by Calculated Risk on 5/11/2023 10:19:00 AM

Thursday, May 11, 2023

MBA: "Mortgage Delinquency Rate in First-Quarter 2023 Declines to Second-Lowest Level in MBA’s Survey"

From the MBA: Mortgage Delinquency Rate in First-Quarter 2023 Declines to Second-Lowest Level in MBA’s Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.56 percent of all loans outstanding at the end of the first quarter of 2023, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was down 40 basis points from the fourth quarter of 2022 and down 55 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the first quarter rose by 2 basis points to 0.16 percent.

“The mortgage delinquency rate fell to its lowest level for any first quarter since MBA’s survey began in 1979 and was the second lowest quarterly rate overall, just 11 basis points above the survey low in the third quarter of 2022,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Mortgage delinquencies and the unemployment rate continue to track each other closely, with the unemployment rate in April falling back to the 54-year low of 3.4 percent set in January.”

Added Walsh, “Consistent with the resilient job market, the performance of existing mortgages is exceeding expectations. Across all states, there was an improvement in the first quarter compared to one year ago. Year-over-year delinquencies for all product types – FHA, VA, and conventional – were also down.”.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q1.

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 15 basis points to 1.77 percent, the 60-day delinquency rate decreased 11 basis points to 0.55 percent, and the 90-day delinquency bucket decreased 14 basis points to 1.24 percent.The sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 0.57 percent, unchanged from the fourth quarter of 2022 and 4 basis points higher than one year ago.

The percent of loans in the foreclosure process increased slightly year-over-year in Q1 with the end of the foreclosure moratoriums but are still historically low.

Weekly Initial Unemployment Claims increase to 264,000

by Calculated Risk on 5/11/2023 08:32:00 AM

The DOL reported:

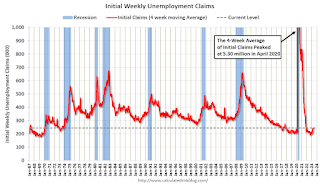

In the week ending May 6, the advance figure for seasonally adjusted initial claims was 264,000, an increase of 22,000 from the previous week's unrevised level of 242,000. This is the highest level for initial claims since October 30, 2021 when it was 264,000. The 4-week moving average was 245,250, an increase of 6,000 from the previous week's unrevised average of 239,250. This is the highest level for this average since November 20, 2021 when it was 249,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 245,250.

The previous week was unrevised.

Weekly claims were above the consensus forecast.

Wednesday, May 10, 2023

Thursday: Unemployment Claims, PPI

by Calculated Risk on 5/10/2023 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 242 thousand last week.

• Also at 8:30 AM, The Producer Price Index for April from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.3% increase in core PPI.

Misery Index

by Calculated Risk on 5/10/2023 03:33:00 PM

For fun, here is an update to the graph of economist Arthur Okun's misery index (popularized by President Reagan).

Okun added inflation and the unemployment rate together as a measure of "misery".

Currently YoY inflation is at 4.9%, and the unemployment rate is at 3.4% for a "misery index" value of 8.3.

2nd Look at Local Housing Markets in April

by Calculated Risk on 5/10/2023 01:34:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in April

A brief excerpt:

This is the second look at local markets in I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in April were mostly for contracts signed in February and March. Since 30-year fixed mortgage rates were over 6% for all of February and March - compared to the 4% range the previous year - closed sales were down significantly year-over-year in April.

It is likely sales were down more year-over-year in April than in March, however, the impact was probably not as severe as for closed sales in December and January (rates were the highest in October and November 2022 when contracts were signed for closing in December and January).

...

In April, sales in these markets were down 30.7%. In March, these same markets were down 24.0% YoY Not Seasonally Adjusted (NSA).

This is a larger YoY decline NSA than in March for these markets, however there was one less selling day in April this year. This early data suggests the April existing home sales report will show another significant YoY decline, and the 20th consecutive month with a YoY decline in sales.

Many more local markets to come!

