by Calculated Risk on 7/14/2010 02:00:00 PM

Wednesday, July 14, 2010

FOMC Minutes: Forecast revised down

From the June 22-23, 2010 (and May 9th) FOMC meeting.

The Fed revised down their forecasts:

| Economic projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| 2010 | 2011 | 2012 | |

| Change in Real GDP | 3.0% to 3.5% | 3.5% to 4.2% | 3.5% to 4.5% |

| April projection | 3.2% to 3.7% | 3.4% to 4.5% | 3.5% to 4.5% |

| Unemployment Rate | 9.2% to 9.5% | 8.3% to 8.7% | 7.1% to 7.5% |

| April projection | 9.1% to 9.5% | 8.1% to 8.5% | 6.6% to 7.5% |

| PCE Inflation | 1.0% to 1.1% | 1.1% to 1.6% | 1.0% to 1.7% |

| April projection | 1.2% to 1.5% | 1.1% to 1.9% | 1.2% to 2.0% |

Unfortunately, I'll take the under on GDP growth and inflation, and the over on the unemployment rate.

On further stimulus:

[M]embers noted that in addition to continuing to develop and test instruments to exit from the period of unusually accommodative monetary policy, the Committee would need to consider whether further policy stimulus might become appropriate if the outlook were to worsen appreciably.That is it.

AIA Forecast: Nonresidential Construction Spending to fall 20% in 2010

by Calculated Risk on 7/14/2010 12:11:00 PM

From Reuters: US nonresidential building seen down 20 pct in '10

Spending on U.S. nonresidential construction is likely to fall more than 20 percent this year before recovering slightly in 2011, according to a semiannual survey by an architects' trade group.Nonresidential construction investment has been a drag on GDP for six consecutive quarters (through Q1 2010), and will remain a drag throughout 2010 and probably into 2011.

...

Construction spending on hotels will drop more than 43 percent this year, construction of office buildings will decline almost 30 percent, and retail and industrial categories will be down more than 20 percent, the [American Institute of Architects] said.

Here is a repeat of a graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Equipment and software investment has made a positive contribution to GDP for three straight quarters (it is coincident). Tech has done better than most other sectors.

Residential Investment (RI) made a small positive contribution to GDP in the second half of 2009, but was a drag in Q1 2010. It will be positive again in Q2 2010 (tax credit related), and be negative again later this year. The rolling four quarter change is moving up, but as expected there has been no strong boost to GDP from RI.

Nonresidential investment in structures continues to be a drag on the economy, and as usual the economy is recovering long before nonresidential investment in structures recovers.

Manufacturing and Trade Inventory-to-Sales Ratio

by Calculated Risk on 7/14/2010 10:00:00 AM

The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed that the inventory adjustment is over:

Inventories. Manufacturers’ and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,355.7 billion, up 0.1 percent (±0.1%)* from April 2010, but down 1.5 percent (±0.3%) from May 2009.

Inventories/Sales Ratio. The total business inventories/sales ratio based on seasonally adjusted data at the end of May was 1.24. The May 2009 ratio was 1.41.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the inventory to sales ratio. This increased slightly in May to 1.24 (SA), after declining sharply from the peak of 1.48 back in Jan 2009. This could decline further - the trend is definitely down over time - but clearly the inventory adjustment is over.

This is important because the change in inventory added significantly to Q4 GDP growth and some to Q1 GDP. See BEA line 13: the contribution to GDP in Q4 2009 from 'Change in private inventories' was 3.79 of the 5.9 percent annualized increase in Q4 GDP. In Q1 2010. the 'change in private inventories' was 1.88 of the 2.7 percent annualized increase.

Any contributions to Q2 GDP from inventory changes will be minor or possibly even negative. This is one of the reasons I expect the change in real GDP growth to slow in the 2nd half.

Retail Sales fall 0.5% in June

by Calculated Risk on 7/14/2010 08:30:00 AM

On a monthly basis, retail sales decreased 0.5% from May to June (seasonally adjusted, after revisions), and sales were up 4.8% from June 2009.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992.

This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 7.3% from the bottom, but still off 5.2% from the pre-recession peak. The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.5% on a YoY basis (4.8% for all retail sales). The year-over-year comparisons are easy now since retail sales collapsed in late 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for June, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $360.2 billion, a decrease of 0.5 percent (±0.5%)* from the previous month, but 4.8 percent (±0.7%) above June 2009. Total sales for the April through June 2010 period were up 6.8 percent (±0.3%) from the same period a year ago. The April to May 2010 percent change was revised from -1.2 percent (±0.5%) to -1.1 percent (±0.2%).Retail sales have declined for two consecutive months. This is another weak report, and the decline in sales was worse than expected.

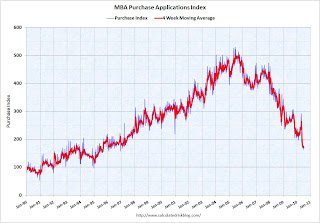

MBA: Mortgage Purchase Applications lowest since December 1996

by Calculated Risk on 7/14/2010 07:46:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 2.9 percent from the previous week and the seasonally adjusted Purchase Index decreased 3.1 percent from one week earlier. This was the lowest Purchase Index observed in the survey since December 1996.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.69 percent from 4.68 percent, with points increasing to 0.96 from 0.86 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Mortgage applications have fallen off a cliff. The weekly applications index is at the lowest level since December 1996, and and the four week average is at the lowest level since September 1995 - almost 15 years ago. The four week average is off 35% since the mini-peak in April (the weekly index is off 44% since the end of April).

This collapse in the mortgage application index has already shown up as a decline in new home sales, and will show up in the July existing home sales report (counted at close of escrow).