by Calculated Risk on 10/09/2009 12:30:00 PM

Friday, October 09, 2009

BLS: Job Openings at Series Low at End of August

From the BLS: Job Openings and Labor Turnover Summary

On the last business day of August, the number of job openings in the U.S. was little changed at a series low level of 2.4 million, the U.S. Bureau of Labor Statistics reported today. The hires rate was little changed and remained low at 3.1 percent in August. The total separations rate was little changed and remained low at 3.3 percent.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. Remember the CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people. See Jobs and the Unemployment Rate for a comparison of the two surveys.

The following graph shows job openings (yellow line), hires (blue Line), Quits (green bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and green added together equals total separations.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (blue line) and separations (red and green together) are pretty close each month. When the blue line is above total separations, the economy is adding net jobs, when the blue line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 4.029 million hires in August, and 4.265 million separations, or 236 thousand net jobs lost.

I'm not sure if openings is predictive of future hires (the data set is limited), but openings at a series low can't be a positive. Separations have declined sharply, with fewer quits and layoffs, but hiring has not picked up.

As David Leonhardt noted in the NY Times last month: Wages Grow for Those With Jobs, New Figures Show

Try thinking of it this way: All of the unemployed people in the country are gathered in a huge gymnasium that’s been turned into a job search center. The fact that this recession is the worst in a generation means that there are many, many people in the gym. The fact that the economy is churning so slowly means that there is not much traffic into and out of the gym.

If you’re inside, you will have a hard time getting out.

More on Problems at the FHA and Quote of the Day

by Calculated Risk on 10/09/2009 10:11:00 AM

“I don’t think it’s a bad thing that the bad loans occurred. It was an effort to keep prices from falling too fast. That’s a policy.”The quote is from David Streitfeld and Louise Story's article in the NY Times: U.S. Mortgage Backer May Need Bailout, Experts Say

Barney Frank, chairman of the House Financial Services Committee on recent FHA lending.

The article covers the problems at the FHA, and includes this anecdote:

Like many Americans, Ms. [Bernadine Shimon] has recently been through some rough times. She lost a house to foreclosure, declared bankruptcy, got divorced and is now a single mother, teaching high school English in a Denver suburb.Maybe Ms. Shimon will make it (I hope so). But according to the article she has no savings, and is spending half her take home income on just the mortgage payment. update

She wanted a house but no lender would touch her. The Federal Housing Administration was more obliging. With the F.H.A. insuring her mortgage, Ms. Shimon was able to buy a $134,000 fixer-upper in August.

...

Any more than [3.5% down] and Ms. Shimon, 45, would still be a renter. As it was, she cashed in her retirement savings account to come up with the necessary funds. She did not have enough to spare for closing costs, so her mortgage broker arranged a deal where the charges were wrapped into the loan at the cost of a higher interest rate. She cried when the deal was done.

The house was empty and trashed. Slowly, she is trying to bring it back to life. She spent the first few weeks picking up garbage in the backyard.

Is Ms. Shimon a good bet? Even she has no easy answer. Her mortgage payment, $1,100, is half of what she takes home every month. It is not easy to make ends meet. Teachers can get laid off like everyone else.

emphasis added

Maybe she can qualify for a loan modification! The HAMP guidelines are for loans not to exceed 31 percent of gross income. Update: It is not clear from the story the percentage of her gross income (the half is take home income). The FHA guidelines are that the payment-to-income ratio not exceed 31%, however, with all of the "compensating factors", it is possible that the FHA is insuring loans that the Obama Administration (through HAMP) has called "unaffordable". (ht TL)

And the NAR thinks Ms. Shimon will spend $10 of thousands of dollars fixing up her home over the next year? That is their argument for extending the "first-time" homebuyer tax credit (for anyone who hasn't owned for three years).

As Frank said, this is "a policy". But is it a good policy?

Trade Deficit Decreases Slightly in August

by Calculated Risk on 10/09/2009 08:37:00 AM

The Census Bureau reports:

The ... total August exports of $128.2 billion and imports of $158.9 billion resulted in a goods and services deficit of $30.7 billion, down from $31.9 billion in July, revised. August exports were $0.2 billion more than July exports of $128.0 billion. August imports were $0.9 billion less than July imports of $159.8 billion.

Click on graph for larger image.

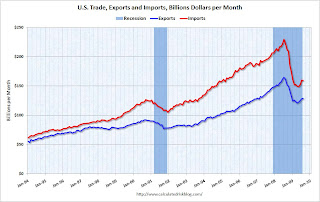

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through August 2009.

Imports were down in August, and exports increased slightly. On a year-over-year basis, exports are off 21% and imports are off 29%.

