributor to the monthly all items increase. This more than offset a decline in the energy index, which decreased 3.5 percent over the month as all major energy component indexes declined. The food index was unchanged in March with the food at home index falling 0.3 percent.

The index for all items less food and energy rose 0.4 percent in March, after rising 0.5 percent in February. Indexes which increased in March include shelter, motor vehicle insurance, airline fares, household furnishings and operations, and new vehicles. The index for medical care and the index for used cars and trucks were among those that decreased over the month.

The all items index increased 5.0 percent for the 12 months ending March; this was the smallest 12-month increase since the period ending May 2021. The all items less food and energy index rose 5.6 percent over the last 12 months. The energy index decreased 6.4 percent for the 12 months ending March, and the food index increased 8.5 percent over the last year.

emphasis added

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 4/12/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 7, 2023.

The Market Composite Index, a measure of mortgage loan application volume, increased 5.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 6 percent compared with the previous week. The Refinance Index increased 0.1 percent from the previous week and was 57 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 8 percent from one week earlier. The unadjusted Purchase Index increased 9 percent compared with the previous week and was 31 percent lower than the same week one year ago.

“Incoming data last week showed that the job market is beginning to slow, which led to the 30-year fixed rate decreasing to 6.30 percent – the lowest level in two months,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Prospective homebuyers this year have been quite sensitive to any drop in mortgage rates, and that played out last week with purchase applications increasing by 8 percent. Refinance application volume was a mixed bag with total volume essentially flat, conventional volume down for the week, but VA refinance volume increasing. The level of refinance activity remains almost 60 percent below last year, as most homeowners are currently locked in at much lower rates.”

..

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.30 percent from 6.40 percent, with points decreasing to 0.55 from 0.59 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 31% year-over-year unadjusted.

Tuesday, April 11, 2023

Wednesday: CPI, FOMC Minutes

by Calculated Risk on 4/11/2023 09:06:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for March from the BLS. The consensus is for 0.3% increase in CPI (up 5.2% YoY) and a 0.4% increase in core CPI (up 5.6% YoY).

• At 2:00 PM, FOMC Minutes, Meeting of March 21-22

The Top Ten Job Streaks: Current Streak is in 9th Place

by Calculated Risk on 4/11/2023 01:28:00 PM

For fun:

| Headline Jobs, Top 10 Streaks | |

|---|---|

| Year Ended | Streak, Months |

| 2019 | 100 |

| 1990 | 48 |

| 2007 | 46 |

| 1979 | 45 |

| 1943 | 33 |

| 1986 | 33 |

| 2000 | 33 |

| 1967 | 29 |

| 20231 | 27 |

| 1995 | 25 |

| 1Currrent Streak | |

2nd Look at Local Housing Markets in March

by Calculated Risk on 4/11/2023 10:53:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in March

A brief excerpt:

This is the second look at local markets in March. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in March were mostly for contracts signed in January and February. Since 30-year fixed mortgage rates were over 6% for all of January and February - compared to 4% range the previous year - closed sales were down significantly year-over-year in March. However, the impact was probably not as severe as for closed sales in December and January (rates were the highest in October and November 2022 when contracts were signed for closing in December and January)..

Median sales prices for single family homes were down 2.2% year-over year (YoY) in northeast Florida (Jacksonville), and unchanged YoY in Georgia.

...

In March, sales in these markets were down 21.0%. In February, these same markets were down 21.9% YoY Not Seasonally Adjusted (NSA).

This is a similar YoY decline NSA as in February for these markets. The March existing home sales report will show another significant YoY decline, and the 19th consecutive month with a YoY decline in sales.

Many more local markets to come!

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Diffusion Indexes

by Calculated Risk on 4/11/2023 09:25:00 AM

A few more employment graphs ...

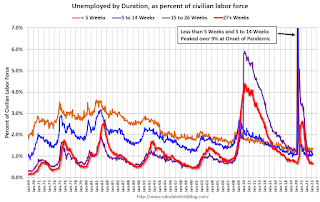

Click on graph for larger image.

Click on graph for larger image.This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

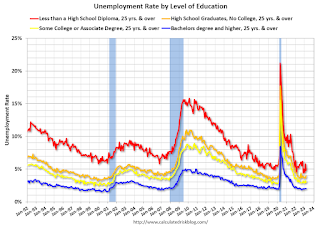

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic). Clearly education matters with regards to the unemployment rate, with the lowest rate for college graduates at 2.0% in March, and highest for those without a high school degree at 4.8% in March.

All four groups were generally trending down prior to the pandemic. And all are close to pre-pandemic levels now.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

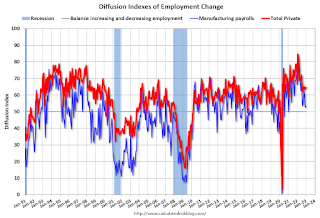

The BLS diffusion index for total private employment was at 60.2 in March, up from 57.4 in February. A solid reading.

The BLS diffusion index for total private employment was at 60.2 in March, up from 57.4 in February. A solid reading.For manufacturing, the diffusion index was at 56.3, up from 47.9 in February.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Overall private job growth was widespread in March.