by Calculated Risk on 4/25/2023 09:15:00 AM

Tuesday, April 25, 2023

Case-Shiller: National House Price Index "Declines Moderated" to 2.0% year-over-year increase in February

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3-month average of December, January and February closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Declines Moderated in February

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 2.0% annual gain in February, down from 3.7% in the previous month. The 10-City Composite annual increase came in at 0.4%, down from 2.5% in the previous month. The 20-City Composite posted a 0.4% year-over-year gain, down from 2.6% in the previous month.

Miami, Tampa, and Atlanta again reported the highest year-over-year gains among the 20 cities in February. The order remained the same with Miami leading the way with a 10.8% year-over-year price increase, followed by Tampa in second with a 7.7% increase, and Atlanta in third with a 6.6% increase. All 20 cities reported lower prices in the year ending February 2023 versus the year ending January 2023.

...

Before seasonal adjustment, the U.S. National Index posted a 0.2% month-over-month increase in February, while the 10-City and 20-City Composites posted increases of 0.3% and 0.2%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.2%, while both the 10-City and 20-City Composites posted increases of 0.1%.

In January, before seasonal adjustment, 19 cities reported declines with only Miami reporting an increase at 0.1%. After seasonal adjustment, 15 cities reported declines while Miami, Boston, Charlotte, and Cleveland had slight increases.

“Home price trends moderated in February 2023,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite, which had declined for seven consecutive months, rose a modest 0.2% in February, and now stands 4.9% below its June 2022 peak. Our 10- and 20-City Composites performed similarly, with February gains of 0.3% and 0.2%; these Composites are currently 6.0% and 6.6% below their respective peaks. On a trailing 12-month basis, the National Composite is only 2.0% above its level in February 2022; the 10- and 20-City Composites are both up 0.4% on a year-over-year basis."

emphasis added

Click on graph for larger image.

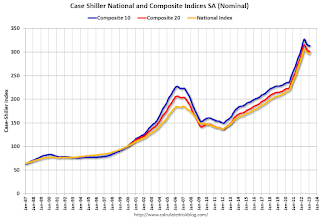

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.1% in February (SA) and down 4.3% from the recent peak in June 2022.

The Composite 20 index is up 0.1% (SA) in February and down 4.6% from the recent peak in June 2022.

The National index is up 0.2% (SA) in February and is down 2.8% from the peak in June 2022.

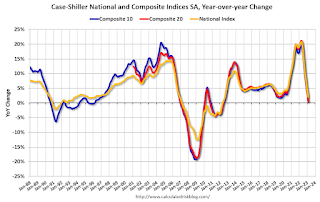

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 0.4% year-over-year. The Composite 20 SA is up 0.4% year-over-year.

The National index SA is up 2.0% year-over-year.

Annual price increases were below expectations. I'll have more later.

Monday, April 24, 2023

Tuesday: New Home Sales, Case-Shiller House Prices

by Calculated Risk on 4/24/2023 09:00:00 PM

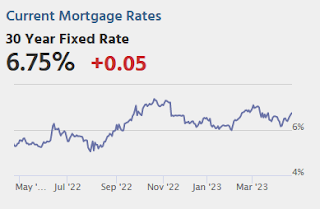

The average lender moved slightly lower in cost. The change was small enough that most borrowers will see it in the form of a modest reduction in upfront costs without any change in the quoted interest rate (relative to what the same scenario would have been quoted on Friday). [30 year fixed 6.59%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for February. The consensus is for a 2.5% year-over-year increase in the Comp 20 index for February.

• Also at 9:00 AM, FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for March from the Census Bureau. The consensus is for 630 thousand SAAR, down from 640 thousand in February.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for April.

Vehicle Sales Forecast: "April U.S. Light-Vehicle Sales to Post Strong Growth"

by Calculated Risk on 4/24/2023 04:27:00 PM

From WardsAuto: April U.S. Light-Vehicle Sales to Post Strong Growth; Inventory to Fall from March (pay content). Brief excerpt:

Even though the seasonally adjusted annual rate could decline slightly from the prior quarter’s 15.2 million units, sales volume is forecast to rise a robust 13% year-over-year in Q2. Inventory will undergo a seasonally related month-to-month decline in April but resume growth by the end of the quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for April (Red).

The Wards forecast of 15.5 million SAAR, would be up 4.6% from last month, and up 8.5% from a year ago.

