by Calculated Risk on 7/11/2010 05:35:00 PM

Sunday, July 11, 2010

Trillions of Bank Debt coming due

Here is the Weekly Summary and a Look Ahead (it will be a busy week).

And some more on bank debt coming due (yesterday the WSJ has a brief article on this) ...

From Jack Ewing at the NY Times: Crisis Awaits World’s Banks as Trillions Come Due

Banks worldwide owe nearly $5 trillion to bondholders and other creditors that will come due through 2012, according to estimates by the Bank for International Settlements. About $2.6 trillion of the liabilities are in Europe.And an answer to some questions on sovereign default:

Last week:

Weekly Summary and a Look Ahead

by Calculated Risk on 7/11/2010 12:49:00 PM

First, more on sovereign debt issues this morning: Part 2B: More on Historic Sovereign Default Research

This will be a busy week. The key economic report this week will be June retail sales to be released on Wednesday.

On Monday, the June Ceridian-UCLA Pulse of Commerce Index (based on diesel fuel consumption) will be released. Also on Monday at 10 AM ET, Fed Chairman Ben Bernanke will open the Fed’s small business forum: Addressing the Financing Needs of Small Businesses.

On Tuesday, the National Association of Independent Business (NFIB) will release the small business optimism survey for June at 7:30 AM. The May Trade Balance report will be released at 8:30 AM by the Census Bureau. The consensus is for a slight decrease in the U.S. trade deficit to $39 billion (from $40.3 billion). Also on Tuesday the Job Openings and Labor Turnover Survey (JOLTS) for May will be released at 10 AM by the BLS. This report has been showing very little turnover in the labor market.

On Wednesday, the June Advance Monthly Retail Trade Report will be released by the Census Bureau at 8:30 AM. The consensus is for a 0.2% decline in retail sales (flat ex-autos). Also on Wednesday, the MBA will release the mortgage purchase applications index. This has been very weak after the expiration of the tax credit, although refinance activity has picked up significantly as mortgage rates have fallen.

Also on Wednesday, the May Manufacturing and Trade Inventories and Sales report from the Census Bureau will be released at 10 AM. This has been suggesting that the inventory adjustment is mostly over. At 2 PM the Fed will release the minutes of the June 23rd FOMC meeting.

On Thursday, the initial weekly unemployment claims will be released. Consensus is for a decline to 445K from 454K last week. The Producer Price index will be released at 8:30 AM. Consensus is for a slight increase in the PPI. The July Empire State manufacturing survey will also be released at 8:30 AM. The consensus is for a slight decrease from the June reading.

Also on Thursday the Federal Reserve will release the June Industrial Production and Capacity Utilization report at 9:15 AM. Expectations are for production to decrease slightly and capacity utilization to fall to 74.0% from 74.7% in May. If so, this will be the first decline since June 2009. The Philly Fed Business Outlook Survey for July will be released at 10 AM, and the consensus is for a slight increase.

On Friday, the June Consumer Price Index will be released at 8:30 AM. Expectations are for a slight decrease of 0.1% in the CPI. At 9:55 AM the July Reuters / University of Michigan's Consumer sentiment index will be released. The consensus is for a slight decrease in the index.

Also this week, the June rail traffic report from the Association of American Railroads (AAR) and June LA port traffic will probably be released and the FDIC will probably be busy ...

Three posts on Sovereign debt:

And a summary of last week:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The June ISM Non-manufacturing index was at 53.8%, down from 55.4% in May - and below expectations of 55. The employment index showed contraction in June at 49.7%.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

The employment index is showing contraction again after one month of expansion.

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.The four-week average of weekly unemployment claims decreased this week by 1,250 to 466,000.

The dashed line on the graph is the current 4-week average.

Initial weekly claims have been at about the same level since December 2009.

The MBA reports: The seasonally adjusted Purchase Index decreased 2.0 percent from one week earlier.

The MBA reports: The seasonally adjusted Purchase Index decreased 2.0 percent from one week earlier. "The Purchase Index has decreased eight of the last nine weeks."

This graph shows the MBA Purchase Index and four week moving average since 1990.

There has been a mini-refi boom because of the low mortgage rates, but the purchase index has fallen sharply to the levels of 1996.

