by Calculated Risk on 4/19/2023 02:05:00 PM

Wednesday, April 19, 2023

Fed's Beige Book: "The labor market becoming less tight ... increases to the labor supply"

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Richmond based on information collected on or before April 10, 2023."

Overall economic activity was little changed in recent weeks. Nine Districts reported either no change or only a slight change in activity this period while three indicated modest growth. Expectations for future growth were mostly unchanged as well; however, two Districts saw outlooks deteriorate. Consumer spending was generally seen as flat to down slightly amid continued reports of moderate price growth. Auto sales remained steady overall, with only a couple of Districts reporting improved sales and inventory levels. Travel and tourism picked up across much of the country this period. Manufacturing activity was widely reported as flat or down even as supply chains continued to improve. Transportation and freight volumes were also flat to down, according to several Districts. On balance, residential real estate sales and new construction activity softened modestly. Nonresidential construction was little changed while sales and leasing activity was generally flat to down. Lending volumes and loan demand generally declined across consumer and business loan types. Several Districts noted that banks tightened lending standards amid increased uncertainty and concerns about liquidity. The majority of Districts reported steady to increasing demand and sales for nonfinancial services. Agriculture conditions were mostly unchanged in recent weeks while some softening was reported in energy markets.

Employment growth moderated somewhat this period as several Districts reported a slower pace of growth than in recent Beige Book reports. A small number of firms reported mass layoffs, and those were centered at a subset of the largest companies. Some other firms opted to allow for natural attrition to occur, and to hire only for critically important roles. Contacts reported the labor market becoming less tight as several Districts noted increases to the labor supply. Additionally, firms benefited from better employee retention, which allowed them to hire for open roles while not constantly trying to back-fill positions. Wages have shown some moderation but remain elevated. Several Districts reported declining needs for off-cycle wage increases compared to last year.

emphasis added

4th Look at Local Housing Markets: California Home Sales down 34% YoY in March; Prices Down 7.0% YoY

by Calculated Risk on 4/19/2023 11:53:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets: California Home Sales down 34% YoY in March; Prices Down 7.0% YoY

A brief excerpt:

This is the fourth look at local markets in March. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is the press release from the California Association of Realtors® (C.A.R.): Uptick in mortgage interest rates nudges down California home sales in March, C.A.R. reports• Existing, single-family home sales totaled 281,050 in March on a seasonally adjusted annualized rate, down 1.0 percent from February and down 34.2 percent from March 2022....

• March’s statewide median home price was $791,490, up 7.6 percent from February and down 7.0 percent from March 2022.Closed Sales in March

In March, sales in these markets were down 20.8%. In February, these same markets were down 21.8% YoY Not Seasonally Adjusted (NSA).

This is a slightly smaller YoY decline NSA than in February for these markets. The March existing home sales report will show another significant YoY decline and will be the 19th consecutive month with a YoY decline in sales.

AIA: Architecture Billings "Slightly Improved" in March

by Calculated Risk on 4/19/2023 10:28:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: After Five Straight Monthly Declines, AIA/Deltek Architecture Billings Index (ABI) Reports Slightly Improved Business Conditions

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

The billings score for March increased from 48.0 in February to 50.4 in March (any score above 50 indicates an increase in firm billings). However, firms reported that inquiries into new projects grew at a slower pace, while the value of new design contracts declined from 51.3 in February to 48.9 in March.

“In spite of the positive movement in architecture firm billings in March, core concerns remain., “said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Inflation still needs to ease further for interest rates to return to more normal levels, and the banking turmoil still threatens to hold back residential and commercial construction loans.”

...

• Regional averages: Midwest (51.4); Northeast (49.1); South (47.4); West (47.2)

• Sector index breakdown: mixed practice (firms that do not have at least half of their billings in any one other category) (53.9); institutional (48.8); commercial/industrial (49.7); multi-family residential (44.2)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.4 in March, up from 48.0 in February. Anything above 50 indicates an increase in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index had declined for five consecutive months and was slightly positive in March. This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment later in 2023.

The Fed on "Possible Macroeconomic Effects of a Temporary Federal Debt Default"

by Calculated Risk on 4/19/2023 09:19:00 AM

This is relevant today.