Cleveland Fed: Median CPI increased 0.4% and Trimmed-mean CPI increased 0.3% in April

by Calculated Risk on 5/10/2023 11:27:00 AM

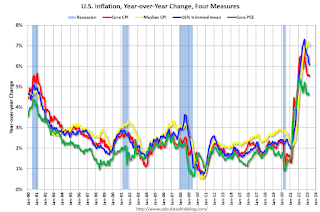

The Cleveland Fed released the median CPI and the trimmed-mean CPI.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.4% in April. The 16% trimmed-mean Consumer Price Index increased 0.3% in April. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Used Cars" increased at a 69% annualized rate in April (this will reverse in May), and "Car and truck rental" decreased at a 33% annualized rate.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 5/10/2023 08:51:00 AM

Here a few measures of inflation:

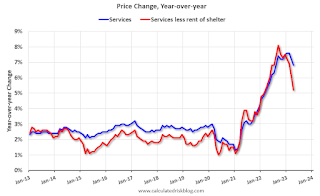

The first graph is the one Fed Chair Powell has been mentioning.

This graph shows the YoY price change for Services and Services less rent of shelter through March 2023.

Services less rent of shelter was up 5.2% YoY in April, down from 6.1% YoY in March.

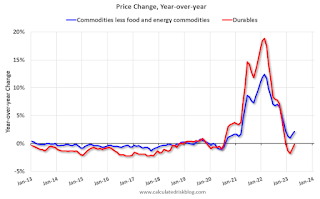

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were up 2.1% YoY in April, up from 1.6% YoY in March.

Here is a graph of the year-over-year change in shelter from the CPI report (through April) and housing from the PCE report (through March 2023)

Here is a graph of the year-over-year change in shelter from the CPI report (through April) and housing from the PCE report (through March 2023)Shelter was up 8.1% year-over-year in March, down from 8.2% in March. Housing (PCE) was up 8.3% YoY in March.

The BLS noted this morning: "The index for shelter was the largest contributor to the monthly all items increase ..."

BLS: CPI increased 0.4% in April; Core CPI increased 0.4%

by Calculated Risk on 5/10/2023 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in April on a seasonally adjusted basis, after increasing 0.1 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 4.9 percent before seasonal adjustment.CPI was slightly lower than expected and core CPI slightly higher than expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter was the largest contributor to the monthly all items increase, followed by increases in the index for used cars and trucks and the index for gasoline. The increase in the gasoline index more than offset declines in other energy component indexes, and the energy index rose 0.6 percent in April. The food index was unchanged in April, as it was in March. The index for food at home fell 0.2 percent over the month while the index for food away from home rose 0.4 percent.

The index for all items less food and energy rose 0.4 percent in April, as it did in March. Indexes which increased in April include shelter, used cars and trucks, motor vehicle insurance, recreation, household furnishings and operations, and personal care. The index for airline fares and the index for new vehicles were among those that decreased over the month.

The all items index increased 4.9 percent for the 12 months ending April; this was the smallest 12-month increase since the period ending April 2021. The all items less food and energy index rose 5.5 percent over the last 12 months. The energy index decreased 5.1 percent for the 12 months ending April, and the food index increased 7.7 percent over the last year.

emphasis added

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 5/10/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

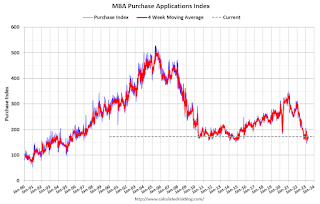

Mortgage applications increased 6.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 5, 2023.

The Market Composite Index, a measure of mortgage loan application volume, increased 6.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 7 percent compared with the previous week. The Refinance Index increased 10 percent from the previous week and was 44 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index increased 5.3 percent compared with the previous week and was 32 percent lower than the same week one year ago.

