by Calculated Risk on 10/06/2009 04:00:00 PM

Tuesday, October 06, 2009

Starwood to Buy Corus Assets

From Zachery Kouwe and Eric Dash at the NY Times DealBook: Sternlicht, Ross Strike Deal for Corus Assets

The Federal Deposit Insurance Corporation plans to announce on Tuesday that it will sell about $4.5 billion of troubled real estate loans that it recently seized from Corus Bancshares to a group of private investment firms led by the Starwood Capital Group ...The details are not available yet.

Under the terms of the complex deal, Starwood and its business partners agreed to pay $554 million for a 40 percent equity stake in the loan pool while the F.D.I.C. keeps a 60 percent stake ... By providing guaranteed financing to the buyers, the government hopes that they will be able finish developing the condo projects or turn them into apartments or hotels.

...

The sale reflects an estimated price of about 50 cents on the dollar for the batch of troubled loans ...

Inland Empire Retail Vacancy Rate Increases

by Calculated Risk on 10/06/2009 02:45:00 PM

Just to complete the CRE circle: rising vacancy rates for apartments, offices, and retail ...

From the Press Enterprise: Vacancy rates among Inland retailers mounts

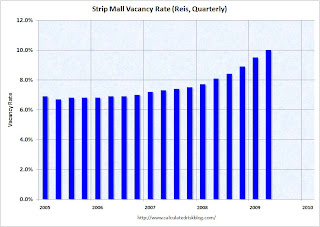

... Inland retail vacancy rates in the third quarter [were] 11.2 percent ...The REIS national Q3 retail vacancy rates will be released soon, but here is a preview based on the Q2 numbers:

That marked a rise from 10.6 percent in the prior quarter, and was well up from 7.6 percent in the third quarter of 2008, according to new data from commercial real estate broker CB Richard Ellis.

...

"I think we're going to be seeing these trends for the rest of this year and for much of 2010," said Matt Burnett, senior associate in the Ontario office of CB Richard Ellis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.In Q2, the U.S. strip mall vacancy rate hit 10%, the highest level since 1992.

"Until we see stabilization and recovery take root in both consumer spending and business spending and hiring, we do not foresee a recovery in the retail sector until late 2012 at the earliest."

Victor Calanog, director of research for Reis Inc, July 2009

Report: Manhattan Office Vacancy Rate Increases, Rents Decline

by Calculated Risk on 10/06/2009 11:43:00 AM

From Bloomberg: Manhattan Office Vacancies Reach Five Year High, Cushman Says

Manhattan’s third-quarter office vacancy rate hit a five-year high ... The rate rose to 11.1 percent, the highest since the third quarter of 2004, New York-based broker Cushman & Wakefield said in a statement today. Rents fell 5.2 percent from the second quarter to $57.08 a square foot and were down 22 percent from a year earlier.Yesterday, NY Fed President commented about falling commercial real estate prices:

emphasis added

First, the capitalization rate—the ratio of income to valuation—has climbed sharply. At the peak, capitalization rates for prime properties were in the range of 5 percent. That means that investors were willing to pay $20 for a $1 of income. Today, the capitalization rate appears to have risen to about 8 percent. That means that the same dollar of income is now capitalized as worth only $12.50. In other words, if income were stable, the value of the properties would have fallen by 37.5 percent. Second, the income generated by commercial real estate has generally been falling.According to Cushman, rents are off 22% over the last year (probably more since the peak), and combined with the higher cap rate, Dudley's estimate suggests office building prices have fallen by half or more in New York.

There was a little good news in the Cushman report:

Sublease space declined to 11.1 million square feet from 11.4 million at mid-year, the first drop since the end of 2007, Cushman said.However the vacancy rate is still expect to rise further, perhaps to 14% in New York according to Cushman.

“A decline in sublease space is indicative of the market beginning to move towards stabilization,” said Joseph Harbert, chief operating officer for Cushman’s New York metropolitan region.

The national office vacancy data from REIS will be released soon.

NRF Forecasts One Percent Decline in Holiday Retail Sales

by Calculated Risk on 10/06/2009 08:50:00 AM

From the National Retail Federation: NRF Forecasts One Percent Decline in Holiday Sales

The National Retail Federation today released its 2009 holiday forecast, projecting holiday retail industry sales to decline one percent this year to $437.6 billion.* While this number falls significantly below the ten-year average of 3.39 percent holiday season growth, the decline is not expected to be as dramatic as last year’s 3.4 percent drop in holiday retail sales ...Notice the focus on cost controls, and that suggests retail hiring for the holiday season will be weak.

“The expectation of another challenging holiday season does not come as news to retailers, who have been experiencing a pullback in consumer spending for over a year,” said NRF President and CEO Tracy Mullin. “To compensate, retailers’ focus on the holiday season has been razor-sharp with companies cutting back as much as possible on operating costs in order to pass along aggressive savings and promotions to customers.”

* NRF defines “holiday sales” as retail industry sales in the months of November and December. Retail industry sales include most traditional retail categories including discounters, department stores, grocery stores, and specialty stores, and exclude sales at automotive dealers, gas stations, and restaurants.

Here is a repeat of a graph from a post a couple weeks ago: Retail Hiring Outlook "Jobs Scarce"

Click on graph for larger image in new window.

Click on graph for larger image in new window.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. This graph shows the historical net retail jobs added for October, November and December by year.

Based on the NRF forecast, seasonal retail hiring might be around 400 thousand again in 2009.

More from Ylan Mui at the WaPo: Retailers Hope for Holiday Cheer

The retail federation's forecast "is a good number in that it shows stabilizing in sales," NRF spokesman Scott Krugman said. "However, it also acknowledges that the recovery is not going to be consumer-led."Typically recoveries are consumer led, and then the increase in end demand eventually leads to more business investment. Not this time. Just another reminder that the typical engines of recovery are still misfiring.

Apartment Vacancy Rate at 23 Year High

by Calculated Risk on 10/06/2009 12:20:00 AM

From Reuters: US apartment vacancy rate hits 23-year high-report

The U.S. apartment vacancy rate rose to 7.8 percent in the third quarter, its highest since 1986, ... according to Reis.Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at a record 10.6% in Q2 2009. This also fits with the NMHC apartment market survey.

...

"It makes me wonder whether the avalanche is on its way for office and retail (real estate) unless things change really quickly and really drastically," Victor Calanog, Reis director of research, said.

Reis still expects the U.S. apartment vacancy rate to pass the 8 percent mark by perhaps next quarter but certainly by next year, Calanog said. That would make it the highest vacancy rate since Reis began tracking the market in 1980.

In the third quarter, the U.S. apartment asking rental rate fell 0.5 percent to $1,035 per month, the fourth consecutive declining quarter. ...

Rising vacancies. Falling Rents. Here comes the Fed's nightmare.