Final Look at Local Housing Markets in March

by Calculated Risk on 4/24/2023 09:56:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in February

A brief excerpt:

Every month I track about 40 local housing markets in the US to get an early sense of changes in the housing market. After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR (and I’m frequently adding more markets). This is the final look at local markets in March.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The big story for March existing home sales was the sharp year-over-year (YoY) decline in sales. Also, active inventory increased YoY, but is still historically low - and new listings were down YoY.

First, here is a table comparing the year-over-year Not Seasonally Adjusted (NSA) declines in sales this year from the National Association of Realtors® (NAR) with the local markets I track. So far, these measures have tracked closely. The NAR reported sales were down 23.0% NSA YoY in February.

...

Note: Even if existing home sales activity bottomed in December (4.03 million SA) and January (4.00 million SA), there are usually two bottoms for housing - the first for activity and the second for prices. See Has Housing "Bottomed"?

My early expectation is we will see a somewhat similar YoY sales decline NSA in April as in March. Even though mortgage rates were higher for contracts signed in March (closed sales in April will be mostly for contracts signed in February and March) sales were already declining in March 2022, as 30-year mortgage rates moved above 4% for the first time since early 2019 (yes, rates were below 4% prior to the pandemic).

More local data coming in May for activity in April!

Housing April 24th Weekly Update: Inventory Increased 2.1% Week-over-week

by Calculated Risk on 4/24/2023 08:30:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, April 23, 2023

Sunday Night Futures

by Calculated Risk on 4/23/2023 06:43:00 PM

Weekend:

• Schedule for Week of April 23, 2023

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for April.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 6 and DOW futures are down 44 (fair value).

Oil prices were down over the last week with WTI futures at $77.87 per barrel and Brent at $81.66 per barrel. A year ago, WTI was at $103, and Brent was at $105 - so WTI oil prices are down about 24% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.64 per gallon. A year ago, prices were at $4.09 per gallon, so gasoline prices are down $0.45 per gallon year-over-year.

The Normal Seasonal Pattern for Median House Prices

by Calculated Risk on 4/23/2023 10:37:00 AM

Last week, in the CalculatedRisk Real Estate Newsletter on March existing home sales, NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March; Median Prices Declined 0.9% YoY, I noted that median prices were down year-over-year (median prices are distorted by the mix).

Seasonally prices typically peak in June (closed sales are mostly for contracts signed in April and May).

And seasonally prices usually bottom the following January (contracts signed in November and December).

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Jan to Mar | 3.7% | 4.1% | 5.4% | 7.5% | 7.1% | 4.0% |

| Mar to Jun | 9.6% | 9.9% | 4.9% | 12.4% | 9.1% | NA |

| Total Jan to Jun | 13.7% | 14.4% | 10.6% | 20.8% | 16.8% | NA |

| Jun to Dec | -7.0% | -3.8% | 5.0% | -2.2% | -11.4% | NA |

The 2023 increase in median prices from January to March was about the same as in 2018 and 2019.

Saturday, April 22, 2023

Real Estate Newsletter Articles this Week: "Most Multi-family Under Construction Since 1973"

by Calculated Risk on 4/22/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March; Median Prices Declined 0.9% YoY

• March Housing Starts: Most Multi-family Under Construction Since 1973

• Lawler on Demographics: New Population Estimates Incorporate Unprecedented Methodological Changes

• Why Measures of Existing Home Inventory appear Different

• 4th Look at Local Housing Markets: California Home Sales down 34% YoY in March; Prices Down 7.0% YoY

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of April 23, 2023

by Calculated Risk on 4/22/2023 08:11:00 AM

The key reports scheduled for this week are the advance estimate of Q1 GDP and March New Home sales.

Other key reports include February Case-Shiller house prices and Personal Income and Outlays for March.

For manufacturing, the April Dallas, Richmond and Kansas City manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for April.

9:00 AM: S&P/Case-Shiller House Price Index for February.

9:00 AM: S&P/Case-Shiller House Price Index for February.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.5% year-over-year increase in the Comp 20 index for February.

9:00 AM: FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 630 thousand SAAR, down from 640 thousand in February.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 0.9% increase in durable goods orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 245 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2023 (Advance estimate). The consensus is that real GDP increased 2.0% annualized in Q1, down from 2.6% in Q4.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 1.0% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for April. This is the last of regional manufacturing surveys for April.

8:30 AM ET: Personal Income and Outlays, March 2023. The consensus is for a 0.2% increase in personal income, and for a 0.1% decrease in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 4.1% YoY, and core PCE prices up 4.5% YoY.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for a reading of 43.5, down from 43.8 in March.

10:00 AM: University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 63.5.

