by Calculated Risk on 7/13/2010 08:56:00 AM

Tuesday, July 13, 2010

Trade Deficit increases in May

The Census Bureau reports:

[T]otal May exports of $152.3 billion and imports of $194.5 billion resulted in a goods and services deficit of $42.3 billion, up from $40.3 billion in April, revised. May exports were $3.5 billion more than April exports of $148.7 billion. [May] imports were $5.5 billion more than April imports of $189.0 billion.

Click on graph for larger image.

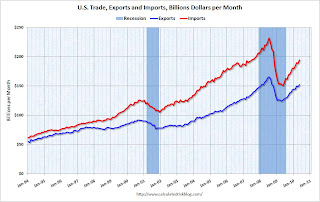

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through May 2010.

Clearly imports are increasing much faster than exports. On a year-over-year basis, exports are up 21% and imports are up 29%. This is an easy comparison because of the collapse in trade at the end of 2008 and into early 2009.

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices decreased slightly to $76.93 in May - and are up 96% from the low of February 2009 (at $39.22). Oil import volumes were down in May.

With oil prices and volumes down, oil imports decreased sharply in May, however other imports - especially from China - increased significantly. Most of the increase in the trade deficit since last year has been related to oil, but now it appears the ex-oil deficit is increasing sharply again.

Ceridian-UCLA: Diesel Fuel index Falls Sharply in June

by Calculated Risk on 7/13/2010 08:20:00 AM

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Press Release: Amid Fears of Double-Dip Recession, PCI Falls Sharply in June

The Ceridian-UCLA Pulse of Commerce Index™ (PCI) by UCLA Anderson School of Management tumbled 1.9 percent in June after its impressive 3.1 percent gain in May.

...

“While June’s number is substantially down, erasing two-thirds of May’s great gain, the daily and weekly activity on which the monthly PCI is based does not suggest that the economy is heading over a cliff,” said [PCI Chief Economist Edward Leamer]. “Part of the apparent strength of May and weakness in June is the result of the Memorial Day holiday occurring on the last day of May, allowing the negative Memorial Day effect which is usually confined to May to leak into June. More importantly, the June weakness was confined to the first two weeks, and by the second half of June, we were seeing strong growth again.”

...

The PCI is based on an analysis of real-time diesel fuel consumption data ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the index since January 1999.

The decline in June is just one month (partially offsetting the large increase in May), and the three month average is still increasing.

Note: This index appears to lead Industrial Production (IP), but there is a significant amount of monthly noise. This is a new index and is something to follow along with other transportation data.

Small Businesses a little more pessimistic

by Calculated Risk on 7/13/2010 07:47:00 AM

From the NFIB:

The National Federation of Independent Business Index of Small Business Optimism lost 3.2 points in June falling to 89.0 after posting modest gains for several months. The Index has been below 93 every month since January 2008 (30 months), and below 90 for 23 of those months, all readings typical of a weak or recession-mired economy.The key problems are a shortage of customers and also falling prices (via WSJ): “widespread price cutting continued to contribute to reports of lower nominal sales.”

...

Over the next three months, 8 percent plan to reduce employment (up one point), and 10 percent plan to create new jobs (down four points), yielding a seasonally adjusted net 1 percent of owners planning to create new jobs, unchanged from the May reading and positive for the second time in 20 months.

...

“Hiring and capital spending depend on expectations for growth in future sales, so the outlook for improved spending and hiring is not good,” said [William Dunkelberg, NFIB’s chief economist].

Small business owners continued to liquidate inventories and weak sales trends gave little reason to order new stock.

Updates: something to remember: "Small businesses" includes a large percentage of real estate related companies - so weak housing skews the results. The press release will be here, and the report here.

Monday, July 12, 2010

Condo Shadow Inventory

by Calculated Risk on 7/12/2010 11:30:00 PM

Another update on condos as shadow inventory ...

From Kelly Bennett at the Voice of San Diego: Vantage Pointe's Trouble Persists, but Downtown Thinks It's Found Bottom

Weighing in at 679 units, downtown's biggest condo building, Vantage Pointe, has met with outsize trouble since 2004 when buyers first got in fistfights for the privilege of securing a unit.This is another reminder that unless these condos are listed, they do not show up as either existing or new home inventory (the new home report doesn't include high rise condos).

The building's trouble continues. The developers haven't sold a single unit in the 14 months since returning deposits to the previous contracted buyers. About 40 buyers have signed contracts to buy there but can't close the deals. More than 150 other units are being rented.

But that's not enough to satisfy the project's lenders behind its $210 million loan, the largest construction loan on a single residential building in San Diego history. Those lenders filed a notice of default in April, pushing the developers to the first stage of foreclosure.

And 150 of these units have been rented and will probably be sold someday too. I spoke to a landlord in the downtown San Diego area yesterday, and she has had to cut rents significantly to compete with all the condo units being rented.

There are some areas - like Las Vegas and Miami - that have a huge number of vacant high rise condos. But there are also many smaller buildings that are mostly vacant in a number of cities (like in New York, Chicago, Raliegh, N.C. and Irvine, Ca). This is all part of the shadow inventory ...

Stress Tests: EU Concerned about "pockets of vulnerability”

by Calculated Risk on 7/12/2010 06:32:00 PM

From James Kanter at the NY Times: European Ministers Weigh Details of Stress Test

European Union finance ministers met Monday to start two days of discussions partly aimed at deciding how much information to reveal after they complete [stress] tests ...The results will be released on July 23rd.

“The European banking sector is, over all, resilient,” Olli Rehn, the European commissioner for economic and monetary affairs, said at a news conference. “At the same time when we publish the stress tests we will have to prepare for any pockets of vulnerability.”

And posted this morning from "some investor guy", part 3 in the series on sovereign default:

Earlier posts:

More coming later this week.