by Calculated Risk on 10/13/2009 08:23:00 AM

Tuesday, October 13, 2009

Report: CIT Nears Bankruptcy, CEO to Resign

From Reuters: CIT debt swap struggles, bankruptcy looms. Reuters is reporting that "sources familiar with the matter" say bondholders are showing little interest in the debt exchange offer and a bankruptcy is now more likely.

Also this morning CIT announced that CEO Jeffrey Peek is resigning effective Dec 31st.

The possible bankruptcy of CIT is a major concern because CIT provides financing for about one million small businesses. And small businesses are already having trouble obtaining credit.

From Peter Goodman in the NY Times: Credit Tightens for Small Businesses

Many small and midsize American businesses are still struggling to secure bank loans, impeding their expansion plans and constraining overall economic growth ...Also see: Small Business and Employment

Most banks expect their lending standards to remain tighter than the levels of the last decade until at least the middle of 2010, according to a survey of senior loan officers conducted by the Federal Reserve Board. ... Bankers worry about the extent of losses on credit card businesses ...[and] are also reckoning with anticipated failures in commercial real estate. Until the scope of these losses is known, many lenders are inclined to hang on to their dollars rather than risk them on loans to businesses in a weak economy ...

A CIT bankruptcy will probably lead to even tighter credit for many small businesses exacerbating the current credit situation.

Monday, October 12, 2009

Fed's Bullard: Falling Unemployment Rate "Prerequisite" for Rate Increase

by Calculated Risk on 10/12/2009 10:07:00 PM

Usually this would be a "duh", but with some of the Fed talk recently, this is worth noting ...

From Bloomberg: Bullard Says Lower Unemployment Condition to Tighten

...“You want some jobs growth and unemployment coming down. That is a prerequisite” for an increase in interest rates, Bullard said. “It doesn’t mean you need unemployment all the way down to more normal levels.”As Paul Krugman noted this weekend, we are a long way from when the Fed will raise rates.

...

Bullard, referring to a prior jobless rate of 10.8 percent, said “I don’t think we will quite hit the peak we hit in 1982, but things have surprised us before.”

...

“I’m the north pole of inflation hawks,” Bullard said. “But we are trying to describe optimal policy, some optimal outcomes in an environment where inflation is below target -- we have an implicit target of 1.5 to 2 percent -- and you have the specter of a Japanese-style outcome, which I have worried about and some other members of the FOMC have worried about.”

...

“It is a little disappointing that private-sector economists are thinking so much about when we are going to move our fed funds rate up,” he said. “We are at zero. We are going to be there awhile. The focus should be more on” the Fed’s asset purchase program.

CBRE: Retail Cap Rates Increase Sharply in Q3

by Calculated Risk on 10/12/2009 06:42:00 PM

From CB Richard Ellis: U.S. Retail Cap Rates

Ending at 8.71%, cap rates were up again. The 59 basis point gain is the largest quarterly increase we have ever measured, even trumping last quarter's previous record.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from CBRE shows the retail cap rate since 2003. Note that 2009 is an average of Q1 through Q3, and the cap rate in Q3 was at 8.71% - above the 2003 annual level.

Sharply higher vacancy rates, lower rents, reduced leverage and much higher cap rates - this is what Brian calls the "neutron bomb for RE equity"; destroys CRE investors (and lenders), but leaves the buildings still standing.

Cap Rate: the net operating income divided by the current value (or purchase price). Net operating income excludes depreciation and interest expenses. Say an investor paid $100 thousand in cash for a retail property, the investor would expect to clear $8,710 in cash per year after expenses with an 8.71% cap rate (the $8,710 is before paying income taxes that depend on financing and depreciation).

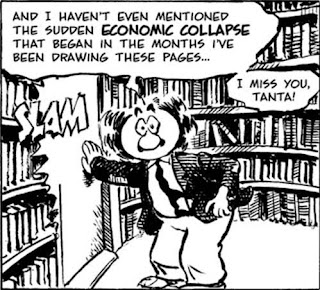

The History of the World wouldn't be complete without ...

by Calculated Risk on 10/12/2009 04:45:00 PM

From Larry Gonick's The Cartoon History of the Modern World, Part 2, on page 248 ... (ht TDM)

Click on cartoon for larger image in new window.

Posted with permission from Larry Gonick. Thanks!

For more on Tanta, see the menu bar above ...

Mortgage Modifications and BofA

by Calculated Risk on 10/12/2009 02:10:00 PM

Renae Merle at the WaPo writes about Bank of America's struggles to ramp-up their mortgage modification department: Racing the Clock to Avoid Foreclosures

The following section probably requires more explanation:

The company was also slow out of the box because it initially took a more conservative approach than some other banks, requiring that borrowers document their income and complete other paperwork before granting preliminary approval for a modification. In August, Bank of America softened the requirement and began authorizing some modifications without getting all the documents first.Read mort_fin notes:

"What the article doesn't make clear is that what was changed was the timing of the income documentation, not the level. It used to be the case that bofa required full documentation of income before they would even run the numbers to tell a borrower that they qualified. Now they will give an answer over the phone and start a trial mod, giving the borrower a month or 2 to provide the docs. No docs, no permanent mod. A borrower who can't document their claims gets a month or two of reduced payments before getting kicked out."This is why it will be important to watch the number of permanent modifications over the next few months. The Treasury announced last week that 500,000 modifications have been started, but the Obama plan had produced only 1,711 permanent loan modifications as of Sept. 1. That number should increase sharply soon.