Friday, April 21, 2023

COVID Apr 21, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 4/21/2023 09:00:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 94,142 | 101,598 | ≤35,0001 | |

| Hospitalized2 | 11,097 | 12,418 | ≤3,0001 | |

| Deaths per Week2 | 1,160 | 1,333 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Q1 GDP Tracking: Around 2%

by Calculated Risk on 4/21/2023 01:31:00 PM

The advance estimate of Q1 GDP will be released this coming Thursday, April 27th. The consensus is that real GDP increased 2.0% annualized in Q1, down from 2.6% in Q4.

From BofA:

On net, the data lowered our tracking estimate a tenth to 1.5% q/q saar. ... Our tracking estimate for personal consumption expenditures (PCE) increased from 3.5% q/q saar to 4.0% q/q saar owing to slightly stronger than expected retail sales and a surge in utitilities production. [Apr 21st estimate]From Goldman:

emphasis added

We have left our Q1 GDP tracking estimate unchanged at +2.2% (qoq ar). Our domestic final sales growth forecast stands at +3.9%. [Apr 20th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 2.5 percent on April 18, unchanged from April 14 after rounding. After this morning's housing starts report from the US Census Bureau, the nowcast of first-quarter real residential investment growth increased from -5.8 percent to -5.5 percent. [Apr 18th estimate]

Why Measures of Existing Home Inventory appear Different

by Calculated Risk on 4/21/2023 09:57:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Why Measures of Existing Home Inventory appear Different

A brief excerpt:

Here is a graph comparing the year-over-year change in Realtor.com’s active inventory, the NAR’s inventory, and Realtor.com inventory including pending sales. Note that the blue line (NAR) and dashed black line (Realtor including pending sales) track.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

As Lawler noted, including pending sales understated the decline in active inventory in 2020 and 2021, and is now understating the increase in active inventory.

But what about Redfin? Redfin takes a very different approach. Their active inventory number for any month includes homes that came on the market and sold quickly during the month, whereas the other measures are a snapshot at the end of the month (or week).

Black Knight: "Mortgage Delinquencies Hit Record Low in March"

by Calculated Risk on 4/21/2023 08:30:00 AM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies Hit Record Low in March, While Prepayments Rose on Easing Rates and Seasonal Tailwinds

• The national delinquency rate dropped 53 basis points (-15%) in March, falling below 3% for the first time on record, ending the month at just 2.92%According to Black Knight's First Look report, the percent of loans delinquent decreased 15% in March compared to February and decreased 13% year-over-year.

• While delinquency rates almost always fall in March – as borrowers utilize tax refunds and other seasonal revenues to pay down past-due debt – the drop marked the second largest decline in the past 17 years

• Factoring in March’s decline, the total number of past-due mortgages (including active foreclosures) has fallen to its lowest level in nearly 23 years, dating all the way back to April 2000

• Serious delinquencies (90+ days past due) showed marked improvement, falling by 51K to their lowest level since March 2020, with volumes shrinking in every state

• Likewise, every state saw overall delinquencies fall in March, with improvements ranging from 11.9% in Washington to 21.5% in Vermont

• Both foreclosure starts (+9.0%) and sales (+4.6%) rose in the month but still remain well below pre-pandemic volumes at the national level

• Active foreclosure inventory held steady, but remains 31K (12%) below March 2020 levels

• The prepayment rate (SMM) rose to 0.50% (+44% month over month) driven, as anticipated, by seasonal tailwinds in sale-related prepayments and an increased demand for refis due to falling rates

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.92% in March, down from 3.45% the previous month.

The percent of loans in the foreclosure process was essentially unchanged in March at 0.46%, from 0.46% the previous month.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2023 | Feb 2023 | |||

| Delinquent | 2.92% | 3.45% | ||

| In Foreclosure | 0.46% | 0.46% | ||

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,539,000 | 1,811,000 | ||

| Number of properties in foreclosure pre-sale inventory: | 240,000 | 240,000 | ||

| Total Properties | 1,779,000 | 2,050,000 | ||

Thursday, April 20, 2023

Hotels: Occupancy Rate Up 3.7% Year-over-year

by Calculated Risk on 4/20/2023 03:39:00 PM

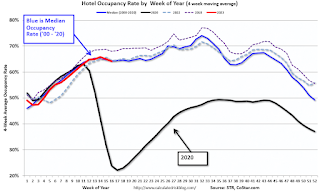

U.S. hotel performance increased from the previous week, according to STR‘s latest data through April 15.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

April 9-15, 2023 (percentage change from comparable week in 2022):

• Occupancy: 64.2% (+3.7%)

• Average daily rate (ADR): $155.33 (+4.7%)

• Revenue per available room (RevPAR): $99.67 (+8.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Weekly Active Inventory Up 49% YoY; New Listings Down 5% YoY

by Calculated Risk on 4/20/2023 01:32:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Apr 15, 2023

• Active inventory growth continued to climb, with for-sale homes up 49% above one year ago. The number of homeowners shifting home listing timelines around spring holidays helped push active inventory growth up this week. Despite the big surge, the number of homes for-sale continues to trail pre-pandemic levels, keeping many cards in the hands of sellers sitting on very high levels of home equity.