Best wishes to all.

Part 2B: More on Historic Sovereign Default Research

by Calculated Risk on 7/11/2010 08:30:00 AM

CR Note: This series is from reader "some investor guy". Part 2B is in response to some questions in the comments.

A number of posters mentioned research which was originally part of later sections in the series. I’ve moved some of this research to this ubernerd post.

Some researchers, especially Reinhart and Rogoff, assert that “this time is not different”, and that rather similar things occur before and after defaults throughout the world and over a period of many centuries. Politicians might or might not know the history. However, one wonders to what extent bond traders and CDS market participants agree with the academics.

Within the bond market, CDS market, and the governments themselves, there is also a chance that someone knows important information regarding the chance of default that others do not. For example, an official misstating government revenues, reserves, or borrowing.

There is a very active effort in many countries to convince voters or investors that “everything will be fine” or “all debts will be paid on schedule”. Often, these claims are correct. If interest rates on government bonds and liquidity are set based on perception of risk, the spin might save a sovereign billions of dollars in reduced funding costs. If the spin loses all credibility, a particular government official might be regarded as “The Baghdad Bob of Bonds” (Term derived from the nickname for Saddam Hussseins’s Information Minister, “Baghdad Bob”).

The Research

Paolo Manasse and Nouriel Roubini studied sovereign default risk and concluded that many guidelines used for estimating when default was likely did not perform well when used in isolation, primarily because those guidelines looked at separate risks. For example, total government debt exceeding 200% of GDP is often used to indicate stress. However, some circumstances may make the problems much less severe, others might make it much worse (“Rules of Thumb” for Sovereign Debt Crises, Paolo Manasse and Nouriel Roubini):

“The analysis has one important, albeit simple, implication for sustainability analysis. It shows that unconditional thresholds, for example for debt-output ratios, are of little value per se for assessing the probability of default. One country may be heavily indebted but have a negligible probability of default, while a second may have moderate values of debt ratios while running a considerable default risk. Why? Because the joint effects of short maturity, political uncertainty, and relatively fixed exchange rates make a liquidity crisis in the latter much more likely than a solvency crisis in the former, particularly if the large external debt burden goes together with monetary stability, a large current account surplus, and sound public finances.”

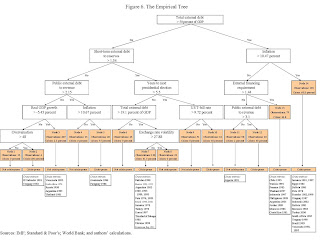

Click on graph for larger image in new window.

Click on graph for larger image in new window.Chart source Predicting Sovereign Debt Crises, page 30. For specific countries, default probabilities from this model could be updated as often as the relevant economic data are updated.

In the earlier paper for the IMF, they found (Predicting Sovereign Debt Crises, Paolo Manasse, Nouriel Roubini, and Axel Schimmelpfennig):

“The empirical evidence suggests that a number of macroeconomic factors predict a debt crisis and the entry into a debt crisis. Measures of debt “solvency” matter: high levels of foreign debt (relative to a measure of the ability to pay, such as GDP) increase the probability of a default and entry into default. Measures of illiquidity, particularly short-term debt (relative to foreign reserves), and measures of debt servicing obligations also matter in predicting debt crises, consistent with the view that some recent crises had to do with illiquidity and/or the interaction of illiquidity and insolvency.Another line of research comes from Carmen Reinhart and Kenneth Rogoff. They have several relevant works, including This Time is Different: Eight Centuries of Financial Crises.

Other macroeconomic variables suggested from the analytical literature on debt sustainability also significantly matter for predicting debt crises: low GDP growth; current account imbalances; low trade openness; tight liquidity and monetary conditions in the Group of seven countries; monetary mismanagement (in the form of high inflation); policy uncertainty (in the form of high volatility of inflation); and political uncertainty leading to economic uncertainty (years of presidential elections).”

