by Calculated Risk on 10/07/2009 09:50:00 PM

Wednesday, October 07, 2009

Report: Pimco, Baupost Quit CIT Bondholder Committee

From Dow Jones: Pimco Has Quit CIT Bondholder Steering Committee

The future of CIT Group Inc. (CIT) grew murkier Wednesday after the disclosure that bond fund giant Pacific Investment Management Co. had quit a steering committee that's trying to prevent the commercial lender from collapse. ... Boston-based Baupost Group LLC [had quit earlier].Small firms have already been hit hard in this recession, accounting for about 45% of the job losses (see Melinda Pitts at Macroblog: Prospects for a small business-fueled employment recovery):

...

The company has an estimated $75 billion in assets, and provides critical short-term financing to about one million small companies.

...

Investors have until 11:59 p.m. Eastern time on Oct. 29 to tender their bonds under the restructuring plan.

In a speech [Monday], William Dudley, the president of the Federal Reserve Bank of New York, identified financial constraints for small businesses as a restraint on the pace of economic recovery.As the article mentioned, CIT provides financing for about one million small business. If CIT files bankruptcy, the company will continue to operate, but they may not write any new business. Their competitors will pick up the best of the business, but many small firms will struggle to find new financing.

...

Looking ahead, it's not clear whether small businesses will continue to play their traditional role in hiring staff and helping to fuel an employment recovery. However, if the above-mentioned financial constraints are a major contributor to the disproportionately large employment contractions for very small firms, then the post-recession employment boost these firms typically provide may be less robust than in previous recoveries.

The clock is ticking.

Jim the Realtor: "No shortage of buyers"

by Calculated Risk on 10/07/2009 05:50:00 PM

Jim says the "market is hot, real hot." This is worth watching to get a feel for what is happening at the lower end of the housing market (in San Diego at least).

The Housing Tax Credit: NAHB Projections and more

by Calculated Risk on 10/07/2009 04:02:00 PM

From the NAHB:

Extending the credit through Nov. 30, 2010 and making it available to all purchasers of a principal residence would result in an additional 383,000 home sales ...The NAHB has also been arguing to expand the tax credit from $8,000 to $15,000. But using $8,000 per home buyer - and estimating 5 million home sales over the next year - the total cost of the tax credit would be $40 billion.

According to the NAHB this would result in 383,000 additional home sales. Dividing $40 billion by 383 thousand gives $104,400 per additional home sold!

That is higher than my original estimate that an extension of the tax credit would cost about $100 thousand per additional home sold.

Note: If the NAHB meant $15,000 per home buyer, the cost would be $75 billion - or $157 thousand per additional home sold.

And this doesn't included the costs of the unintended consequences.

[Fed economist] Mr. Conway's presentation painted a bleak picture of the sliding real-estate values and enormous debt that will need to be refinanced in the next few years. Vacancy rates in the apartment, retail and warehouse sectors already have exceeded those seen during the real-estate collapse of the early 1990s, Mr. Conway noted. His report also predicted that commercial real-estate losses would reach roughly 45% next year. Valuing real estate has always been tricky for banks, and the problem is particularly acute now because sales activity is practically nonexistent.

...

More than half of the $3.4 trillion in outstanding commercial real-estate debt is held by banks.

Anyone analyzing the tax credit should call the economists at the BLS and ask about how falling rents will impact owners' equivalent rent and CPI. Then call the economists at the Federal Reserve and ask how CPI deflation will impact consumer behavior and monetary policy. Welcome to the Fed's nightmare.

Consumer Credit Declines Sharply in August

by Calculated Risk on 10/07/2009 03:00:00 PM

From MarketWatch: U.S. consumer credit falls for 7th straight month

U.S. consumers reduced their debt for the seventh straight month in August, the Federal Reserve reported Wednesday. Total seasonally adjusted consumer debt fell $11.98 billion, or at a 5.8% annual rate ... In the subcategories, credit-card debt fell $9.91 billion, or 13.1%, to $899.41 billion. This is the record 11th straight monthly drop in credit card debt. Non-revolving credit, such as auto loans, personal loans and student loans fell $2.10 billion or 1.6% to $1.56 trillion.Cash-for-clunkers probably kept non-revolving credit from falling further - just wait for the September numbers!

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year (YoY) change in consumer credit. Consumer credit is off 4.4% over the last 12 months. The previous record YoY decline was 1.9% in 1991.

Here is the Fed report: Consumer Credit

Consumer credit decreased at an annual rate of 5-3/4 percent in August 2009. Revolving credit decreased at an annual rate of 13 percent, and nonrevolving credit decreased at an annual rate of 1-1/2 percent.Note: The Fed reports a simple annual rate (multiplies change in month by 12) as opposed to a compounded annual rate. Consumer credit does not include real estate debt.

Hotel Defaults and Foreclosures Increase Sharply in California

by Calculated Risk on 10/07/2009 11:52:00 AM

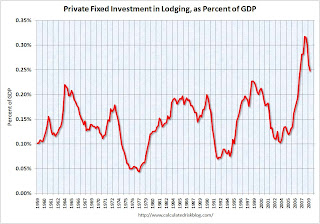

Hotel investment has always been boom and bust, but the most recent boom was off the charts ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows lodging investment as a percent of GDP since 1959 through Q2 2009.

Lodging investment peaked in mid-2008, but because of the length of time for hotel construction, there are many new hotels still coming online - at just the wrong time.

From the LA Times: Hotel defaults, foreclosures rise in California (ht Ann)

... Statewide, more than 300 hotels were in foreclosure or default on their loans as of Sept. 30 -- a nearly fivefold increase since the start of the year, according to an industry report released Tuesday.Not only is the recession impacting business and leisure travel, but there are just too many hotel rooms, and many more on the way.

...

Most struggling hotels remain open, but industry experts believe many properties are likely to be closed down in the months ahead, even if they are not in foreclosure, because they are losing so much money. ...

"I have never seen so many lenders contemplating mothballing properties," said Jim Butler, a hotel lawyer and chairman of the global hospitality group for Jeffer, Mangels, Butler & Marmaro. "It can and it will get worse for the hotel industry."

...

Statewide, 260 hotels were in default on their loans and 47 had been taken over by their lenders in foreclosure, the Atlas report said.

... a leading hotel consulting firm, Smith Travel Research, recently issued a report that predicted no significant improvement for the hotel industry until 2011 at the earliest.

"It's going to be a lot worse than it is now," said Bobby Bowers, senior vice president of Smith Travel Research.

... an increasing number of hotels have so little revenue that they can't even afford to pay their operating bills and payroll, not to mention servicing debt.

Owners of such hotels are increasingly handing the keys back to the lenders, and the problem is likely to get worse: As many as 1 in 5 U.S. hotel loans may default through 2010, UC Berkeley economist Kenneth Rosen said.

In some cases the lenders are simply locking up the properties...

emphasis added