by Calculated Risk on 10/19/2009 05:21:00 PM

Monday, October 19, 2009

An FHA Loan Example, Einhorn Speech, and More

Denise works three jobs so she can afford her new house. She makes $2470 a month but pays $1328 to service her mortgage. That means 54% of her income goes to the house, leaving her with $285 a week to live on. Doable, but tight. She’s breaking the 30% rule and then some, not to mention she’s still spending out of pocket to renovate the yard, fix the roof and paint.Apparently 20 year old Denise bought the home for $155,000, and according to the comments, obtained an additional $28,000 on a "203K HUD supplemental loan to renovate the home" for a total of $183,000.

Not exactly up to the new proposed FSA standards of affordability!

The government has doled out billions to 687 banks [1] over the past year through a program meant to bolster already “healthy” banks. But an increasing number of those are troubled. Four banks in particular are foundering, including one that has acknowledged its executives cooked its books.Paul has the details.

Moody’s: CRE Prices Off 41 Percent from Peak, Off 3% in August

by Calculated Risk on 10/19/2009 02:59:00 PM

From Bloomberg: U.S. Commercial Property Values Fall 3% in August (ht James)

The Moody’s/REAL Commercial Property Price Indices fell 3 percent in August from July, bringing the market’s decline to almost 41 percent since its peak in October 2007, Moody’s Investors Service said in a statement today. ...Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

“We can’t call a bottom at this point, but it’s an encouraging sign to see the deceleration in the decline,” said Connie Petruzziello, a Moody’s analyst and co-author of the commercial property price report.

...

August was the 11th consecutive month the commercial property index fell.

The August report was based on prices for 73 properties that sold during the month and for which Moody’s has previous price records.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted - that is the name of the company (an unfortunate choice for a price index). Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - only 73 repeat sales in August - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

Campbell Surveys: ‘Mini-Boom’ in Existing Home Market

by Calculated Risk on 10/19/2009 02:21:00 PM

Excerpts posted with permission from Campbell Surveys

In September the housing market took a major turn to the upside, according to respondents to the Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions. Real estate agent survey respondents reported average residential property prices rose 6% from August to September ...As we've discussed before, there is a buying frenzy right now in the existing home market, especially at the low end. Unfortunately existing home sales add little to the economy (compared to new home sales). And the impact is even less than usual right now because many of the marginal buyers are using the first-time homebuyer tax credit as their downpayment, and have little additional money to spend on furniture or upgrades.

The reported month-to-month price increase of 6% was driven by high demand for REO –also commonly referred to as foreclosed properties--according to transaction data reported by survey respondents. ...

The average price for non-distressed properties remained nearly constant between August and September. ...

Strong demand for moderately priced REO caused time-on-market for these properties to decline markedly. In August, damaged REO stayed on the market an average of 9.4 weeks; by September, time-on-market had declined to 7.0 weeks. For move-in ready REO, time-on-market declined from 8.0 weeks in August to 5.9 weeks in September. In contrast, average time-on-market for non-distressed properties rose from 13.0 weeks in August to 14.2 weeks in September.

First–time homebuyer demand for properties continued to be strong in the month of September. First-time homebuyers accounted for 42% of home purchase transactions in September. ...

Many agents indicated an REO buying frenzy in local markets, especially California. “Entry level REO's are taken by the storm! Many multiple offers!” exclaimed a California agent. “Low inventory and high demand are resulting in 20-60 offers on most properties in the entry level to moderate price points. First-time homebuyers have difficulty competing with investors and high down-payment buyers,” reported another real estate agent located in California. “Banks and listing agents are pricing these REO's at liquidation prices to encourage a bidding war and it's working,” wrote a real estate agent located in Florida.

Despite reporting strong increases in both average prices and number of transactions, real estate agents responding to the survey gave a hint of looming problems caused by rising unemployment. For the third month in a row, the survey’s inventory index showed rising inventories of short sale properties, while inventories of REO properties were flat or declining.

emphasis added

For the economy, the numbers to track are housing starts, new home sales, and residential investment - not existing home sales.