“We find that serial default is a nearly universal phenomenon as countries struggle to transform themselves from emerging markets to advanced economies. Major default episodes are typically spaced some years (or decades) apart, creating an illusion that “this time is different” among policymakers and investors. A recent example of the “this time is different” syndrome is the false belief that domestic debt is a novel feature of the modern financial landscape. We also confirm that crises frequently emanate from the financial centers with transmission through interest rate shocks and commodity price collapses.”Eight Centuries of Financial Crises also contains quite a bit of data on inflation, which the authors view as a second way to default (if the bonds are denominated in the issuer’s native currency), and exchange rate problems.

Historically, we will see that the average percent of sovereigns in default or restructuring have sometimes been quite large (source: Eight Centuries of Financial Crises, page 4).

Historically, we will see that the average percent of sovereigns in default or restructuring have sometimes been quite large (source: Eight Centuries of Financial Crises, page 4). Rogoff also has analysis of what happens with high debt levels when there is not default. Some readers will enjoy their paper from early 2008, “Is the 2007 U.S. Sub-Prime Financial Crisis So Different?”

We will revisit both sets of authors when looking at the indirect effects of default later in the series. Numerous posters have mentioned Rogoff research showing a possible dropoff in growth above a threshold of 90% debt to GDP (CR Note: this level is disputed).

CR Note: This is from "Some investor guy". Over the next week or so, some investor guy will address several questions: What are market estimates of the probabilities of default? What are total estimated losses on sovereign bonds due to default? What happens if things go really badly and what are the indirect effects of default?

Coming Monday: Part 3. What are the Market Estimates of the Probabilities of Default?

Series:

• Part 1: How Large is the Outstanding Value of Sovereign Bonds?

• Part 2. How Often Have Sovereign Countries Defaulted in the Past?

• Part 2B: More on Historic Sovereign Default Research

• Part 3. What are the Market Estimates of the Probabilities of Default?

• Part 4. What are Total Estimated Losses on Sovereign Bonds Due to Default?

• Part 5A. What Happens If Things Go Really Badly? $15 Trillion of Sovereign Debt in Default

• Part 5B. Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

• Part 5C. Some Policy Options, Good and Bad

• Part 5D. European Banks, What if Things Go Really Badly?

Saturday, July 10, 2010

Euro and European Bond Spreads

by Calculated Risk on 7/10/2010 06:57:00 PM

Related to the earlier post on sovereign debt: Part 2. How Often Have Sovereign Countries Defaulted in the Past?

Here is a graph from the Atlanta Fed weekly Financial Highlights released today (graph as of July 7th): Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

Most peripheral European bond spreads (over German bonds) have narrowed or stabilized over the past two weeks, though they remain elevated.Note: The Atlanta Fed data is a few days old. Nemo has links to the current data on the sidebar of his site.

After rising steadily through May and most of June, the 10-year Greece-to-German bond spread has narrowed 38 basis points (bps) (from 8.01% to 7.63%), through July 6. Most other European peripherals’ spreads have narrowed, too, with Portugal’s down 28 bps. However, Spain (up 18 bps) and Italy (8 bps higher) were the exceptions.

Here are the spread for the 10-year relative to the German bonds:

| Country | Spreads July 7th | Spreads June 16th | Spreads June 2nd |

|---|---|---|---|

| Greece | 7.64% | 6.40% | 5.03% |

| Portugal | 2.75% | 2.74% | 1.95% |

| Ireland | 2.62% | 2.83% | 2.19% |

| Spain | 2.06% | 2.09% | 1.62% |

The second graphs shows the number of dollars per euro since Jan 1, 1999.

The second graphs shows the number of dollars per euro since Jan 1, 1999.The euro has rebounded recently after dipping below 1.20 dollars per euro.

The dashed line is the current exchange rate. The euro is currently at 1.26 dollars.

WSJ: "$1.65 trillion Euro zone bank debt coming due in 2010 and 2011"

by Calculated Risk on 7/10/2010 01:50:00 PM

From Mark Whitehouse at the WSJ Real Time Economics: Number of the Week: Euro Zone Debt Is Coming Due (ht jb)

$1.65 trillion: Euro zone bank debt coming due in 2010 and 2011.The results of the stress tests will be released on July 23rd.

...

As investors fret about European banks’ exposures to Greece and other financially troubled countries, those banks’ borrowing costs are rising sharply. ... This year and next, some $1.7 trillion in euro-area bank debt will come due, far more than among banks in the U.S., the U.K. or elsewhere.