by Calculated Risk on 5/22/2023 08:30:00 AM

Monday, May 22, 2023

Housing May 22nd Weekly Update: Inventory Increased 0.9% Week-over-week

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, May 21, 2023

Sunday Night Futures

by Calculated Risk on 5/21/2023 07:10:00 PM

Weekend:

• Schedule for Week of May 21, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 8 and DOW futures are down 58 (fair value).

Oil prices were up over the last week with WTI futures at $71.55 per barrel and Brent at $75.58 per barrel. A year ago, WTI was at $113, and Brent was at $114 - so WTI oil prices are down about 37% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.52 per gallon. A year ago, prices were at $4.58 per gallon, so gasoline prices are down $1.06 per gallon year-over-year.

The Changing Mix of Light Vehicle Sales

by Calculated Risk on 5/21/2023 09:54:00 AM

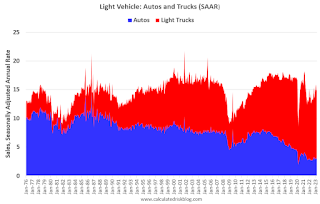

The first graph below shows the mix of sales since 1976 (Blue is cars, Red is light trucks and SUVs) through April 2023.

Click on graph for larger image.

The mix has changed significantly. Back in 1976, most light vehicles were passenger cars - however passenger car sales have trended down over time.

Note that the big dips in sales are related to economic recessions (early '80s, early '90s, the Great Recession of 2007 through mid-2009 and the pandemic in 2020).

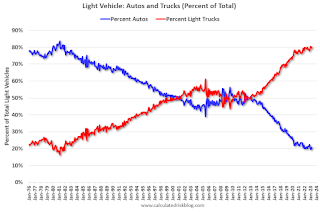

The second graph shows the percent of light vehicle sales between passenger cars and trucks / SUVs.

Saturday, May 20, 2023

Real Estate Newsletter Articles this Week: "Near Record Multi-Family Under Construction"

by Calculated Risk on 5/20/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• April Housing Starts: Near Record Multi-Family Under Construction

• NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April; Median Prices Declined 1.7% YoY

• Similar Number of Housing Units started in Q1 as 'Built-for-Rent' as 'Built-for-Sale'

• 4th Look at Local Markets in April

• Lawler: Early Read on Existing Home Sales in April

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of May 21, 2023

by Calculated Risk on 5/20/2023 08:11:00 AM

The key reports this week are the second estimate of Q1 GDP, April New Home Sales, and Personal Income and Outlays for April.

For manufacturing, the May Richmond and Kansas City Fed manufacturing surveys will be released.

No major economic releases scheduled.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 660 thousand SAAR, down from 683 thousand SAAR in March.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Minutes Meeting of May 2-3, 2023

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 242 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2023 (Second estimate). The consensus is that real GDP increased 1.1% annualized in Q1, unchanged from the advance estimate of 1.1%.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.5% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for May.

8:30 AM ET: Personal Income and Outlays, April 2023. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 4.3% YoY, and core PCE prices up 4.6% YoY.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 1.1% decrease in durable goods orders.

10:00 AM: University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 57.7.

Friday, May 19, 2023

May 19th COVID Update: New Pandemic Lows for Deaths and Hospitalizations

by Calculated Risk on 5/19/2023 09:01:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

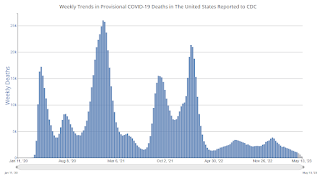

| Hospitalized2 | 8,159 | 8,859 | ≤3,0001 | |

| Deaths per Week2 | 865 | 1,079 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

LA Port Inbound Traffic Down Sharply YoY in April

by Calculated Risk on 5/19/2023 03:03:00 PM

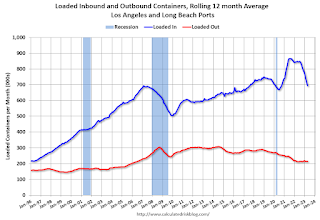

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

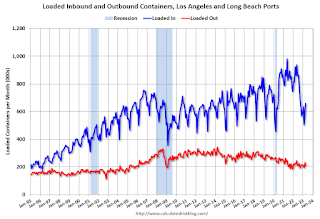

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 2.4% in April compared to the rolling 12 months ending in March. Outbound traffic decreased 0.4% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.Similar Number of Housing Units started in Q1 as 'Built-for-Rent' as 'Built-for-Sale'

by Calculated Risk on 5/19/2023 12:03:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Similar Number of Housing Units started in Q1 as 'Built-for-Rent' as 'Built-for-Sale'

A brief excerpt:

Along with the monthly housing starts report for January last week, the Census Bureau released Housing Units Started by Purpose and Design through Q1 2023.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and multi-family built for sale.Single family starts ‘built for sale (red) were down 33% in Q1 2023 compared to Q1 2022. And owner built starts (orange) were down 22% year-over-year. Multi-family ‘built for sale’ decreased and are still low.