From Federal Reserve Staff in 2013 on the debt ceiling debate: Possible Macroeconomic Effects of a Temporary Federal Debt Default. Excerpts:

Key considerations in evaluating the consequences of a debt defaultUsually the debt ceiling (I prefer "default ceiling") is raised with a clean bill. It is up to Congress. As Senator Mitch McConnell noted in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility.

• Such an event would be unprecedented. Although other countries have defaulted on their sovereign debt, these defaults occurred in situations where the government could not feasibly continue to service its debt. Failure to raise the U.S. federal debt ceiling, in contrast, would be a voluntary decision to stop meeting the government’s obligations even though it has no problems doing so. In addition, no other nation that defaulted on its sovereign debt ever enjoyed two key features of the U.S. economy—Treasury securities are the world’s “safe” asset and the dollar is the world’s main reserve currency. For these reasons, we have essentially no historical experience to help us predict the likely consequences of a failure by the Congress and the Administration to raise the debt ceiling.

• The financial market effects of a debt default would be highly uncertain, both because of its unprecedented nature, and because (as events in recent years have illustrated) we have only a limited understanding of the dynamics of the financial system when hit with a major shock.

o Yields on Treasury securities could rise noticeably, even if the default lasted only a day or two. And if the debt limit impasse dragged on for weeks, it could conceivably lead investors to demand a premium similar to that paid on AAA corporate bonds.

o Given that Treasury yields serve as a benchmark rate for the pricing of other securities, and given that a prolonged stand-off would probably make the general economic outlook much more uncertain, private interest rates could rise sharply. Rising interest rates and risk premiums would in turn push stock prices down appreciably.

o In some extreme scenarios with a prolonged default, financial markets could be severely impaired. For example, the functioning of the repo market could be compromised and some money market mutual funds could experience liquidity pressures.

o A debt default could also have some international repercussions. For example, a prolonged default might increase the reluctance of investors to hold Treasury securities and perhaps dollar-denominated assets more generally. Although the resulting rebalancing in portfolios might be relatively gradual, it could lead to a decline in the dollar over time (although a sudden drop could not be ruled out) and a higher “country-risk” premium on all U.S. assets.

• A debt default would also adversely affect the economy through its direct effects on aggregate income flows and government operations if the impasse in raising the debt limit lasted for several weeks.

o Currently, an extremely large portion of federal government spending is funded through borrowing (in part because tax payments are concentrated in other months). From mid-October through mid-November, for example, only 65 percent of projected spending would be covered by revenues. Thus, 35 percent of government cash outlays would need to be cut if a debt limit accord was not reached until the middle of November.

o Assuming that the Treasury prioritizes its payments to cover all scheduled net interest payments, other federal spending would be temporarily reduced by the following amounts (expressed in nominal terms at an annual rate): $340 billion in nominal federal purchases; $630 billion in Social Security, Medicare, and other transfer payments; and $150 billion in grants to state and local governments.

emphasis added

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 4/19/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 8.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 14, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 8.8 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 8 percent compared with the previous week. The Refinance Index decreased 6 percent from the previous week and was 56 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 10 percent from one week earlier. The unadjusted Purchase Index decreased 9 percent compared with the previous week and was 36 percent lower than the same week one year ago.

“Last week’s increase in mortgage rates prompted a pullback in application activity. With more first-time homebuyers in the market, we continue to see increased sensitivity to rate changes. The 30-year fixed rate increased 13 basis points to 6.43 percent, which led to purchase applications declining 10 percent,” said Joel Kan, MBA’s Vice President and Chief Economist. “Affordability challenges persist and there is limited for-sale inventory in many markets across the country, so buyers remain selective on when they act. The 10-percent drop in FHA purchase applications, and the increase in the average purchase loan size to its highest level in a month, are other indications that first-time buyers have pulled back. The spread between the jumbo and conforming 30-year fixed rates widened slightly last week to 15 basis points, but this was a much tighter spread compared to the past year. As banks reduce their willingness to hold jumbo loans, we expect this narrowing trend to continue.”

Added Kan, “Refinances also declined and accounted for just over a quarter of all applications, as rates remained more than a full percentage point above the same week a year ago. This leaves very little refinance incentive for most homeowners.”

..

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.43 percent from 6.30 percent, with points increasing to 0.63 from 0.55 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 36% year-over-year unadjusted.