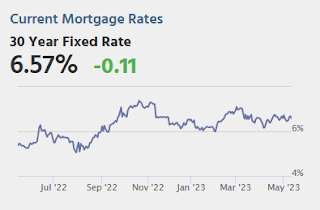

“Mortgage applications responded positively to a drop in rates last week, as the Fed signaled a potential pause at the current level for the federal funds rate in anticipation of inflation slowing and tightening financial conditions that will slow economic and job growth. Mortgage rates for all surveyed loan types decreased over the week with the 30-year fixed rate at 6.48 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications increased 5 percent last week but were still more than 30 percent below last year’s level. Lower rates from week to week have helped buyers in the market, but limited for-sale inventory remains a challenge for many homebuyers. Refinance activity jumped 10 percent to its highest levels since September 2022, although there is only a small pool of borrowers who can benefit from refinancing with rates at these levels.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.48 percent from 6.50 percent, with points decreasing to 0.61 from 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 32% year-over-year unadjusted.

Tuesday, May 09, 2023

Wednesday: CPI

by Calculated Risk on 5/09/2023 08:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for 0.4% increase in CPI (up 5.0% YoY), and a 0.3% increase in core CPI (up 5.5% YoY).

Leading Index for Commercial Real Estate Decreased in April

by Calculated Risk on 5/09/2023 04:17:00 PM

From Dodge Data Analytics: Dodge Momentum Index Declines In April After Pullback In Commercial Planning

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, fell 5.1% in April to 180.9 (2000=100) from the revised March reading of 190.6. In April, the commercial component of the DMI fell 8.0%, and the institutional component improved 0.3%.

“On par with our expectations, the Dodge Momentum Index continued to recede in April, due to declining economic conditions and ongoing banking uncertainty.” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “Weaker commercial planning is driving the DMI’s decline, as it is more exposed to real-time economic changes than the largely publicly funded institutional segment.”

Commercial planning in April was pushed down by sluggish office, hotel and retail activity. Institutional planning remained flat, as weak education planning offset growth in healthcare and amusement projects. Year over year, the DMI remains 11% higher than in April 2022. The commercial and institutional components were up 7% and 17% respectively.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 180.9 in April, down from 190.6 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a solid pickup in commercial real estate construction in early 2023. but a slowdown towards the end of 2023 or in 2024.

House Price Battle Royale: Low Inventory vs Affordability

by Calculated Risk on 5/09/2023 10:33:00 AM

Today, in the Calculated Risk Real Estate Newsletter: House Price Battle Royale: Low Inventory vs Affordability

Brief excerpt:

I’ve been wrestling with the impact on house prices of the rapid increase in mortgage rates and monthly payments over the last year. My reaction was the current situation was somewhat similar to the 1978 to 1982 period and we would see prices decline in real terms (adjusted for inflation). See from March 2022: Housing: Don't Compare the Current Housing Boom to the Bubble and Bust.There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/.

In that article I wrote on prices:[W]e should expect something similar to the what happened in the late ‘70s - a decline in real house prices seems likely … Currently we just have to watch and wait. However, we can be fairly confident that we won’t see cascading nominal price declines like during the housing bust - since there will be few distressed sales.In the 1980 period, nominal prices only declined slightly on a month-to-month basis a few times according to the Case-Shiller National house price index. However, real prices - adjusted for inflation - declined 10.7% from the peak. The inflation adjusted peak was in October 1979, and real prices didn’t exceed that peak until May 1986 (See from October 2022: House Prices: 7 Years in Purgatory).

Note that if we use the Freddie Mac House Price Index, nominal prices declined 6.9% in the early 1980s, and real prices declined 17.5%!

As I noted in “7 Years in Purgatory”:Earlier this year, I argued the most likely path for house prices was for nominal prices to “stall”, and for real prices (inflation adjusted) to decline over several years. The arguments for a stall included historically low inventory levels, mostly solid lending over the last decade, and that house prices tend to be sticky downwards. … However, we are already seeing nominal house price declines on a national basis.And the historically low level of inventory is a key reason house prices haven’t declined more to date. As of February, the Case-Shiller National Index was off 2.8% in nominal terms (seasonally adjusted), and off 4.6% in real terms.

Here is a look at the house price battle between low inventory and affordability.

Second Home Market: South Lake Tahoe in April

by Calculated Risk on 5/09/2023 08:27:00 AM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through April 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, and only up slightly from the record low set in February 2022.