NAHB: Builder Confidence Decreases Slightly in October

by Calculated Risk on 10/19/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

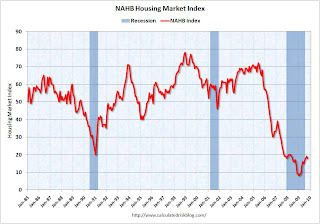

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 18 in October from 19 in September. The record low was 8 set in January. Note that Traffic of Prospective Buyers declined sharply.

This is still very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts (September starts will be released tomorrow).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts (September starts will be released tomorrow).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month. Those expecting a sharp rebound in starts are probably wrong.

Press release from the NAHB (added): Builder Confidence Slips in October

“This is the first time since November of 2008 that all three component indexes of the HMI have declined,” noted NAHB Chief Economist David Crowe. “Clearly, builders are experiencing the effects of the expiring tax credit on their sales activity, since it would be virtually impossible at this point to complete a new home sale in time to take advantage of that buyer incentive before Nov. 30.”

...

Each of the HMI’s component indexes recorded declines in October. The component gauging current sales conditions fell one point to 17, while the component gauging sales expectations for the next six months declined two points to 27 and the component gauging traffic of prospective buyers fell three points to 14.

On a regional basis, the Northeast was the only part of the country to record an improvement in its HMI score, with a one-point gain to 25. Meanwhile, the Midwest and South each recorded one-point declines to 18 and the West recorded a four-point decline to 14.

Bloomberg: FDIC Failed to Limit CRE Loans

by Calculated Risk on 10/19/2009 09:55:00 AM

Bloomberg reviewed 23 recent Inspector General reports of bank failures and concluded that the FDIC "failed to enforce its own guidelines to rein in excessive commercial real estate lending" (CRE).

From Bloomberg: FDIC Failed to Limit Commercial Real-Estate Loans, Reports Show (hts Mike in Long Island, Ron at WallStreetPit)

... The FDIC’s Office of Inspector General analyzed 23 lenders taken over by regulators from August 2008 to March and found that for 20, the agency’s examiners didn’t identify the issue early enough or should have taken stronger supervisory action after recognizing the banks had dangerously high levels of the loans before they failed. ...This is recurring theme. The examiners in the field, for both the FDIC and the Fed, recognized problems fairly early, but the agencies failed to take aggressive action.

“It’s often we’ll see in our reports that the FDIC detected problems in the bank in a timely fashion, but in some cases forceful corrective action wasn’t required by the FDIC to be taken quickly enough,” Jon Rymer, the FDIC’s inspector general, said in a telephone interview.

Here are two related posts: Inspector General: FDIC saw risks at IndyMac in 2002 and Federal Reserve Oversight and the Failure of Riverside Bank of the Gulf Coast

The from a state regulator:

“We should have been more strict,” Joseph Smith, North Carolina’s bank commissioner and chairman of the Conference of State Bank Supervisors, said in a telephone interview. ...I believe the regulators should have clamped down on CRE lending in 2006 - and the FDIC was aware of the problem. Here is a proposed interagency guidance on CRE lending from January 13, 2006.

“Had we required the reduction of CRE lending, it would have been thought of as an intrusion by regulators into the businesses of banks and to the operations of local economies,” Smith said. “Yes, it would have been the right thing to do. It would have caused a firestorm then. That might have been better than a firestorm now.”

Concentrations of CRE loans may expose institutions to unanticipated earnings and capital volatility in the event of adverse changes in the general commercial real estate market. ... The proposed guidance reinforces existing guidelines for real estate lending and provides criteria for identifying institutions with CRE loan concentrations that may warrant greater supervisory scrutiny.The final comments from Joseph Smith provide a clue as to the real problem. The examiners in the field were finding the problems, but the regulators were failing to act because "it would cause a firestorm" and it would be "thought of as an intrusion by regulators".