Tuesday, April 18, 2023

Wednesday: Architecture Billings Index, Beige Book

by Calculated Risk on 4/18/2023 08:12:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Misery Index

by Calculated Risk on 4/18/2023 12:12:00 PM

For fun, here is a graph of economist Arthur Okun's misery index (popularized by President Reagan).

Okun added inflation and the unemployment rate together as a measure of "misery".

Currently YoY inflation is at 5.0%, and the unemployment rate is at 3.5% for a "misery index" value of 8.5.

March Housing Starts: Most Multi-family Under Construction Since 1973

by Calculated Risk on 4/18/2023 09:07:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: March Housing Starts: Most Multi-family Under Construction Since 1973

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

Red is single family units. Currently there are 716 thousand single family units (red) under construction (SA). This was down in March compared to February, and 112 thousand below the recent peak in April and May 2022. Single family units under construction have peaked since single family starts are now declining. The reason there are still so many homes under construction is probably due to supply constraints.

Blue is for 2+ units. Currently there are 958 thousand multi-family units under construction. This is the highest level since November 1973! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are 1.674 million units under construction, just 37 thousand below the all-time record of 1.711 million set in October 2022.

Housing Starts Decreased to 1.420 million Annual Rate in March

by Calculated Risk on 4/18/2023 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in March were at a seasonally adjusted annual rate of 1,420,000. This is 0.8 percent below the revised February estimate of 1,432,000 and is 17.2 percent below the March 2022 rate of 1,716,000. Single‐family housing starts in March were at a rate of 861,000; this is 2.7 percent above the revised February figure of 838,000. The March rate for units in buildings with five units or more was 542,000.

Building Permits:

Privately‐owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,413,000. This is 8.8 percent below the revised February rate of 1,550,000 and is 24.8 percent below the March 2022 rate of 1,879,000. Single‐family authorizations in March were at a rate of 818,000; this is 4.1 percent above the revised February figure of 786,000. Authorizations of units in buildings with five units or more were at a rate of 543,000 in March

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) decreased in March compared to February. Multi-family starts were up 6.5% year-over-year in March.

Single-family starts (red) increased in March and were down 27.7% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse in single-family starts.

Total housing starts in March were slightly above expectations, however, starts in January and February were revised down slightly, combined.

I'll have more later …

Monday, April 17, 2023

Tuesday: Housing Starts

by Calculated Risk on 4/17/2023 09:01:00 PM

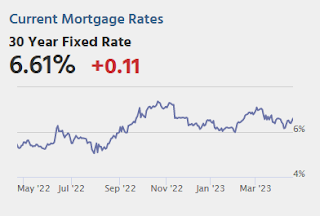

After bottoming out at the lowest levels in months in the first week of April, mortgage rates have been rising fairly quickly. As of this afternoon, you'd have to go back nearly a month to see a higher 30yr fixed rate from the average lender.Tuesday:

In the slightly bigger picture, this leaves us slightly higher than the middle of 2023's range marked by lows near 6% in early February and highs just over 7% in early March. [30 year fixed 6.61%]

emphasis added

• At 8:30 AM ET, Housing Starts for March. The consensus is for 1.400 million SAAR, down from 1.450 million SAAR in February.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.55% in March"

by Calculated Risk on 4/17/2023 04:00:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.55% in March

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 5 basis points from 0.60% of servicers’ portfolio volume in the prior month to 0.55% as of March 31, 2023. According to MBA’s estimate, 275,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 7.8 million borrowers since March 2020.

In March 2023, the share of Fannie Mae and Freddie Mac loans in forbearance decreased 2 basis points to 0.26%. Ginnie Mae loans in forbearance decreased 10 basis points to 1.18%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 10 basis points to 0.68%.

“As the COVID-19 national emergency draws to a close, the number of loans in forbearance continues to drop,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Mortgage performance remains strong with the percentage of borrowers who were current on their mortgage payments and post-forbearance workouts increasing in March.”

Adds Walsh, “MBA’s forecast still calls for a recession in 2023, which may change the current performance levels, but credit quality is generally good and many borrowers facing financial hardship can now access enhanced loss mitigation options that resulted from successes of pandemic-related policies.”

emphasis added

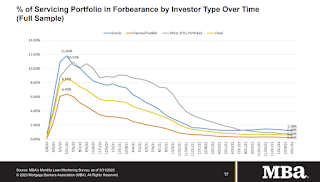

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans has been decreasing, declined to 0.55% in March from 0.60% in February.