It is possible the massive snowstorms have limited listings in the Tahoe market this year.

Monday, May 08, 2023

"Mortgage Rates Jump to Highest Levels Since Last Monday"

by Calculated Risk on 5/08/2023 09:00:00 PM

Mortgage rates moved noticeably higher to start the new week--high enough that you'd have to go back to last Monday to see anything higher. That's the bad news.Tuesday:

The good news is that rates are in the midst of their flattest trend in a long time. This is true both in a broad sense going back to Q4 2022 and a more recent/narrow sense going back to mid-March. Since then, the top tier 30yr fixed rate hasn't strayed too far from 6.5% despite spending time on both sides of that level. [30 year fixed 6.65%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for April.

Update: Framing Lumber Prices Down 57% YoY, Below Pre-Pandemic Levels

by Calculated Risk on 5/08/2023 04:00:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through May 8th.

Prices are below the pre-pandemic levels of around $400.

Click on graph for larger image.

Click on graph for larger image.We didn't see a significant runup in prices this Spring due to the housing slowdown.

Fed Survey: Banks reported Tighter Standards, Weaker Demand for All Loan Types

by Calculated Risk on 5/08/2023 02:08:00 PM

From the Federal Reserve: The April 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

The April 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the first quarter of 2023.

Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to large and middle-market firms as well as small firms over the first quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans other than government-sponsored enterprise (GSE)-eligible and government residential mortgages, which remained basically unchanged. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Standards tightened for all consumer loan categories; demand weakened for auto and other consumer loans, while it remained basically unchanged for credit cards.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

This shows that demand has declined.

Fannie "Real Estate Owned" inventory essentially unchanged in Q1

by Calculated Risk on 5/08/2023 12:02:00 PM

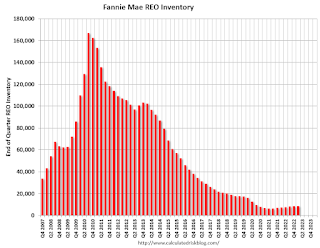

Fannie reported results for Q1 2023. Here is some information on single-family Real Estate Owned (REOs).

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie Real Estate Owned (REO).

This is well below a normal level of REOs for Fannie, and REO levels will increase further in 2023, but there will not be a huge wave of foreclosures.

Lawler: American Homes 4 Rent Net Seller of Single-Family Homes Last Quarter

by Calculated Risk on 5/08/2023 09:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: American Homes 4 Rent Net Seller of Single-Family Homes Last Quarter

Brief excerpt:

Housing economist Tom Lawler brings us some interesting data from American Homes 4 Rent. Last week, Lawler discussed Invitation Homes Net Seller of Single-Family Properties for Second Straight Quarter and also provided statistics from eight public builders):There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/.

American Homes 4 Rent Net Seller of Single-Family Homes Last Quarter; Rent Growth Slowed but Remained Elevated

American Homes 4 Rent (AMH), a publicly-traded company in the single-family rental business with over 58,000 SF rental properties, reported that it disposed of 354 more SF properties than it acquired last quarter, and excluding deliveries of build-to-rent homes from its own AMH Development Program its net sales of SF properties totaled 653 properties. Below is a table showing AMH’s acquisitions, dispositions, and total wholly-owned SF properties.

Housing May 8th Weekly Update: Inventory Decreased 0.6% Week-over-week

by Calculated Risk on 5/08/2023 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, May 07, 2023

Monday: Senior Loan Officer Opinion Survey on Bank Lending Practices

by Calculated Risk on 5/07/2023 11:53:00 PM

Weekend:

• Schedule for Week of May 7, 2023

Monday:

• At 2:00 PM ET Senior Loan Officer Opinion Survey on Bank Lending Practices for April.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $71.34 per barrel and Brent at $75.30 per barrel. A year ago, WTI was at $110, and Brent was at $114 - so WTI oil prices are down about 35% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.50 per gallon. A year ago, prices were at $4.28 per gallon, so gasoline prices are down $0.78 per gallon year-over-year.