by Calculated Risk on 7/16/2010 05:09:00 PM

Friday, July 16, 2010

Bank Failure #91: Woodlands Bank, Bluffton, South Carolina

Woodlands Bank squanders their trust

Grasshoppers rescued

by Soylent Green is People

From the FDIC: Bank of the Ozarks, Little Rock, Arkansas, Assumes All of the Deposits of Woodlands Bank, Bluffton, South Carolina

As of March 31, 2010, Woodlands Bank had approximately $376.2 million in total assets and $355.3 million in total depositsFriday arrives ...

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $115.0 million. ... Woodlands Bank is the 91st FDIC-insured institution to fail in the nation this year, and the second in South Carolina. The last FDIC-insured institution closed in the state was Beach First National Bank, Myrtle Beach, on April 9, 2010.

Mortgage Repurchase: The growing writedown

by Calculated Risk on 7/16/2010 02:01:00 PM

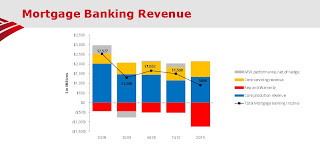

Another graph from the BofA Second Quarter 2010 Earnings Presentation (ht Brian)

This graph shows the components of BofA mortgage banking revenue. The increasing red contribution is from "Rep and warranty" - these are the loans being pushed back on BofA.

Notice the pipeline of repurchase requests continues to grow, the high rescission rate of 40-50%, and the loss severity of 50-55% (the loss to First Horizon on mortgages they have to repurchase).

Note: the FHFA issued subpoenas last week "seeking documents related to private-label mortgage-backed securities" in which Fannie Mae and Freddie Mac invested. That could lead to more repurchase requests for the Wall Street banks.

BofA 30+ Day Delinquency and FHA

by Calculated Risk on 7/16/2010 11:32:00 AM

The following graph from the BofA Second Quarter 2010 Earnings Presentation says more about the FHA than BofA (ht Brian):

For BofA, the 30+ day deliquency trends continue to improve.

That red line at the top that is still increasing? That includes FHA insured residential mortgages ...

Notice how the risk has been shifted to the FHA.

Reuters University of Michigan's Consumer Sentiment drops sharply in July

by Calculated Risk on 7/16/2010 10:01:00 AM

From Reuters: Consumer Sentiment Sinks To Lowest in 11 Months

The survey's preliminary July reading on the overall index on consumer sentiment plummeted to 66.5 from 76.0 in June.

The figure was below the median forecast of 74.5 among economists polled by Reuters.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Consumer sentiment is a coincident indicator - and this is further evidence of an economic slowdown.

Interesting - the survey's one-year inflation expectations increased to 2.9% even as measured inflation has been falling.

Consumer Price Index declines 0.1% in June

by Calculated Risk on 7/16/2010 08:30:00 AM

From the BLS report on the Consumer Price Index this morning:

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the index increased 1.1 percent before seasonal adjustment.Even with the slight monthly increase, Owners' equivalent rent (OER) is down year-over-year.

...

The index for all items less food and energy rose 0.2 percent in June after increasing 0.1 percent in May. ... The 12-month change in the index for all items less food and energy remained at 0.9 percent for the third month in a row.

...

The index for owners' equivalent rent also rose 0.1 percent, its first increase since August 2009 ...

The general disinflationary trend continues - CPI is unchanged over the last 8 months - and with all the slack in the system (especially the 9.5% unemployment rate), CPI will probably stay low or even fall further.