At the end of March, there were about 275,000 homeowners in forbearance plans.

Lawler on Demographics: New Population Estimates Incorporate Unprecedented Methodological Changes

by Calculated Risk on 4/17/2023 11:30:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler on Demographics: New Population Estimates Incorporate Unprecedented Methodological Changes

A brief excerpt:

Demographics are very useful in predicting long term trends for housing and the economy.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The following note from housing economist Tom Lawler discusses the most recent release from the Census Bureau.

Last week Census released its “Vintage 2022” estimates of the US resident population by single year of age, and the estimates incorporated unprecedented methodological changes that, if accurate, significantly changed estimates of the age distributions of the US population from previous “vintage” estimates.

In December Census noted that because of some “issues” with Census 2020, it would create a “blended” base (or decadal starting point) for April 1, 2020 that would incorporate age and sex data from the 2020 Demographic Analysis. Stated another way, for (I believe) the first time ever the starting point for this decade’s population estimates do NOT reflect the age distribution from the Decennial Census. Here is an excerpt from its methodology section.“At the national level, then, it is accurate to say that resident, household, and group quarters (GQ) population totals are derived from the 2020 Census, age and sex detail is drawn from 2020 DA, and race and Hispanic origin detail comes from V2020.”Incorporation of this “blended” base resulted in significant changes in the age distribution of the resident population, as shown in the table below.

As the table shows, while the total population estimates for 4/1/2020 are virtually unchanged, there were sizable changes in population estimates for various age groups.

...

CR Note: ... This estimated change in the late teens / early 20’s population in 2020 - that Lawler highlighted - is important (if accurate) for multi-family housing.

NAHB: Builder Confidence Increased Slightly in April

by Calculated Risk on 4/17/2023 10:06:00 AM

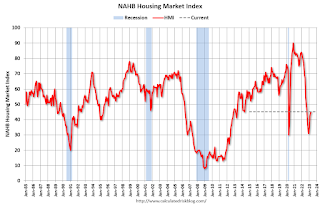

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 45, up from 44 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Lack of Existing Inventory Continues to Support Builder Sentiment

Builders remained cautiously optimistic in April as limited resale inventory helped to increase demand in the new home market even as the industry continues to grapple with building material issues.

Builder confidence in the market for newly built single-family homes in April rose one point to 45, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

Currently, one-third of housing inventory is new construction, compared to historical norms of a little more than 10%. More buyers looking at new homes, along with the use of sales incentives, have supported new home sales since the start of 2023.

...

The HMI index gauging current sales conditions in April rose two points to 51 and the component charting sales expectations in the next six months increased three points to 50. This marks the first time these components both returned to the 50+ range since June 2022. The gauge measuring traffic of prospective buyers remained unchanged at 31. This is the first time the traffic component failed to improve in 2023.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose four points to 46, the Midwest edged up two points to 37, the South increased four points to 49 and the West moved four points higher to 38.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was at the consensus forecast.

Housing April 17th Weekly Update: Inventory Decreased 1.3% Week-over-week

by Calculated Risk on 4/17/2023 08:25:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, April 16, 2023

Monday: NAHB Homebuilder Survey, NY Fed Mfg

by Calculated Risk on 4/16/2023 06:52:00 PM

Weekend:

• Schedule for Week of April 16, 2023

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of -18.0, up from -24.6.

• At 10:00 AM, The April NAHB homebuilder survey. The consensus is for a reading of 45, up from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 8 and DOW futures are up 50 (fair value).

Oil prices were up over the last week with WTI futures at $82.52 per barrel and Brent at $86.31 per barrel. A year ago, WTI was at $107, and Brent was at $111 - so WTI oil prices are down about 23% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.65 per gallon. A year ago, prices were at $4.05 per gallon, so gasoline prices are down $0.40 per gallon year-over-year.