The 'units built for rent' (blue) and were up 8% in Q1 2023 compared to Q1 2022. The number of ‘built-for-rent’ units in Q1 was almost the same number as ‘built-for-sale’. Last quarter, Q4 2022, was the first time since this series started in 1974, that there were more units built-for-rent started than single family units built-for-sale started.

Q2 GDP Tracking: Around 2%

by Calculated Risk on 5/19/2023 08:41:00 AM

From BofA:

Overall, this week’s data pushed up our 1Q US GDP tracking estimate up from 0.9% q/q saar to 1.1% q/q saar and kicked off our 2Q GDP tracking estimate at 1.2% q/q saar [May 19th estimate]From Goldman:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +2.0% (qoq ar) and our past-quarter GDP tracking estimate for Q1 unchanged at +1.4%. Our Q2 domestic final sales growth forecast stands at +1.9%. [May 17th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 2.9 percent on May 17, up from 2.6 percent on May 16. After this morning's housing starts report from the US Census Bureau, the nowcast of second-quarter real residential investment growth increased from -6.3 percent to 0.6 percent. [May 17th estimate]

Thursday, May 18, 2023

Friday: Discussion, Fed Chair Jerome Powell and Ben Bernanke

by Calculated Risk on 5/18/2023 08:35:00 PM

Friday:

• At 10:00 AM ET, State Employment and Unemployment (Monthly) for April 2023

• At 11:00 AM, Discussion, Conversation with Chair Jerome Powell and Ben Bernanke, former Chair of the Board of Governors of the Federal Reserve System

At the Thomas Laubach Research Conference, Washington, D.C.

Hotels: Occupancy Rate Down 2.0% Year-over-year

by Calculated Risk on 5/18/2023 04:01:00 PM

U.S. weekly hotel performance produced mixed year-over-year comparisons, according to STR‘s latest data through 13 May.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

U.S. weekly hotel performance produced mixed year-over-year comparisons, according to STR‘s latest data through 13 May.

• Occupancy: 65.1% (-2.0%)

• Average daily rate (ADR): US$154.90 (+3.4%)

• Revenue per available room (RevPAR): US$100.81 (+1.3%)

Worsened comparisons than the week prior were expected and normal given seasonal slowing and the negative side of the Mother’s Day calendar shift.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Weekly Active Inventory Up 23% YoY; New Listings Down 25% YoY

by Calculated Risk on 5/18/2023 02:09:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending May 13, 2023

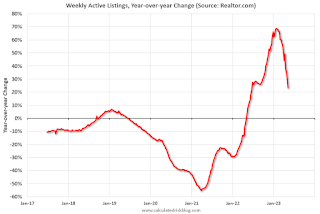

• Active inventory was up at a slower pace, with for-sale homes up just 23% above one year ago. The number of homes for sale continues to grow, but at a slower pace compared to one year ago.

...

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 25% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 45 weeks.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed sharply recently.

NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April; Median Prices Declined 1.7% YoY

by Calculated Risk on 5/18/2023 10:47:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April; Median Prices Declined 1.7% YoY

Excerpt:

The second graph shows existing home sales by month for 2022 and 2023.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!

Sales declined 23.2% year-over-year compared to April 2022. This was the twentieth consecutive month with sales down year-over-year.

NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April

by Calculated Risk on 5/18/2023 10:13:00 AM

From the NAR: Existing-Home Sales Faded 3.4% in April

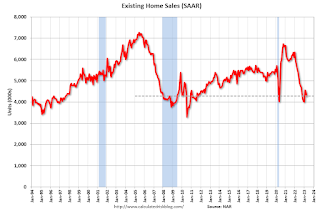

Existing-home sales decreased in April, according to the National Association of REALTORS®. All four major U.S. regions registered month-over-month and year-over-year sales declines.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – slid 3.4% from March to a seasonally adjusted annual rate of 4.28 million in April. Year-over-year, sales slumped 23.2% (down from 5.57 million in April 2022).

...

Total housing inventory registered at the end of April was 1.04 million units, up 7.2% from March and 1.0% from one year ago (1.03 million). Unsold inventory sits at a 2.9-month supply at the current sales pace, up from 2.6 months in March and 2.2 months in April 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in April (4.28 million SAAR) were down 3.4% from the previous month and were 23.2% below the April 2022 sales rate.

According to the NAR, inventory increased to 1.04 million in April from 0.97 million in March.

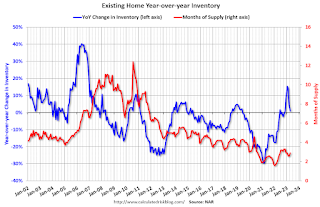

According to the NAR, inventory increased to 1.04 million in April from 0.97 million in March.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 1.0% year-over-year (blue) in April compared to April 2022.

Inventory was up 1.0% year-over-year (blue) in April compared to April 2022. Months of supply (red) increased to 2.9 months in April from 2.6 months in March.