The second graph shows the U.S. trade deficit, with and without petroleum, through August.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $64.75 in August - up more than 50% from the prices in February (at $39.22) - and the sixth monthly increase in a row. Import oil prices will probably rise further in September.

It appears the cliff diving for U.S. trade is over. The weaker dollar is probably helping exports - and hurting imports.

Thursday, October 08, 2009

NY Times: Divergent Fed Views

by Calculated Risk on 10/08/2009 09:05:00 PM

From the Edmund Andrews at the NY Times: Rift Emerges in Fed Over When to Tighten Money

Fissures are developing among policy makers at the Federal Reserve as they debate how and when to start raising the benchmark interest rate from its current level just above zero.And on the other side:

...

One hint of the discord came Tuesday, in a speech by Thomas M. Hoenig, president of the Federal Reserve Bank of Kansas City.

Though he stopped short of calling for immediate rate increases, Mr. Hoenig made it clear that he was getting impatient.

“My experience tells me that we will need to remove our very accommodative policy sooner rather than later,” he told an audience of business executives. ...

And he is not alone.

Richard Fisher, president of the Federal Reserve Bank of Dallas, sent a similar message in a speech on Sept. 29. “That wind-down process needs to begin as soon as there are convincing signs that economic growth is gaining traction,” he told a business group.

Other Fed officials [have] similar views ...

“The turnaround is certainly welcome, but it shouldn’t be overstated,” Daniel K. Tarullo, a Fed governor ...As I noted last month, it is unlikely that the Fed will increase the Fed's Fund rate until sometime after the unemployment rate peaks.

“Some observers are concerned that this expansion will ultimately prove to be inflationary,” William C. Dudley, president of the New York Fed told an audience at the Fordham University’s Corporate Law Center. “This concern is not well founded.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, since the unemployment rate will probably continue to increase into 2010, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011.

And from Chairman Bernanke tonight:

When the economic outlook has improved sufficiently, we will be prepared to tighten the stance of monetary policy and eventually return our balance sheet to a more normal configuration.Some people are taking that as tough talk, see: Dollar Rises After Bernanke Says Fed Ready to ‘Tighten’ Policy, but I disagree - I think "improved sufficiently" means Bernanke will wait for a meaningful decline in the unemployment rate.

Fed's Tarullo: "Considerable uncertainty" about "how robust growth will be in 2010"

by Calculated Risk on 10/08/2009 05:40:00 PM

From Fed Governor Daniel Tarullo: In the Wake of the Crisis

Turning first to the economic outlook, let me begin by stating the obvious: After a period in which there seemed to be only two plausible scenarios--very bad and even worse--financial and economic conditions have steadied. ... As we closed out the third quarter last week, it was apparent that economic growth was back in positive territory. ...

This turnaround is certainly welcome, but it should not be overstated. Although we can expect positive growth to continue beyond the third quarter, economic activity remains relatively weak. The upturns in industrial production and residential investment, for example, follow startling declines in the first half of the year. Improvement is gradual and beginning from very low levels.

The employment situation continues to be dismal. While the pace of job losses has slowed from the extraordinary levels of early 2009, the economy has recently still been losing on average about a quarter of a million jobs each month. Hopes for a steady reduction in the pace of job losses were once again confounded last Friday with release of the September employment report, which showed net job declines well above the consensus expectation of economic forecasters. The unemployment rate has risen to 9.8 percent. ...

Indicators apart from the unemployment rate underscore the weakness of labor markets. The percentage of working-age people with jobs has fallen to a point not seen in a quarter century. Average hours worked have not increased through the spring and summer from what were, by historic standards, unusually low levels.The number of part-time workers who want full-time jobs jumped nearly 50 percent last fall and winter and has remained elevated since. The a>verage duration of unemployment has risen almost 10 weeks since the recession began, to more than six months.

The labor market conditions I have just described reflect the low level of resource utilization in the economy as a whole. In this context, with inflation expected to remain subdued for some time, the Federal Open Market Committee indicated after our meeting two weeks ago that exceptionally low interest rates are likely to be warranted for an extended period. Indeed, with the effects of the February stimulus package diminishing next year, bank lending that is still declining, and continued dysfunction in some parts of capital markets, there is considerable uncertainty as to how robust growth will be in 2010. At the same time, the unconventional policies pursued by the Federal Reserve in order to halt the crisis have produced levels and types of reserves that will eventually require use of the unconventional exit tools discussed on numerous occasions by Chairman Bernanke and Vice Chairman Kohn.

The coincidence of a weak economy and an unusually large balance sheet at the Federal Reserve will require some judgments by the Federal Open Market Committee of a sort for which there are not many historical precedents. Still, just as with conventional monetary policy, decisions on the timing and pace for removing accommodation should and will depend on our ongoing analysis and forecasts of all relevant economic factors.

emphasis added