by Calculated Risk on 7/08/2010 10:56:00 PM

Thursday, July 08, 2010

New Paper: "Shadow Banking"

For a little light reading: Zoltan Pozsar, Tobias Adrian, Adam Ashcraft and Hayley Boesky (now at BofA) of the NY Fed have written a new Staff Report: Shadow Banking

From the authors:

Our monograph “Shadow Banking” documents the origins, evolution and economic role of the shadow banking system. Its aim is to aid regulators and policymakers globally to reform, regulate and supervise the process of securitized credit intermediation in a market-based financial system.It is hard to summarize this paper, but here are a couple of excerpts:

At the eve of the financial crisis, the volume of credit intermediated by the shadow banking system was close to $20 trillion, or nearly twice as large as the volume of credit intermediated by the traditional banking system at roughly $11 trillion.

...

Some segments of the shadow banking system have emerged through various channels of arbitrage with limited economic value ...

Consumer Credit declines sharply in May

by Calculated Risk on 7/08/2010 06:51:00 PM

The Federal Reserve reports:

Consumer credit decreased at an annual rate of 4-1/2 percent in May 2010. Revolving credit decreased at an annual rate of 10-1/2 percent, and nonrevolving credit decreased at an annual rate of 1-1/2 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year (YoY) change in consumer credit. Consumer credit is off 3.9% over the last 12 months.

Revolving credit (credit card debt) is off 14.9% from the peak. Non-revolving debt (auto, furniture, and other loans) is off 1.5% from the peak. Note: Consumer credit does not include real estate debt.

Still working down the debt ... also the previously reported slight increase in April was revised to a $14.9 billion decrease in credit.

What might the Fed do?

by Calculated Risk on 7/08/2010 04:02:00 PM

Neil Irwin at the WaPo discusses some possible future actions at the Fed: Federal Reserve weighs steps to offset slowdown in economic recovery

Federal Reserve officials, increasingly concerned over signs the economic recovery is faltering, are considering new steps to bolster growth.Irwin mentions a few possibilities, such as the Fed expanding the "extended period" language in the FOMC statement to describe an even longer period, or buying more agency MBS (mortgage backed securities).

Professor Krugman weighs in with some analysis: How Much Can The Fed Help?

I think it might be useful to revisit Bernanke's 2002 speech for hints of the roadmap: Deflation: Making Sure "It" Doesn't Happen Here This entire speech is worth rereading. Bernanke suggests several policies (many have been used), but this might be a clue to the next possible action:

One relatively straightforward extension of current procedures would be to try to stimulate spending by lowering rates further out along the Treasury term structure--that is, rates on government bonds of longer maturities. There are at least two ways of bringing down longer-term rates, which are complementary and could be employed separately or in combination. One approach, similar to an action taken in the past couple of years by the Bank of Japan, would be for the Fed to commit to holding the overnight rate at zero for some specified period. Because long-term interest rates represent averages of current and expected future short-term rates, plus a term premium, a commitment to keep short-term rates at zero for some time--if it were credible--would induce a decline in longer-term rates. A more direct method, which I personally prefer, would be for the Fed to begin announcing explicit ceilings for yields on longer-maturity Treasury debt (say, bonds maturing within the next two years). The Fed could enforce these interest-rate ceilings by committing to make unlimited purchases of securities up to two years from maturity at prices consistent with the targeted yields.In the 2002 speech, Bernanke mentioned the possibility of a "specified period" for holding short rates low, as opposed to the "extended period" language (Irwin suggested this in the WaPo article).

... if operating in relatively short-dated Treasury debt proved insufficient, the Fed could also attempt to cap yields of Treasury securities at still longer maturities, say three to six years.

However Bernanke clearly prefers targeting longer term maturities. So if the Fed decides to take action, the FOMC might announce "explicit ceilings for yields on longer-maturity Treasury debt" - just like they do with the Fed funds rate at each FOMC meeting. Although the Fed purchased longer term Treasury securities during the crisis, the FOMC didn't announce an explicit interest-rate ceiling.

Below is a table of recent yields. There isn't much the Fed can do at 6 months or 1 year, but the Fed could announce lower targets for the 3 year and the 5 year and flatten the yield curve.

| Treasury constant maturities | |

|---|---|

| 1-month | 0.07% |

| 3-month | 0.17% |

| 6-month | 0.22% |

| 1-year | 0.30% |

| 2-year | 0.62% |

| 3-year | 1.03% |

| 5-year | 1.83% |

| 7-year | 2.49% |

| 10-year | 3.05% |

| 20-year | 3.82% |

| 30-year | 4.01% |

30 Year Mortgage Rates fall to Record Low

by Calculated Risk on 7/08/2010 02:16:00 PM

From Freddie Mac: 30-Year Fixed Rate Mortgage Drops Slightly to Create Another New Low

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.57 percent with an average 0.7 point for the week ending July 8, 2010, down from last week when it averaged 4.58 percent. Last year at this time, the 30-year FRM averaged 5.20 percent. This rate is yet another all-time low in Freddie Mac’s 39-year survey.

