by Calculated Risk on 10/24/2009 02:41:00 PM

Saturday, October 24, 2009

Report: Capmark May File Bankruptcy this Weekend

This has been coming for some time ...

From the NY Times Dealbook: Capmark, Big Commercial Lender, May File for Bankruptcy

The Capmark Financial Group, the big commercial real estate finance company cobbled together from pieces of GMAC, may file for bankruptcy as soon as this weekend ... The company is only the latest to fall victim to continued trouble in the commercial real estate market ... Capmark has about $10 billion in assets, with another $10 billion in a Utah bank the company owns that would not be subject to a bankruptcy filing.Capmark bank in Utah is in trouble too, and is the fifth largest bank (in assets) on the unofficial problem bank list.

From a Capmark press release in September:

The FDIC has notified Capmark Bank that it intends to issue an administrative order, which will impose certain requirements and restrictions on Capmark Bank, including requiring submission of capital and liquidity plans, restrictions on affiliated party transactions and other activities.

Goldman: Government Policies Boosted House Prices 5%

by Calculated Risk on 10/24/2009 11:45:00 AM

From James Hagerty at the WSJ: Uncle Sam Adds 5% to Prices of Homes, Goldman Says

Uncle Sam’s interventions in the housing market have pushed home prices 5% higher on a national average than they would have been otherwise, Goldman Sachs estimates in a report released late Friday.In the research note, Phillips discussed how policies have reduced foreclosures, and stimulated demand with both the first-time home buyer tax credit and "abnormally low mortgage rates". Phillips wrote (no link):

...

But these artificial props won’t last forever and may have created a false bottom in the market. “The risk of renewed home-price declines remains significant,” Goldman economist Alec Phillips writes in the report, “and our working assumption is a further 5% to 10% decline by mid-2010.”

"In 2010, we expect some of these supports to fade. Fed and Treasury purchases of mortgage-backed securities will taper off, and the pause in foreclosures created by federal mortgage modification programs may end.Based on Goldman's estimates, the first-time home buyer tax credit probably cost around $80,000 per additional home sold. Ouch.

The federal tax credit for first-time homebuyers appears likely to be extended for at least a few months, but probably no longer than through the first half of 2010."

The report isn't all negative. Goldman believes "the brunt of the price decline is behind us" and the outlook is uncertain: "the cloudy policy outlook adds to our already considerable uncertainty of where house prices will ultimately bottom".

This is very close to my view, see: The Uncertain Housing Outlook

FDIC Bank Failure Update

by Calculated Risk on 10/24/2009 08:29:00 AM

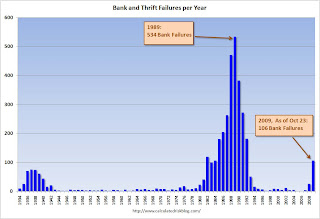

The FDIC closed seven more banks on Friday, and that brings the total FDIC bank failures to 106 in 2009. The following graph shows bank failures by week in 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: Week 1 on graph ends Jan 9th.

After a busy summer, the FDIC slowed down in late September and early October with only five bank failures in four weeks. Perhaps the pace is about to pick up again. With 10 weeks to go, it seems 130 or so bank failures is likely this year.  The 2nd graph covers the entire FDIC period (annually since 1934).

The 2nd graph covers the entire FDIC period (annually since 1934).

This is the most failures per year since 1992 (181 failures).

As far as failures per week - there were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits. Also the cumulative estimated losses for the DIF, since early 2007, is now about $45 billion.

And a message from Sheila Bair:

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.

Friday, October 23, 2009

Problem Bank List (Unofficial) Oct 23, 2009

by Calculated Risk on 10/23/2009 09:30:00 PM

Note: A late addition: R-G Premier Bank of Puerto Rico (SEC 8-K) to be added next week ($6.5 Billion in assets, Cert# 32185). The failures today will be removed next week.

This is an unofficial list of Problem Banks.

Changes and comments from surferdude808:

There is a net four institutions added to this week’s Unofficial Problem Bank List.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Overall, the institution count is 482 with aggregate assets of $321.9 billion, up from $316.6 billion last week. Additions include EuroBank, Hato Rey, PR ($2.7 billion); Cascade Bank, Everett, WA ($1.6 billion) (update: listed under "corrective action program"); Liberty Savings Bank, FSB, Wilmington, OH ($1.5 billion); Edgewater Bank, Saint Joseph, MI ($191 million); and Western Commercial Bank, Woodlands, CA ($122 million).

The sole deletion was San Joaquin Bank, Bakersfield, CA, which failed last Friday.

The only other change to the list is an FDIC issued Prompt Corrective Action order against Imperial Capital Bank, La Jolla, CA, which has been operating under a Cease & Desist Order since February 2009.

For next week’s list, we anticipate the FDIC will finally release its enforcement actions issued during September; thus, look for the list to grow by at least ten institutions.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure 106: First Dupage Bank, Westmont, Illinois

by Calculated Risk on 10/23/2009 08:14:00 PM

Not quite for 1st DuPage Bank

Cruel roll of the dice.

by Soylent Green is People

From the FDIC:

First Dupage Bank, Westmont, Illinois, was closed today by the Illinois Department of Financial & Professional Regulation – Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...When the levee breaks ... seven down today ...

As of July 31, 2009, First Dupage Bank had total assets of $279 million and total deposits of approximately $254 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $59 million. .... First Dupage Bank is the 106th FDIC-insured institution to fail in the Nation this year, and the seventeenth in Illinois. The last FDIC-insured institution closed in the state was Corus Bank, Chicago, on September 11, 2009.