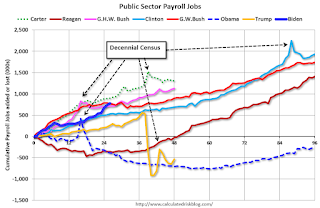

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 4/16/2023 11:13:00 AM

Note: I used to post this monthly, but I stopped during the COVID-19 pandemic. I've received a number of requests lately to post this again, so here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

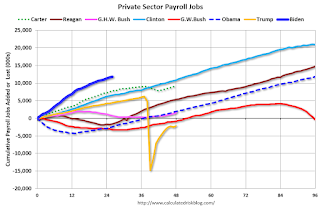

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter, George H.W. Bush and Trump only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession. And there was a pandemic related recession in 2020.

First, here is a table for private sector jobs. The top two previous private sector terms were both under President Clinton.

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,039 |

| Reagan 1 | 5,363 |

| Reagan 2 | 9,351 |

| GHW Bush | 1,511 |

| Clinton 1 | 10,877 |

| Clinton 2 | 10,093 |

| GW Bush 1 | -820 |

| GW Bush 2 | 447 |

| Obama 1 | 1,906 |

| Obama 2 | 9,927 |

| Trump | -2,135 |

| Biden | 11,8241 |

| 1After 26 months. | |

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 820,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 373,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 9,039,000 under President Carter (dashed green), by 14,714,000 under President Reagan (dark red), 1,511,000 under President G.H.W. Bush (light purple), 20,970,000 under President Clinton (light blue), and 11,833,000 under President Obama (dark dashed blue). During Trump's term (Orange), the economy lost 2,135,000 private sector jobs.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 271,000 jobs). During Trump's term, the economy lost 535,000 public sector jobs.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -710 |

| Obama 2 | 447 |

| Trump | -535 |

| Biden | 7761 |

| 1After 26 months. | |

Saturday, April 15, 2023

Real Estate Newsletter Articles this Week: "Early Read on Existing Home Sales in March"

by Calculated Risk on 4/15/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Lawler: Early Read on Existing Home Sales in March

• Current State of the Housing Market; Overview for mid-April

• Remote Work and Household Formation

• A Few Comments on Commercial Real Estate

• 2nd Look at Local Housing Markets in March

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of April 16, 2023

by Calculated Risk on 4/15/2023 08:11:00 AM

The key reports this week are March Housing Starts and Existing Home Sales.

8:30 AM: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of -18.0, up from -24.6.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 45, up from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM ET: Housing Starts for March.

8:30 AM ET: Housing Starts for March. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.400 million SAAR, down from 1.450 million SAAR in February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of -20.0, up from -24.6.

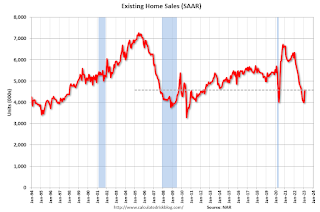

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 4.50 million SAAR, down from 4.58 million.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 4.50 million SAAR, down from 4.58 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.51 million SAAR for March.

10:00 AM: State Employment and Unemployment (Monthly) for March 2023

Friday, April 14, 2023

COVID Apr 14, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 4/14/2023 09:01:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 101,437 | 122,632 | ≤35,0001 | |

| Hospitalized2 | 11,933 | 13,640 | ≤3,0001 | |

| Deaths per Week2 | 1,327 | 1,779 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Lawler: Early Read on Existing Home Sales in March; 3rd Look at Local Housing Markets in March

by Calculated Risk on 4/14/2023 02:13:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in March

A brief excerpt:

This is the third look at local markets in March. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in March were mostly for contracts signed in January and February. Since 30-year fixed mortgage rates were over 6% for all of January and February - compared to 4% range the previous year - closed sales were down significantly year-over-year in March. However, the impact was probably not as severe as for closed sales in December and January (rates were the highest in October and November 2022 when contracts were signed for closing in December and January).

A few prices: Median sales prices in the Charlotte region were down 0.4% year-over year (YoY), up 1.9% YoY in Des Moines, and down 10.0% YoY in Sacramento.

...

In March, sales in these markets were down 21.2%. In February, these same markets were down 23.4% YoY Not Seasonally Adjusted (NSA).

This is a slightly smaller YoY decline NSA than in February for these markets. The March existing home sales report will show another significant YoY decline and will be the 19th consecutive month with a YoY decline in sales.

Many more local markets to come!