...

• New listings–a measure of sellers putting homes up for sale–were down again this week, but only by 5% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 41 weeks and while this week continued that trend, the magnitude shifted in a big way. Shifts in religious holidays that fell earlier in 2023 are likely responsible for last week’s big drop and this week’s significantly smaller decline. On average across the two weeks, the decline in new listings is roughly on track with what we’ve seen so far this year.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed recently, although this was a pickup from up 44% YoY last week.

NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March; Median Prices Declined 0.9% YoY

by Calculated Risk on 4/20/2023 10:42:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March; Median Prices Declined 0.9% YoY

Excerpt:

On prices, the NAR reported:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!The median existing-home price for all housing types in March was $375,700, a decline of 0.9% from March 2022 ($379,300). Price climbed slightly in three regions but dropped in the WestMedian prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

The YoY change in the median price peaked at 25.2% in May 2021 and prices are now down 0.9% YoY. Median house prices increased 3.3% from February to March and have declined 9.2% from the peak in June 2022 (NSA).

It is likely the Case-Shiller index will be down soon year-over-year.

Note that closed sales in March were mostly for contracts signed in January and February. Mortgage rates, according to the Freddie Mac PMMS, were around 6.3% in January and February, and that provided a boost to closed sales in February and March compared to closed sales in December and January.

April sales will be for contracts signed in February and March, and mortgage rates averaged 6.5% in March and that might impact closed sales in April.

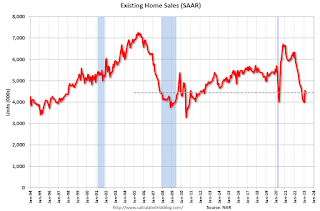

NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March

by Calculated Risk on 4/20/2023 10:11:00 AM

From the NAR: Existing-Home Sales Slid 2.4% in March

Existing-home sales edged lower in March, according to the National Association of Realtors®. Month-over-month sales declined in three out of four major U.S. regions, while sales in the Northeast remained steady. All regions posted year-over-year decreases.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – fell 2.4% from February to a seasonally adjusted annual rate of 4.44 million in March. Year-over-year, sales waned 22.0% (down from 5.69 million in March 2022).

...

Total housing inventory registered at the end of March was 980,000 units, up 1.0% from February and 5.4% from one year ago (930,000). Unsold inventory sits at a 2.6-month supply at the current sales pace, unchanged from February but up from 2.0 months in March 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March (4.44 million SAAR) were down 2.4% from the previous month and were 22.0% below the March 2022 sales rate.

According to the NAR, inventory increased to 0.98 million in March from 0.97 million in February.

According to the NAR, inventory increased to 0.98 million in March from 0.97 million in February.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 5.4% year-over-year (blue) in March compared to March 2022.

Inventory was up 5.4% year-over-year (blue) in March compared to March 2022. Months of supply (red) was unchanged at 2.6 months in March from 2.6 months in February.

This was below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims increase to 245,000

by Calculated Risk on 4/20/2023 08:33:00 AM

The DOL reported:

In the week ending April 15, the advance figure for seasonally adjusted initial claims was 245,000, an increase of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 239,000 to 240,000. The 4-week moving average was 239,750, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 240,000 to 240,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 239,750.

The previous week was revised up.

Weekly claims were above the consensus forecast.

Wednesday, April 19, 2023

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 4/19/2023 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of -20.0, up from -24.6.

• At 10:00 AM, Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 4.50 million SAAR, down from 4.58 million.

LA Port Inbound Traffic Down Sharply YoY in March

by Calculated Risk on 4/19/2023 04:11:00 PM

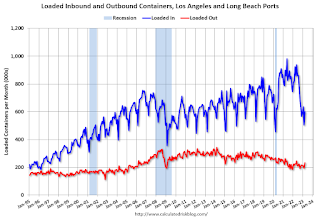

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 3.7% in March compared to the rolling 12 months ending in February. Outbound traffic increased 0.2% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.