This was slightly below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims decrease to 242,000

by Calculated Risk on 5/18/2023 08:33:00 AM

The DOL reported:

In the week ending May 13, the advance figure for seasonally adjusted initial claims was 242,000, a decrease of 22,000 from the previous week's unrevised level of 264,000. The 4-week moving average was 244,250, a decrease of 1,000 from the previous week's unrevised average of 245,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 244,250.

The previous week was unrevised.

Weekly claims were below the consensus forecast.

Wednesday, May 17, 2023

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 5/17/2023 08:52:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 253 thousand initial claims, down from 264 thousand last week.

• Aslo at 8:30 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of -21.1, up from -31.3.

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.30 million SAAR, down from 4.44 million.

4th Look at Local Housing Markets in April

by Calculated Risk on 5/17/2023 06:01:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in April

A brief excerpt:

Yesterday, housing economist Tom Lawler noted:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.33 million in April, down 2.5% from March’s preliminary pace and down 22.3% from last April’s seasonally adjusted pace.The National Association of Realtors (NAR) is scheduled to release April existing home sales on Thursday, May 18, 2023, at 10:00 AM ET. The consensus is for 4.30 million SAAR.

...

In April, sales in these markets were down 24.7%. In March, these same markets were down 19.4% YoY Not Seasonally Adjusted (NSA).

This is a larger YoY decline NSA in April than in March for these markets, however there was one less selling day in April this year. This data suggests the April existing home sales report will show another significant YoY decline, and the 20th consecutive month with a YoY decline in sales.

Several more local markets to come next week!

April Housing Starts: Near Record Multi-Family Under Construction

by Calculated Risk on 5/17/2023 09:35:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: April Housing Starts: Near Record Multi-Family Under Construction

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

Red is single family units. Currently there are 698 thousand single family units (red) under construction (SA). This was down in April compared to March, and 133 thousand below the recent peak in May 2022. Single family units under construction have peaked since single family starts declined sharply. The number of single-family homes under construction will decline further in coming months.

Blue is for 2+ units. Currently there are 977 thousand multi-family units under construction. This is the highest level since September 1973! This is close to the all-time record of 994 thousand in 1973 (being built for the baby-boom generation). For multi-family, construction delays are a significant factor. The completion of these units should help with rent pressure.

Combined, there are 1.675 million units under construction, just 35 thousand below the all-time record of 1.710 million set in October 2022.

Housing Starts at 1.401 million Annual Rate in April

by Calculated Risk on 5/17/2023 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in April were at a seasonally adjusted annual rate of 1,401,000. This is 2.2 percent above the revised March estimate of 1,371,000, but is 22.3 percent below the April 2022 rate of 1,803,000. Single‐family housing starts in April were at a rate of 846,000; this is 1.6 percent above the revised March figure of 833,000. The April rate for units in buildings with five units or more was 542,000.

Building Permits:

Privately‐owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,416,000. This is 1.5 percent below the revised March rate of 1,437,000 and is 21.1 percent below the April 2022 rate of 1,795,000. Single‐family authorizations in April were at a rate of 855,000; this is 3.1 percent above the revised March figure of 829,000. Authorizations of units in buildings with five units or more were at a rate of 502,000 in April.

emphasis added

Click on graph for larger image.

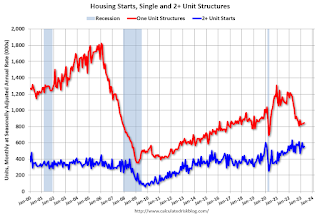

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in April compared to March. Multi-family starts were down 12.2% year-over-year in April.

Single-family starts (red) increased in April and were down 27.9% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse in single-family starts.

Total housing starts in April were slightly above expectations, however, starts in February and March were revised down, combined.

I'll have more later …

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 5/17/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 12, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 5.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 6 percent compared with the previous week. The Refinance Index decreased 8 percent from the previous week and was 43 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 4.8 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 26 percent lower than the same week one year ago.

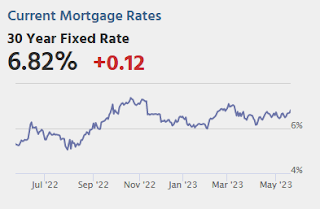

“Mortgage rates increased last week even as Treasury yields were essentially flat, with the spread between the two rates widening to 310 basis points. Mortgage application activity slowed, as most mortgage rates in the survey increased, with the 30-year fixed rate jumping nine basis points to its highest level in two months at 6.57 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications decreased 5 percent to its slowest pace in a month, as buyers remain wary of this rate volatility, but also as for-sale inventory in many parts of the country remains scarce.

Added Kan, “Refinance applications accounted for 27 percent of all applications and dropped almost 8 percent last week. Most borrowers have lower rates on their mortgages, and those who are in the market are extremely rate sensitive.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.57 percent from 6.48 percent, with points remaining at 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 26% year-over-year unadjusted.