...

“With mortgage rates falling to historic lows, refinance activity has been strong over the past three months,” said Frank Nothaft, Freddie Mac vice president and chief economist. “The Bureau of Economic Analysis. reported that the effective mortgage rate of all loans outstanding was just below six percent in the first quarter of 2010, the lowest since the series began in 1977. Since the start of the second quarter, two out of three mortgage applications on average were for refinancing, according the Mortgage Bankers Association."

Click on graph for larger image in new window.

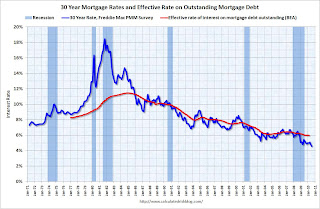

Click on graph for larger image in new window.This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The red line is a quarterly estimate from the BEA of the effective rate of interest on all outstanding mortgages (Owner- and Tenant-occupied residential housing).

The effective rate on outstanding mortgages is at a series low of just under 6%, but the rate is moving down slowly since so many borrowers can't refinance because they do not qualify (either because the property value is too low or their incomes are insufficient).

How Large is the Outstanding Value of Sovereign Bonds?

by Calculated Risk on 7/08/2010 11:02:00 AM

CR Note: Reader "some investor guy" has put together some data on sovereign default risk. This is the first in a series of posts.

Debt issued by governments worldwide is immense. According to the Bank for International Settlements, at year end 2009 worldwide sovereign debt exceeded $34 trillion, and is greater than the amount of corporate bonds outstanding.

Japan and the US dwarf most other borrowers. Together they have about half of all sovereign debt worldwide. Still, 23 other countries have over $100 billion of debt outstanding. The other 100+ countries worldwide have a total debt of about $1.4 trillion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: This graph shows the sovereign debt in December 2007 and December 2009.

Due to the recession and increased expenditures to rescue banking systems, total sovereign debts grew by almost 30% in just two years. Sovereigns became the majority of worldwide debt. Several countries doubled their debts from 2007 to 2009 (BIS data).

Source: Bank for International Settlements (BIS)

*For the US, figures include public holdings of Treasuries, but not Fannie Mae or Freddie Mac (about $8.1 trillion year end 2009, per BIS), or the “intragovernmental holdings” of Social Security, Medicare, the Civil Service Retirement Fund, etc. (about $4.5 trillion year end 2009, per US Bureau of Public Debt).

When shown as a percent of GDP, the picture looks a bit different. Japan and Italy have both a large amount of debt in absolute terms, and as a % of GDP.

When shown as a percent of GDP, the picture looks a bit different. Japan and Italy have both a large amount of debt in absolute terms, and as a % of GDP.

The United States has a more moderate debt as a % of GDP.

The third graph shows the size of sovereign debt compared to equities and other bonds.

Because of its immense size, sovereign debt is one of the largest risks to the global financial system. There are many linkages to sovereign debt, including interest rates, exchange rates, bank debt, and credit default swaps. Many of the potential problems and risks are surprising, even to those well-versed in their particular area of finance.

Because of its immense size, sovereign debt is one of the largest risks to the global financial system. There are many linkages to sovereign debt, including interest rates, exchange rates, bank debt, and credit default swaps. Many of the potential problems and risks are surprising, even to those well-versed in their particular area of finance.

CR Note: This is from "Some investor guy". Over the next couple of weeks, some investor guy will address several questions: How often have sovereign countries defaulted in the past? What are market estimates of the probabilities of default? What are total estimated losses on sovereign bonds due to default? What happens if things go really badly and what are the indirect effects of default?

Part 2 will be posted on Saturday: How often have sovereign countries defaulted in the past?

Series:

• Part 1: How Large is the Outstanding Value of Sovereign Bonds?

• Part 2. How Often Have Sovereign Countries Defaulted in the Past?

• Part 2B: More on Historic Sovereign Default Research

• Part 3. What are the Market Estimates of the Probabilities of Default?

• Part 4. What are Total Estimated Losses on Sovereign Bonds Due to Default?

• Part 5A. What Happens If Things Go Really Badly? $15 Trillion of Sovereign Debt in Default

• Part 5B. Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

• Part 5C. Some Policy Options, Good and Bad

• Part 5D. European Banks, What if Things Go Really Badly?